Dear friends, I am Christian Luis Ahumada, Founder and Chief Analyst of Quantitative Trading at Prosper Grove Asset Management, and I am very happy to meet you again in this group at this promising time.

Today, we are not only going to systematically summarize the stage-by-stage results achieved by the strategic layout of the “Dynamic Diversified Asset Allocation System”, we are also going to stand on the overall perspective, and prospectively define the main lines of the strategic allocation and the operation rhythm for the next week, so as to continuously optimize the asset structure, and accelerate the leap of wealth.

Today's important information:

1. In the strategic layout of “Dynamic Diversified Asset Allocation System”, what are the results of the strategy of high-quality assets and what are the important signals?

2. What are the main lines of strategic asset allocation for next week and what is our view?

Today, the markets were once again hit with major news.

President Trump's statement that he intends to impose tariffs on imported iPhones that are not made in the U.S. and his proposal to impose punitive tariffs of up to 50% on the European Union quickly heightened market expectations of international trade tensions and left investment markets running under short-term pressure.

While the current topic of tariffs is heating up again, we captured the more informative key message from Finance Minister Besant's latest speech:

He noted that most trading partners are negotiating aggressively and in very good faith, with very good terms, and that he expects an agreement to be reached with more countries before the end of the 90-day tariff watch period, with the exception of the European Union, which is now in a stalemate.

This means: the current trade friction, although there are repetitions, but the essence is not a full deterioration, but the game of the stage of disagreement.

We must soberly realize: that the market's violent fluctuations stem from the news level of disturbance, rather than the outbreak of structural risks.

Although the trade issue has moved emotions, but will not change the general direction of medium- and long-term economic cooperation and value consensus, in the end, the negotiations are still the main theme of the problem, only the rhythm of the time difference.

Therefore, in the current situation, our response strategy is very clear:

1. Maintain rationality and patience, and resolutely refrain from wavering our strategic direction due to emotional fluctuations;

2. Continue to steadily implement the strategic layout of the “Dynamic Diversified Asset Allocation System” to strengthen the resilience of asset structure;

1. Make use of the window of structural adjustment to optimize the asset portfolio and enhance the allocation efficiency and anti-risk ability.

Now, let's focus on the results of this week's “Dynamic Diversified Asset Allocation System” strategy.

This week, through the trend analysis and powerful forecasting capabilities of the ProMatrix Quantitative Trading System, we have steadily advanced the strategic layout of the Dynamic Diversified Asset Allocation System. This has delivered substantial profit growth for those who have firmly followed our Prosper Grove Asset Management asset allocation strategy, while also paving a promising path for wealth accumulation through market volatility.

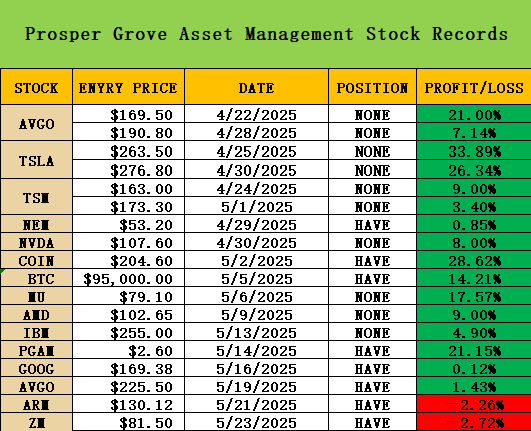

This week, the results of our strategic placement were as follows:

1. Successfully locked in a 4.9% profit return from IBM.

2. Continuously held assets are performing steadily better:

GOOG currently reaps 0.12% profit growth;

AVGO reaps 1.43%;

core strategic asset PGAM tokens overall reaps 21.15%;

cryptocurrency mainstream asset BTC reaps 14.21%.

This week, we have increased the strategic allocation of ARM and ZM, two high-quality stocks, although the two high-quality stocks have not brought us gains for the time being, please be patient and wait for them to think about the trajectory of the market next week.

Friends, through the sustained attention and active participation of all of you during this period of time, I believe that every one of us who firmly implemented the “dynamic and diversified asset allocation system” has already felt the power of wealth growth.

Through our asset allocation, we can not only help our friends in the time of attack, to achieve substantial growth in wealth, but also in the time of risk, to build a strong barrier.

