Dear friends, I’m Christian Luis Ahumada, the founder and Chief Quantitative Analyst of Prosper Grove Asset Management. I’m very pleased to reconnect with all of you in the group at this moment filled with hope and value.

Today, we will continue to use the Dynamic Diversified Asset Allocation System as our main framework, closely tracking the real-time performance of high-quality assets within the strategic layout. We will timely optimize the allocation rhythm, grasp the pulse of market trends, and ensure that our asset allocation remains efficient and powerful in operation.

Today’s Key Insights:

What changes have occurred in the current investment environment, and what is our strategy?

What are the detailed highlights of the high-quality stocks selected today by the ProMatrix Quantitative Trading System?

What is the real-time performance of high-quality assets within the Dynamic Diversified Asset Allocation System, and what are the optimization strategies?

Friends, today’s market experienced a brief pullback due to external news disruptions.

The key trigger was President Trump’s statement suggesting that, due to a “lack of progress” in trade negotiations with the European Union, a 50% tariff on the EU should be imposed starting June 1, 2025.

In the current environment of global trade uncertainty, this signal has undoubtedly suppressed the release of short-term investor optimism.

Nevertheless, both sides are still scheduled to hold a trade conference call today, indicating that there is still room for policy negotiation and that market sentiment remains within a manageable range.

Our view: short-term disruptions do not alter the long-term logic, and structural opportunities continue to persist. We believe today’s pullback is a news-driven technical correction rather than a trend reversal, and it does not change the underlying logic of overall asset value realization.

We remain cautiously optimistic about the current macro environment and the ongoing structural market trends.

Therefore, under the current market conditions, our operational strategy is as follows:

1.For high-quality stocks that have already generated short-term profits, implement a “profit-taking reduction” approach to proactively lock in partial gains and free up liquidity for future rebalancing.

2. During the correction phase, continue to actively participate in trading by selecting high-quality stocks based on systematic logic, and combine structural trend signals to continuously optimize the strategic layout of the Dynamic Diversified Asset Allocation System, building a more resilient portfolio structure amid market volatility.

Let’s now focus on the detailed information of the high-quality stock selected by the ProMatrix Quantitative Trading System:

This high-quality stock is a technology company that has long been dedicated to developing and operating cloud-based video communication platforms. It primarily provides online video communication and remote collaboration solutions.

Moreover, with its high-definition, stable connectivity technology, excellent user experience, and platform usability, it has become a key provider of digital collaboration infrastructure on a global scale.

The company has deeply integrated artificial intelligence into its communication toolchain, continuously expanding its service dimensions to deliver a more intelligent meeting experience for users.

This strategic move is not only a technological upgrade but also a long-term growth driver that supports the optimization of its revenue and profit structure.

The latest earnings report clearly shows:

1.Revenue for the first quarter ending April 30 was $1.17 billion, in line with market expectations;

2.Adjusted earnings per share came in at $1.43, exceeding the expected $1.31.

3. Full-year earnings guidance raised:

a. EPS was revised upward from the previously projected range of $5.34 to $5.37, to a new range of $5.50 to $5.59.

b. At the same time, the company raised its fiscal year 2026 revenue forecast from $4.80 billion to $4.81 billion.

Behind this series of indicators lies a picture of healthy fundamental expansion, improved profitability, and growing confidence in the company’s future growth trajectory.

Technical Perspective:

This high-quality stock has formed an irregular inverted head and shoulders pattern from its lower levels, a structure that often signals a mid-term bottom and a potential trend reversal.

Subsequently, the stock price has been steadily climbing along an upward trendline. Although there has been a short-term technical pullback, it has not disrupted the existing bullish structure, indicating that the bullish control remains intact.

Moreover, after pulling back to a previously identified support zone, the stock price of this high-quality asset quickly rebounded and successfully held above the middle band of the Bollinger Bands. This not only serves as a trend confirmation but also aligns with the system strategy that a strong pullback presents a buying opportunity.

Comprehensive Analysis: Boosted by the momentum of artificial intelligence, this high-quality stock is experiencing strong demand. The company has raised its annual performance forecast, and the price trend is holding steadily above the middle band of the Bollinger Bands, meeting our criteria for a buy. The initial target price: $90.

Friends, if you’re interested in this high-quality stock, please contact the assistant immediately to receive the latest trading strategy.

Dear friends, congratulations to those who have completed today’s synchronized purchase of high-quality stocks. You’ve taken the first important step in staying aligned with the system’s rhythm and seizing the advantage of the trend.

