Dear friends, I am Christian Luis Ahumada, Founder and Chief Quantitative Trading Analyst of Prosper Grove Asset Management. I am delighted to reunite with all of you in this beautiful time filled with sunshine and opportunity. This group is not only a place for the exchange of ideas but also our strategic starting point on the path to financial freedom.

At this moment, we are not only experiencing the compound growth brought by high-quality assets together, but more importantly, we are witnessing the real returns and wealth elevation empowered by the precise ratings and high-probability signals of the ProMatrix Quantitative Trading System.

Today’s Key Insights:

1.What structural changes have occurred within the high-quality assets included in the “Dynamic Diversified Asset Allocation System” strategic layout?

2.What critical information has been derived from the optimized rating function of the ProMatrix Quantitative Trading System?

Friends, recently, due to President Trump continuing to send strong signals of uncertainty in trade policy, market tensions have been steadily rising, and global capital is rapidly shifting toward a defensive stance. At the same time, the OECD has significantly downgraded global economic growth expectations, further amplifying investor concerns over the potential systemic risks triggered by a trade war.

These signals reflect not only market turbulence but also a form of systemic pressure at the macro level. In the face of such pressure, we must strengthen our defensive allocations to gain more strategic advantage in future market reversals.

High volatility will be the norm in the investment market this week, so our trading strategy should prioritize defense while maintaining a secondary focus on offense, aiming to achieve steady wealth growth.

Let us continue to follow the guidance of the “Dynamic Diversified Asset Allocation System,” leveraging the trend signals provided by the ProMatrix Quantitative Trading System to stay in rhythm, strike with precision, and achieve steady and secure wealth growth.

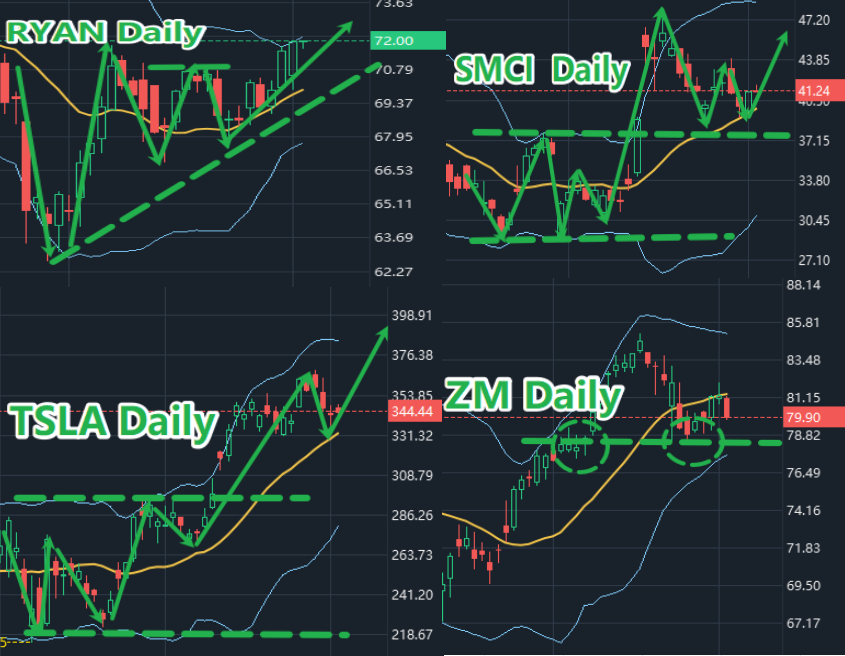

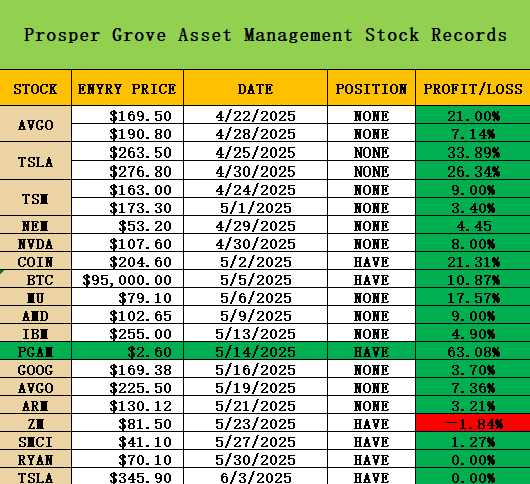

At this moment, the overall trend structures of SMCI, TSLA, ZM, and RYAN remain intact, and their future growth potential and profitability are significant. Therefore, we choose to patiently wait for profits to be gradually realized.

Moreover, as our recently established “Dynamic Diversified Asset Allocation System” continues to be refined, more and more of our friends have truly embarked on a path of accelerated wealth growth.

