Dear friends, I am Christian Luis Ahumada, founder and Chief Analyst of Quantitative Trading at Prosper Grove Asset Management. I am very happy to be reunited with you all in the group. This is not just a meeting, but a journey of mutual upgrading of cognition and wealth.

Here, we share the joy of the wealth leap brought about by the "Dynamic Diversified Asset Allocation System." This is the dividend of the trend and the result of strategic execution. At the same time, we must also pursue the steady improvement of practical capabilities.

Today's Important Information:

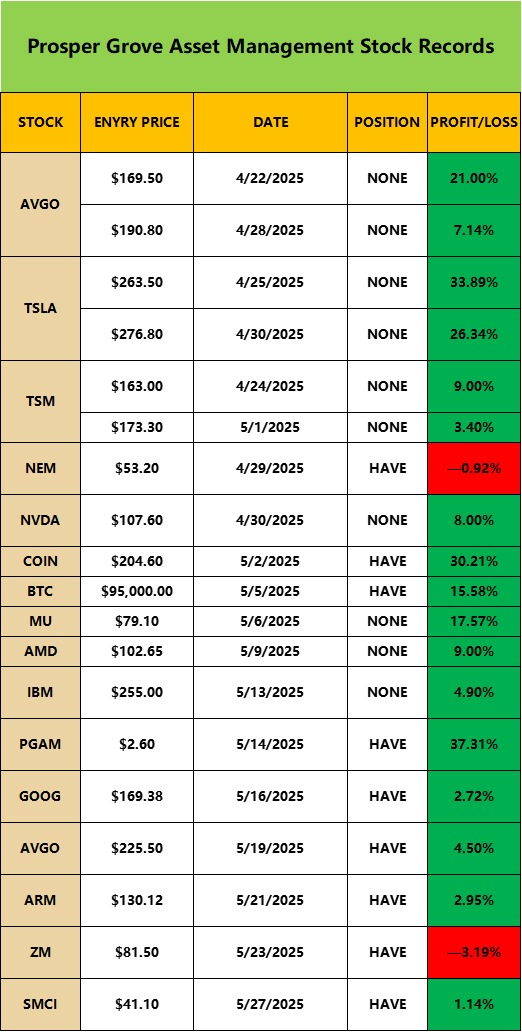

1.What are the latest changes in the results of acquiring high-quality assets through our "Dynamic Diversified Asset Allocation System" strategic layout?

2.Practical Trading Skills: Practical application of KDJ in trend identification and trading decisions.

Last weekend, President Trump agreed to extend the start date for imposing 50% tariffs on the European Union from June 1st to July 9th. This not only creates a window of opportunity for further negotiations between the two parties, but also sends a key signal: the trade war will not escalate further in the short term.

At the same time, the EU demonstrated a positive negotiating attitude, clearly stating its desire to avoid escalating confrontation through negotiation. This significantly alleviated previous market concerns about another setback in the global supply chain and stabilized market expectations for risk assets.

Further boosting market sentiment: White House National Economic Council Director Hassett said that several trade agreements may be reached this week. This once again sends a clear signal to global investors: tensions will gradually ease, and market confidence is accelerating its recovery.

More importantly, the ProMatrix Quantitative trading system has identified important information through big data screening: the latest data from the Conference Board shows that the Consumer Confidence Index rose 12.3 points to 98, the largest monthly increase in four years.

This shows that the tariff trade war is developing in a favorable direction, and consumers' views on the economic and employment market prospects have improved, and confidence has increased.

Friends, when macro policies release goodwill, market confidence rebounds significantly, and capital risk appetite rises, this is the golden window for the rapid start and trend extension of high-quality assets in our system.

This round of market recovery has not only promoted the stabilization and rebound of the three major stock indexes but also injected solid upward momentum into the high-quality assets of the "Dynamic Diversified Asset Allocation System" strategic layout we have built.

