Dear friends, I am Christian Luis Ahumada, founder of Prosper Grove Asset Management and chief quantitative trading analyst. I am very happy to be with you in our learning and growth group at this miraculous moment.

Every gathering is a gathering of wisdom and faith, which not only allows us to feel the wealth leap brought by the market, but more importantly, we have gradually established our own "dynamic diversified asset allocation system" strategic layout in this process.

Today's important information:

1. What changes have occurred in the high-quality asset structure of the "dynamic diversified asset allocation system" strategic layout?

2. The core strength of our Prosper Grove Asset Management: What are the disruptive functions of the ProMatrix Quantitative trading system?

Friends, today, due to the uncertainty signals released by President Trump on trade tariff policies, the global market has seen rising panic among investors, and short-term capital behavior has led to a market correction. Faced with the sudden market shock, I know that many friends are still full of doubts and even uneasiness.

But we have repeatedly emphasized in the group: the overall upward trend structure of the current market has not changed.

More importantly, the strategic layout of the "dynamic diversified asset allocation system" constructed by our Prosper Grove Asset Management has already built a solid defense line for us. The real high-quality assets still show excellent resilience and growth potential, which not only effectively resists external risks, but also continues to contribute to our gratifying profit growth.

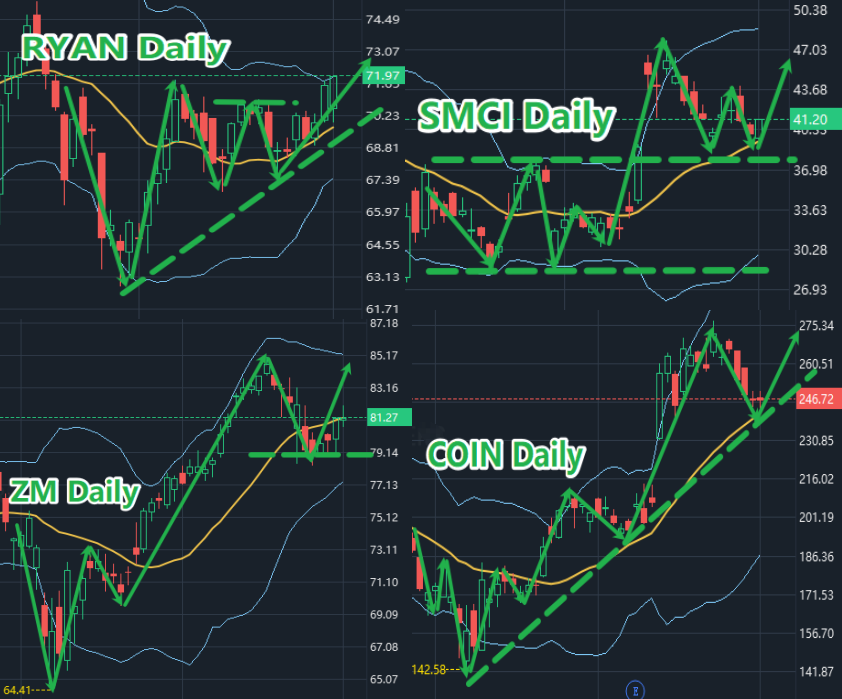

Now let us focus on the real-time dynamics of the high-quality assets in the "dynamic diversified asset allocation system" strategic layout, and feel the joy they bring us again.

Dear friends, the high-quality assets of the "dynamic diversified asset allocation system" strategic layout we have built have shown strong resilience in the face of drastic fluctuations in the stock market. At this moment, they are creating lasting wealth growth for us. I believe that everyone not only enjoys the joy of a substantial leap in wealth but also feels the powerful trend analysis and powerful prediction functions of the ProMatrix Quantitative trading system.

Friends, in this era of information-intensive and volatile markets, it is difficult to make high-quality investment decisions based on intuition or experience alone. The real path to wealth freedom must rely on systematic, data-based, and intelligent investment logic.

