Dear friends, I’m Christian Luis Ahumada, Founder and Chief Quantitative Trading Analyst of Prosper Grove Asset Management. I’m truly delighted to continue walking alongside all of you at such a moment full of surprises and unlimited expectations, as we actively learn and keep exploring together.

Today, through the strategic layout of the "Dynamic Diversified Asset Allocation System" and the trend analysis and signal execution capabilities of the ProMatrix Quantitative Trading System, we will continue to expand both the height and breadth of our asset growth.

Today's Key Updates:

1.What is today’s optimization plan for the “Dynamic Diversified Asset Allocation System” strategic layout?

2.What are the detailed plans for the second internal test trading of the ProMatrix Quantitative Trading System?

Friends, the market’s attention remains focused on the U.S.–China trade negotiations and the upcoming release of the May CPI data tomorrow.

Against this backdrop of dual uncertainty, we’ve observed that overall investor sentiment has become more cautious, with capital mostly staying on the sidelines and a noticeable decline in short-term trading enthusiasm.

In particular, the CPI data will offer a fresh perspective for the market to assess inflation trends amid the evolving trade policies of the Trump administration.

As a result, today's investment market is expected to maintain a tone of consolidation and fluctuation.

In terms of strategy, it's still important to manage position sizing carefully, optimize asset allocation, and strengthen the ability to generate wealth.

Another wonderful moment has arrived!

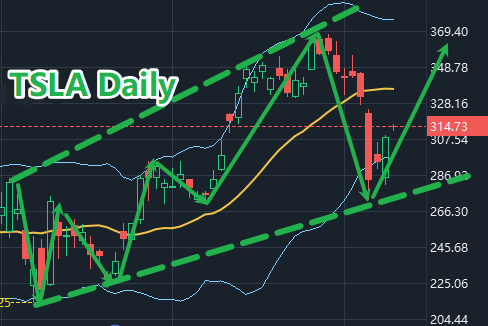

At this very moment, TSLA is once again showing positive signs of a rebound!

Currently, it is steadily advancing along its upward channel. Although there has been a short-term price pullback during the rebound, we’ve always emphasized: a temporary step back in rhythm is not the end of the trend, but rather the buildup for the next upward move.

From a technical perspective, TSLA is still moving within a clearly defined upward channel, and the overall trend structure remains intact. Market bullish sentiment is gradually recovering.

At this moment, I want to give special congratulations to those who decisively increased their positions at lower levels and executed precisely .The value you’ve captured will continue to expand.

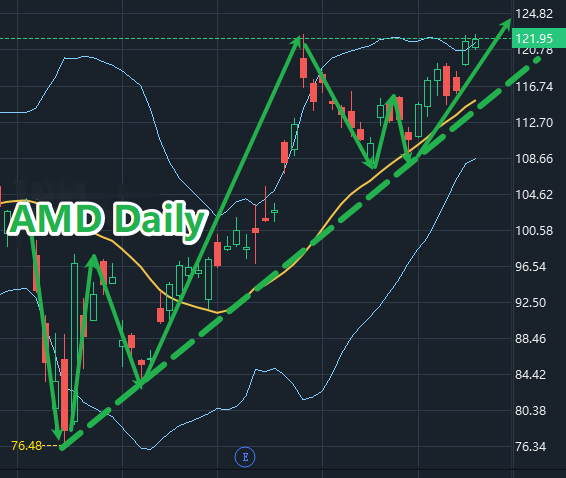

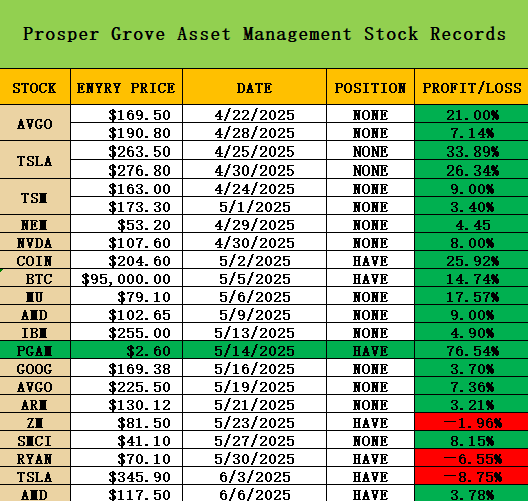

Today, AMD's price surged again, bringing us a 3.78% phase profit gain. This is the fulfillment of the system signal, the reward of strategic execution, and the real value released by our "Dynamic Diversified Asset Allocation Strategy" in actual trading.

