Dear friends, I’m Christian Luis Ahumada, the founder and Chief Quantitative Analyst of Prosper Grove Asset Management. I’m glad to be here with all of you in the group. Today, we are not only optimizing asset allocation and deepening our understanding of trends and strategies, but also, through the accumulation of knowledge, gradually building a Dynamic Diversified Asset Allocation System that belongs to each and every one of us.

Today’s Key Insights:

1.What is the current investment environment in the market, and what is our perspective?

2.Practical Trading Techniques: Identifying buy and sell signals with MACD and mastering its precise application in real trading scenarios.

Today, the three major stock indexes as a whole to maintain the pattern of oscillating operation, market sentiment, although repeated, but the underlying structure is still maintaining stability, now the market focus around corporate earnings, the Federal Reserve interest rate policy trends and the international trade situation.

From the current market performance, despite the technical short-term retracement phenomenon, but we believe that the underlying logic of the market is still solid, the trend foundation has not been fundamentally undermined.

Therefore, the main strategy is to firmly promote the construction of “dynamic diversified asset allocation system”, and continue to optimize the defense system, as well as dynamically adjust the asset allocation, to achieve a steady rise in wealth.

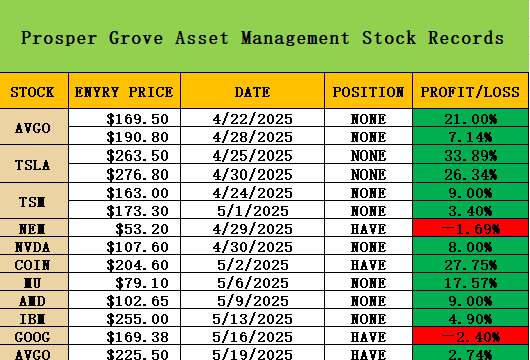

Now let's focus on the real-time dynamics of the quality assets in the strategic layout of the “Dynamic Diversified Asset Allocation System”:

Within our strategic allocation of high-quality assets, the gold sector stock NEM has shown a very solid rebound, once again proving that opportunities in gold and gold-related stocks require patience and should be approached with a medium- to long-term perspective. Therefore, we have decided to continue holding our position in gold and in NEM, the gold-related stock.

Today, with TSLA's share price breaking out to a new milestone high, it brought us a profit return of 33.89%.

From the perspective of stable profitability and risk control, we decided to sell all of our shares at a profit, successfully locking in the current round of gains and freeing up more liquidity for flexible deployment.

Once again, congratulations to all of you who have followed Prosper Grove Asset Management's strategy of building a “Dynamic Multi-Asset Allocation System”, your wealth has once again risen to new heights.

But I want to emphasize this in particular: every profit realized means an opportunity for higher-dimensional asset allocation opens up. As we unleash our precious capital momentum, it must be more efficiently reallocated to better-structured and stronger growth assets to ensure that we continue to stand in the midst of an accelerating channel of wealth growth.

Therefore, we need a dual-track strategic layout, focusing on core assets:

1. Take out a portion of our liquidity and continue to participate in opportunities in quality stocks screened by the ProMatrix Quantitative trading system to continue to capture structural swing profits.

2. With the remaining liquidity, continue to allocate our Prosper Grove Asset Management strategic asset: PGAM tokens,

to move from a stage of victory to a long-term value leap.

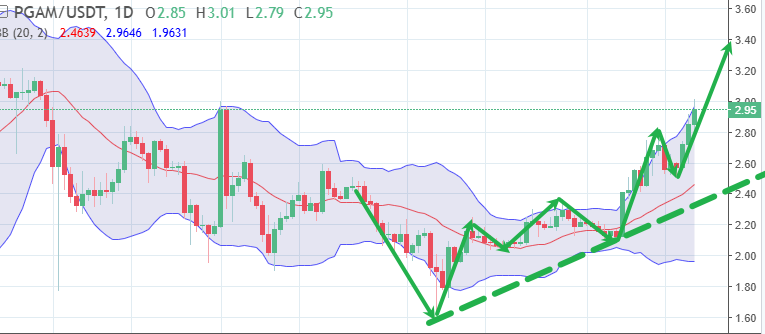

Moreover, based on the in-depth analysis of multi-dimensional market data, trend modeling, and probability calculations by the ProMatrix Quantitative Trading System,

We have come up with an extremely important strategic judgment: in the next three months, the price of PGAM tokens is conservatively expected to rise by 500%, and even has the potential to rise by 800% under certain structural resonance conditions.

This is not an unattainable dream, but rather a strategic window of certainty based on the four dimensions of the ProMatrix Quantitative trading system's continued growth and evolution, market expectations, the trust and support of a growing number of potential users, and capital linkages.

Friends, at this moment, PGAM tokens are constructing a grand blueprint for wealth.

Currently, those who own PGAM tokens have already achieved 13.46% stage profit, which is not only a victory in terms of data, but also the results of strategic direction judgment, but also the verifiable and cashable return scenarios brought about by the right choices we made at the right point in time.

Please remember: the wealth compounding curve of PGAM tokens has just begun, and we believe that along with the continuous development of Prosper Grove Asset Management, the continuous growth and evolution of the ProMatrix Quantitative trading system, and the continuous superposition of the market's recognition and consensus, the growth of the value of PGAM tokens will also get the most substantial increase!

