Dear friends, I am Christian Luis Ahumada, Founder and Chief Quantitative Trading Analyst of Prosper Grove Asset Management. I’m delighted to reconnect with all of you here in the group at this moment filled with hope and possibility.

At this moment, we are not isolated individuals, but a team of wealth pioneers united by a shared belief and vision. What we do goes beyond asset allocation and optimization; we are giving wings to our dreams and building a bridge to financial freedom.

Today’s Key Updates:

What are the real-time developments of the high-quality assets in our “Dynamic Diversified Asset Allocation System” strategic layout? What changes have occurred in our asset structure?

What is the core logic behind the strategic layout of the “Dynamic Diversified Asset Allocation System”?

Friends, as President Trump prepares to raise import tariffs on steel and aluminum to 50%, trade policy tensions have once again escalated. Combined with the continued release of geopolitical uncertainties, this has led to short-term market volatility. Investor risk appetite has clearly declined, triggering a temporary technical pullback in the market.

However, we believe this is merely a short-term fluctuation in rhythm, not a reversal of the long-term trend.

At this moment, it is even more important for us to return to systematic logic and maintain strategic conviction.

Our “Dynamic Diversified Asset Allocation System” was specifically designed to address complex market conditions like these. It is not a blind investment portfolio, but rather a strategy built around core principles of cross-asset diversification, multi-cycle alignment, and strong trend recognition, creating a solid wealth defense line for us.

When market volatility intensifies, our system automatically adjusts positions to implement defensive measures.

When the trend resumes, our system takes the initiative to seize new opportunities.

It is precisely because of this that, even amid short-term market disruptions, we continue to maintain strategic focus and steadily advance our strategic allocation.

Dear friends,now, let’s turn our focus to the “Dynamic Diversified Asset Allocation System” strategic framework and track the latest developments of our core high-quality assets, so we can further optimize our asset allocation structure.

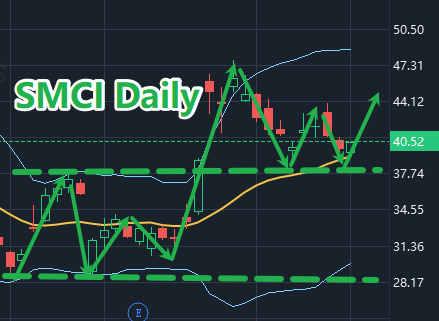

Now, let's focus our attention on the trend performance of the quality stock SMCI.

SMCI went through a period of consolidation at lower levels, during which it successfully established a solid and powerful trend support zone, laying a strong foundation for the subsequent breakout in price.

Following that, SMCI successfully broke through the upper boundary of the consolidation range, signaling the official start of a new upward trend. Although its price has recently experienced a brief pullback, it has retraced precisely to the trendline support level, which also overlaps with the support from the BOLL middle band. Therefore, the overall trend structure remains intact.

I will continue to hold and wait for more profits to be realized.

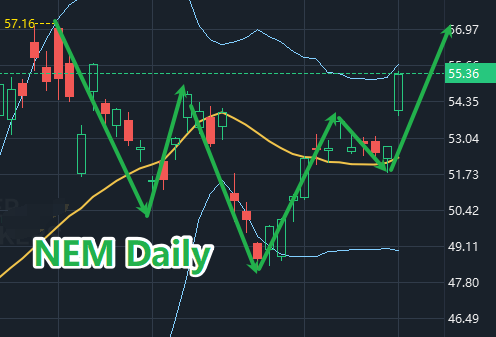

This is an exciting moment! Against the backdrop of the re-escalation of global trade policy tensions and the continued release of geopolitical uncertainties, the market's risk aversion sentiment has rapidly increased, and NEM, a gold sector concept stock in our strategic layout, has stood out in such a complex market environment.

So far, NEM has brought us a 4.45% profit growth, which is not only a phased figure but also a firm return on our strategic vision and system logic!