From a technical standpoint, the overall trend remains in good condition, so we choose to continue holding and waiting.

Once again, congratulations to all our friends who continue to pay attention to our Prosper Grove Asset Management and firmly implement strategic asset allocation. At this moment, your wealth has once again reached a new height.

Friends, through the "dynamic diversified asset allocation system" we have built, the stable performance and continuous profitability of a series of high-quality assets have once again clearly conveyed a core concept to everyone: truly mature asset allocation can not only increase the "attack capability" and amplify profit returns when opportunities come; but also build a solid defense fortress when risks come, ensuring the continuous leap of wealth.

Therefore, no matter how the market changes or how the macro environment evolves, you will find that the high-quality assets we configure can always create continuous and substantial profit growth for us at different stages.

The core driving force to achieve all this is: the ProMatrix Quantitative trading system.

Currently, the ProMatrix Quantitative trading system has entered the most critical stage before its official launch, which is a sprint cycle integrating "testing, correction, and optimization". Every step of the system upgrade is the result of the wisdom and hard work of our entire team.

During the first internal testing phase of the ProMatrix Quantitative trading system, we have successfully collected more than 260,000 valid actual trading data. These data have been fully retrieved, deeply analyzed, and accurately traced back by our R&D team, providing extremely valuable data support for the further upgrade of the ProMatrix Quantitative trading system.

Through the improvement and optimization of this system, we have reason to believe that the ProMatrix Quantitative trading system has four core driving forces of the enhanced version:

1. The trend analysis function will be more accurate;

2. The predicted trading signals will be more efficient;

3. The asset rating will be more authoritative;

4. The success rate and execution stability of the system will reach a new height.

Moreover, we at Prosper Grove Asset Management are actively preparing for the second internal test of the ProMatrix Quantitative trading system.

Therefore, we have reason to believe that in the upcoming second internal test of the ProMatrix Quantitative trading system, we will reap a greater profit return, and we are full of greater confidence and expectations for this.

Friends, at this moment, we are standing at a critical threshold in the evolution of the ProMatrix Quantitative trading system. In order to ensure the smooth progress of the second internal test transaction that is about to be launched, I will share with you the core goals and key details of this test in detail.

Please read carefully and fully understand it, and ensure that in this new practical opportunity, go all out and execute accurately to reap higher profit returns!

1. The core goal of the second internal test

The original intention of our current round of testing is very clear: to further verify the stability, profitability, and completeness of the ProMatrix Quantitative trading system in real scenarios in the current highly volatile market environment.

This time, we will fully implement:

1. A low-risk, high-win rate robust trading strategy;

2. Only select signals with stronger trend confirmation and higher expected win rate to participate in trading;

3. Obtain sufficient "real, high-quality, non-repetitive" actual combat data.

2. Test target

In the second round of internal testing of the ProMatrix Quantitative trading system, we will continue to focus on the cryptocurrency market as the core test target.

Why choose the cryptocurrency market as the main battlefield for testing?

After our top analyst team's systematic research on major asset classes, combined with the powerful trend analysis, forecast analysis, and asset rating functions of the ProMatrix Quantitative trading system, we have come to a clear conclusion: the cryptocurrency market, with its high volatility, data transparency, and trading flexibility, is most suitable for the priority landing scenario of the system's internal testing.

Recently, global funds have accelerated the transfer from traditional markets to cryptocurrency markets, which not only improves the liquidity and depth of the cryptocurrency market but also provides a more ideal investment environment for the second internal test of our ProMatrix Quantitative trading system.

Moreover, through the first internal test of the ProMatrix Quantitative trading system, we achieved a profit growth of up to 99% in just two days, which is difficult to achieve in the traditional investment field, once again proving that our ProMatrix Quantitative trading system is more profitable in the cryptocurrency market.