And our ProMatrix Quantitative trading system integrates artificial intelligence, quantitative trading models, and multi-dimensional data analysis to provide clear and scientific operation guidance for every investor who pursues stable returns and controllable risks.

Now let's take a deeper look at the pinnacle functions of the ProMatrix Quantitative trading system and truly enter the world of the ProMatrix Quantitative trading system.

1. How does the ProMatrix Quantitative trading system obtain daily buy and sell signals?

Buy/sell signals are a complex analysis system consisting of several modules:

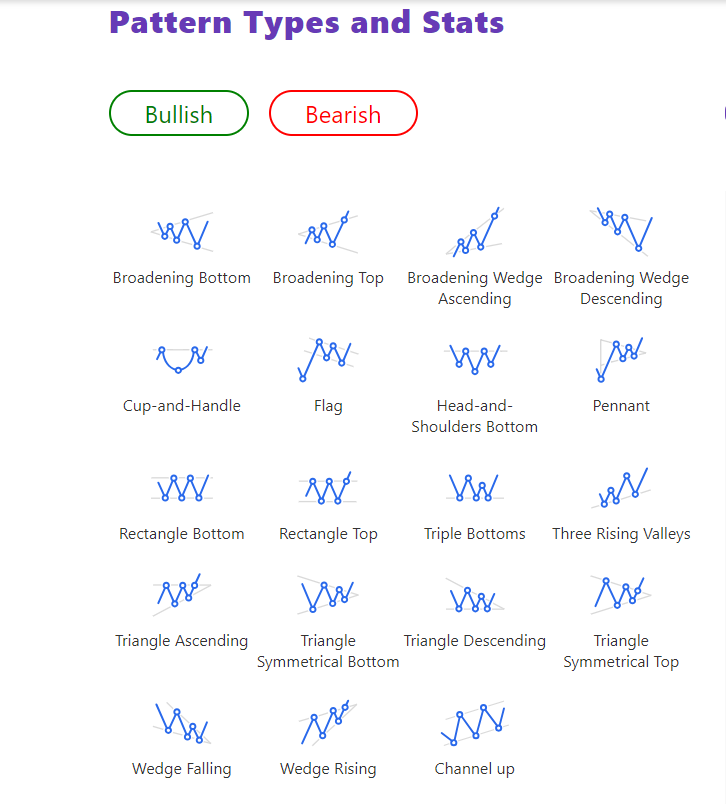

Technical scoring module (TA scoring) - uses artificial intelligence and quantitative trading in combination, while using price behavior patterns (including double bottom patterns, flag patterns, aggregate triangle patterns, cup handle patterns, etc.) and the system's real-time tracking and analysis of multiple key technical indicators (including MACD KDJ BOLL moving average, RSI, etc.) signals.

Through deep learning algorithms, the system can identify trend start points, acceleration points and recession points by itself, thereby generating executable buy/sell signals in the first place.

Fundamental Scoring Module (FA Scoring) - Through big data mining, financial statement analysis, and industry comparison, the following dimensions are comprehensively evaluated:

1. Valuation rationality (PE, PB, PS)

2. Growth (revenue growth, net profit growth rate)

3. Earnings quality (ROE, ROA, gross profit margin, free cash flow)

4. SMR rating (three core wealth scoring dimensions: Sales, Margin, Return)

The system updates the core asset pool data daily, and gives a clear logical and financially sound quantitative evaluation of high-quality assets, providing solid fundamental support for investment.

Buy/Sell Rating System - TA and FA ratings will be automatically integrated and weighted to form an "investment temperature chart" for each asset.

The system automatically generates strong buy signals and sell signals based on the rating range, and pushes them to the user terminal, providing you with a daily operation list, stop-profit/stop-loss suggestions, and position adjustment prompts, truly achieving "systematic, disciplined, and directional".

2. How to set signals?

In a rapidly changing market, information is the most valuable resource, and timely signal access is the key link in investment layout.

Our ProMatrix Quantitative trading system, based on technical pattern recognition, trend strength judgment, capital flow changes and fundamental weight scoring, ultimately generates three core signal types for each high-quality asset: buy signal, sell signal, and hold signal.

