Dear friends, I’m Christian Luis Ahumada, Founder and Chief Quantitative Trading Analyst at Prosper Grove Asset Management. I’m truly delighted that at this pivotal moment filled with surprises and hope, we’re once again gathering in our group, embarking together on a journey of continuous wealth growth.

Today, we will analyze the impact of the May CPI data on the market and further assess the path of the Federal Reserve’s monetary policy. At the same time, we’ll share the detailed guidelines for participating in the second internal test of the ProMatrix Quantitative Trading System, ensuring that you not only participate smoothly in live trading, but also contribute to the system’s advancement and earn substantial profit returns for yourself.

Today's Key Updates:

1.What impact has the release of the May CPI data had on the investment market?

2.What is the optimization plan for the wealth strategy system we have built?

3.What are the important guidelines for the second internal test of the ProMatrix Quantitative Trading System?

In the investment market, policy is always the guiding force of direction, while economic data serves as the barometer of trends.

Policy determines the direction, and data determines the pace.

Only by understanding the impact of policy and economic data can we make the right strategic decisions at the right time and ultimately achieve steady growth in wealth.

The May CPI data is being released today.

CPI, or Consumer Price Index, reflects the price changes of a basket of goods and services.

It is one of the key indicators used to measure the level of inflation and also serves as one of the key references for determining the Federal Reserve’s monetary policy path.

After screening big data through the ProMatrix Quantitative Trading System, the following key May CPI year-over-year unadjusted data was extracted:

The Consumer Price Index (CPI) rose 0.1% month-over-month in May, while the market had expected an increase of 0.2%. On a year-over-year basis, CPI rose 2.4%, compared to the expected 2.5%.

Excluding the more volatile food and energy components, the core CPI rose 0.1% month-over-month, below the expected 0.3%. On a year-over-year basis, it increased 2.8%, while the forecast was 2.9%.

This is a consumer inflation report that came in below market expectations, easing investors' concerns about price pressures potentially intensified by President Donald Trump’s tariffs. It sends a positive signal to the overall market.

Moreover, the preliminary agreement reached in the trade negotiations with China has effectively eased trade tensions, which is a favorable development for the entire investment market and injects new momentum into our “Dynamic Diversified Asset Allocation Strategy.”

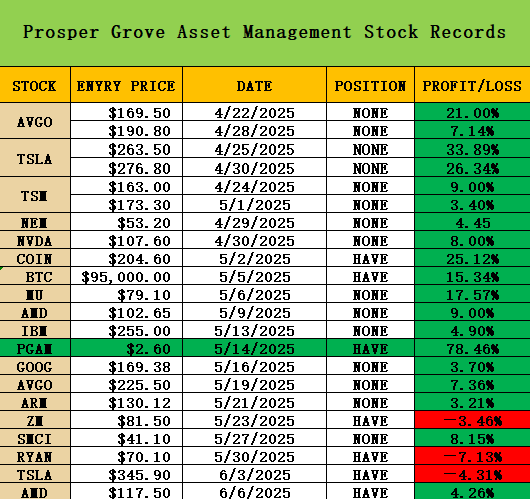

Dear friends, let us now focus on the performance trajectory of the quality assets within the “Dynamic Diversified Asset Allocation Strategy.”

Another exciting and uplifting moment!

Today, TSLA’s price continued to rise steadily, demonstrating through solid performance the long-term value potential of quality assets within a structurally diversified portfolio.

This is not only a technical recovery, but also a reaffirmation of the effectiveness of our “Dynamic Diversified Asset Allocation Strategy.”

During the period when TSLA experienced a significant pullback, market sentiment was filled with uncertainty. But it was precisely at that moment that we stayed committed to our strategic logic, followed the system’s signal, and decisively increased our positions at lower levels.

To those who stood firmly with us and moved forward with conviction, at this moment, I sincerely applaud you!

Moreover, Elon Musk stated that the pilot run of TSLA's autonomous robotaxi in Austin, Texas is "tentatively" scheduled to begin on June 22, and the first autonomous Tesla vehicle will be driven from the factory to a customer’s home on June 28.

This news is undoubtedly very positive and lays a solid foundation for the continued value release of TSLA.

Dear friends, at this moment, have you once again deeply felt the powerful trend analysis and accurate prediction capabilities demonstrated by the ProMatrix Quantitative trading system?

Now, it is becoming our core engine for rational investment, stable profits, and long-term wealth-compounding growth.

In the past few days, our Prosper Grove Asset Management's top analyst team and technical R&D team have worked day and night, conducted dozens of rounds of strategy optimization and signal backtesting, and systematically upgraded and comprehensively corrected multiple modules such as system architecture, model algorithm, signal recognition, trend analysis, rating system optimization, and risk control.

Now, in everyone's eager anticipation, the improvement and upgrade of the ProMatrix Quantitative trading system has been successfully completed, and its three core functions have been greatly improved:

1. Trend analysis ability: more sensitive, early identification of structural turning points;

2. Signal prediction and capture ability: further reduce market "noise" and improve winning rate;

3. Market rating ability: multi-dimensional evaluation model, more scientific screening of high-quality targets.

At this moment, we are confidently welcoming the official start of the second round of internal testing of the ProMatrix Quantitative trading system.