3. Time of this internal test

Thursday, June 12, Eastern Time

4. Test period, profit target, and test success and failure criteria

3-7 trading signals to achieve 80% profit growth. If the established target is successfully achieved, it is considered successful, otherwise it fails.

5. Test quota: 1500

Dear friends: Through multiple rounds of in-depth strategic talks with our strategic partner: True Guard Coin Trading Center, we have successfully secured more practical opportunities and resource support for everyone!

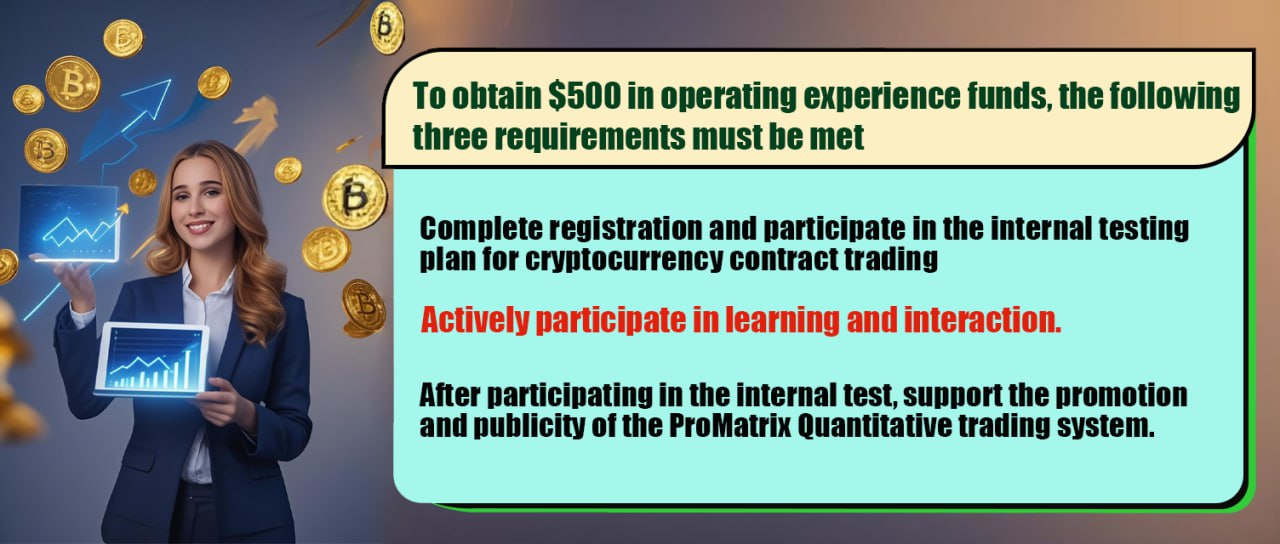

In this round of the second internal test of the ProMatrix Quantitative trading system, we have secured 1500 test quotas for everyone, and each participant will receive $500 in real-time test funds.

Therefore, friends who have successfully obtained a place in the second round of internal testing, this is a very scarce "ticket to the next wealth curve". Please pay great attention to it, prepare carefully, and familiarize yourself with the testing process to ensure that you can participate and make profits as soon as possible.