This strategy level not only accurately captures trend turning points, but also improves our ability to dynamically manage assets, attack in opportunities and defend in risks.

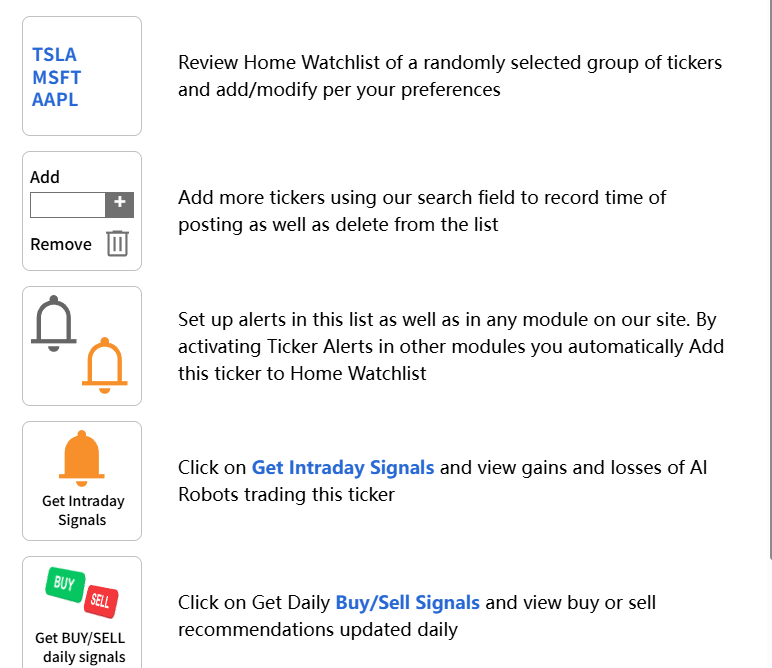

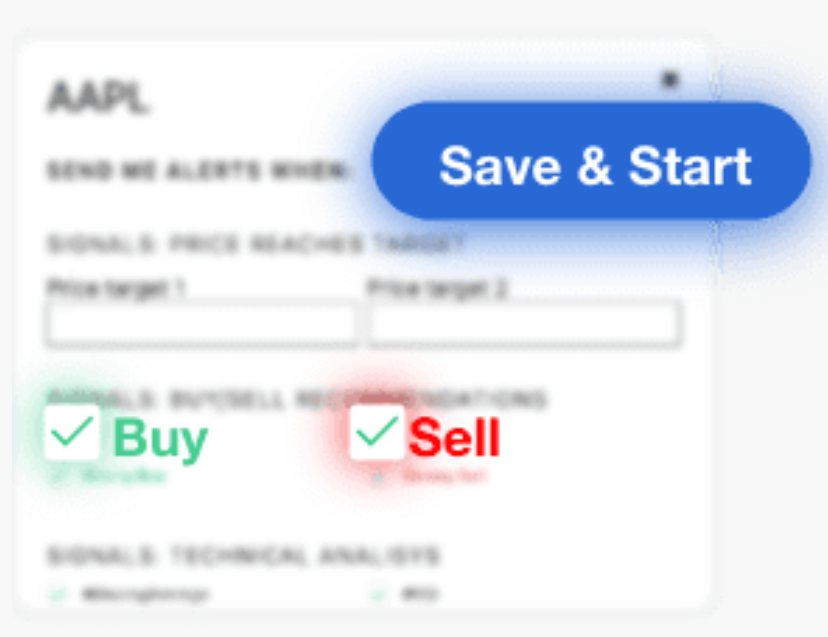

At this moment, we provide all users with an extremely intuitive and convenient signal setting function. For example, your homepage watch list. Just click the bell and you will see a window for selecting the signal type, so that you can react quickly based on the current market analysis and manage your portfolio more effectively.