Here, I would like to congratulate all friends who firmly trust our Prosper Grove Asset Management and decisively include NEM gold concept stocks in the "dynamic diversified asset allocation system". At this moment, your trust is being transformed into steady growth of wealth.

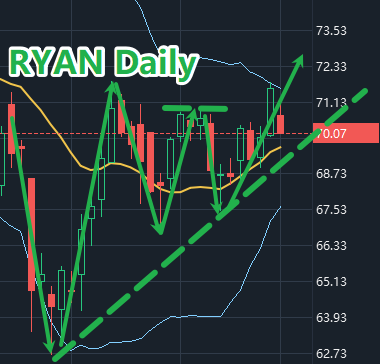

The high-quality asset RYAN, which we jointly purchased last Friday, experienced a brief pullback due to market sentiment. Currently, its price remains above the BOLL mid-band and continues to follow the trend line. The overall trend structure has not changed, so we choose to continue holding and wait for more potential profits to be realized.

Dear friends: At this moment, I believe that you have not only felt the joy of compound wealth growth brought by our "dynamic diversified asset allocation system", but more importantly, your practical trading ability is also constantly improving and becoming more mature!

This is a very exciting change!

Moreover, recently, we have received a lot of messages from friends to my assistant and me. Some of these messages expressed their inner excitement and gratitude; some conveyed their strong interest in the core logic of our strategic layout of building a "dynamic diversified asset allocation system"; and many friends are eager to learn more about the core power behind us: ProMatrix Quantitative Trading System.

These genuine voices make me feel very excited and happy.

Why?

Because this is the result of our long-term persistence and continuous efforts: We not only fulfill the promise of "wealth leap" in the market but also sow the seeds of trust and wisdom growth in your hearts.

At this moment, we not only win the wealth and profit of the market but also win your trust, recognition, and resonance.

This is what I cherish most and is also the core driving force for our continuous evolution.

Friends, now let me share with you the first core question: What is the core operating logic of our strategic layout of building a "dynamic diversified asset allocation system"?

The global capital market is like a huge melting pot. Looking at the entire global capital market, it is not a single-dimensional battlefield, but a multi-resonant system melting pot. It mainly includes the stock market, gold, options, funds, and the cryptocurrency market. These fields each play an important role, so these fields cannot be simply judged as "good" or "bad". The key lies in the rhythm of capital flow and the timing of participation.

At this moment, the entire market is like a large pool of funds, and the total amount of this pool of funds is fixed, assuming that the total amount is 10 trillion US dollars.

These funds will continue to rotate and flow between different investment fields based on various factors such as the global economic cycle, policy trends, and hot topics.

What we need to do is to enter the right asset field at the right time and make the right capital allocation. This is the core logic of "dynamic diversified asset allocation."

Now, let's focus on exploring the important dynamics in the stock market: From 2023, with the explosive application of artificial intelligence technology in all walks of life, market sentiment has rapidly heated up, and a large amount of funds have continued to flow into artificial intelligence-related stocks and industrial chains, driving the entire technology sector into a continuous upward cycle, presenting a prosperous scene of a bull market in the stock market supported by technology as the backbone.

I believe that at this stage, investors who decisively allocate stocks in the artificial intelligence sector will reap huge rewards.

Friends, it is no exaggeration to say that the strong rise of the artificial intelligence sector has not only brought us exciting profit returns but also profoundly changed the operating logic and development trajectory of the entire society.

Therefore, in the strategic layout of the "dynamic diversified asset allocation system" we have built, the artificial intelligence sector has always been one of the core directions of our asset allocation.

We firmly incorporate AVGO, TSLA, TSM, NVDA, MU, AMD, GOOG, ARM, SMCI, etc. into our strategic layout in batches.

I believe that friends who continue to pay attention to the strategic layout of the "dynamic diversified asset allocation system" we have built and actively allocate these high-quality assets have obtained very considerable profit returns.