Those who have stayed committed and actively participated have already experienced the substantial rewards brought by the system firsthand. At this moment, not only are their account balances rising, but seeds of greater vision and future wealth have also been planted in their hearts.

As we have consistently emphasized: a truly powerful trading system must excel in both offense and defense in order to navigate through bull and bear cycles.

Our ProMatrix Quantitative Trading System is exactly such a core engine—integrating trend recognition, profit alerts, and risk protection into one comprehensive solution.

When market opportunities arise, it leverages precise data analysis and systematic ratings to identify the most explosive wealth-building opportunities in advance, helping us amplify returns and gain an early advantage.

When risks emerge, it builds strong layers of defense, enabling us to effectively shield against market shocks and preserve our gains and core positions.

Moreover, yesterday, we also focused on sharing the disruptive functions of the ProMatrix Quantitative trading system in the group. Now, please allow me to take you to review the core strength of this strategic weapon again:

1. Through the integration of the technical scoring module (TA scoring) and the fundamental scoring (FA scoring), buy signals and sell signals are automatically generated to provide us with the best trading strategy.

2. The ProMatrix Quantitative trading system has a market intelligence screening engine that runs 24 hours a day, which can monitor the dynamics of major global markets in real-time, quickly lock in high-quality assets with trend potential, and provide the most professional strategic deployment for our asset allocation.

3. Provide technical chart training and application further to improve our interpretation ability and practical trading ability.

4. The ProMatrix Quantitative trading system has a multi-level rating system, covering from individual stock ratings to industry ratings, and finally to the overall market rating, to fully improve and optimize our strategic layout of a "dynamic diversified asset allocation system".

Now let's focus on the system ratings of various investment products summarized by the powerful rating function provided by the ProMatrix Quantitative trading system.

Are you all ready? If you are ready, reply YES.

Let's look back to 1792, when the "Sycamore Agreement" was signed under the Sycamore tree on Wall Street, marking the beginning of the New York Stock Exchange (NYSE). Since then, a beacon of global financial civilization has been burning in the heart of Manhattan!

In the past 232 years, NYSE has never stopped:

It has witnessed the rise of the industrial revolution, the baptism of the technological wave, and has also endured the storm of economic crisis and the turmoil of the global market.

During these long years, NYSE has always been at the forefront of financial innovation through continuous mergers, reorganizations and technological upgrades, and has worked hand in hand with the U.S. Securities and Exchange Commission (SEC) to build the world's most transparent and fair trading system, allowing global capital to flow safely here.

It is in this investment background that a group of financial giants has emerged, such as JPMorgan Chase & Co., Morgan Stanley, The Blackstone Group, and The Goldman Sachs Group.

They are not only the symbol of Wall Street, but also an important hub for global capital flows. They have made in-depth layouts in multiple fields such as finance, technology, energy, infrastructure, and mergers and acquisitions, driving changes in the world economic landscape.

In particular, what do global asset management giants such as BlackRock and Vanguard Group have in common?

They have a deep understanding of market trends, constantly innovative investment strategy models and the concept of maximizing customer value. They have always maintained excellent asset appreciation capabilities in turbulent markets, truly realizing the acceleration engine of investors' wealth freedom.

Friends, in our journey to financial freedom, if we want to stand high and see far, we must first recognize "who is the most powerful player in the world in terms of financial power".

Now let us understand the hierarchical structure of financial institutions and grasp the underlying logic of the operation of the global financial system.

1. Global large financial institutions: These institutions can be called "financial versions of the United Nations". They have a huge capital scale and global business network and are the rule makers and resource allocators in the international market.

They not only design and issue various high-end financial products (such as hedge funds, CDS, derivatives, etc.), but also deeply participate in the volatility manipulation of global interest rates, currencies, and precious metals markets.

For example, Goldman Sachs, JPMorgan Chase, UBS Group, etc., these giants are often backed by national capital or sovereign funds, and their systemic importance is enough to affect global financial stability.

2. National large financial institutions: This level of institutions serves individual customers, small and medium-sized enterprises to large enterprises. Typical institutions include large banks, securities companies and insurance companies, such as JPMorgan Chase, Citigroup and Bank of America.

3. Regional banks and financial institutions: These financial institutions focus on local market needs, take root in the region, and serve small and medium-sized enterprises and retail customers. They usually target regional market needs, such as regional banks, trust companies, and mutual fund companies.

4. Investment management and asset management companies: These institutions focus on managing wealth, designing asset allocation, and executing investment plans for clients. They serve institutional investors (pensions, insurance funds, sovereign wealth funds), high-net-worth individuals, and family financial offices.

5. FinTech companies: These companies have reconstructed the traditional financial service model with the help of cutting-edge technologies such as artificial intelligence, big data, blockchain, and cloud computing. Their service targets range from individual users, and corporate customers to other financial institutions, involving payment systems, online banks, investment platforms, etc.