And the real long-term winners, never chasing in the climax, but in the early market start quietly, and layout.

Opportunity, never waiting for the waiter; strategy, only belongs to the forerunner. When most people are still hesitating, watching and waiting for a “better time to enter the market”, the investors who really have strategic vision and systematic thinking have already completed the strategic layout in the low valuation stage of PGAM tokens.

Therefore, I once again encourage all friends to actively participate in the layout of PGAM tokens, seize the wealth opportunities given to us by the market, and truly enjoy the charm of the continuous strengthening of wealth.

Dear friends, while we are doing a good job of laying out our strategic assets, we should also continue to strengthen our practical abilities.

Now let's start today's learning journey with a positive mindset.

Today, we will focus on sharing practical trading skills: MACD's judgment of buying and selling points and precise application skills in practical combat.

Yesterday, I shared with you the basic composition and working principle of MACD. Now, let us review the content of yesterday's focus.

The MACD indicator helps us to extract the medium and long-term trend signals in the process of price operation by smoothing the closing data of the price, so as to recognize the market's running direction more clearly and capture the key buying and selling moments.

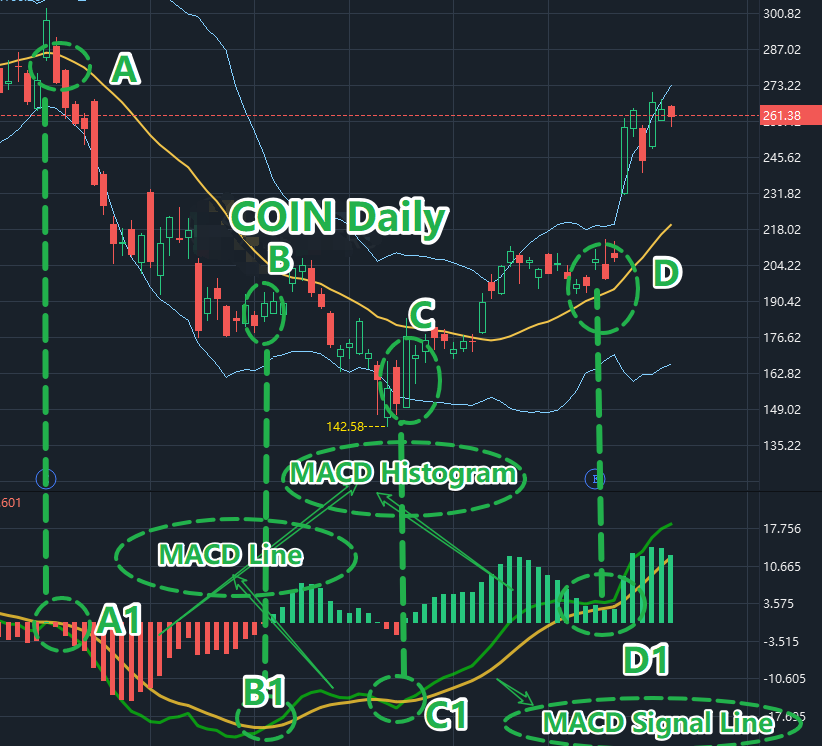

As shown in the chart: the MACD indicator consists of MACD line, MACD signal line, MACD histogram.

MACD line: often referred to as the fast line, reflecting short-term market trend changes in high sensitivity, can quickly respond to price fluctuations.

MACD signal line: usually called the slow line, used to confirm the reliability of trading signals, play a trend confirmation role.

MACD histogram: shows the gap between the MACD line and the signal line, visually reflecting the strength of the market momentum and the rhythm of conversion.

The value of the MACD is not only in determining “where the market is going”, but also in issuing “forward-looking warnings” at key points.

Now, let's focus further on the MACD indicator in real trading in the judgment of the buy and sell points.

In the chart A-A1, B-B1, C-C1, D-D1, we clearly see the key signals released by the MACD, how to help us determine the timing of entry and exit.

MACD bullish crossover: When the MACD line breaks through the MACD signal line from below, i.e., when the fast line crosses the slow line upwards,

As shown in the chart: B1 point, C1 point, D1 point, this signal is considered a buy signal.

MACD Bearish Crossover: When the MACD line breaks below the MACD signal line from above, as shown in the chart: point A1, this signal is considered a sell signal or a trend reversal alert.

Dear friends, through today's content, we not only understand the structure of MACD more clearly, more importantly, we have mastered how to transform it into an executable trading strategy judgment tool.

MACD is not only an indicator, but also a practical framework to help us establish a stable rhythm and operating system in a complex market.

Tomorrow, we will continue to explore the extended application of MACD in real-world trading, helping us to better integrate MACD into a complete trading strategy, improving the quality of judgment and expanding profitability.

Dear friends, today's sharing has come to a successful conclusion. I would like to thank you for your active participation and high quality interactions throughout the learning process, as your inputs are the driving force for the continuous progress and win-win situation of our Prosper Grove Asset Management community.

Tomorrow, I will continue to follow the real-time developments of the quality assets in the strategic layout of the “Dynamic Diversified Asset Allocation System” with you, especially the changes in the potential value of our Prosper Grove Asset Management's strategic asset: the PGAM tokens and market trends, and I look forward to the active participation of more strategically minded people. We look forward to the active participation of more friends with a strategic vision.See you tomorrow!