For example, in recent years, we have witnessed drastic changes in the global situation. Frequent geopolitical conflicts in the Middle East, increased uncertainty in global trade, and especially President Trump's repeated tariff policy orientation have kept the entire capital market in a turbulent mood.

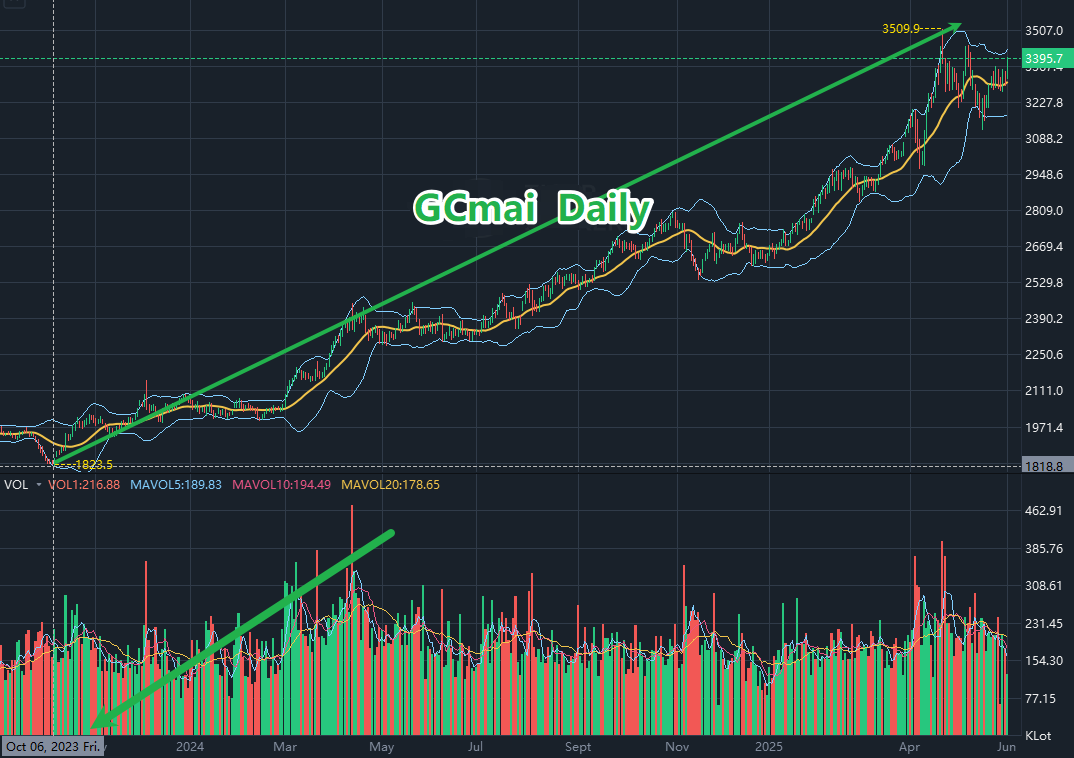

As the first choice of traditional safe-haven assets, gold often becomes the main flow of market funds; moreover, this phenomenon is not limited to a certain region, but a global capital flow trend.

From the above figure, we can clearly see that since October 2023, as tensions in the Middle East have intensified, gold prices have shown a continuous unilateral rise structure, building a strong bull market.

However, recently, with the marginal easing of geopolitical conflicts in the Middle East and the temporary clarification of tariff policies, the market's risk aversion has cooled down, resulting in a short-term fluctuation in gold prices.

But friends, please remember: that the geopolitical situation is not stable, and trade tariffs are still facing challenges. These are all factors that determine the long-term allocation value of gold.

For this reason, in the strategic layout of the "dynamic diversified asset allocation system" we have built, we still insist on allocating a portion of gold and gold concept stocks to ensure that when the market fluctuates, we can still build a safe line of defense for wealth and ensure the steady growth of wealth.

