Dear friends, I’m Christian Luis Ahumada, the founder and Chief Quantitative Analyst of Prosper Grove Asset Management. I’m pleased to be here with all of you in the group. Today, we will analyze the impact of economic data on the investment market together, further optimize our asset allocation, and ensure we remain firmly positioned within the channel of wealth growth.

Today’s Key Insights:

1.What signals are conveyed by the initial jobless claims for the week ending May 17, and what impact do they have on the investment market?

2.What is the real-time performance of high-quality assets within the Dynamic Diversified Asset Allocation System, and what is our strategy?

Let us now begin today’s journey of learning and discovery with focus and anticipation.

Initial jobless claims refer to the number of individuals filing for unemployment benefits for the first time during the week. It is a high-frequency, leading indicator used to assess changes in the labor market and the overall health of the economy.

According to data filtered through the ProMatrix Quantitative Trading System, for the week ending May 17, seasonally adjusted initial jobless claims decreased by 2,000 to 227,000, coming in below the market expectation of 230,000.

Although the change is modest, this result sends a clear structural signal: despite ongoing macroeconomic uncertainties, the labor market continues to demonstrate strong resilience and stability, and systemic recession risks have not yet become apparent.

As a result, the Federal Reserve may maintain a “wait-and-see” and “patient” stance in formulating interest rate policy, lowering expectations for an imminent rate cut. This could have a short-term negative impact on the investment market.

Let us now focus on the real-time performance of the high-quality assets within the strategic layout of the Dynamic Diversified Asset Allocation System, which are currently demonstrating strong profit-generating capability.

GOOG’s price is steadily moving within an upward channel, with a stable rhythm and well-defined structure. Its fundamentals remain strong, with both financial health and profitability rated as “excellent.” In addition, its future growth outlook is stable and clearly defined, making it a valuable asset for medium- to long-term allocation. Therefore, we have decided to continue holding and waiting.

While everyone is enjoying the strong returns brought by recent high-quality assets, the cryptocurrency-related stock COIN is presenting an even stronger and clearer trend structure, painting a highly promising picture of future wealth growth.

COIN is currently moving steadily within an upward channel and is once again making a strong move toward its short-term high. From a price pattern perspective, a breakout above the key resistance level would open up a new phase of unidirectional, trend-driven upside. This is not only a price breakout but also a signal of amplified trend momentum and str

Friends, at this very moment, our core strategic asset, the PGAM token, is building an exciting blueprint for wealth with unlimited potential in an empowering manner.

For those of you who have been decisively allocating PGAM tokens for a long time now, your feelings are undoubtedly the most profound: you are not outsiders, but participants and witnesses to this leap in value.

At this moment, COIN has delivered a 29.96% short-term profit return.

More importantly, its upward movement is not yet over. The price structure and trading momentum it is displaying indicate that the mid-term trend remains healthy and that there is still room for further profit potential.

Therefore, we choose to continue holding and waiting, maintaining a strategic perspective as we anticipate the further release of its profit potential.

Dear friends, we believe that everyone who has been consistently following our Prosper Grove Asset Management group and firmly executing the strategic layout of the Dynamic Diversified Asset Allocation System has now truly experienced the powerful strength of the ProMatrix Quantitative Trading System. Whether in trend identification, opportunity capture, strategy formulation, or execution, it has demonstrated exceptional performance that is systematic, intelligent, and forward-looking.

The ProMatrix Quantitative Trading System is not a single algorithmic tool, but an intelligent investment framework built through the coordination of four major functional modules.

Trading Signal Decision System: Efficiently identifies market trends and turning points, delivering precise buy and sell signals.

Advanced Quantitative Trading System: Executes strategies based on big data and historical models, automatically performing low-latency trades.

Investment Strategy Decision System: Integrates macroeconomics, sector rotation, and market psychology to develop multi-dimensional asset allocation strategies.

Expert-Level Investment Decision System: Integrates global information and AI-driven predictive capabilities to provide in-depth support for advanced decision-making in complex environments.

These four core modules operate in highly integrated coordination, forming a complete loop from data collection, signal generation, and strategy decision-making to execution and feedback. This truly achieves a system-driven understanding and decision-guided action.

