Dear friends, I am Christian Luis Ahumada, founder and chief quantitative trading analyst of Prosper Grove Asset Management. I am very happy to meet with you again in the group today to share the joy and sense of accomplishment brought by the steady growth of wealth.

At this moment, we are not only sharing market trends and tracking trends but also strengthening our core motivation for acquiring wealth through every learning and communication.

Important information today:

1. How to adjust the strategic direction of high-quality assets in the strategic layout of a "dynamic diversified asset allocation system"?

2. What are the principles of the second internal test of the ProMatrix Quantitative trading system?

3. The core working principle of the ProMatrix Quantitative trading system: BOLL judgment logic and application.

Friends, based on the intelligent filtering and comprehensive analysis of macroeconomic data by the ProMatrix Quantitative Trading System, we have identified an important signal: the monthly consumer survey released by the New York Federal Reserve on Monday shows that in May, consumer expectations for future price pressures have eased significantly; at the same time, household confidence in the labor market has begun to recover.

This result sends a strong signal: inflation sentiment is stabilizing, market expectations are becoming more rational, and consumer confidence is gradually recovering.

At this moment, global attention is focused on the U.S.-China trade negotiations, and market investors are closely watching the progress. Let us maintain strategic patience and wait for a clear signal of the market’s true trend to take shape.

Dear friends, let us now focus on the performance of high-quality assets in the strategic layout of the "dynamic diversified asset allocation system" and clarify the operation strategy:

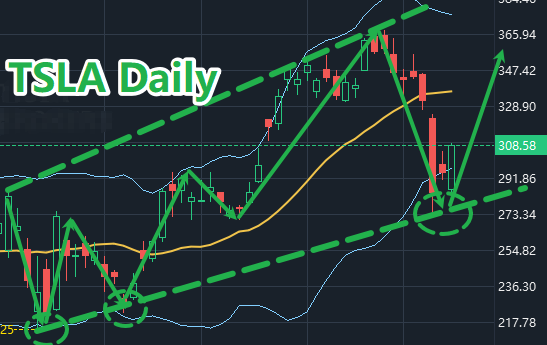

The first focus: TSLA

From the perspective of trend structure, TSLA is still running steadily in a clear upward channel, and the price is advancing rhythmically along the trend line, showing a good medium- and long-term operation trend.

From the news perspective: Recently, due to the disagreement between Musk and President Trump on the new tariff bill, the market sentiment fluctuated briefly, causing TSLA's stock price to fall back.

But we must clearly realize that this kind of short-term disturbance belongs to the market-level emotional disturbance, which cannot change TSLA's long-term industrial logic and value main line.

From the strategic point of view: On June 12, TSLA will launch its self-driving taxi project in Austin. Once the project is successfully implemented, it will most likely push the company to open a new growth curve and valuation revaluation channel, bringing us additional structural value release.

Therefore, we choose to continue holding and wait for more value release.

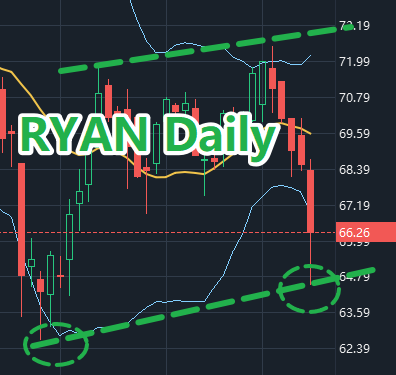

Recently, although RYAN prices have experienced a short-term correction, we believe that this is more like a technical pause in a healthy adjustment process rather than a trend reversal.

The current stock price has run to the vicinity of the short-term support line, and there is an obvious "lower shadow" pattern at this position, which is a common signal in the market, meaning that the carrying capacity below is enhanced and bulls are willing to enter the market.

From the news perspective, RYAN Specialty has officially announced that it will acquire the insurance business of JM Wilson, headquartered in Michigan.