We believe that every participant will not only reap rich profits, but also quickly improve their actual trading capabilities in actual combat, and with everyone's joint efforts, this round of internal testing will be pushed to a new climax.

Therefore, in order to help everyone grasp the wealth opportunities contained in the second internal test transaction of the ProMatrix Quantitative trading system tomorrow with clearer thinking, more professional preparation, and higher quality execution, I will now focus on sharing with you the matters that need attention:

1. The time of the second internal test transaction of the ProMatrix Quantitative trading system is from 4:00 pm to 4:30 pm on June 12, Eastern Time.

2. For friends who have not yet registered: I encourage you to actively contact assistant Sophia Morgan, who will assist you in registering a trading account dedicated to the test, receive $500 in test funds, and teach you the buying and selling operation procedures and basic rules. Make sure to complete all preparations before 4:00 pm on June 12, Eastern Time.

Through this process, you can successfully get the opportunity to participate in tomorrow's internal test and reap rich profits with zero risk.

3. For friends who have successfully registered.

a. Friends who participate in the internal test for the first time: If this is your first time participating in the internal test transaction, we will provide you with $500 of exclusive test experience funds, which means that you will fully experience the trend judgment and profitability of the ProMatrix Quantitative trading system in a high-volatility market with zero risk; at the same time, you can also reap rich profits through the guidance of the system.

b. If you are participating in the internal test transaction for the second time: Although you cannot obtain the $500 test funds repeatedly, you can still choose to continue to participate in the second round of test transactions with your own funds.

I want to emphasize that the biggest difference in this round of internal testing is that the ProMatrix Quantitative trading system has achieved three key capabilities: more accurate trend identification, more sensitive signal prediction, and a more scientific asset rating system.

This means that even if you use your own funds to participate in the test, you will have the opportunity to use the powerful profitability of the ProMatrix Quantitative trading system to achieve higher quality and more reproducible stable profit growth.

4. How to correctly participate in this round of test transactions?

After the ProMatrix Quantitative trading system is launched for testing, I will formulate a corresponding exclusive trading strategy based on the robust trading signals issued by the system and publish it to the group simultaneously.

a. After the robust trading strategy is shared with the group, please read it as soon as possible and firmly execute the buying and selling operations.

b. After you complete the transaction according to the strategy, please send a screenshot of the transaction information to assistant Sophia Morgan in time. She will help you check whether your transaction information is correct and track the real-time dynamics of the underlying products you are involved in, ensuring that you can receive subsequent updated strategies and strategic adjustment notifications as soon as possible.

c.During the trading process, if the price of the underlying product fluctuates, please do not panic, and do not leave the system to trade based on subjective emotions.

Please firmly implement the formulated trading strategy, abide by the trading rhythm, and control your emotions.

5. Before participating in the second internal test transaction of the ProMatrix Quantitative trading system, each participant must take their preparation seriously, which is not only related to the execution quality of the test but also directly affects whether you can really seize this zero-risk, high-return practical opportunity.

Please do the following three things:

a. Master the basic operation process of the trading software to ensure that the execution actions such as placing orders, closing positions with one click, and reversing with one click are clear and accurate;

b. Understand and be familiar with the structure and execution rhythm of the ProMatrix Quantitative trading system strategy to avoid hesitation and emotional trading;

c. Adjust your mentality, calm your emotions, and participate in trading in a rational state.

6. All friends who successfully sign up and participate in the second internal test transaction of the ProMatrix Quantitative trading system will get one-year use rights of the personal version of the system after the ProMatrix Quantitative trading system is officially launched, which is worth 129,999 US dollars.

Dear friends, at this moment, funds in the global market are accelerating to the field of cryptocurrency, providing a very ideal testing environment for the second round of internal testing of our ProMatrix Quantitative trading system.

At the same time, the ProMatrix Quantitative trading system has successfully completed a new round of core function upgrades: its trend analysis function is more sensitive, signal capture and prediction capabilities are comprehensively enhanced, and the asset rating system is continuously optimized.

This means that the profitability, stability, and actual combat efficiency of the system have achieved a significant leap.

Therefore, when the trend, system, and human nature reach a harmonious resonance, the real channel to the world of wealth compounding will be opened.

At this moment, you are not only a tester, but also a practitioner of wealth growth, a promoter of system evolution, and a co-builder and sharer of the ProMatrix Quantitative trading system towards maturity and the global stage.

Friends, this morning's sharing has come to a successful conclusion. Thank you for your careful listening and active participation.

Later, we will continue to track the latest developments of high-quality assets in the strategic layout of the "dynamic diversified asset allocation system"; at the same time, we will also share in-depth the core working principle of the ProMatrix Quantitative trading system: the application logic of the BOLL indicator in actual trading.

Looking forward to the active participation of more friends, see you later!