Dear friends, I am Christian Luis Ahumada, founder and chief quantitative trading analyst of Prosper Grove Asset Management. I am very happy to meet you again in the group at this hopeful moment. Today, we will start a journey of jointly exploring the operating logic of high-quality stocks.

Today's important information:

1. What are the real-time dynamics of the high-quality assets in the strategic layout of the "dynamic diversified asset allocation system"? What important information does our strategy convey?

2. What are the practical operation methods of cryptocurrency contract trading?

Today, the overall market momentum has slowed down, with TSLA experiencing a pullback due to short-term sentiment fluctuations, which has affected the performance of the tech sector. Meanwhile, global capital is now focused on the upcoming non-farm payroll data set to be released tomorrow.

Tomorrow, we will continue to analyze the non-farm payroll data to further explore the Federal Reserve’s monetary policy trajectory, providing guidance for the next phase of our wealth growth strategy.

Next, our strategy is as follows:

1.Optimize our current high-quality assets to protect the gains we’ve achieved.

2.Continue to wait for tomorrow’s non-farm payroll data release, which will guide us in refining and upgrading the strategic layout of our Dynamic Diversified Asset Allocation System.

Dear friends, now let us focus on the real-time dynamics of the high-quality assets in the strategic layout of the "dynamic diversified asset allocation system" and further understand its operating logic.

Among the high-quality assets in the strategic layout of the "dynamic diversified asset allocation system" we have built, TSLA is worth mentioning.

Are you worried or scared when you see the price of TSLA fall back in the past two days?

I believe that many friends’ first reaction is worry or even panic, especially for new friends who have just joined the stock market. It is very normal to have such emotional reactions. We do not deny the existence of emotions, but in the professional investment system, we emphasize "understanding logic and controlling emotions".

First of all, we have to ask ourselves a fundamental question:

Is the decline of TSLA due to problems in business operations or external policy disturbances?

The answer is very clear: this is not a shake in fundamentals, but a typical "non-systemic emotional shock".

The background of the incident is this: Musk publicly criticized President Trump's latest tax bill, and President Trump expressed "disappointment" in response.

This high-level policy-level disagreement did trigger market concerns about TSLA in a short period of time, causing prices to fall rapidly.

But what I want to tell you is: that this is the release of emotions, not the loss of value; it is a short-term fluctuation, not a reversal of the long-term trend!

Please remember that what really drives a company's mid-to-long-term growth is its core competitiveness and development path.

TSLA's core logic remains solid:

1. Global technology leader in the field of autonomous driving;

2. Austin will launch autonomous taxi testing on June 12, which is not only an upgrade at the technological level but may also reshape the future of urban travel!

Therefore, we choose to hold TSLA temporarily and wait for the panic in the market to end before seeking a more stable opportunity to increase positions.

Friends, as I have always emphasized: the market has never lacked volatility, what is really lacking is investors who can still keep a clear mind and firmly implement strategies in the face of volatility.

Only those who can truly stabilize their emotions in panic and stick to their strategies in callbacks can finally cross the cycle and move towards the road of real wealth leap.

Please always remember: you are not fighting alone in the market, we are a team with a common dream, and each of us is a charging warrior in this journey of wealth!

When the market is good and the profits are lucrative, we are happy together and share the joy of victory with each other;

When the market is temporarily frustrated and individual stocks are not profitable, we must learn to listen, understand and support each other and become a solid support for each other's hearts.

Every truly excellent investor will experience fluctuations and uncertainties. But this is not terrible. What is terrible is stagnating in emotions and getting lost in short-term gains and losses.

And what we have to do is, after the emotional catharsis is over, we must continue to analyze and summarize information data, re-formulate strategic planning, regain confidence, and make back the money we didn't make.

So, in the next wealth journey, I hope that we are not only the recipients of wealth but also the spiritual supporters of each other.

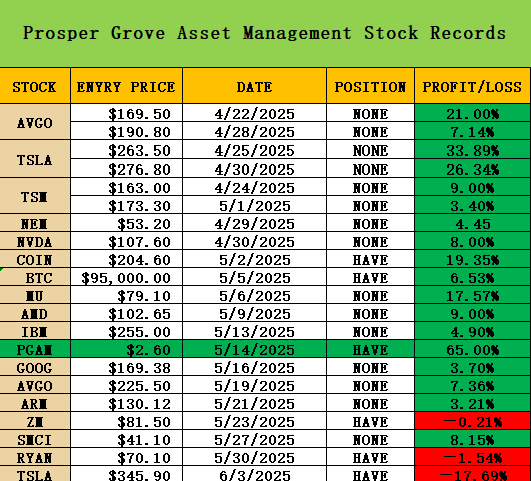

Moreover, through the high-quality assets of the "dynamic diversified asset allocation system" strategic layout we have recently built, it can be found that after the ProMatrix Quantitative trading system screens big data, the wealth system built can lead everyone to achieve a steady increase in wealth.

Although TSLA's price has fallen due to a short-term disturbance at the policy level, some friends have become anxious, which is completely understandable. But TSLA is only one part of the entire "dynamic diversified asset allocation system" strategic layout, not the whole picture; our system layout is moving forward in multi-dimensional resonance.