This acquisition will not only help expand its business coverage in the central US market, but more importantly, it conveys the company's clear intention in terms of expansion strategy and industry concentration.

Moreover, there is no negative news about RYAN yet, so we choose to continue holding and waiting.

Friends: Although some stocks in our "dynamic diversified asset allocation system" have not yet brought direct profit growth,

I want to emphasize that this is not a failure, but the natural rhythm of assets in dynamic rotation. What really deserves our attention is the continuous value release ability of core assets in the entire strategic layout.

In particular, it is worth focusing on the value path released by the core asset PGAM token.

At present, the price of PGAM tokens has been steadily rising, which has brought us a 76.92% phased profit growth. This is the result of our strategic configuration completed in advance under the guidance of the signal of the ProMatrix Quantitative trading system.

I believe that for all friends who have been paying attention to and firmly implementing asset allocation for a long time, your wealth is entering an accelerated growth track.

At this moment, we need to clarify three core strategies:

1. In our asset allocation, if individual high-quality assets have not yet generated profits, please remain patient, continue to hold, and execute the updated asset allocation strategy as planned to ensure that your overall portfolio grows steadily and does not deviate from the main line.

3. It is very important to adjust your mentality. No one will oppose getting rich slowly. Steady growth is our goal. It is absolutely undesirable to participate in transactions with the mentality of getting rich overnight. Therefore, all friends must not fall behind, and move forward bravely with the fullest passion and pursuit of wealth and freedom.

So, I hope all friends, especially those who have just joined our Prosper Grove Asset Management, must quickly build your own strategic layout of a "dynamic diversified asset allocation system" and continue to improve and upgrade it.

I believe that many old friends have already deeply experienced that the focus of profit growth of the high-quality assets in our layout is rapidly migrating from the traditional investment field to the cryptocurrency sector.

This is not driven by emotions or blind enthusiasm, but the result of trend promotion, structural evolution, and system prediction.

Especially the mainstream cryptocurrency asset BTC and the strategic core asset PGAM token, they are releasing value signals with unprecedented strength, leading the entire asset allocation system to continuously advance towards higher growth rates, greater imagination space, and stronger cycle penetration!

What is even more exciting is that during the period of internal testing of our ProMatrix Quantitative trading system, the entire market seems to be following our trading rhythm.

The mainstream cryptocurrency asset BTC and the core asset PGAM token have risen one after another as if the market is paving the way and cheering for the internal testing of our ProMatrix Quantitative trading system.

This once again shows that our ProMatrix Quantitative trading system has built a very bright wealth path that follows the trend.

Therefore, we attach great importance to the growth and evolution of the ProMatrix Quantitative trading system, and attach more importance to the trust and execution of each participant.

This time, we successfully collected enough valid trading data through the first internal test of the ProMatrix Quantitative trading system. These valuable practical data provide solid support for the next stage of improvement and upgrading of the system.

Now our R&D team is working overtime to conduct in-depth proofreading, logic optimization, and performance tuning of the test data, and further improve and upgrade the various functions of our system.

At the same time, the second internal test of the ProMatrix Quantitative trading system is being actively prepared and is expected to be officially launched this Thursday.

Moreover, my assistant Sophia Morgan and I have received many messages from friends in the past two days. They expressed their gratitude for leading everyone through fluctuations and gaining wealth; they expressed their high recognition of the professional ability of our Prosper Grove Asset Management; they also expressed their high trust in the strong profitability of the ProMatrix Quantitative trading system, and took the initiative to express their willingness to participate in and support the second internal test, and to fully assist the system to go further, more stable, and stronger!

At this moment, seeing everyone's high enthusiasm and continuous message feedback, I and the entire Prosper Grove Asset Management team is extremely excited, and feel warm and encouraged.

But at the same time, we are also more aware of the responsibilities and missions we shoulder.

We know that every friend who chooses to join Prosper Grove Asset Management is not only looking for an investment opportunity but also looking for a way to break through the status quo and reshape their destiny.

