Dear friends, I’m Christian Luis Ahumada, Founder and Chief Quantitative Trading Analyst of Prosper Grove Asset Management. I’m truly delighted that today we stand together at a pivotal moment filled with excitement and anticipation: the second live testing phase of the ProMatrix Quantitative Trading System has officially set sail!

Today, we will not only continue to interpret the impact of economic data and further explore the anticipated shifts in the Federal Reserve’s monetary policy path, but also firmly execute the signals generated by the ProMatrix Quantitative Trading System to capture greater profit opportunities in a zero-risk environment.

Today’s Key Updates:

1.What are the implications of the May PPI data and the initial jobless claims for the week ending June 7, and what are the expectations for the Federal Reserve’s monetary policy path?

2.How are the high-quality assets within our "Dynamic Diversified Asset Allocation System" strategic layout performing, and what is our perspective?

3.What advantages can friends who actively participate in the second internal test of the ProMatrix Quantitative Trading System expect to gain?

The Producer Price Index (PPI) year-over-year measures the percentage change in the prices that domestic producers receive for their goods and services in a given month compared to the same month of the previous year. This indicator reflects inflationary trends in the production stage.

Friends, although today’s economic data has sent a positive signal to the overall market, President Trump’s latest statement that he will unilaterally impose tariffs on trade partners within the next two weeks has raised concerns.

This statement has shifted market sentiment back toward caution and a wait-and-see approach.

It is expected that the market will show a weak and volatile pattern today, and we may see structural divergence in capital flows.

Therefore, it's important to remain cautious during operations.

After screening big data through the ProMatrix Quantitative Trading System, the following May PPI data was identified: In May 2024, the Producer Price Index (a gauge of consumer inflation) rose by 2.6%. From April to May, the PPI increased by 0.1%, following a 0.2% decline in the previous month.

Excluding volatile food and energy prices, wholesale costs rose by 0.1% compared to April 2024, and by 3% compared to May of the previous year.

This data indicates that inflation remains mild and that the overall investment market continues to show moderate performance, with limited impact.

The weekly initial jobless claims refer to the number of people filing for unemployment insurance for the first time. It reflects the health of the labor market and the state of economic growth, providing guidance for the Federal Reserve’s monetary policy.

After screening macro data using the ProMatrix Quantitative Trading System, we extracted the initial jobless claims data for the week ending June 7: the actual figure was 248,000, higher than the market forecast of 240,000 and slightly above last week's 247,000.

This suggests that although the labor market is not experiencing sharp growth, the data is beginning to signal a marginal weakening in labor demand, which supports expectations for a potential interest rate cut by the Federal Reserve.

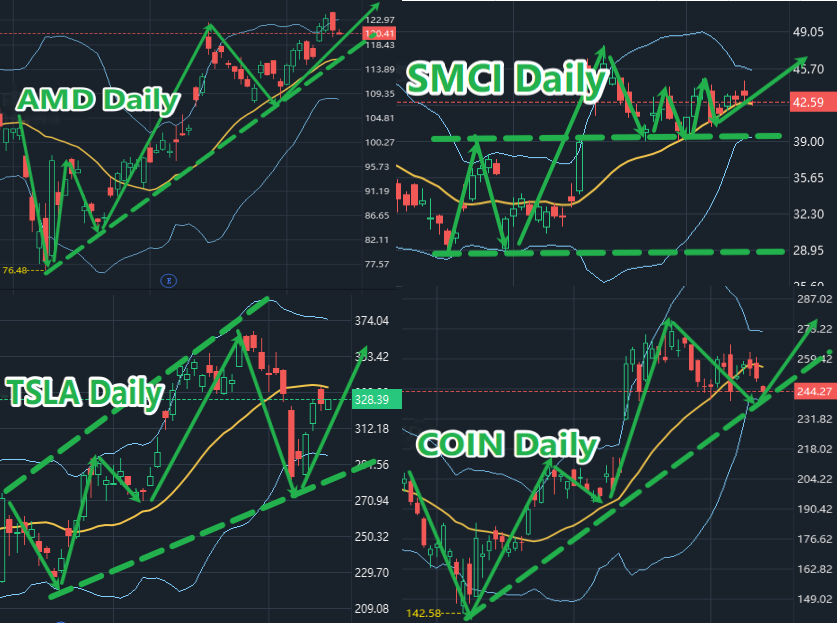

Now let’s focus on the real-time performance of the high-quality assets within the “Dynamic Diversified Asset Allocation Strategy” and continue to optimize our asset allocation.

From the performance of the above-mentioned stocks, we can clearly see that due to the unexpected news of President Trump’s announcement to unilaterally impose tariffs, some high-quality stocks in our asset allocation have indeed experienced brief price fluctuations.

But I want to emphasize one core point again: the fluctuations caused by this kind of unexpected event are more about market sentiment disturbances, not changes in the intrinsic value of the assets. These news-driven adjustments are often short-lived and do not possess the fundamental strength to overturn the logic behind our asset allocation.

Therefore, we must remain calm at all times and patiently wait for opportunities after the emotional reactions subside.

