Dear friends, I’m Christian Luis Ahumada, Founder and Chief Quantitative Trading Analyst at Prosper Grove Asset Management. I’m delighted to be here with all of you on this exciting day.

Today, we will interpret the wealth implications brought by the non-farm payroll data together, and further guide the refinement and upgrade of our Dynamic Diversified Asset Allocation Strategy.

Today's Key Updates:

1.What impact does the released non-farm payroll data have on the current market? What signals does it convey?

2.What are the detailed contents of today's synchronized buy-in high-quality stocks?

3.How are the dynamic changes in the high-quality assets within the Dynamic Diversified Asset Allocation Strategy evolving? What is our optimization strategy?

Dear friends, at this moment, investors around the world are closely focused on the economic signals revealed by the non-farm payroll data.

This is not just an economic data point; it is a key indicator of the Federal Reserve's monetary policy direction and a core variable influencing global capital flows and market risk appetite. We must take a higher perspective to clearly understand the logic and opportunities behind it.

The non-farm payroll number refers to the number of new jobs added across all industries except the agricultural sector, including manufacturing, services, construction, retail, education, and healthcare.

It is a key indicator of economic health and labor market conditions, and it directly influences the Federal Reserve's monetary policy decisions.

The unemployment rate represents the overall slack in the labor market.

The non-farm payroll data filtered through the ProMatrix Quantitative Trading System is as follows:

Non-farm payrolls: In May, the labor market added 139,000 jobs, exceeding economists’ expectations of 126,000. The unemployment rate remained steady at 4.2%.

Meanwhile, other data also began to reveal signs of a cooling labor market. On Wednesday, ADP reported that the private sector added only 37,000 jobs in May, marking the smallest monthly increase in over two years. On Thursday, weekly initial jobless claims reached the highest level since October 2024. At the same time, the number of continuing claims for unemployment benefits remained near its highest level in nearly four years.

Based on the above data, we must clearly recognize that although the headline numbers appear solid, the underlying resilience of the labor market is weakening, and structural softness is beginning to emerge.

Economic growth remains stable, but its momentum is starting to slow, further increasing expectations for a Fed rate cut.

Today’s data is expected to have a positive impact on the investment market. The market is likely to show a choppy rebound throughout the day.

Today’s release of the non-farm payroll data has created a favorable investment environment for our synchronized purchase of high-quality stocks.

Now, let’s focus on the detailed information of today’s featured stock:

This high-quality stock is not only a global leader in the semiconductor industry but also a tech giant that has made a strong breakthrough in the wave of artificial intelligence. It boasts broad deployment, solid foundations, and a clear future outlook.

Its business structure spans four segments: Data Center, Client, Gaming, and Embedded.

Key highlights of this high-quality stock:

1.Strong Financial Performance and Outlook

Driven by robust demand for artificial intelligence and data center technologies, the semiconductor industry is expected to continue its growth trajectory in 2025. According to a report by Mordor Intelligence, the global semiconductor market size is projected to reach $631.01 billion by 2025 and grow to $958.93 billion by 2030, with a compound annual growth rate (CAGR) of 8.73%.

In this wave of AI-driven data center transformation, this high-quality stock is rapidly advancing toward a core leadership position:

a. In Q1 2025, data center revenue surged by 57.2% year-over-year, reaching $3.674 billion and accounting for an impressive 49.4% of total revenue.

b. The EPYC Turin processors and Instinct AI accelerators have been widely deployed by hyperscale customers such as Oracle Cloud and Google Cloud.

Behind all of this is the company’s unwavering commitment to advancing technological innovation and expanding its footprint within the AI ecosystem.

2.A series of acquisitions accelerating strategic expansion, challenging NVDA’s dominant position

This high-quality stock acquired Mipsology in August 2023, Nod.AI in October 2023, and Silo AI in July 2024.

Now, this high-quality stock continues to strengthen its control over the AI ecosystem, having recently completed the acquisition of Brium. This marks its fourth strategic acquisition within two years, as it consistently challenges NVDA’s dominant position in the field of AI inference.

These initiatives have expanded the influence of this high-quality stock and, within the rapidly growing field of artificial intelligence, provided a competitive and open alternative to NVDA’s dominance in proprietary software.

3.Technical Perspective

Currently, this high-quality stock has been steadily climbing along the trendline since its low point, forming a classic and healthy upward channel.

Moreover, the price has now successfully held above the middle Bollinger Band, establishing a solid medium-term support level.

Even more importantly, this high-quality stock is forming a “W-shaped bottom structure” and is currently at the critical neckline breakout point. Once a confirmed breakout occurs, a new round of strong upward momentum is expected to follow.

Based on the above analysis, this high-quality stock demonstrates strong upward potential and strategic value, supported by four major factors: macroeconomic conditions, fundamentals, market confidence, and technical indicators. These combined signals fully meet our criteria for a joint buy-in.

The first target price: $140.

