Dear friends, I am Christian Luis Ahumada, Founder and Chief Analyst of Quantitative Trading at Prosper Grove Asset Management, and I am happy to meet you in the group to embark on this journey of wealth cultivation for real people.

Today we will continue to follow the real-time dynamics of quality assets, optimize our asset allocation structure, and strengthen our ability to acquire wealth.

Today's important information:

1. How are the high-quality assets in the "Dynamic Diversified Asset Allocation System" strategic layout performing?

2. Practical trading skills: judgment and application of buying and selling points in practical trading of KDJ indicators.

Today, our ProMatrix Quantitative Trading System accurately screened the latest meeting minutes released by the Federal Reserve after comprehensive big data analysis. The minutes show that most decision makers believe that the current economic environment is still highly uncertain, so they should maintain a "patient" and "wait-and-see" attitude on interest rate policy.

This statement has suppressed the market's optimistic expectations in the short term. The Dow Jones Industrial Average, Nasdaq Index, and S&P 500 Index all performed mainly in a weak and volatile pattern today, and most of the stocks in the market showed a differentiated trend, and the wait-and-see sentiment has increased;

Dear friends, at the moment when market sentiment is unstable, it is precisely the moment when our "Dynamic Diversified Asset Allocation System" shows its value!!

While the index is fluctuating and adjusting, the core assets and high-quality allocation targets in our strategic layout continue to operate steadily and continue to bring us wealth growth.

I believe that those of you who have been firmly focusing on and implementing our “Dynamic Diversified Asset Allocation System” strategy layout, at this moment you have already truly felt the solidity and joy brought by the continuous growth of wealth.

More importantly, you have also felt the powerful trend research ability and forward-looking forecasting power released by our ProMatrix Quantitative trading system.

The ProMatrix Quantitative trading system is not just a simple investment tool, it is the foundation of our beliefs and a beacon above the trend.

In this investment era full of variables, information is like a torrent and emotions are like waves. Only by relying on the ProMatrix Quantitative alternating system can we move forward steadily in the wind and waves.

Our ProMatrix Quantitative trading system is precisely the strategic tool we have built in countless battles, every prediction, and every signal, behind it is built on four core logic supports:

1. Take quantitative logic as the cornerstone to build a rigorous decision-making framework.

2. With big data as the core, it dynamically captures the market wind direction.

3. Artificial intelligence algorithm as the engine, optimize strategy execution

4. Tested by the results of the real disk, and constantly self-growth and upgrading

Dear friends, the power of trends is galloping, and the ladder of wealth is extending upward step by step.

At this moment, we are standing on a road of wealth leap paved by trends and guided by systems. What you are participating in is not only an investment behavior, but also a full-process practice of cognitive upgrading, strategic execution, and value realization!

I believe that you have personally felt that under the guidance of the ProMatrix Quantitative trading system strategy, the high-quality assets we carefully selected are continuously delivering trend dividends and driving your asset structure to steadily leap forward.

It is especially worth mentioning that the core asset PGAM token is becoming the core engine of your wealth leap. It is helping us to walk more steadily, go further, and win more wealth with a clear, grand, and sustainable wealth path.

During this period of time, friends who have continued to pay attention to and firmly follow the strategic rhythm of our Prosper Grove Asset Management are lucky, and they are also people who deserve high recognition and deep admiration!

Because it is your trust, persistence, and decisive execution that have brought about the real realization of today's wealth return!