Dear friends, although the money-making effect of the overall investment market has weakened, capital sentiment has become cautious, and some sectors have begun to diverge, it is exciting that the strategic layout of "dynamic diversified asset allocation system" built by our ProMatrix Quantitative trading system is still steadily releasing considerable wealth value.

I believe that those friends who have been paying attention to our Prosper Grove Asset Management for a long time, and have firmly implemented the ProMatrix Quantitative trading system strategy and actively allocated core asset PGAM tokens, must have deeply felt the joy of asset appreciation and the power of actual combat verification.

At this moment, the core asset PGAM token has achieved a profit growth of 78.46%. What an exciting number!

PGAM tokens not only bring wealth growth rates far exceeding those in traditional investment fields but also show strong momentum for continued growth and potential for structural value release.

This once again highlights the strong profitability of the ProMatrix Quantitative trading system.

It is worth emphasizing that the profitability of the ProMatrix Quantitative trading system is particularly prominent and penetrating in the field of cryptocurrency.

Especially for those friends who have actively participated in the first internal test transaction, your experience is the most direct and real verification:

In just two days, the ProMatrix Quantitative trading system helped friends who participated in the internal test to achieve a profit growth of up to 99%! This is difficult to achieve in the traditional financial market, which is a true reflection of the powerful prediction and execution capabilities of the ProMatrix Quantitative trading system.

It is this highly deterministic profitability and outstanding actual performance that have won the ProMatrix Quantitative trading system-wide recognition and support from the market, users, and the entire group. Now, the rhythm of the official launch of the ProMatrix Quantitative trading system has been pushed to a climax.

Therefore, with everyone's firm support and the careful preparation of our Prosper Grove Asset Management team, we will officially start the second internal test transaction of the ProMatrix Quantitative trading system from 4:00 pm to 4:30 pm Eastern Time today.

The core purpose of this test is to further collect larger-scale and higher-quality actual trading data to provide solid data support for the next stage of optimization and function upgrade of the ProMatrix Quantitative trading system.

Moreover, every time you actively participate, it is not only a trust and support for the ProMatrix Quantitative trading system, but also a solid force for the future development of our Prosper Grove Asset Management ecosystem.

At the same time, this is an opportunity to comprehensively improve your practical ability. It is a strategic opportunity for you to open the door to wealth and rewrite the trajectory of your destiny.

In recent days, my assistant and I have received many messages from friends in the group. They enthusiastically expressed a common wish: to continue to follow the signals of the ProMatrix Quantitative trading system and actively participate in internal test transactions.

More and more friends have reported that through the first internal test of the ProMatrix Quantitative trading system, they have not only achieved exciting profit growth but also significantly improved their practical capabilities. More importantly, they have found that as long as they follow the trading signals issued by the ProMatrix Quantitative trading system and participate in transactions, they can easily seize opportunities and achieve steady growth in wealth.

It is precisely based on the clear understanding of trends and the high trust in the ProMatrix Quantitative trading system that more and more friends have taken the initiative to express their willingness to invest more of their own funds and continue to firmly participate in the second round of testing of the ProMatrix Quantitative trading system.

Everyone's main goal is to once again achieve excess profit growth and realize their own wealth dividends under systematic, disciplined, and zero-risk practical guidance.

Therefore, I encourage more friends to actively participate in the second internal testing opportunity of the ProMatrix Quantitative trading system this afternoon, so that they can personally participate in this zero-risk, cashable wealth feast.

At this moment, if you are not ready yet, please contact assistant Sophia Morgan immediately. She will assist you in completing all the preparations before the internal test, and teach you to be familiar with and master the buying and selling operation procedures of the trading software, to ensure that you can participate in the internal test transaction on time from 4:00 pm to 4:30 pm Eastern Time today.

Dear friends, this afternoon, you will gain three core values in the zero-risk environment of the second internal test of the ProMatrix Quantitative trading system:

1. Master the actual trading rhythm of strategy execution;

2. Exercise your ability to respond to and respond to the signals issued by the ProMatrix Quantitative trading system;

3. In a zero-risk environment, gain the dual results of actual experience and rich profits.

Friends, the horn of the second internal test of the ProMatrix Quantitative trading system has officially sounded!

The opportunity to change our wealth has arrived, so I hope all friends can truly cherish this internal test opportunity and pay enough attention to it:

1. Put aside your hesitation, take the initiative, and actively participate in this wealth feast;

2. Cherish the opportunity, take every internal test transaction seriously, and accelerate the improvement of actual trading ability and the ability to grow wealth.

3. All friends who have successfully signed up to participate in this internal test must be fully prepared before 4:00 pm Eastern Time, ensure that you have registered a test trading account, are familiar with and master the buying and selling process of the trading software, have a stable mentality, and bravely move towards the peak of wealth with the most firm belief, the strongest execution, and the most optimistic state.

Friends, I look forward to meeting you again in the second internal test transaction of the ProMatrix Quantitative trading system this afternoon.

This afternoon, we will not only witness the power of trends together, but also experience the fun of making money easily, and also harvest the sense of accomplishment brought by steady profits together. See you later!