Moreover, no matter which page you are on, as long as the asset you are interested in appears, you can click the "Signal Setting Icon" next to the target, complete the personalized settings in the pop-up window, and realize the seamless connection of signal reminders across all platforms.

Warm reminder: At present, this function will open configuration permissions with the official launch of our ProMatrix Quantitative trading system.

By then, you will truly have your own "trend radar". The system will automatically "watch the market" for you, send accurate signals at the first time of market changes, help you optimize your position structure, and ensure that every decision we make is more stable, timely, and smarter.

3. ProMatrix Quantitative Trading System Screening

Friends, our ProMatrix Quantitative Trading System is an intelligent screening system that embodies the wisdom of the world's elite. It extracts high-quality asset signals with practical value and profit potential for us every day, making our strategic deployment more accurate and tactical execution more efficient.

a. Get real-time buy and sell signals:

Real-time signal push: Based on the big data quantitative model of our ProMatrix Quantitative system, it automatically outputs buy/sell/hold recommendations for stocks and ETFs;

Transparent and traceable trading logic: Behind each signal, the system will simultaneously mark the core technical indicators (such as MACD, KDJ, BOLL, moving average structure, etc.) and fundamental scoring logic (such as valuation, ROIC, growth rate, etc.);

Highly operable: The signal not only has a direction but also has clear entry and exit point suggestions and stop-profit and stop-loss plans, providing tactical execution guidance for actual combat;

Automatic warning system: Once the signal is triggered, you will be reminded immediately through email or website push to ensure that you do not miss any wealth opportunities.

b. Keep abreast of market trends and in-depth analysis at any time:

Authoritative data source aggregation: The system integrates big data every day to filter out real-time hot news and macro data;

Sentiment and trend analysis: With the help of artificial intelligence sentiment algorithms, the system can evaluate the changes in market participants' sentiment towards specific assets and assist in judging potential price directions;

Expert perspective in-depth interpretation: We will invite macroeconomists, senior fund managers, and strategy analysts to write market reviews from time to time to help you gain a comprehensive understanding of the market from a high position.

