Dear friends, I’m Christian Luis Ahumada, the founder and Chief Quantitative Analyst of Prosper Grove Asset Management. I’m pleased to be here with all of you in the group. Today, we will not only continue to monitor the performance of high-quality assets within the strategic layout of the Dynamic Diversified Asset Allocation System and optimize our asset allocation, but also deepen our trading knowledge to further enhance practical trading skills.

Today's important information:

1. “Dynamic diversified asset allocation system” strategic layout, how is our asset allocation, and how should we adjust?

2. Practical trading skills: judgment and application of MACD top divergence pattern.

Friends, the core focus of the current market is focusing on the tax reform bill promoted by President Trump.

Currently, the House of Representatives has passed a bill containing tax cuts and increased military spending, if this bill is subsequently passed by the Senate,will likely significantly push up the size of the government budget, expanding the pressure on the fiscal deficit, thus constituting a certain policy negative impact on the medium- to long-term macroeconomic and capital markets.

Despite the potential uncertainty of the policy surface, but from the current market structural reaction, we observe: that three major stock indexes still maintain the rhythm of oscillation upward, the market investor sentiment is relatively stable, which indicates that, at the current stage, the overall market environment has not changed, the structure of the trend is still in a relatively healthy running track.

At this moment, in the face of potential policy perturbations, we always remain cautious, do a good job of risk control, always optimize and upgrade our “dynamic diversified asset allocation system” strategic layout, and strengthen the ability to obtain wealth.

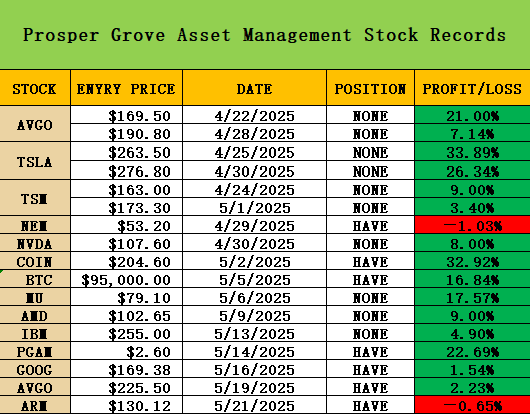

Dear friends, let us now focus on the results of the strategic allocation of the “dynamic diversified asset allocation system”:

1. Equity assets:

Artificial Intelligence Sector:

AVGO has realized a profit return of 2.23% and at the moment, the trend is working well;

GOOG's profit growth has realized 1.54%, rising at a steady pace, with strong fundamental support;

ARM is currently dominated by a short-term oscillator pattern with a current loss of 0.65%, a healthy backtracking phase and no change in trend structure.

Cryptocurrency Concepts sector:

COIN has been performing exceptionally strong and has reached a milestone gain of 32.92% with the trend running in good shape.

Gold Concept Sector:

NEM currently has a temporary temporary loss of 1.03%, as a defense asset still has long-term allocation significance.

2. Cryptocurrency assets:

BTC, as the vane of the crypto market, has realized a stable gain of 16.84%, and at this moment, the uptrend remains strong.

PGAM tokens, our core strategic asset at Prosper Grove Asset Management, have realized a 22.69% rise in profits, catalyzed by both system-driven and ecological expansion, and more importantly, the upside logic is still in the early stages of release, with plenty of potential for subsequent growth.

Dear friends, I believe that through the systematic comparison of the performance of various types of assets just now, we have been able to clearly see an important trend: as the time cycle continues to advance, the matrix of high-quality assets constructed by the Dynamic Diversified Asset Allocation System is steadily and consistently generating a return of wealth for us.

Moreover, a new wave of wealth growth is gradually shifting towards cryptocurrency assets, and more importantly, the structural growth potential of cryptocurrency assets continues to amplify, attracting more capital, more attention, and more strategic awareness.

At this moment, crypto assets are once again collectively releasing strong upward mobility, the most representative of which are the mainstream cryptocurrency asset BTC and our core strategic asset at Prosper Grove Asset Management: the PGAM token.

Currently, BTC is showing an extremely strong rising rhythm, not only the technical pattern of strong breakthrough, but also in the macro-expectation of improvement and funds continue to add positions, gradually released in the medium and long term power to expand the power of wealth momentum.

This round of rise is not a short-lived emotional fluctuation, but the result of crypto market fundamentals and structural capital intensive.

Therefore, you can continue to allocate BTC to the strategic layout of the “dynamic diversified asset allocation system”.

Meanwhile, in the process of BTC's strong price rise, our core asset PGAM token is building a promising and exciting long-term wealth blueprint by virtue of its ecological binding value, platform growth momentum, and market expectations.

Since last week, we at Prosper Grove Asset Management have been explicitly recommending that we include our core strategic asset, PGAM tokens, in the core structure of our “Dynamic Diversified Asset Allocation System”.

The average price of most of our friends' allocations is around 2.60 USDT, and in just one week's time, against the backdrop of a continuously improving regulatory outlook for crypto-assets and a warming of optimism in the market, PGAM tokens have risen strongly, with a current gain of 22.69%,showing amazing profit resilience and structural outbreak potential.

We believe that you have already felt the strong profit potential of PGAM tokens, and PGAM tokens, as an important carrier of value mapping and transaction empowerment in the system ecosystem, will also see a rapid rise in market interest and transaction demand.

In particular, the ProMatrix Quantitative trading system is always growing and evolving, and the expectation of “accelerating the launch” continues to grow, which, once successfully implemented, will significantly increase the brand influence and asset management scale of Prosper Grove Asset Management, and bring more benefits to PGAM tokens. Once successfully implemented, it will significantly increase the brand influence and asset management scale of Prosper Grove Asset Management, and bring wider application scenarios and valuation reconstruction space for PGAM tokens.