Another example is the field of options. As a financial instrument with high flexibility, high leverage and risk management functions, options are increasingly favored by professional investors around the world.

An option is a contract that gives the buyer the right to buy or sell the underlying asset at a specific price at a certain time in the future but without the obligation.

Options are divided into call options and put options, so options can be used for speculation to obtain leveraged returns; they can also be used to hedge risks and reduce losses.

Moreover, recently, it is precise because of the steady upward trend of high-quality stocks in our "dynamic diversified asset allocation system" that many friends have actively participated in the call option trading of high-quality stocks, and with the leverage advantage of options, they have made considerable profits far exceeding the increase in the stock itself.

Again, I would like to congratulate all friends who actively participate in the strategic layout of the "dynamic diversified asset allocation system". Your wealth has been greatly improved

However, it should be noted that option trading is not without risk. Especially when the market fluctuates violently, the value of options may also fluctuate rapidly, which is a potential threat to investors. More importantly, options have time value, which means that even if we are right about the direction of the market if the market fluctuations do not occur at the expected time, we may still face losses.

Therefore, the options market is a highly flexible and mature derivatives market, suitable for leveraged investment, risk management and strategic trading. But it is not suitable as the main part of our investment portfolio. It should be used as an "auxiliary tool" for asset allocation, especially when the market fluctuates violently, we can only allocate a small part of the funds to option trading, and should not invest too much money in it.

Another example is the fund sector. As a tool for collecting funds from many investors, funds are managed by professional fund managers, and their investment targets are broad and diverse. They cover diversified assets including stocks, bonds, real estate, etc.

According to the management method, funds can be divided into active and passive types. Active funds are constantly adjusted by fund managers or investment teams through active stock selection and timing operations, trying to surpass the market average or the performance of a benchmark index. On the contrary, passive funds do not take the initiative and mainly track market indices such as the S&P 500 Index and NASDAQ 100. By holding the same stocks or assets as the index, the purpose is to replicate the performance of the index. There is basically no active trading, and low fees and high transparency are maintained.

Therefore, active funds seek to outperform the market. Their advantages are flexibility and aggressiveness, but at the same time, they have higher fees and greater risk of drawdown.

Passive funds are also called index funds. Their core goal is to "copy the market." They have low fees and high transparency. They are an excellent tool for long-term and stable value-added and are also an indispensable part of most asset allocations.

However, we can clearly see from the current operation status of the index that the overall volatility of the market is limited, the index tends to be stable and fluctuates within a range, and the overall return performance is not as expected.

In other words, if the index is not strong, the fund will not have much room for attack. In particular, we focus on the principle of "creating higher returns within a limited time", and the current fund's time-based return efficiency is low.

If a large amount of funds are invested in fund assets at this moment, it is tantamount to using the limited time to pursue inefficient results, which is not suitable for our strategic layout of "accelerating wealth compounding".

Therefore, we have not yet configured fund investments.

Finally, let's focus on the field of cryptocurrency.

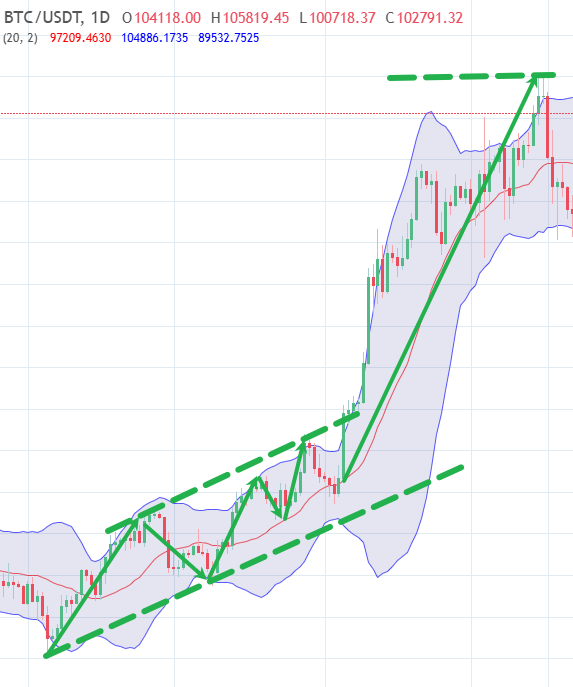

As the leader of cryptocurrency, BTC has completely broken the inherent logic of the market since September 2023.