Over the past 200 years, the financial world has undergone a huge transformation from manual analysis to intelligent analysis. In that era, the core competitiveness of financial institutions depended on human analysts, researchers, economists, investment consultants, etc. Almost every decision and every judgment came from the research and judgment of these professionals day and night.

To understand the global geopolitical landscape, they must read the real-time reports of major global media;

To evaluate the true value of an industry or company, they must read through hundreds of pages of financial reports, announcements, and audit reports;

To capture opportunities in price fluctuations, they need to master technical analysis tools such as stock price charts, MACD, RSI, BOLL, etc., and accurately define every turning point of the trend.

This is an era of "human resources as the core", an investment logic that relies heavily on professional experience and subjective judgment.

However, as time goes by, the investment world is no longer just a single battlefield of the stock market.

Today, our asset choices have already expanded to include stocks and funds, bonds and options, foreign exchange and futures, and even cryptocurrencies.

The breadth and depth of the market are expanding at an unprecedented rate, and the amount of information is also growing exponentially. The daily increase in information, data, and indicators is enough to overwhelm the judgment load of a top analyst.

Faced with such a reality, it is far from enough to rely on the eyes and pen of an analyst. Therefore, under this structural bottleneck, the times need a brand new tool.

This is the fundamental logic behind our development of the ProMatrix Quantitative trading system: using systems to replace manpower, using intelligence to replace experience, and using data to drive strategic decisions!

At this moment, the ProMatrix Quantitative trading system is no longer an auxiliary tool for traditional analysts, but an intelligent core with full market perception, 24-hour tracking, and full-dimensional research and judgment capabilities.

Therefore, today, we only need to tap our fingertips, and the ProMatrix Quantitative trading system can present you with the most cutting-edge, authoritative, and accurate analysis and judgment of the global market in real-time. This is the result of our years of hard work.

We integrate the world's best investment technical analysis, financial analysis, news judgment, portfolio optimization and market prediction capabilities into the ProMatrix Quantitative trading system, making it an all-round smart asset management company decision maker.

The original intention of the design of the ProMatrix Quantitative trading system is to make complexity simple and make professionalism accessible.

Now, with the comprehensive analysis results of the ProMatrix Quantitative trading system, we can quickly and accurately identify the timing of buying/selling, the pros and cons of holdings, the rhythm of industry rotation and the overall trend of the market, and truly realize the automation, intelligence and systematization of investment strategies.

Friends, if the wealth accumulation in the past few decades belongs to those Wall Street giants, then today's ProMatrix Quantitative trading system is a "wealth freedom booster" tailored for each of our ordinary investors.

Therefore, in our eleventh ProMatrix Quantitative trading system course, I will personally lead you to deeply interpret and experience the newly upgraded ProMatrix Quantitative trading system. Whether it is our old students or new friends, they will have the opportunity to experience the upgraded ProMatrix Quantitative trading system and gain new cognition and a more powerful wealth profit system.

Next, we will focus on sharing the core functions of the ProMatrix Quantitative trading system: investment category rating and investment opportunity recommendations.

At this moment, the ProMatrix Quantitative trading system will analyze the current market situation through a full-dimensional market analysis system, including international geopolitical dynamics and global macroeconomic trends; synchronize the market's long-short game situation and market participation sentiment heat map; integrate the technical chart structure recognition engine to capture the trend initial point and provide accurate system ratings.