It is believed that these factors will become the core driving force for PGAM tokens to realize a 500% increase.

Friends, we must be acutely aware that:

The path to wealth built by the core strategic asset, the PGAM Token, has only just begun. Now is the best strategic window to own PGAM tokens on a large scale.

At this moment, owning PGAM tokens means owning a triple strategic value:

1. To own through the cycle. The ability to continue to grow assets

2. Receive the growth dividend of being deeply tied to our Prosper Grove Asset Management ecosystem.

3. The right to initiate a structural leap in wealth.

So, the PGMA token is not just a code name for a digital asset, it is a resonance point of strategy, confidence and future dividends, and it is your participation in the operations of Prosper Grove Asset Management. It is a certificate of value and identity symbol for you to participate in Prosper Grove Asset Management's operations, governance, and to share the dividends of growth.

Friends, I believe that for those of you who continue to follow our group and firmly implement the “Dynamic Diversified Asset Allocation System”

you are the real participants and witnesses of the growth of curved wealth: now you don't need to invest by “guessing”, but by using the Now you don't need to “guess” to invest, but rather use the ProMatrix Quantitative trading system to position yourself, amplify the “trend” and cash in over time.

Dear friends, when we are immersed in the joy brought by the growth of wealth, we need to be more awake to realize that: the real leap in wealth comes not only from the trend of attention, but also from the ability to accurately judge and effectively defend at the key points.

Therefore, in today's learning journey, we will focus on sharing practical trading skills: MACD top divergence judgment and application.

MACD top divergence refers to when the price continues to make new highs, but the MACD line or histogram does not make new highs in tandem, but instead goes lower, with a clear divergence.

Such divergences are indicative:

Although the market is rising on the surface, the upward momentum behind it is weakening.

Long forces are gradually showing weakness, and the risk of a trend or phase correction is approaching.

Therefore, MACD Top Divergence is a warning signal in technical analysis, which usually appears at the end of an uptrend, signaling the exhaustion of upward momentum and a possible reversal of the market downward. It is an important pattern for identifying top areas and guarding against a phased pullback or trend reversal.

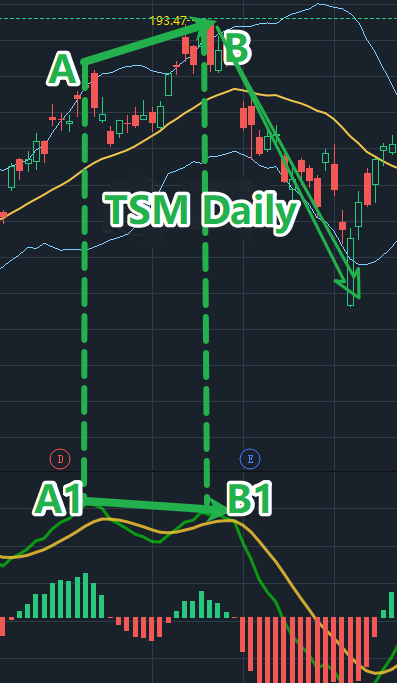

The daily chart of TSM for the period June 2024-August 2024 is shown in the figure below.

1. As the stock price continues to rise, it makes a first high, point A, which corresponds to point A1 of the MACD indicator.

2. When the stock price retraces and then rises again to make the second high, point B, but at this point the MACD indicator corresponding to point B1 does not continue to make new highs, indicating that the rising momentum is weakening, which is a warning signal.

When the stock price continues to make new highs, as in the A-B segment of the chart, but the trend of the MACD shows a downward trend, as in the A1-B1 chart, the MACD divergence phenomenon is formed, that is, the possibility of a short-term retracement of the market to appear, always be on the alert.

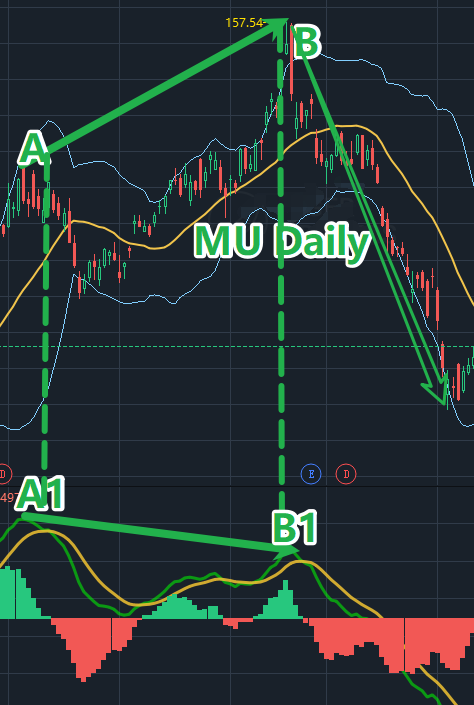

There are many similar examples, such as the chart: MU in April 2024 - July 2024 daily chart.

I believe that now you have a deeper understanding of the top divergence pattern of the MACD, you can better verify in real-world trading.

Dear friends, today's learning and sharing has come to a successful conclusion, thank you for your continued attention and active participation.

Tomorrow, under the guidance of the system, we will continue to work together to screen and buy quality stock with an expected profit of about 30%, interested parties can contact the assistant in advance to register, to ensure that you can participate in the trading and profit first time tomorrow.

At the same time, we will continue to track the performance of the core assets in the Dynamic Diversified Asset Allocation System, to dynamically optimize the structural layout and achieve the wealth growth curve. See you tomorrow!