Dear friends, I am Christian Luis Ahumada, founder and chief quantitative trading analyst of Prosper Grove Asset Management. I am very happy to be with you all.

Today, we should not only feel the joy and encouragement brought by the continued rise in wealth value, but also make all-round, practical and professional preparations for the upcoming second round of internal test transactions of the ProMatrix Quantitative trading system.

Important information today:

1. How is the environment of the investment market changing today, and what are the signals it conveys?

2. What are the key points to pay attention to in the second internal test transaction of the ProMatrix Quantitative trading system?

3. Practical trading skills: sharing of practical application skills of the BOLL indicator.

From the overall performance of the current investment market, although the latest CPI data is lower than market expectations, it should have injected certain easing expectations and positive sentiment into the market, but we have observed that the market reaction has not shown consistent optimism.

Market investors are worried about the impact of the Trump administration's trade conflict on the world's largest economy, and the market has become more cautious, and the market's money-making effect has weakened.

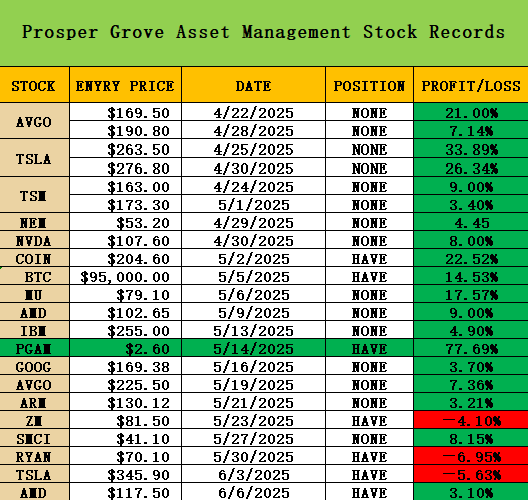

At this moment, the high-quality stocks in the strategic layout of the "dynamic diversified asset allocation system" have also experienced short-term price fluctuations, but other high-quality assets in the asset allocation, such as the core PGAM token, are still performing well.

Moreover, after comprehensive multi-dimensional big data analysis, the ProMatrix Quantitative trading system has made an important judgment of great strategic significance: in the next three months, the core asset PGAM token will conservatively be expected to usher in an astonishing increase of up to 500%.

At the same time, the PGAM token now has three core driving forces to support its continued growth potential:

1. Global funds are pouring in, and the cryptocurrency bull market cycle has started.

2. After the first internal test of the ProMatrix Quantitative trading system, its various functions have been greatly improved.

3. The call for the global launch of the ProMatrix Quantitative trading system continues to rise, injecting continuous upward momentum into the price increase of the PGAM token.

Friends, with the help of the ProMatrix Quantitative trading system's powerful trend analysis capabilities, accurate signal prediction mechanism, and intelligent asset rating system, we are gradually mastering the initiative to identify the market, grasp the rhythm, and layout high-quality targets.

It can be said that the ProMatrix Quantitative trading system provides us with a core weapon that can cross-market fluctuations, lock in value, and release profits.

Moreover, tomorrow, the second round of internal testing of the ProMatrix Quantitative trading system will officially set sail! This is not just an ordinary test, but also a new round of wealth feast driven by the system and fulfilled by execution!