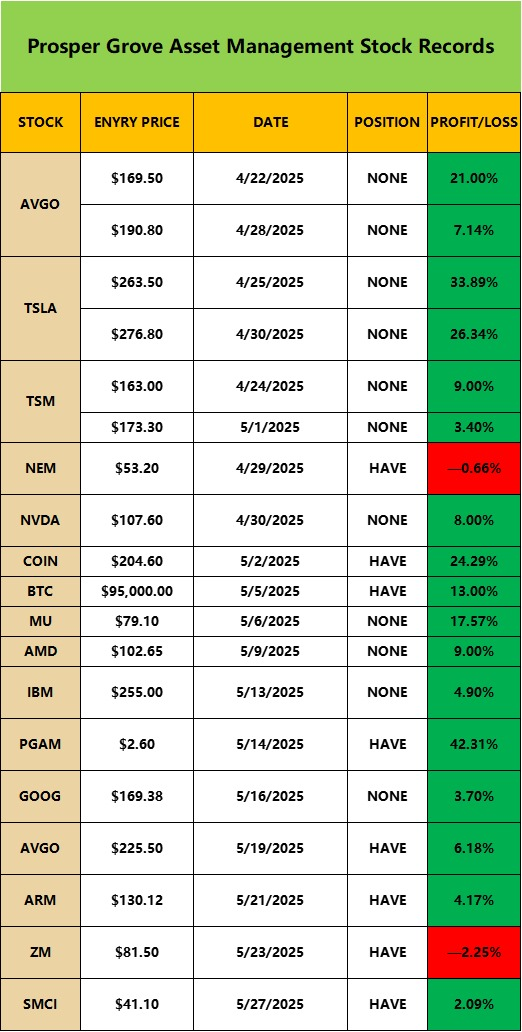

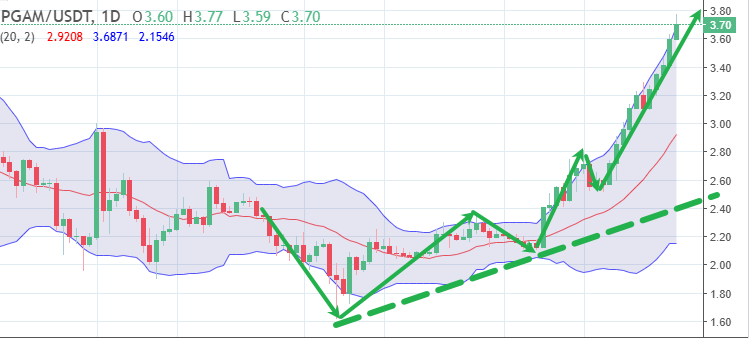

Just three weeks ago, our ProMatrix Quantitative trading system issued an important trend buy signal for the core asset PGAM token. Many strategic friends responded to the system instructions for the first time and actively participated in the rush to buy.

At that time, the average cost of buying PGAM tokens was 2.60 USDT; and today, the price of the core asset PGAM token has risen to 3.70 USDT;

In three weeks, a 42.31% profit increase was successfully achieved!

Dear friends, please imagine these two scenarios:

1. If you hold PGAM tokens worth $1 million, you have earned $423,100 today!

2. If you hold PGAM tokens worth $5 million, you have earned more than $2,115,500 in profits in three weeks!

Dear friends, I believe that at this moment, you are no longer a bystander in the market, but a witness, creator, and beneficiary of this trend feast!

Moreover, our ProMatrix Quantitative trading system has sent out a very strong signal through comprehensive big data and multi-dimensional trend model analysis: the core asset PGAM token will have a profit growth potential of up to 500% in the next three months!

This is not just a numerical expectation, but also three important messages released behind the ProMatrix Quantitative trading system:

1. The wealth path of PGAM tokens has just begun. The current 42.31% profit is just the prologue of the trend. There is still more than 450% profit space beckoning us!

2. The system signal has been confirmed, and the market attention continues to increase. Now is a great time to participate in the configuration of PGAM tokens.

3. The profit increase of PGAM tokens has surpassed BTC and ETH, becoming the new core of capital focus.

Dear friends, the continuous inflow of funds is not only driving up the price of PGAM tokens but also a concentrated reflection of the market's high recognition and increased trust in the overall ecological value, strategic path, and system capabilities of our Prosper Grove Asset Management.

At this moment, I would like to say to the new friends who have just joined our Prosper Grove Asset Management: please immediately take out your own funds at your disposal and decisively allocate the core asset PGAM tokens.

Friends, today you may see the price curve of the core asset PGAM token on the market chart, but I want to tell you that behind every rising wave of PGAM tokens are the footprints of our ProMatrix Quantitative trading system's step-by-step growth, our team's strategic breakthroughs, and our unshakable original intention and persistence.

Therefore, in order to enable everyone to understand the structural reasons, trend differentiation logic, and potential value opportunities behind this in a more systematic and comprehensive manner, I will specifically share in depth in the course sharing tomorrow morning:

1. Why is the increase in PGAM tokens ahead of BTC and ETH?

2. What ecological advantages and strategic significance are hidden behind the PGAM token?

Tomorrow, I will share it with you in detail.

Dear friends, now is the time for us to strengthen our practical trading ability. Please continue to participate in the journey of learning and growth with a positive attitude.

Today, the practical trading skills I will share with you are: the KDJ indicator's judgment of buying and selling points in practical trading.