As President Trump's election votes gradually took the lead, market confidence was boosted, and funds flowed into crypto assets like a tide. By November, President Trump won the election, which successfully ignited the structural bull market cycle of BTC.

From around $69,000, it soared to $108,000, an increase of 56.52%, not only breaking history but also refreshing the cognition of global investors.

Subsequently, the cryptocurrency market was hit by trade tariffs and showed a trend of correction. At the same time, the Trump administration has successively introduced policies to bring cryptocurrency from the margins to the core strategic vision of the country:

1. Signed an executive order to formally establish the "Strategic Bitcoin Reserve" and the "U.S. Digital Asset Reserve", and included the crypto assets confiscated by the Department of Justice into the national asset structure;

2. Regulatory changes: Appointed crypto-friendly representative Paul Atkins as SEC Chairman, sending a clear signal of regulatory relaxation;

3. Institutions and listed companies continue to purchase Bitcoin.

4. Under macroeconomic fluctuations, crypto assets have become a value focus to fight inflation and resist uncertainty.

Friends, all of the above are key factors that drive the cryptocurrency market into a bull market. Therefore, we actively incorporate cryptocurrency concept stocks COIN, mainstream cryptocurrency assets BTC and ETH, and our Prosper Grove Asset Management's core asset PGAM token into our "dynamic diversified asset allocation system" strategic layout.

Now we have also obtained considerable profit returns:

COIN brought us a 19.62% profit growth;

BTC brought us a 9.58% profit return;

ETH brought us a 0.8% profit growth;

PGAM tokens brought us an exciting 59.23% stage victory.

At this moment, I believe that friends who continue to pay attention to our Prosper Grove Asset Management and firmly implement the strategic layout of a "dynamic diversified asset allocation system" have already obtained very considerable profit returns.

What is worth noting is that our view is very clear: the alternation of the rebound rhythm and short-term retracement in the cryptocurrency market is the norm in the bull market, so there is no need to panic.

Therefore, although the price of the mainstream cryptocurrency asset BTC has experienced a short-term correction, it does not affect our confidence and expectation that BTC's next goal will reach $180,000.

It is for this reason that we actively incorporate BTC, ETH and core asset PGAM tokens into the strategic layout of "dynamic diversified asset allocation system".

Moreover, it is worth emphasizing that through the powerful trend analysis and powerful forecasting function of the ProMatrix Quantitative trading system, important strategic information is obtained: the core asset PGAM token will successfully achieve a profit increase of 500% within three months.

We are very confident about this.

Moreover, at this moment, the value of PGAM tokens is in the early stage of value release, and greater profit returns are continuing to come to us.

Dear friends, the above content is the core logic of the strategic layout of "dynamic diversified asset allocation system" formulated by our ProMatrix Quantitative trading system after comprehensive big data multi-dimensional analysis. At this moment, I believe that everyone has a deeper understanding of our wealth strategy system.

Therefore, I hope that all friends can actively pay attention to the dynamics of our Prosper Grove Asset Management, firmly implement the strategic layout of the "dynamic diversified asset allocation system" we have built, accelerate the accumulation of wealth, and turn the dream of wealth freedom into a reality within reach as soon as possible.

Friends, this morning's sharing has come to a successful conclusion. Thank you all for your active participation.

Later, we will continue to optimize the strategic layout of the "dynamic diversified asset allocation system" and strengthen the ability to obtain wealth; at the same time, we will also focus on sharing the disruptive functions of the ProMatrix Quantitative trading system. Looking forward to more friends' participation, see you later!