Therefore, our responsibility is not only to help you make money but also to help you improve your life and achieve freedom through systematic thinking, scientific trading, and more detailed profit plans.

Our mission is to collect more effective trading data, continuously optimize and upgrade the ProMatrix Quantitative trading system, and let the system step onto the global stage with a more perfect attitude.

At the same time, we are also simultaneously advancing: Enhance the global visibility and influence of our Prosper Grove Asset Management, further expand the scale of asset management, so that our company's market value will also be gradually increased, which will lay a solid foundation for us to embark on the road to Nasdaq listing within three years, and steadily move towards the world's top asset management company.

The realization of all this is inseparable from you, and each of our friends with dreams.

Therefore, as we actively prepare for the second internal test transaction of ProMatrix Quantitative, we are also pleased to see that more and more friends are actively contacting assistant Sophia Morgan to sign up, willing to work with us again to contribute to the upgrade and practical optimization of ProMatrix Quantitative trading system.

First of all, I would like to thank everyone for their active participation and support, but it is worth emphasizing that when we collect transaction data for internal testing, we emphasize "real, high-quality, non-repetitive" actual combat data.

In other words: if you have participated in the first internal test, then the transaction data you generate in the second test will not bring new incremental value to the system upgrade.

Why emphasize this point?

Because we do not test for the sake of testing, but to ensure that every transaction data can contribute unique feedback information and operating performance to the upgrade of the ProMatrix Quantitative system. This is our insistence on system quality and our responsible attitude towards every participant.

Besides, due to the limited number of test places, the principles for participating in the second internal test are as follows:

1. For friends who have not participated in the first internal test but have successfully registered for the second round of tests, we will still provide 500 US dollars of test experience funds to help you experience the logic and actual results of the system signals without risk.

2. For friends who have participated in the first internal test, we will no longer give 500 US dollars of test experience funds again. But if you want to continue to follow the signals issued by the ProMatrix Quantitative trading system to participate in transactions and obtain considerable profit returns, you can choose to use your own funds to continue to participate in the second internal test.

Dear friends, at this moment, I would like to encourage those friends who missed the first internal test, especially those who have not really experienced the extraordinary power brought by the ProMatrix Quantitative trading system, to contact assistant Sophia Morgan in advance to sign up for the second round of internal testing. We will give priority to those who actively sign up and have strong execution ability, and welcome the next greater wealth opportunity with you!At this moment, in order to enable everyone to more accurately grasp the trading signals issued by the system and improve the efficiency of actual execution in the upcoming internal test, next, we will take you to further understand and master the core working principles and practical application logic of the ProMatrix Quantitative trading system.

Now, let us join hands to enter the world of the ProMatrix Quantitative trading system and explore its unique charm and powerful power in the investment field.

Today, I will focus on sharing the core working principle of the ProMatrix Quantitative trading system: the judgment and application of the BOLL indicator.

As shown in the figure: the running trajectory of the AMD daily trend chart.

Important components of BOLL: upper rail, i.e. A; middle rail, i.e. B; lower rail, i.e. C

The core working principle of BOLL is to construct a "price channel" by dynamically counting the price fluctuation range. Its upper and lower rails expand and contract with price fluctuations to form a "price fluctuation belt".

How to judge the direction, how to judge the buying and selling points and deeper research and judgment of the BOLL indicator will be shared tomorrow. I hope all my friends can pay attention to it in time.

Dear friends, today's sharing has come to a successful conclusion. Thank you for your careful listening and enthusiastic participation.

Tomorrow, we will continue to promote the optimization process of the "dynamic diversified asset allocation system", combine the current market trends and sector rhythms, formulate a new round of asset allocation optimization plans, and strengthen the ability to make money; at the same time, we will also focus on sharing more detailed planning content of the internal test of the ProMatrix Quantitative trading system. We look forward to more friends' attention and participation. See you tomorrow!