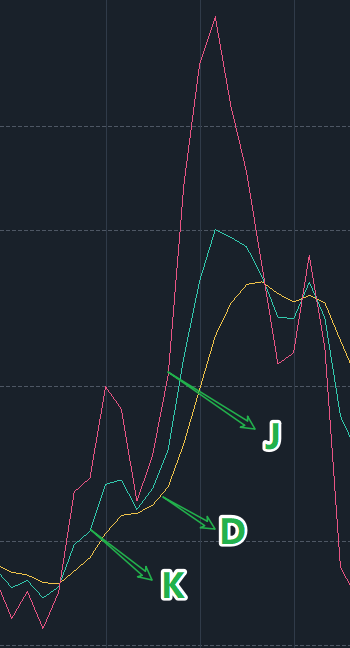

Now let's review the important knowledge points shared yesterday, as shown in the figure:

The KDJ indicator consists of three curves: K line (fast line), D line (slow line), and J line (regarded as a signal for judging oversold and oversold).

Now let's focus on the KDJ indicator and understand the specific buying and selling methods of KDJ to help you identify buying and selling opportunities more accurately in actual trading and build a clear operation logic.

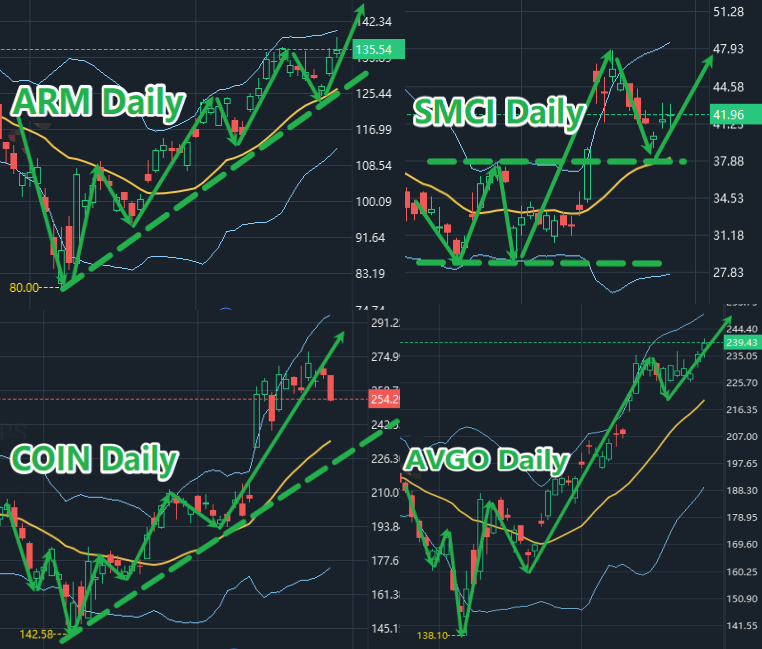

As shown in the figure, the daily trend chart of AVGO, from the performance of the chart, we can clearly draw important information:

1. Buy and sell signals:

When the K line crosses the D line upward, a bullish crossover is formed, indicating that a bullish trend may form, which is a buy signal.

When the K line crosses the D line downward, a bearish crossover is formed, indicating that a downward trend may appear, which is a sell signal.

2. Overbought and oversold judgment

When the K line, D line, and J line are above 80, indicating that the market is in an overbought state, the short-term rise is large, and the risk of retracement increases, this time is the time we avoid risk.

When the K line, D line and J line are below 20, indicating that the market is in an oversold state, the price is likely to bottom out and rebound, this time is our opportunity to buy.

Dear friends, the above content is the judgment of the buying and selling points and the judgment of the overbought and oversold of the KDJ indicator that we focus on sharing. I believe that everyone has a deeper understanding, and this part of the content is not an isolated knowledge point but is systematically and comprehensively integrated into the internal decision-making engine of our ProMatrix Quantitative trading system.

At this moment, you are not only learning how to use the indicator but also deeply understanding the wisdom core of the ProMatrix Quantitative trading system and its working principle.

Friends, Today's sharing has come to a successful conclusion. Thank you to everyone who listened carefully and actively participated.

Tomorrow, we will continue to track the real-time dynamics of high-quality assets in the "dynamic diversified asset allocation system" strategy, interpret the asset operation structure and potential layout opportunities through system signals, and help everyone accurately grasp the adjustment rhythm.

At the same time, we will also focus on sharing the core operating logic and strategic significance of the core asset PGAM token's increase ahead of BTC and ETH.

Looking forward to more friends active participation, see you tomorrow!