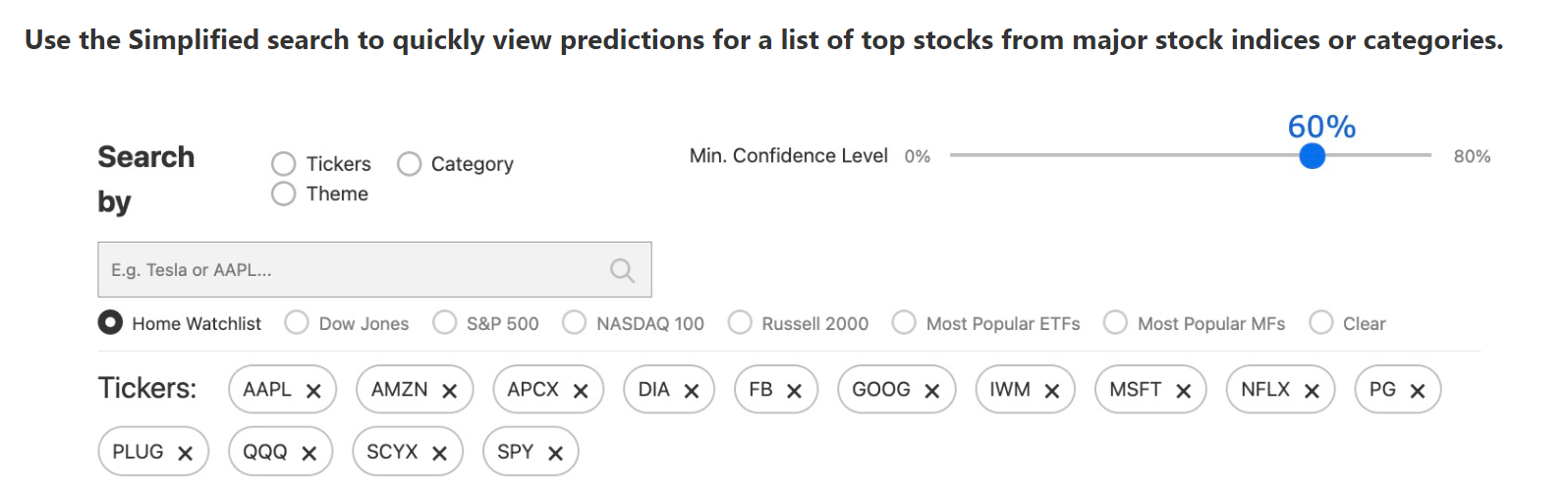

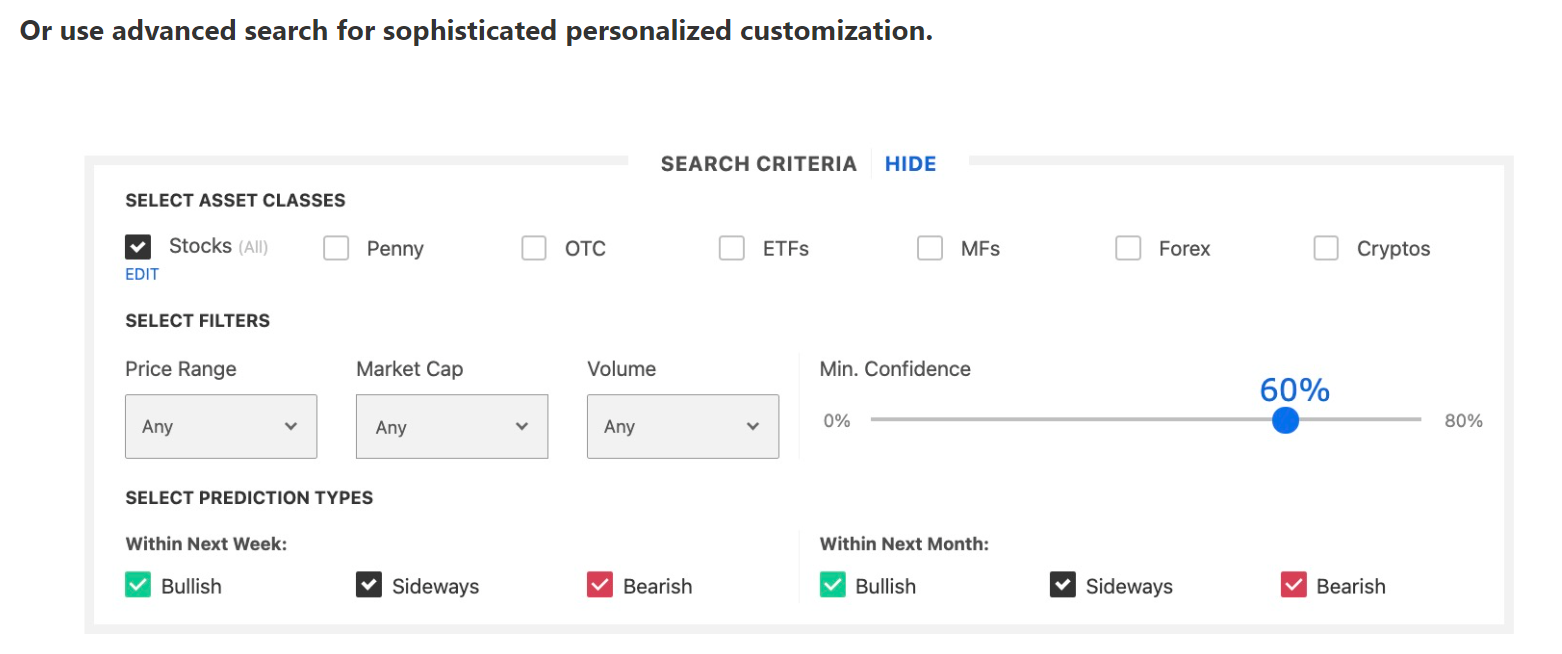

c. Find the best stock opportunities:

Multi-dimensional screening engine: flexible screening by industry, track, market value, valuation, profitability, technical form, and other dimensions;

4. Trend prediction engine function

In the trend of the financial market, the real winner is often not the person with the most information, but the person who first sees the future trend and takes decisive action.