At this moment, I believe that all friends who firmly follow the "Dynamic Diversified Asset Allocation System" strategic layout built by our Prosper Grove Asset Management and actively participate in transactions, in your asset allocation, not only have high-quality stocks been significantly boosted, but also the value of cryptocurrency assets BTC, ETH, and core asset PGAM tokens is also being continuously released.

Now, you have all truly felt the power of the trend, which is crossing market fluctuations and pushing your wealth to unprecedented new heights!

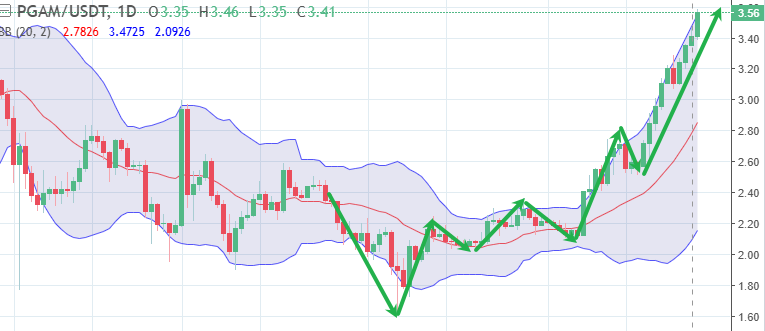

It is worth noting that our Prosper Grove Asset Management's core asset, PGAM tokens, is showing an extremely strong upward trend!

Under the trend signal confirmation of the ProMatrix Quantitative trading system and the precise guidance of the "Dynamic Diversified Asset Allocation System," the price of PGAM tokens has been rising steadily, with strong momentum, opening a new chapter of wealth growth for each of our firm allocation friends.

This is not just a round of gains, but a magnificent wealth blueprint. In this wealth blueprint, the cognition you adhere to and the "Dynamic Diversified Asset Allocation System" strategic layout strategies you implement are gradually being transformed into your wealth leap.

Friends, under the strategic guidance of the "Dynamic Diversified Asset Allocation System", our Prosper Grove Asset Management's core asset: PGAM tokens have brought us a 37.31% phased profit increase. This is not only a leap in numbers, but a real return under the trinity synergy of system, strategy, and execution!

This round of victory once again confirms the powerful trend judgment and prediction function of the ProMatrix Quantitative trading system.

Moreover, through the comprehensive big data analysis of the ProMatrix Quantitative trading system, important information is obtained: PGAM tokens will achieve a profit growth potential of up to 500% in the next three months.

We are full of firm confidence in this piece of wealth information, which is not only a deep understanding and accurate prediction of market trends, but also a high degree of trust and recognition of the powerful data analysis capabilities, trend identification capabilities, and strategic guidance capabilities of our ProMatrix Quantitative trading system.

Now, our ProMatrix Quantitative trading system has once again conveyed very important information: The core asset PGAM tokens have brought us a 37.31% profit increase, and what is exciting is that the wealth path created by PGAM tokens has just begun, and more than 460% of the profit potential is pouring towards us like a flood.

Friends, the market never waits for those who hesitate, and execution is always the accelerator of wealth. Our ProMatrix Quantitative trading system has already told you with results: the real winners are those who know how to make the right decisions at key nodes.

At this moment, the opportunity of the trend is right now, and the key lies in whether you are willing to take action.

Now, I encourage all friends to take active action and use their own funds to buy enough PGAM tokens. This is not only an investment behavior, but also a trust in the ProMatrix Quantitative trading system, a respect for the trend, and an active control of the future!

Friends, under the guidance of big data comprehensive analysis and trend identification of the ProMatrix Quantitative trading system, the "Dynamic Diversified Asset Allocation System" we have built is continuously realizing strategic dividends, and batches of high-quality assets are constantly bringing us considerable profit growth.

Whether it is the strong rise of PGAM tokens or the synchronous resonance of other crypto and traditional assets, it is proving to us that the power of the ProMatrix Quantitative trading system is leading us to steadily traverse the market and enter a new stage of wealth leap!

