Dear friends, I am Christian Luis Ahumada, founder and chief quantitative trading analyst of Prosper Grove Asset Management. I am very happy to be with you at this moment full of hope and opportunity.

Today we will jointly participate in and witness the real value and wealth momentum released by high-quality assets in the strategic layout of a "dynamic diversified asset allocation system"!

At this moment, you will not only reap the profits brought by the trend but also experience the pleasure and growth brought by trading skills.

Important information today:

1.Where is the current market focus? What is our viewpoint?

2. What are our expectations in the second internal test of the ProMatrix Quantitative trading system?

3. ProMatrix Quantitative practical trading skills: What is the method of BOLL indicator to judge buying and selling points and trends?

Friends, the current market focuses on three aspects:

1. According to the latest news, US Secretary of Commerce Howard Lutnick publicly stated: "The current trade negotiations with China are progressing smoothly, and the talks are expected to last a whole day." This not only sends a positive signal to the ongoing tense trade situation but also boosts the market's expectations and confidence in reaching a phased agreement.

At the same time, bilateral trade negotiations with India are also progressing simultaneously. The two sides are accelerating the pace of negotiations in order to achieve the goal of "early results", further enhancing the prospects for global economic coordination and cooperation.

2. Next, the market will focus on the final results of the two key inflation indicators, CPI and PPI, which will be announced soon, so as to further explore the path of the Federal Reserve's monetary policy.

3. The Dow Jones Industrial Average, the Nasdaq Index, and the S&P 500 Index all showed a pattern of high-level fluctuations. The market is in a wait-and-see state before "waiting for news to land". The long-short game is fierce, and rhythm control is particularly important.

Therefore, during the operation, you must always be cautious and continue to optimize asset allocation:

1. For high-quality stocks that currently make a lot of money, you can consider reducing your position and releasing sufficient funds.

2. For high-quality assets that have not yet received profit returns, continue to hold them and wait for the release of value.

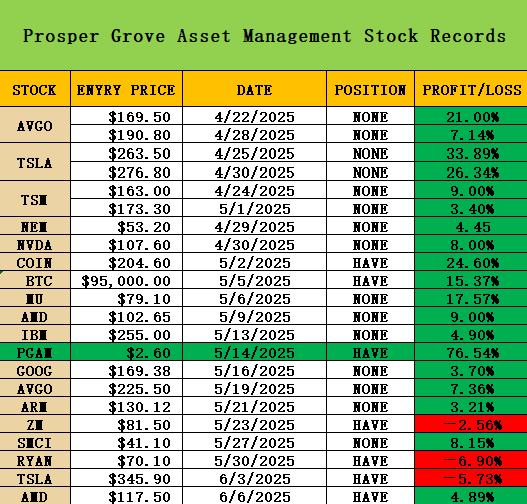

Now let's focus on the operation trajectory of high-quality assets in the strategic layout of a "dynamic diversified asset allocation system".

TSLA deserves special mention.

Today, TSLA's performance is exciting, and it has once again come out of a very strong and signal-significant rebound trend!

Facing this trend, I believe that many friends will have a question in their minds at this moment:

When TSLA experienced a large adjustment before, how did I tell everyone?

When TSLA's emotional panic spread and the market experienced a sharp correction, I repeatedly emphasized: TSLA's decline is not a loss of value, but a release of market sentiment; it is not the end of the trend, but an illusion caused by short-term price fluctuations.

Moreover, when everyone was hesitating, watching, or even questioning, our ProMatrix Quantitative trading system, relying on its powerful trend analysis and signal prediction capabilities, decisively issued a trading signal of "adding positions" at a key low!

We also shared the signal with everyone as soon as possible, and led everyone to firmly execute, layout against the trend, and welcome the rebound.

Now, with the strong rebound of TSLA, those friends who boldly added positions at low levels and firmly implemented system strategies have once again felt the excitement and joy brought by the continuous release of wealth value!

I believe that at this moment, all of us have once again deeply realized that the three core capabilities of the ProMatrix Quantitative trading system: powerful trend analysis capabilities, accurate signal recognition and prediction mechanisms, and scientific asset rating functions, are continuing to release amazing value charm.

Friends, in the blink of an eye, we have walked through a journey of nearly two months. From the initial unfamiliarity to the gradual familiarity to today's deep trust and walking side by side, this is not only a process of building trust between people, but also a growth trajectory between us and the ProMatrix Quantitative trading system from cognition to verification, and then to trust.

When everyone first came into contact with the ProMatrix Quantitative trading system, they might still have doubts in their hearts and even looked at the trading signals issued by the system with a wait-and-see attitude. But with every precise transaction and every successful trend capture,

the ProMatrix Quantitative trading system speaks with results, allowing everyone to feel its professionalism, stability, and ability to create wealth in actual combat.

Please review the representative high-quality assets we focused on sharing in the early days: AVGO, TSLA, TSM, etc. Under the guidance of system signals,

they all brought extremely considerable profit returns,

making everyone truly feel the strong profitability of the ProMatrix Quantitative trading system.

With the advancement of time, the ProMatrix Quantitative trading system is also continuously evolving, constantly optimizing its core functions, including trend identification, signal analysis, direction prediction, risk control, rating system, etc.

At this moment, the ProMatrix Quantitative trading system is no longer a simple intelligent tool but has gradually become an indispensable smart brain, a stable strategy engine, and a trustworthy practical partner in our investment decision-making.

Therefore, everyone's expectations and calls for the ProMatrix Quantitative trading system to be launched as soon as possible are also growing. It is with your strong support and promotion that we, Prosper Grove Asset Management, have fully launched the internal testing process of the ProMatrix Quantitative trading system. The purpose is very clear: to lay a solid foundation for the final optimization and adjustment of the ProMatrix Quantitative trading system before its official launch by collecting larger-scale real, effective, and non-repetitive actual trading data.