Therefore, throughout multiple rounds of market volatility, the ProMatrix Quantitative Trading System has leveraged its keen trend analysis and powerful predictive capabilities to provide us with real-time wealth decision-making insights. It continuously enhances and upgrades the strategic layout of the Dynamic Diversified Asset Allocation System, helping us build a solid fortress of wealth.

At this moment, the ProMatrix Quantitative Trading System is not just an intelligent trading tool; it is also a concrete embodiment of systematic thinking and investment philosophy.

Using data as the foundation to eliminate emotional judgment;

Using technology as the framework to connect market dynamics with behavioral patterns;

Using strategy as the core to serve long-term wealth building;

Using execution as the path to achieve a value leap from insight to asset growth.

Friends, the ProMatrix Quantitative Trading System is the core engine that helps us continuously optimize the Dynamic Diversified Asset Allocation System. It has built for us a digital fortress that withstands risk, embraces opportunity, and consistently generates wealth.

At this moment, the “Dynamic Diversified Asset Allocation System” carefully constructed by the ProMatrix Quantitative Trading System based on comprehensive big data analysis and powerful research and forecasting functions is continuously and effectively strengthening our ability to acquire wealth and resist volatility in the current market.

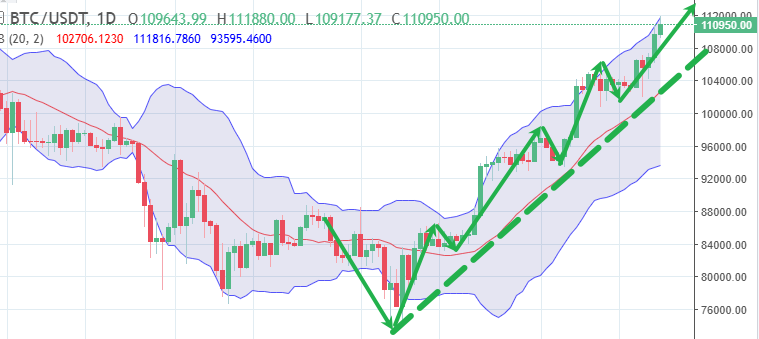

Among them, it is worth focusing on: the cryptocurrency asset BTC, which is gradually building a clear, full of potential, with a long-term compounding effect of value growth path.

Currently, the mainstream cryptocurrency asset BTC has once again shown a strong trend, not only breaking through the previous historical highs but also opening a new round of medium- to long-term uptrend.

This upward breakthrough is not only the interpretation of the technical structure but also a real response to the full return of market investor confidence.

Let's take a look back at an exciting real-life journey.

Just two weeks ago, we were the first in our group to issue a strategic guideline explicitly recommending that BTC, the dominant cryptocurrency asset, be included in the core portfolio of the Dynamic Diversified Asset Allocation System. At that time, the price of BTC was at the stage of $95,000, and at that time it was predicted that the first target for BTC would be $180,000. Many of you may have wondered, or even questioned, “Is the trend of allocating BTC at this point in time coming to an end?”

Just last week, the BTC price as I predicted the trend to run, successfully reached $103,000, we once again firmly emphasized: that BTC's first goal is $180,000, and it should be a key asset allocation, continue to be included in the strategic system, at that time, there are friends again questioned.

But now the actual result is: today, BTC has successfully exceeded the $110,000 mark, and at this moment, those who firmly implement our “dynamic diversified asset allocation system” strategic layout, are personally experiencing the joy of the wealth leap brought about by the trend explosion.

Now, BTC is steadily progressing towards the goal of $180,000 that I have predicted for everyone.

Now, let's start with the price of BTC at $95,000 two weeks ago. Since we included BTC, the mainstream cryptocurrency asset, into the strategic layout of the “Dynamic Diversified Asset Allocation System”, in just two weeks' time, the price of BTC started from around $95,000, rose steadily all the way, and now successfully surpassed the $110,000 mark. Now it has successfully exceeded the $110,000 mark, successfully realizing a 15.78% return on profit at this stage. If our next BTC target of $180,000 is successfully achieved, it means that we will be looking at a whopping 89.47% expected increase.

This is an exciting and tangible wealth scenario.

However, just as everyone was reveling in the profit growth that BTC's brought, our strategic perspective moved forward, once again.