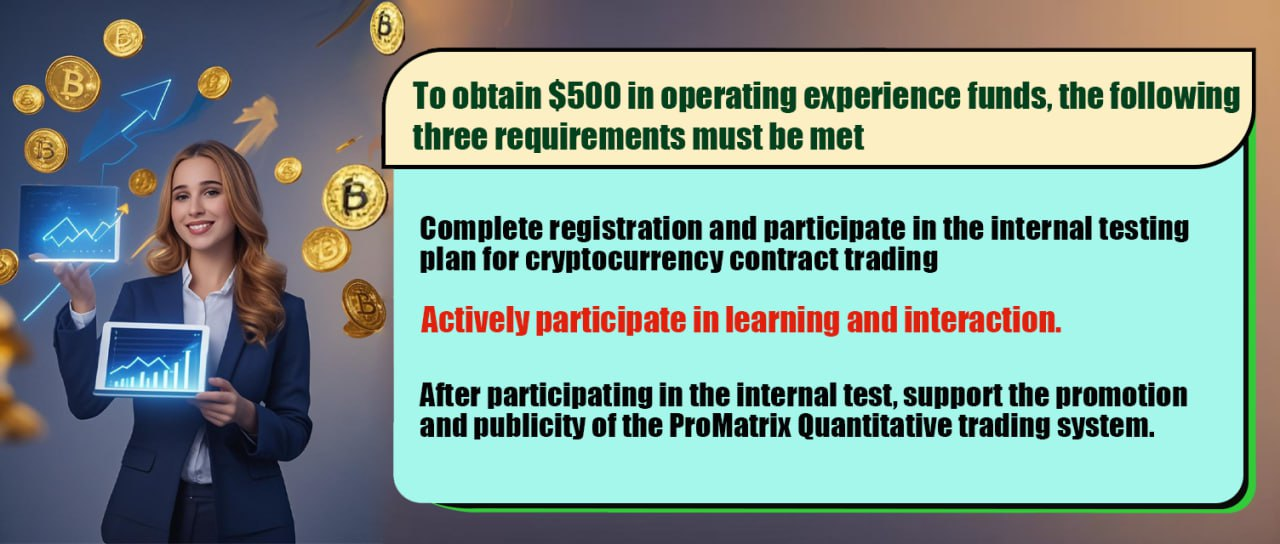

For all friends who have completed the registration, this is a ticket to participate in the new round of wealth feast; if you have not yet participated in the registration, please actively contact assistant Sophia Morgan to get this valuable ticket: Register an exclusive trading account, receive $500 in test funds, and familiarize yourself with and master the trading rules and operating procedures.

Friends, in this wealth feast driven by the system and led by the trend, each of you is the real protagonist of this wealth feast!

This is not only a journey about profit, but also a deep practice about cognitive improvement, execution evolution, and system practice.

Here, you can not only broaden your horizons and enhance your ability to judge trends, but also improve your practical trading ability and make huge profits.

At this moment, the ProMatrix Quantitative trading system is continuing to evolve and is one step closer to global launch. It is precisely because of your trust, participation and execution that each test of the ProMatrix Quantitative trading system is accumulating valuable data and practical feedback, which will further promote the maturity of the system functions and push it to accelerate towards the goal of global launch.

I firmly believe that in the near future, the ProMatrix Quantitative trading system will stand on the international stage with a more perfect attitude and create a new round of wealth opportunities for more investors around the world. And you are the participants, witnesses and beneficiaries of the evolution of this system.

Therefore, in order for everyone to truly grow and gain rich profits in this ProMatrix Quantitative trading system, please pay enough attention and keep in mind the following four key points:

1. Maintain a correct trading mentality: Please do not participate in the transaction with a "try it out" mentality, nor seek short-term stimulation with the emotions of a gambler, and do not fall into panic, impatience or hesitation due to short-term fluctuations.

2. Please repeatedly practice and familiarize yourself with the buying and selling operation process of the trading software, master the trading skills and strategy details in the trading process, and ensure that you can participate in the transaction efficiently and obtain rich profits as soon as the strategy is released.

3. Firm execution: When operating, do not hesitate or question, and firmly implement the trading signals issued by the ProMatrix Quantitative trading system and the formulated trading strategies to participate in the transaction.

4. In this internal test, you will be in a zero-risk state, which is a great opportunity for you to improve your actual combat ability; at the same time, as long as the execution is in place, you will also reap sufficient profit growth returns.

At this moment, in order to ensure that everyone can smoothly participate in the second round of internal test transactions of the ProMatrix Quantitative trading system tomorrow, and achieve ideal profit returns and ability leaps in actual combat, we will continue to strengthen our understanding of the core technical logic of the system: the application skills of the BOLL indicator in actual combat.