Friends, it is worth emphasizing that in the process of testing the ProMatrix Quantitative trading system, what we really need is the "real, effective, and referenceable" actual trading data you submit during the transaction.

This is not only a system verification, but also a core testing stage of the evolution of a data-driven system. It directly determines whether we can successfully promote the early launch, official release, and globalization of the ProMatrix Quantitative trading system.

At present, my top analyst team and system development team have all entered the sprint state. They hope to obtain the most valuable real-time data through this round of testing in order to complete the final stage of adjustment and function improvement of the ProMatrix Quantitative trading system.

Therefore, I must solemnly remind every friend who is about to participate in the internal test:

1. Please do not enter the market with the mentality of "just for fun";

2. Please eliminate the "gambler mentality" and do not participate in the transaction with the attitude of fantasizing about getting rich overnight;

This mentality not only cannot provide valuable data for system optimization, but is more likely to disrupt the judgment logic of the strategy model on user behavior, and cause real and irreversible negative impact on the optimization process of the ProMatrix Quantitative trading system.

Therefore, I encourage all friends to actively participate in the internal test of the ProMatrix Quantitative trading system. Not only should they adjust their mentality, but also treat each transaction with a professional and respectful attitude, and strictly follow the signals issued by the ProMatrix Quantitative trading system to participate in the transaction.

At the same time, we also solemnly promise to everyone that during this round of testing, as long as you strictly follow the trading signals issued by the ProMatrix Quantitative trading system, even if there is a loss in the end, this part of the loss will be fully borne by our Prosper Grove Asset Management team, and you only need to return the remaining test funds.

This is exactly the philosophy that we at Prosper Grove Asset Management have always adhered to: responsible for the ProMatrix Quantitative trading system, responsible for the $500 test funds, responsible for every friend who participated in the test, and responsible for the reputation of our Prosper Grove Asset Management.

I hope everyone can understand my concerns and explore more infinite possibilities of the ProMatrix Quantitative trading system with me.

Dear friends, let us now start today's journey of in-depth learning and exploration with more enthusiasm and firmer faith.

Today, we will focus on sharing the core working principle of the ProMatrix Quantitative trading system: the practical application of the BOLL indicator in buying and selling points and trend judgment.

In yesterday's sharing, we systematically sorted out:

1. The three core components of the BOLL indicator:

Upper rail: the upper boundary of fluctuations, often used as a short-term pressure reference;

Middle rail: the equilibrium center axis of the price, the reference line for trend confirmation;

Lower rail: the lower boundary of fluctuations, usually used as a support or reversal signal.

The core working principle of BOLL is to construct a "price channel" by dynamically counting the price fluctuation range. Its upper and lower rails expand and contract with price fluctuations to form a "price fluctuation belt".

Let us grasp the trend rhythm in uncertainty and gain insight into structural opportunities in complexity.

I believe that all my friends are already familiar with and have mastered this part of the content. Now we continue to extend the application of BOLL indicators.

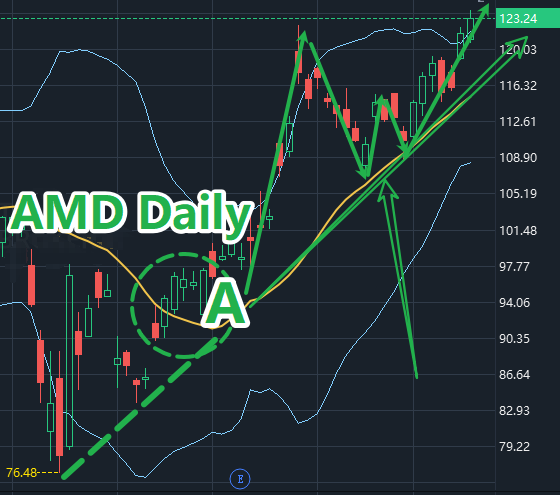

As shown in the figure: AMD daily chart performance

1. Trend operation judgment method

The middle track line is the "lifeline" of trend identification.

When the stock price runs above the BOLL middle track line, it means that the market is in an upward trend structure, and the middle track line is the critical support point;

When the stock price runs below the BOLL middle track line, it means that the market is in a downward trend structure, and the middle track line is converted into a pressure point.

The middle track line is both the dividing line of the trend and the first judgment signal for the system to identify the long and short directions.

2. Buy and sell point judgment

When the stock price rebounds from a low level and the price successfully breaks through the BOLL middle track line, it often means that the market may have a trend reversal, that is, the key turning point from a downward trend to an upward trend.

This structural breakthrough is shown at point A in the figure.

This signal reflects the shift in market forces and is also the key time for the system to accurately intervene in long opportunities.

Dear friends, the key identification logic of the above BOLL applications has been embedded in the program of the ProMatrix Quantitative trading system, and with the continuous advancement of our R&D team's day and night optimization work, the various functions of the ProMatrix Quantitative trading system are gradually being improved and evolved.

We firmly believe that the ProMatrix Quantitative trading system will be officially launched with stronger strength, more mature functions, and faster speed, and will go global. This requires the joint efforts of all of us.

Friends, today's sharing has come to a successful conclusion. Thank you for your careful listening and active participation.

Although the course has come to an end, our journey to wealth growth is still continuing.

Tomorrow, we will jointly interpret the inflation signals released by the May CPI data and further explore the path of the Federal Reserve's monetary policy; at the same time, we will share the matters that need to be paid attention to in the second internal test of the ProMatrix Quantitative trading system.

Looking forward to the active participation of more friends, see you tomorrow!