I believe that you have once again felt the ProMatrix Quantitative trading system's powerful trend research and powerful forecasting capabilities.

At this moment, the ProMatrix Quantitative trading system is not only a simple intelligent function, it is an investment companion on our investment path.

Moreover, in order to better help you understand the ProMatrix Quantitative trading system and really enter its world, this week, we also focus on sharing the basic concepts and core components of the MACD indicator, the working principle of the MACD, and the judgment of buying and selling points, the judgment and application of the bottom divergence pattern and the top divergence pattern of the MACD in real-world transactions, and other investment and trading skills. Trading skills.

Moreover, these trading techniques have been successfully embedded into the ProMatrix Quantitative trading system program, and your daily investment in trading techniques is the process of gaining a deeper understanding of the core working principles of the ProMatrix Quantitative trading system.

Therefore, I encourage all my friends to pay attention to and learn from the group's daily updates and knowledge sharing, which is not only a shortcut to obtaining periodic profit signals, but also a valuable opportunity to gain a deeper understanding of the core working principles of the ProMatrix Quantitative trading system and the logic of its practical application.

At this moment, the ProMatrix Quantitative trading system is constantly improving and optimizing our “Dynamic Diversified Asset Allocation System” strategic layout, and has already set the strategic main direction for us next week:

1. We will continue to take the artificial intelligence sector as the long-term strategic main line of allocation, selecting high-quality stocks with strong profitability, reasonable valuation and a clear trend.

1. We will continue to allocate gold and gold concept stocks as defensive assets to protect against external policy and geopolitical uncertainties.

3. Continue to hold and focus on increasing the allocation weighting of the digital asset matrix:

Cryptocurrency concept stocks COIN continue to hold; can continue to allocate cryptocurrency mainstream assets BTC and core strategic assets PGAM tokens.

Especially worth focusing on is the core asset PGAM tokens are awakening the path of wealth.

The price of PGAM tokens is running steadily along the trend line from the low level, and the overall upward structure is very good, and the upward logic has been gradually constructed.

Moreover, I would like to emphasize that

PGAM Token is not a single digital asset, it is a strategic incubator of ProMatrix Quantitative and is highly tied to our ProMatrix Quantitative trading system.

And, the value of the PGAM token will resonate with three core drivers:

1. The continued growth of the ProMatrix Quantitative trading system and the expected increase in go-live;

2. The rapid expansion of our Prosper Grove Asset Management's global market awareness, influence, and user base;

3. Structural catalysts as the cryptocurrency market as a whole enters a new bullish cycle.

These three driving forces constitute a strong engine for the growth of PGAM token value. Moreover, the road of PGAM tokens' value leap has just begun, and this is the perfect opportunity to own enough PGAM tokens in a strategic way.

I believe that all of you will have a chance to draw the core asset PGAM tokens in the lucky draw session later.

I hope all of you will cherish this opportunity and really become a participant and witness the 500% profit growth of PGAM tokens in three months.

Dear friends, the above is the core layout of the “Dynamic Diversified Asset Allocation System” developed by our ProMatrix Quantitative trading system after aggregating global market data and comprehensively calculating trend structure and strategy logic.

At this moment, this asset allocation system is opening up a sustainable wealth growth path full of unlimited potential, and you are officially the pioneers and strategic participants in this value growth curve.

Therefore, I encourage those who have just joined our group of friends to actively participate in the improvement and upgrading of the “Dynamic Diversified Asset Allocation System” strategic layout, each of your firm holdings, each strategic allocation, are injecting trust and power into this value curve, are accumulating potential for the future dividends.

Friends, today's sharing has come to a successful conclusion, thank you for your interaction and listening.

In the current cycle of market volatility, as long as you continue to adhere to the system as the core, to the implementation of the fundamentals, and faith as a beacon, you will be able to grasp more wealth opportunities, which will be the dream of freedom of wealth into a reality within reach.

The busy week is coming to an end, and the beautiful weekend is coming, I hope you can spare more time to get together with your family and friends and feel the beauty of life.

Next week, we will continue to track the real-time dynamics of high-quality assets in the strategic layout of the “Dynamic Diversified Asset Allocation System” to further improve the asset structure and strengthen our wealth growth path and look forward to the participation and testimony of more friends.

Have a good weekend, everyone!