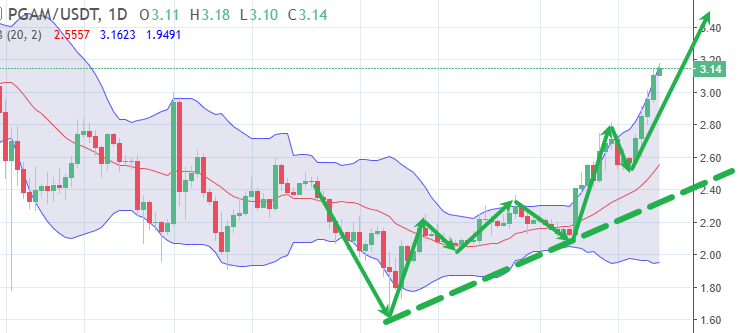

Once again, the focus is on our core strategic asset at Prosper Grove Asset Management: the PGAM token.

Since last week, we have been strongly recommending in our groups that we actively include our core strategic asset, the PGAM token, in our strategic allocation.

At that time, the average price of PGAM tokens was 2.60USDT, but due to the strong cryptocurrency rally, as well as the growth and evolution of the ProMatrix Quantitative trading system, the price of PGAM tokens has now managed to reach 3.14USDT, an exciting increase of 20.77%.

With the above data information:

BTC, the mainstream cryptocurrency asset, has realized a 15.78% profit return in two weeks;

PGAM token, the core strategic asset, has realized a 20.77% profit return in about a week.

By comparison, we can clearly see that the growth potential realized by the core strategic asset PGAM tokens in a shorter period has significantly outperformed BTC's rise.

Friends, through the ProMatrix Quantitative trading system on the market trend, big data momentum and other multi-dimensional comprehensive analysis we have come to an important information: the core strategic asset: PGAM tokens in the next three months, the minimum expected upside space will reach 500%.

At this moment, the potential upside profit of the mainstream cryptocurrency asset BTC is clearly lacking compared to the potential upside profit of the strategic asset PGAM tokens.

Summarizing all of the above information, we can clearly draw the exciting conclusion that the valuation space and upside explosion potential that the core asset PGAM tokens are currently in is already far superior to the resilience space offered by BTC.

Furthermore, the core asset, PGAM Token, has managed to reach a 500% profit increase in three months, and this is our promise from Prosper Grove Asset Management:

If PGAM Token fails to reach the 500% increase target in the next three months, or if you suffer a loss while participating in the trading of PGAM Token, then we, at Prosper Grove Asset Management will compensate you for the full amount of your principal.

This is not a paper promise, but:

1. Our deep confidence in the trend judgment and forecasting ability of the ProMatrix Quantitative trading system;

2. Our full recognition of the ecological value and platform growth logic represented by PGAM tokens;

3. Our responsibility and respect for all participants and strategic partners.

At this moment, the core drivers of the rise of the core strategic asset PGAM Token:

1. A new bullish cycle in the cryptocurrency space has begun, creating a favorable investment environment and laying the groundwork for crypto assets to continue to unlock their potential value potential.

2. With the ProMatrix Quantitative trading system growing and evolving every moment, and bringing steady wealth growth to our friends every day, the expectation that the ProMatrix Quantitative trading system will be launched as soon as possible to the community has been strengthened.

3. Once the ProMatrix Quantitative trading system is successfully launched, it will further increase the popularity and influence of Prosper Grove Asset Management, attracting more friends to participate and join us, expanding the scale of our asset management, increasing the market value of the company, and opening up the path to Nasdaq listing, injecting new energy into the rise of PGAM tokens.

And, the journey of wealth creation with the core asset PGAM tokens has just begun, and this is the perfect strategic window to act and own enough PGAM tokens.

Friends, we look forward to working hand-in-hand with you on the journey of continued growth in the value of our core strategic asset, the PGAM Token, and together we will move into wealth freedom.

Dear friends, the content of this morning's sharing has been successfully concluded, here, thank you for your active participation and attentive listening.

Later, we will continue to focus on the “dynamic diversified asset allocation system”, quality asset allocation brought about by the milestone results, and further in-depth discussion of practical trading skills: MACD top divergence pattern judgment and application strategy.

We look forward to the participation and discussion of more friends, see you later!