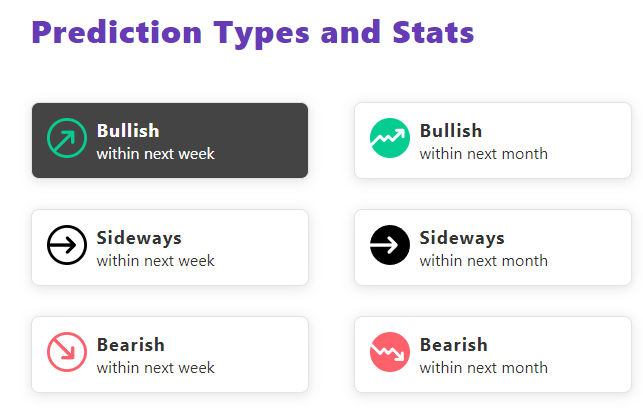

At this moment, our ProMatrix Quantitative alternating system has a trend prediction engine TPE, which relies on big data, artificial intelligence learning, technical graphic recognition, and multi-dimensional analysis of the investment advisory expert group to systematically predict the trend direction of individual stocks and other high-quality assets in the next week or month.

Whether the trend continues or is about to reverse, TPE can accurately depict the probability picture, allowing you to firmly seize the market opportunity when others are still hesitating.

a. View the trend forecast of the entire market, gain comprehensive insights, and plan ahead

b. Configure trend alerts to capture market opportunities in a timely manner

The system allows you to set trend alerts for any stocks and high-quality assets you are interested in. When the trend strength, direction, or score of the stock changes significantly, you will be notified immediately. It supports multi-terminal synchronization of mobile phones, emails, and website notification centers to ensure that you do not miss any turning signals;

c. View the progress of trend forecasts that have been bookmarked to continuously track the performance of the stocks you are interested in

You can add the stocks you are focusing on as "trend bookmarks", and the system will continue to display the trend evolution path of the stock;

5. ProMatrix Quantitative Trading System Technical Chart Training and Application

The best way to make money using pattern trading is to use our ProMatrix Quantitative Investment Decision System's Advanced Search Engine (PSE), which is one of the core modules of the ProMatrix Quantitative Trading System. It integrates 39 classic chart pattern recognition algorithms, covering stocks, low-priced stocks, ETFs, and crypto markets, and accurately identifies important signals in technical charts.

You will get the following through PSE:

1. Closing price basis for buy/sell signals

2. Graphic structure recognition, such as: double bottom pattern, aggregate triangle consolidation, flag pattern, cup handle pattern, etc.

3. Customized screening by multi-dimensional conditions such as confidence, price range, asset category, etc.

Please remember: the clearer the setting, the more accurate the signal; the more detailed the screening, the clearer the opportunity.

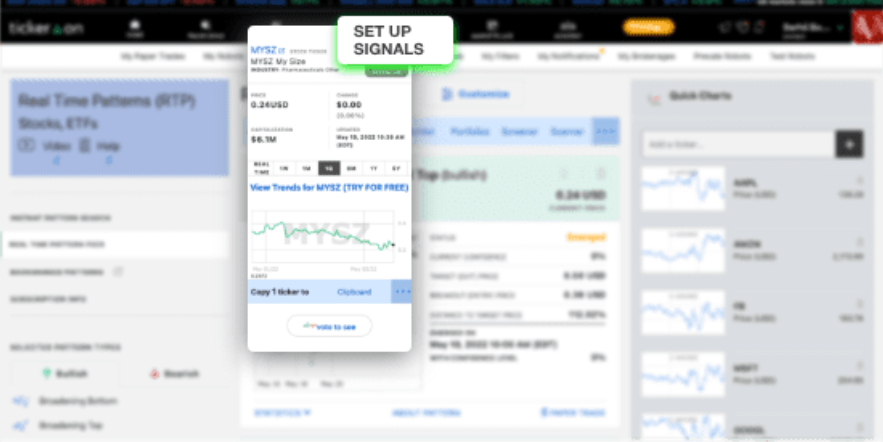

The ProMatrix Quantitative trading system includes a powerful feature: Real-time Pattern Feed (RTP), which will provide you with market scanning capabilities every minute. Highlights of this feature:

1. Minute-level dynamic scanning: The system automatically analyzes thousands of stocks and ETFs every minute;

2. Multi-time period support: Supports different K-line periods such as 5 minutes, 15 minutes, 30 minutes, 1 hour, and 1 day to ensure the most timely market dynamics;

3. Confidence scoring mechanism: Set statistical confidence levels for each pattern to make trading decisions more scientific and credible;

4. Instant push reminders: Help you complete the strategic layout in advance before opportunities come.

6. The multi-level rating system of the ProMatrix Quantitative trading system covers:

Individual stock rating: Based on core indicators such as fundamentals (FA rating), technical aspects (TA rating), valuation, growth, profitability, etc., it provides "buy, hold, sell" rating recommendations;

Industry rating: Combined with dimensions such as capital flow, policy support, and business cycle, we comprehensively judge which industry is the current wealth-gathering place;

Overall market rating: Integrate key variables such as global macroeconomics, policy sentiment, and dollar flows to provide a scientific basis for our judgment of global trends.

7. The ProMatrix Quantitative trading system also provides industry-leading portfolio optimization capabilities, which can tailor the optimal asset portfolio recommendations for you based on your risk preference, target return, and asset allocation ratio.

Dear friends, through our in-depth analysis of the disruptive functions of the ProMatrix Quantitative trading system, I believe that every friend has a more comprehensive and profound understanding of the core driving force of our Prosper Grove Asset Management: the ProMatrix Quantitative trading system.

Therefore, I encourage all friends to continue to actively participate in the learning and thinking of the daily updated content in the group, seize every opportunity to learn and grow, and deeply understand the core working principles and usage methods of ProMatrix Quantitative, to ensure that while we continue to improve our actual trading capabilities, we can turn the dream of wealth freedom into a clear and visible reality.

Friends, in this ever-changing financial era, real power comes not only from the accumulation of experience but also from the evolution of the system and the breakthrough of technology.

Today, with great excitement, I officially announce to you that the ProMatrix Quantitative trading system that Prosper Grove Asset Management has fully upgraded and improved has reached the final test and correction stage before going online. According to our current test results, the ProMatrix Quantitative trading system has surpassed 90% of professional analyst teams and investment companies on Wall Street.

Moreover, we have been continuously conducting in-depth debugging and real-time testing to ensure that when the system goes online, it can be accurately judged, effective in actual combat, replicable, and scalable!

We at Prosper Grove Asset Management have launched a comprehensive marketing plan for the ProMatrix Quantitative trading system. Not only have we invested heavily in system development and testing, but we have also begun planning a global publicity layout to make the most adequate preparations for the ProMatrix Quantitative system to officially enter the public eye.

In the following courses and interactive sharing, I will lead you to:

1. Continuously improve and update the strategic layout of the "dynamic diversified asset allocation system";

2. Launch multi-market synchronous trading tests to verify the profitability of the ProMatrix Quantitative trading system in actual combat, to ensure the authenticity of the trading profit rate and improve the trading success rate

Friends, all of this will be launched in the short term, please be patient and look forward to it.

Dear friends, today's content has come to a successful conclusion, but our pursuit of wealth has never stopped. The real investment path is a journey of wisdom that requires long-term persistence and continuous optimization.

Tomorrow, we will continue to track and optimize the operating status of high-quality assets in the current strategic layout, further strengthen the asset allocation structure, and accelerate the accumulation of wealth. At the same time, we will also focus on sharing the content of the optimization rating function of the ProMatrix Quantitative trading system, and look forward to more friends' participation. See you tomorrow.