At this moment, you should not only be a beneficiary of market profits, but also become a practitioner of comprehensive improvement of cognitive system and practical capabilities!

Therefore, at this moment, we should not only be immersed in the returns we have already obtained, but also continue to delve into the logical structure and strategic principles of the ProMatrix Quantitative trading system, grasp the rhythm in the evolution of trends, and move forward steadily in market fluctuations.

Now, let's start today's learning journey with a positive attitude.

Today, we will focus on sharing practical trading skills: Practical application of KDJ in trend identification and trading decisions.

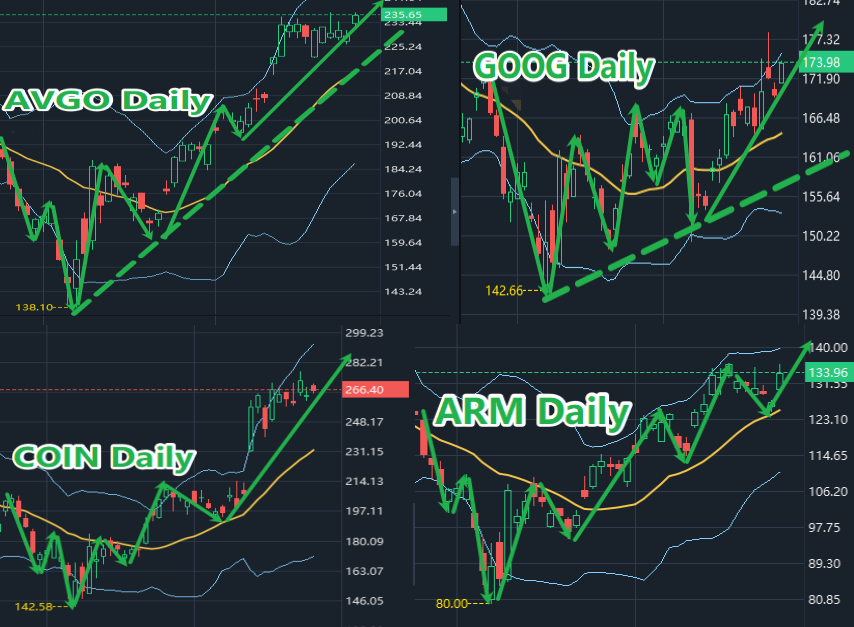

As shown in the figure:

Basic components of the KDJ indicator: K line, D line, J line.

K line (fast line): reflects recent price changes in the market, reacts quickly, fluctuates violently, and is a manifestation of market sensitivity;

D line (slow line): emphasizes the smoothness of the trend and is the core and direction confirmation signal of the KDJ indicator;

J line (leading line): calculates the degree of deviation between K and D and is an important reference line for judging overbought and oversold conditions and capturing extreme trading opportunities.

The interaction and divergence between these three constitute the main source of decision signals for the KDJ indicator in actual trading.

Application principle of the KDJ indicator: Based on the research on "price momentum" and "overbought and oversold" concepts in technical analysis, it helps investors identify the short-term trend direction of the market and potential buying and selling opportunities.

Friends, today we have focused on sharing the basic principles and components of the KDJ indicator. I believe that everyone has a deeper understanding of the KDJ indicator. Tomorrow, we will continue to share the application of the KDJ indicator in actual trading. I look forward to more friends participating in the discussion.

Dear friends, today's sharing has come to a successful conclusion, but our strategic process is still continuing.

Tomorrow, we will continue to track the latest developments of high-quality assets in the "Dynamic Diversified Asset Allocation System" strategic layout, continuously update the latest optimized asset allocation strategies, and strengthen the ability to acquire wealth.

I look forward to more friends actively participating in tomorrow's updated asset allocation strategy, joining us in moving forward, and jointly moving towards the road to wealth freedom. See you tomorrow!