From the current overall performance, other high-quality assets still bring us clear and visible profit growth, which is the charm of the diversified asset allocation strategy.

It is particularly worth focusing on the core asset in the strategic system we have built: PGAM token, which has recently brought a gratifying 65.00% profit growth!

It not only brings us a substantial leap in wealth but also plays a strong role in hedging and filling in the short-term volatility of TSLA, which once again verifies the powerful strategic construction ability of our ProMatrix Quantitative trading system.

After screening big data information analysis through the ProMatrix Quantitative trading system, we have constructed a "dynamic diversified asset allocation system" to strategically deploy high-quality assets. The market performance also conveys three extremely important wealth wisdom to us:

1. Keeping a stable mentality is the first lesson of investment practice

Whether it is an increase or a pullback, it is just a "process" rather than a "result". Emotional ups and downs will only interfere with judgment. Only with a calm mentality and firm execution can you go long-term.

2. Diversified allocation is a wealth shield that crosses the cycle

A single asset cannot carry all hopes. Only a multi-dimensional layout can resist risks and grow steadily. This is exactly the power of the "dynamic diversified asset allocation system" that we at Prosper Grove Asset Management have always emphasized.

3. Firm trust in the system is the key cornerstone of actual profit

The ProMatrix Quantitative trading system is not a simple tool, it is the intelligent partner of each of our investors and the command center on the battlefield.

As long as we firmly execute the system signals and bravely execute the trading plan, we can surely achieve a steady leap in wealth.

Friends, over the past period of time, we have witnessed the rich returns brought by the strategic layout of the "dynamic diversified asset allocation system", and personally experienced the extraordinary strength of the ProMatrix Quantitative trading system in trend analysis, prediction functions and asset ratings.

It is the continuous verification of this powerful ability that has aroused the desire and enthusiasm of countless investors. Therefore, the call for the official launch of the ProMatrix Quantitative trading system is as high as a tide!

In order to make the ProMatrix Quantitative trading system officially debut in a more perfect and intelligent state, our Prosper Grove Asset Management team has fully launched the internal testing strategy plan.

This test is not only a functional verification, but also the three core missions that drive us toward the future:

1. Through large-scale actual trading, we will collect enough trading data to provide solid data support for the further upgrading and optimization of the ProMatrix Quantitative trading system, thereby accelerating the process of the system's mature launch.

2. Through the precise operation of the signals issued by the ProMatrix Quantitative trading system, the students have achieved stable profits many times.

These real cases will become the best endorsement for promoting the Prosper Grove Asset Management brand while promoting the continuous expansion of our asset management scale.

3. We at Prosper Grove Asset Management have prepared sufficient advertising budgets and planned a strong global promotion plan.

Before the ProMatrix Quantitative trading system is officially launched, we will create momentum, create voice, and create momentum for it to ensure that it can make a shocking debut and quickly open up the market once it is launched.

So at this moment, if you:

1. Hope to have a deep understanding of the core working principle and usage of ProMatrix Quantitative;

2. Hope to personally participate in the real-time internal testing of the ProMatrix Quantitative trading system;

3. Want to get priority to obtain $500 in test funds, participate in trading operations with zero risk throughout the process, and obtain considerable profit returns;

4. Want to become the core force that promotes the successful launch of the ProMatrix Quantitative trading system;

Then, please take action immediately, contact the assistant to complete the registration, register a trading account and receive $500 in test funds, and quickly master the trading operation process.

Friends, in order to enable every friend to execute efficiently in actual combat, successfully participate in transactions, and make profits for the first time, I will explain in detail: how to quickly and accurately complete trading operations after receiving the signal from the ProMatrix Quantitative trading system.

How to buy and sell cryptocurrency contract transactions:

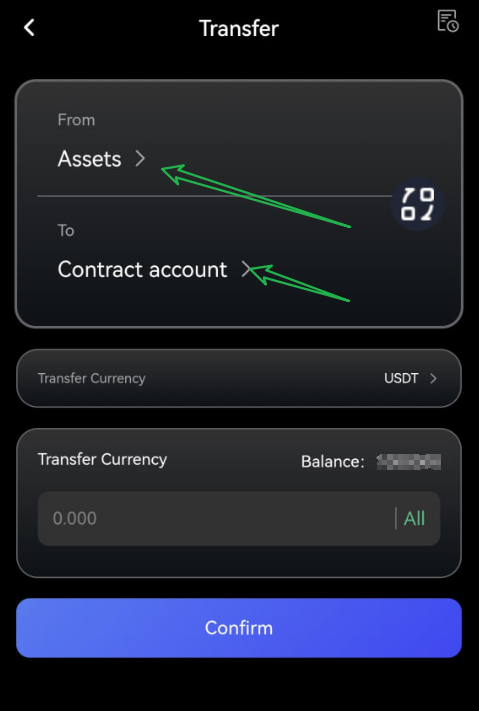

1. Fund transfer, that is, funds are transferred from the asset account to the contract account, as shown in the figure:

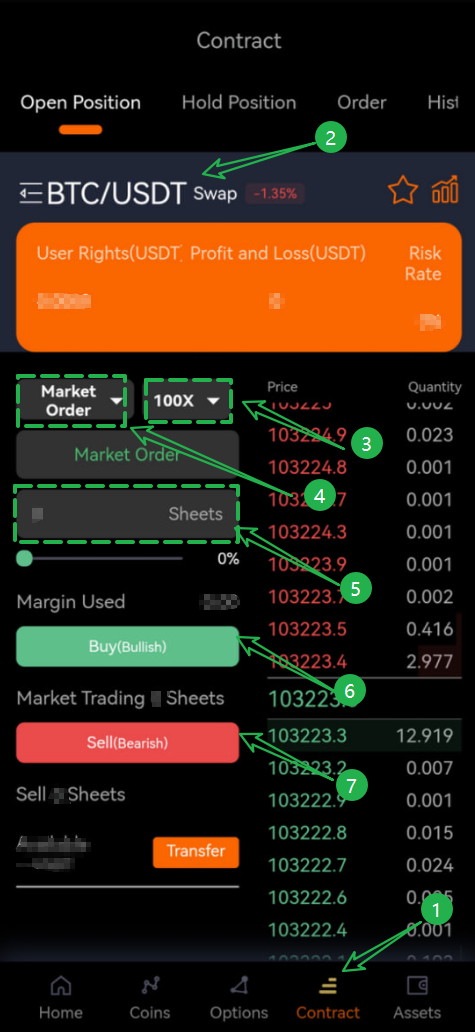

2. Enter the trading interface, here are the things to note:

2.1 Click Contract to enter the trading interface

2.2 Select the underlying product

2.3 Select the corresponding leverage ratio, the default is 100X.

2.4 Select the corresponding transaction price

2.5 Select the position ratio

2.6 Buy represents "buy bullish"

2.7 Sell represents "sell bearish"

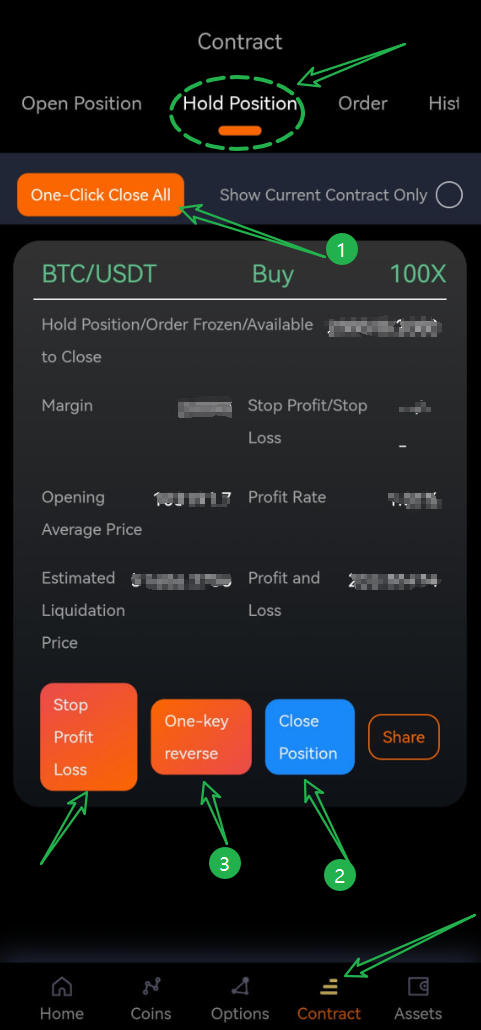

3. Click Hold Position to enter the position interface. Things to note on this interface:

3.1 One-Click Close All represents a one-click position closing operation

3.2 Close Position token closes a single position variety

3.3 One- Key reverse represents the one-click reverse operation

Friends, the above content is about the buying and selling methods of cryptocurrency contract trading. I hope you will not only listen and study carefully but also actively practice. This is not only an accumulation of knowledge, but also a practical exercise leading to a leap in wealth.

Here, I remind everyone: If you encounter any operational confusion, unclear technical details, or questions about process execution during learning or trading, please contact the assistant as soon as possible. She will provide you with one-on-one full-time assistance to ensure that you do not get lost or fall behind in actual trading, do not miss any signals, and do not delay any profits.

At this moment. If you have not signed up yet, please contact the assistant immediately to sign up, receive $500 in test funds, and obtain the operation guide for cryptocurrency contract trading, quickly understand and master the operation process, and ensure that you will follow up and participate in the transaction and make a profit when participating in the internal test of the ProMatrix Quantitative trading system.

Dear friends, today's sharing has ended successfully. Thank you for your dedicated participation and firm companionship in every knowledge feast.

Tomorrow, we are about to usher in a global investment feast: the release of non-agricultural employment data. Every release of data will not only bring about drastic price fluctuations, but also our investment feast.

Moreover. Tomorrow, we will once again launch the "Buy High-Quality Stocks Simultaneously" trading plan. Please be prepared. If you want to participate in the opportunity to buy high-quality stocks tomorrow, please contact the assistant to sign up immediately.

I look forward to moving forward with you on tomorrow's wealth growth journey. See you tomorrow!