At this moment, to ensure we can provide you with more accurate tracking services moving forward, please send today’s transaction details to our assistant. She will record the information for each friend who has completed the trade and will monitor the daily performance of the high-quality stock, ensuring that you stay up to date with real-time updates at all times.

This is not just a trading move; it is the starting point for continuous strategy execution and dynamic profit management.

Additionally, those of you who have successfully completed your trades and submitted your records today will be entered into a drawing this afternoon at for a chance to win one of Prosper Grove Asset Management's core strategic assets: the PGAM Token.

Dear friends, I believe that at this moment, for those of you who have successfully allocated and held our core strategic asset PGAM tokens,

You are not only lucky, but you are also an actor with a strategic vision.

You have realized that the PGAM token is not only a crypto asset symbol but also a key to open the door to wealth freedom.

This week, as the outlook of the cryptocurrency field continues to be optimistic, with the continuous optimization and upgrading of the ProMatrix Quantitative trading system, and with the continued expansion of the ecological influence of Prosper Grove Asset Management, the logic of the value of the PGAM tokens is gradually being realized, and the potential energy is being fully accelerated to release.

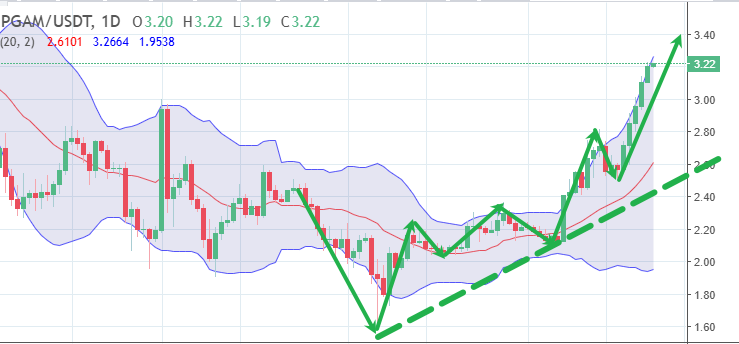

Friends, in just one week, since we launched our joint allocation of PGAM tokens last week, this core strategic asset has realized a significant phase of value increase.

According to everyone's feedback, the average price of PGAM tokens held by all of us is 2.60 USDT, and up to now, its market price has climbed to 3.14 USDT, which means that all of us who have firmly implemented the strategic layout of “Dynamic and Diversified Asset Allocation System” have already gained 20.77% of the phased profit growth! Profit growth!

This is a real, verifiable and realizable picture of the wealth leap, but also another strong proof of our “dynamic diversified asset allocation system” strategic model.

It is worth pointing out in particular that although the current price of PGAM tokens has experienced a brief technical retracement, it is not a trend reversal, but a precursor to another rise after organizing.

For those who have not yet completed the allocation, this is the “strategic replenishment window” given by the system signal,

is a golden opportunity to grasp the future value of dividends at a better price.

Right now, our core strategic asset at Prosper Grove Asset Management, the PGAM token, is opening up a path of potential wealth growth at

My friends, what you are seeing at this moment is the continued rise in the price of our core strategic asset, the PGAM token, but what we are seeing is the continued release of the deeper structural value behind it.

This is not only the interpretation of a period of rising numbers, but also the inevitable result of the superimposed effect of technology-driven, system growth and ecological resonance.

So, please wake up and realize the following three core keys:

1. The overall market expectation of the cryptocurrency market, which has not yet been fully released, means that the incremental dividend of the entire cryptocurrency asset space is still on its way.

2. The ProMatrix Quantitative trading system is still in the process of continuous growth and intelligent evolution, which will become an important engine for the continuous rise in the value of PGAM tokens.

3. Our Prosper Grove Asset Management ecosystem is entering a phase of rapid expansion, with the platform's visibility and influence, and the user base all jumping, and the demand for and consensus on PGAM tokens as the value core of the entire ecosystem will continue to amplify.

All this means that the wealth creation path of PGAM tokens is in the beginning stage, and now, it is the key window for all friends with strategic vision to strategically buy and increase their positions.

The earlier you own PGAM tokens, the earlier you lock in the starting point of your wealth growth; the more you hold on to PGAM tokens, the more you will be able to traverse fluctuations in the cycle, and enjoy the long-term dividends.

At this moment, the horn of wealth growth has sounded and we stand on a new value growth curve.

PGAM tokens, as the core strategic asset of our Prosper Grove Asset Management ecosystem, are unleashing unprecedented potential and momentum.