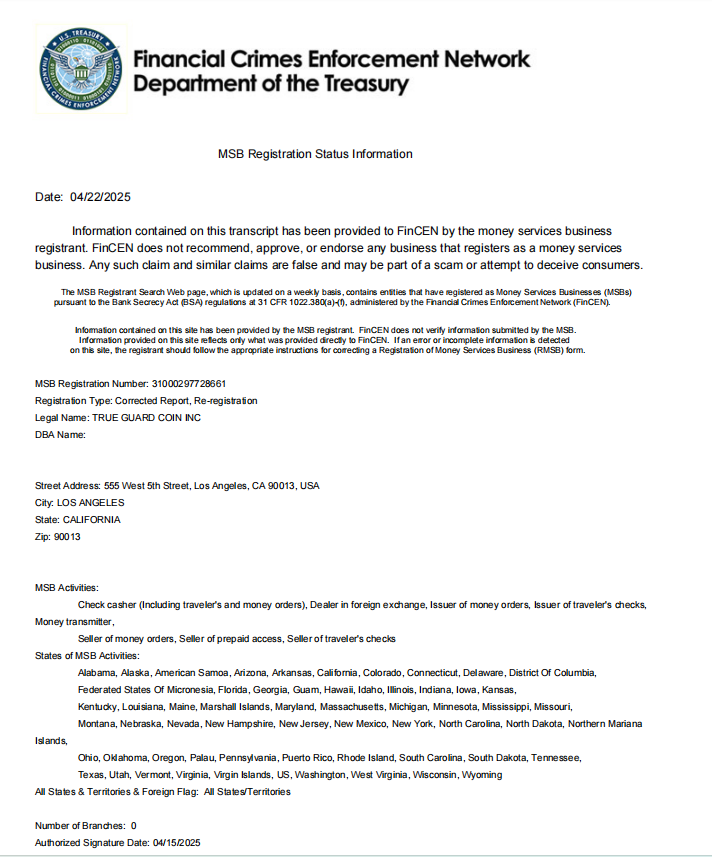

It is worth noting that our strategic partner: True Guard Coin Trading Center has obtained a financial operation license issued by the US SEC, and has the compliance qualifications to provide legal asset trading services to global users; it has also obtained the MSB financial services license issued by the US Financial Crimes Enforcement Network (FinCEN), indicating that it has fully connected with the high standards of the international mainstream regulatory system in terms of anti-money laundering mechanisms, customer funds transparency, and cross-border transaction compliance.

This series of compliance qualifications endorsement not only highlights the legitimacy, professionalism and operational compliance of True Guard Coin Trading Center; it also builds a solid security guarantee for our ProMatrix Quantitative trading system internal test transactions and asset management.

6. Principles of the second internal test of the ProMatrix Quantitative trading system:

a. For friends who have not participated in the first internal test but have successfully registered for this round of testing, we will still provide you with $500 in testing experience funds to help you experience the logic, rhythm, and practical value of the ProMatrix Quantitative trading system signals at zero risk.

b. For friends who have participated in the first round of internal testing, we will no longer give you $500 in testing funds. But you can still voluntarily use your own funds to continue to participate in the second actual test, continue to follow the precise trading signals issued by the ProMatrix Quantitative trading system, strengthen the sense of rhythm in the real market, verify the profitability of the system, and accumulate rich profits!

It is worth praising that in the past two days, we have seen many friends who participated in the first round of testing actively use their own funds to participate in actual combat again without the support of test funds. They firmly implement the trading signals issued by the ProMatrix Quantitative trading system, continue to participate in trading, and have obtained very considerable profit returns!

At this moment, these friends are no longer bystanders, but actors and beneficiaries of the new round of wealth growth.

7. Distribution of trading results

During the entire testing process, as long as you strictly follow the trading signals issued by the ProMatrix Quantitative trading system, even if there is a loss after the test, you do not need to compensate for any loss amount. All you need to do is to return the unused test funds.

In other words, we at Prosper Grove Asset Management will cover the bottom line for everyone! This not only reflects our core concept of "customer interests first", but also our confidence and confidence in the strong profitability of the ProMatrix Quantitative trading system!

Of course, if you are profitable after the test, then congratulations, this profit belongs entirely to you!

You only need to return the $500 test experience funds we provide, and then you can withdraw the remaining profits to your cryptocurrency wallet.

Dear friends: The above is the core content and execution details of the second internal test of our ProMatrix Quantitative trading system.

I sincerely hope that every friend can pay enough attention to this test, and all friends who have not signed up yet, please contact assistant Sophia Morgan immediately to make an appointment for the test in advance, receive the test funds, and familiarize yourself with the test process.

At this moment, every time you firmly participate, you will not only win yourself considerable actual profits and growth experience but also contribute your precious strength to the further improvement, upgrading, and globalization of our ProMatrix Quantitative trading system.

Friends, this morning's sharing has come to a successful conclusion. Thank you for your active participation and careful listening.

Later, we will continue to share the operation process of the internal test of the ProMatrix Quantitative trading system, as well as the core working principle of the ProMatrix Quantitative trading system: how the BOLL indicator determines the trend and the buying and selling points.

Looking forward to more friends participating in the discussion, see you later!