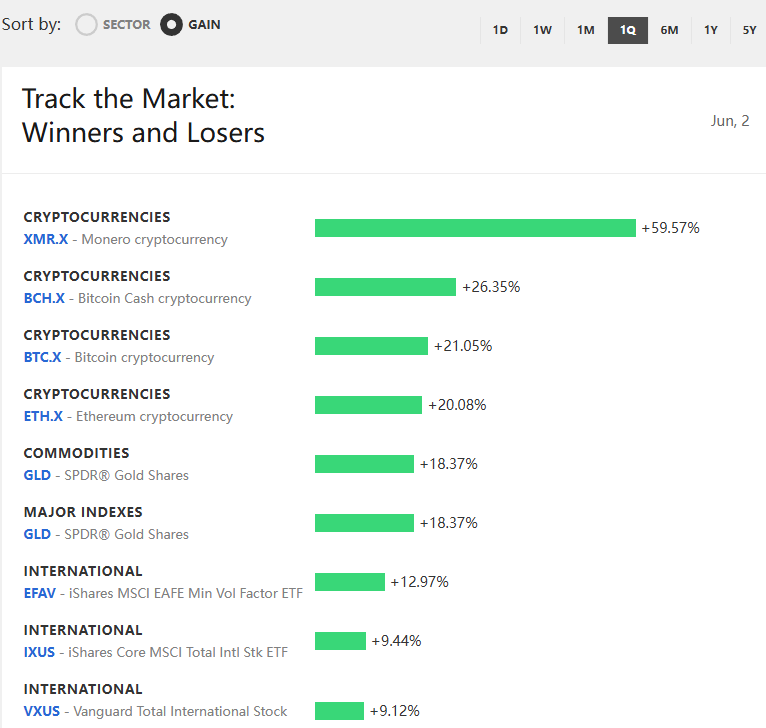

At the same time, the ProMatrix Quantitative trading system will systematically rate and sort the six major asset categories, including stocks, futures, foreign exchange, funds, bonds, and cryptocurrencies, through advanced algorithms, providing the most powerful reference for our decision-making.

At this moment, our top professional analyst team will tailor an exclusive asset allocation plan for each member based on the system rating results, combined with fund management principles, trading cycle logic, and individual needs.

Now let’s take a look at the current top ratings for the ProMatrix Quantitative trading system:

Dear friends, facing the current market rating and investment environment, our views are as follows:

1. With the tension of President Trump's trade policy heating up again, coupled with the continued release of geopolitical uncertainty, the potential risks in the market still exist. In the process of operation, it is necessary to always maintain risk awareness and be prepared for both hands.

a. Reduce the holding position of high-quality stocks that make money in your hands and release enough available funds.

b. Actively improve and upgrade the strategic layout of the "dynamic diversified asset allocation system" to strengthen the ability to obtain wealth.

1. Against the background of the increasingly complex and changeable global geopolitical situation, the capital market has once again entered a highly sensitive cycle. Faced with the rise of trade barriers, the spread of geopolitical conflicts, and the uncertainty of macroeconomic policies, the market's risk aversion sentiment still exists, and the gold sector closely related to the geopolitical situation has become an indispensable configuration in asset allocation.

3. With the coming to power of President Trump, who is pro-cryptocurrency, a series of major measures have been officially implemented, and cryptocurrencies have moved from the periphery to the core strategic vision of the country:

a. Signing an executive order to formally establish the "Strategic Bitcoin Reserve" and the "US Digital Asset Reserve", and incorporating the crypto assets confiscated by the Ministry of Justice into the national asset structure;

b. Regulatory changes: Appointing Paul Atkins, a representative of crypto-friendly factions, as Chairman of the SEC, sending a clear signal of regulatory relaxation;

c. Institutions and listed companies continue to purchase Bitcoin.

d. Under macroeconomic fluctuations, crypto assets have become a value focus to fight inflation and resist uncertainty.

Therefore, we have reason to believe that the cryptocurrency market has entered a bull market cycle, and the bull market has just begun.

More importantly, the current increase is only in the early stage of the bull market, and the future profit potential is huge. These provide important references for our investment strategy.

Therefore, based on the above analysis and the current market profitability and risk control, whether it is the rating of the ProMatrix Quantitative trading system or the rating of our institutional analyst team, this year we have ranked the investment market rating in the following order:

1. Cryptocurrency and cryptocurrency contract trading

2. Gold and related stocks and derivatives

3. Stocks

The above content is an in-depth analysis and strategic recommendations made by our top analyst team of Prosper Grove Asset Management on the current global market environment and asset categories based on the powerful trend prediction and rating engine of the ProMatrix Quantitative trading system.

This is not just a rating report, but also a navigation map to wealth freedom. It brings together system big data analysis, real-time market feedback, and multi-dimensional risk measurement results, providing each of our friends with the most valuable investment guide.

Dear friends, through the trend prediction and rating functions of our ProMatrix Quantitative trading system, the strategic layout of the "dynamic diversified asset allocation system" we have built has brought a steady leap in wealth to all of our friends.

At present, we are not only committed to the stable growth of wealth but also actively preparing for internal test trading. This test is aimed at verifying the profitability, stability, and completeness of the ProMatrix Quantitative trading system and collecting effective trading data. These data will support the upgrade and improvement of the ProMatrix Quantitative trading system and accelerate the launch process of the ProMatrix Quantitative trading system. All of this requires the joint participation and support of each of us.

Friends, the morning sharing has come to a successful conclusion. I believe that at this moment, more and more friends have a deeper and more systematic understanding and experience of our "dynamic diversified asset allocation system" and the core logic of the ProMatrix Quantitative trading system. This understanding is the first step towards wealth freedom.

Later, I will continue to track the real-time dynamics of high-quality assets strategically deployed in the "dynamic diversified asset allocation system", further optimize the asset allocation path, and further share the latest rating results of the ProMatrix Quantitative trading system to help everyone master the real-time rating of core assets and potential targets and seize more wealth opportunities.

Looking forward to more friends' participation, see you later.