Friends, if you're interested in this high-quality stock and wish to participate in the joint buy-in opportunity, please contact the assistant immediately to obtain detailed strategy information, including the timing of the buy-in and position planning. This will ensure you can join the trade in sync and work together toward a leap in wealth.

Dear friends, the investment market's wealth feast is accelerating towards the climax. Especially today, the heavy release of non-agricultural employment data has become the focus of global investors and also provided clear strategic guidance.

After the release of non-agricultural data today, the expectation of the Fed's interest rate cut was further increased. This key signal has injected strong confidence into our upcoming ProMatrix Quantitative trading system internal test.

According to statistics, the unilateral trend triggered by each release of non-agricultural data often continues to the next week, which means: the time node of our ProMatrix Quantitative trading system internal test is just in the coverage area of unilateral market outbreak. At this moment, the trend will move in the same direction as us, which is an excellent window for actual trading.

Friends, in this market atmosphere, we can fully expect that tomorrow's internal test will not only be a test of the accuracy of the ProMatrix Quantitative trading system but also an excellent opportunity to test the market trend theory.

Especially tomorrow, the internal test of the ProMatrix Quantitative trading system will officially start from 13:00 to 15:00 Eastern Time. This is not only a test of system performance, but also a practical trial and wealth voyage for every brave person.

At this moment, there are less than 500 places for internal testing. If you are still hesitating, you may lose this opportunity of zero risk, actual profit, and wealth accumulation.

If you have successfully registered, please complete the following preparations immediately:

1. Complete the registration of the trading account;

2. Receive $500 in test funds;

3. Learn how to quickly complete the buying and selling operations by following the trading signals.

If you have not registered yet, now is the last window! Please contact the assistant immediately to complete all the preparations.

She will guide you through the operation process to ensure that when the ProMatrix Quantitative trading system issues a trading signal,

you respond, trade, and make profits for the first time!

Friends, please note: Friends who participate in the internal test transaction will have the opportunity to receive the "11th Prosper Grove Asset Management Trading System Financial Training Course" course reward.

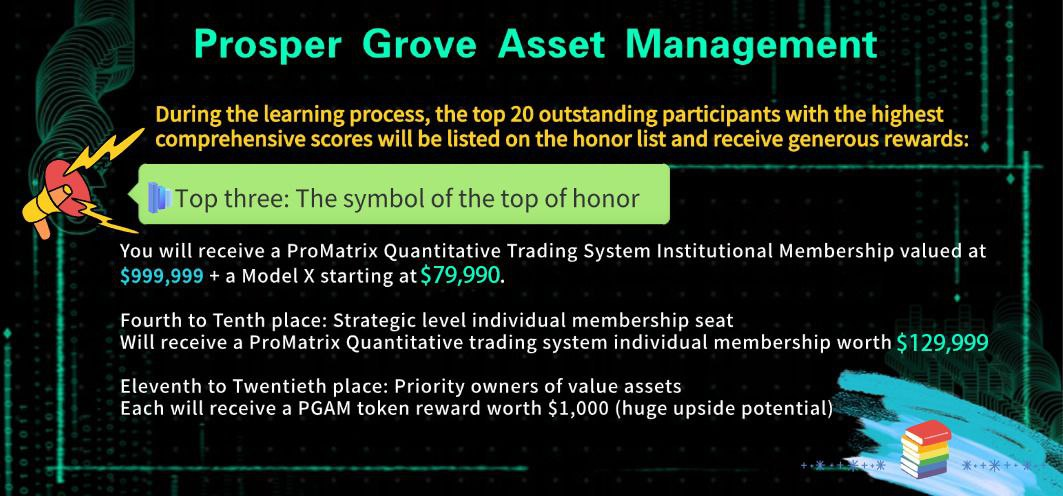

During the learning process, the top 20 outstanding participants with the highest comprehensive scores will be listed on the honor list and receive generous rewards:

Top three: The symbol of the top of honor

You will receive a ProMatrix Quantitative Trading System Institutional Membership valued at $999,999 a Model X starting at $79,990.

Fourth to Tenth place: Strategic level individual membership seat

Will receive a ProMatrix Quantitative trading system individual membership worth $129,999.

Eleventh to Twentieth place: Priority owners of value assets

Each will receive a PGAM token reward worth $1,000 (huge upside potential)

Friends, today's morning content sharing has come to a successful conclusion. I would like to thank every friend for their active participation and dedicated investment!

It is because of your trust and execution that the strategic layout of the "dynamic diversified asset allocation system" that we jointly promote has been continuously optimized and upgraded, and the light of profit continues to shine!

Later, I will focus on sharing with you the: Things to note when participating in the internal test of the ProMatrix Quantitative trading system tomorrow. This is not only a guarantee to ensure that you can successfully complete the test transaction, but also a key step for you to steadily obtain profits and accumulate practical experience.

Please all friends who have successfully registered for the internal test must attend on time to ensure that you can efficiently execute every trading signal issued by the ProMatrix Quantitative trading system, and truly transform the wisdom of the ProMatrix Quantitative trading system into your own profit results! See you later!