In the past two days of learning, we have systematically shared the four core elements of the BOLL indicator:

1. Indicator composition structure: upper rail, middle rail, lower rail;

2. Working principle mechanism: construct a dynamic "price fluctuation channel" through standard deviation;

3. Trend judgment method: use the middle rail as the critical point to identify the rising and falling structures;

4. Buying and selling point capture skills: key signal reactions when breaking through the middle rail and touching the upper and lower rails.

I believe that everyone has mastered this basic knowledge. Now, we will continue to study and strengthen the core application skills of the BOLL indicator in actual trading.

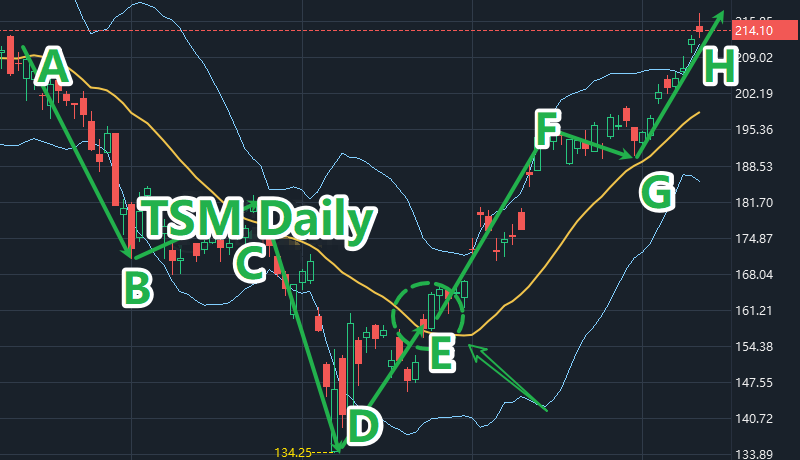

As shown in the figure: the running trajectory of the TSM daily chart, we will further understand the internal logic of trend judgment and trading node identification.

The BOLL middle line is the lifeline of the trend and the dividing line between the upward trend and the downward trend.

When the stock price runs below the BOLL middle line, it is a downward trend.

A-B segment is a downward trend;

B-C segment is a short rebound band in the downward trend;

C-D segment is a downward trend;

D-E segment is an oversold rebound stage in the downward trend.

When the stock price runs above the BOLL middle line, it is an upward trend.

E-F segment is an upward trend;

F-G segment is a short-term correction band in the upward trend;

G-H segment has an upward trend

It should be noted that: the BOLL upper track is the upper boundary of price fluctuations, often used as a short-term pressure reference, so when the price approaches or breaks through the upper track, it often means that there is a possibility of a short-term correction;

The BOLL lower track is the lower boundary of price fluctuations, often used as a short-term support and potential reversal signal, so when the stock price is about to reach the lower track or break away from the lower track, there is often a possibility of price rebound.

Dear friends, I believe that everyone is familiar with and mastered the above content. More importantly, all of this content has been embedded in the program logic of the ProMatrix Quantitative trading system. We are not only learners but also promoters of system evolution.

After everyone actively participated in the first internal test of the ProMatrix Quantitative trading system, our top analyst team and R&D department of Prosper Grove Asset Management collected more than 260,000 valid trading data, and after their day and night testing and optimization, the system has now been further upgraded.

Now the trend analysis ability, signal capture and prediction ability, and rating mechanism ability of the ProMatrix Quantitative trading system have achieved a qualitative leap.

I firmly believe that tomorrow the second internal test of the ProMatrix Quantitative trading system will be a complete success, and all friends who actively participate in this internal test will receive rich profit returns.

Therefore, I hope that all my friends can take action and actively participate in tomorrow's internal test of the ProMatrix Quantitative trading system to seize the wealth feast that belongs to us.

Friends, today's sharing has come to a successful conclusion. Thank you for your active participation and enthusiasm.

Tomorrow, we will continue to interpret the impact of the number of initial jobless claims in the week ending June 7 on market sentiment and the Fed's monetary policy expectations; at the same time, we will also actively launch the second internal test transaction of the ProMatrix Quantitative trading system. We look forward to all friends' active participation with full enthusiasm. See you tomorrow!