At this moment, you are not only the witnesses of this compounding wealth growth, but also the co-builders and participants of the PGAM Token value growth curve.

Dear friends, at this moment, not only is the core strategic value of PGAM tokens continuing to be released and accelerating to be realized, but BTC, as a global crypto asset weathervane, is also performing very well recently, continuing to break through all-time highs, and refreshing the boundaries of our knowledge of the crypto market.

I believe that those of you who followed the strategic layout of the “Dynamic Diversified Asset Allocation System” constructed by Prosper Grove Asset Management and added BTC to your asset allocation two weeks ago are now enjoying the joy of wealth growth every day.

At the moment, the BTC price has pulled back briefly. For those who have not yet included BTC in their “dynamic and diversified asset allocation system”, this is a good time to pay attention to the strategic replenishment.

Friends, let's focus again on the real-time action in the quality stocks in the strategic layout of the Dynamic Diversified Asset Allocation System.

Quality stocks also saw a brief period of volatility today as President Trump announced that he would impose 50% tariffs on the European Union.

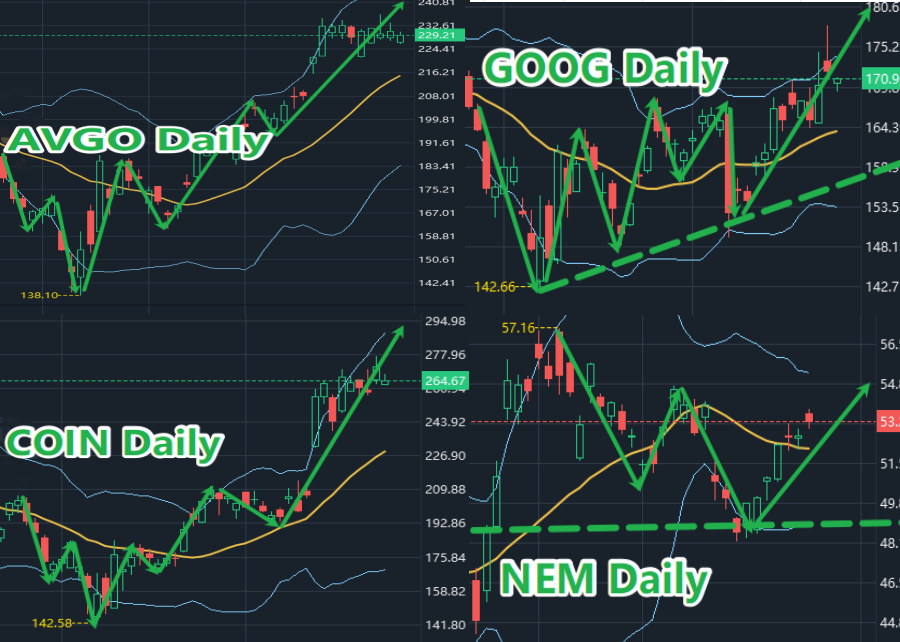

AVGO price has been steadily rising along the trend line and is currently near new stage highs, once it succeeds in breaking through the key pressure positions, it means that a new round of uptrend will start, and the current technical structure is extremely healthy and steady, with a clear continuation of momentum.

Therefore, we choose to continue to hold and wait, further waiting for potential profit release.

GOOG price along the trend line steadily rising, the overall trend running status is good, although, now the price appeared a short retracement, but the logic of the rising structure has not changed, we choose to continue to hold waiting.

Cryptocurrency Concept COIN The overall trend is running in an extremely solid state and has brought us a 29.64% stage profit growth so far. I believe that those who have included COIN in their portfolios as early as the early stage of the layout are, at this moment, actually enjoying the pleasure of the wealth leap brought about by the trend dividend.

More crucially: the current global cryptocurrency regulatory environment is continuing to improve, the policy outlook is expected to be favorable, and its growth space and strategic value remain fully imaginative.

Therefore, we continue to hold the cryptocurrency concept stock COIN.

NEM belongs to the gold concept stock, I believe you have clearly found that along with the market risk aversion, the gold concept stock will often show very good performance, which is also our “dynamic diversified asset allocation system” strategic layout of the important asset allocation.

NEM as our defensive allocation, now chooses to continue to hold.

Dear friends, this morning's sharing has come to a successful conclusion. Thank you for your active participation and interaction.

Later, I will summarize the results of this week's strategic layout of the “Dynamic Diversified Asset Allocation System” and our strategic layout path for next week.

I look forward to meeting you again later in the sharing, see you later!