Dear friends, I’m Christian Luis Ahumada, the founder and Chief Quantitative Analyst of Prosper Grove Asset Management. I’m glad to be here with all of you in the group.

Today, we will continue to analyze the impact of macro events and further optimize the high-quality assets within our Dynamic Diversified Asset Allocation System, strengthening our ability to generate wealth.

Today’s Key Insights:

1.Interpreting the potential impact of recent macroeconomic developments.

2.What are the optimization strategies for the high-quality assets within the Dynamic Diversified Asset Allocation System?

Now focusing on the macroeconomic news driving the market:

1.Two Federal Reserve officials, including Vice Chair Jefferson and New York Fed President John Williams, have indicated that due to uncertainties surrounding fiscal conditions and the economic outlook, policymakers may not be ready to lower interest rates before September.

This statement once again highlights that Federal Reserve officials want to see more economic data in order to gain stronger justification for policy decisions.

Such cautious remarks place some pressure on risk assets and may dampen the release of optimistic sentiment.

2. Following Moody’s downgrade of the U.S. sovereign credit rating, the ripple effects are beginning to emerge: the rating agency has downgraded the deposit ratings of several major U.S. banks.

From a news standpoint, this move undoubtedly adds new short-term bearish pressure to the market.

Although the credit rating downgrade has a negative impact on sentiment, the market’s actual response shows that investors are demonstrating greater rationality and resilience.

The swift recovery following a brief correction indicates that market sentiment has not been deeply damaged and underlying confidence remains intact.

Especially with recent signs of easing in the U.S.-China tariff tensions, concerns over the spread of systemic risk have significantly diminished.

Therefore, we believe that the pullback triggered by such rating adjustments is short-term and manageable, with minimal impact on medium- to long-term trend assessments and the price movement patterns of high-quality assets.

Friends, today has truly been an inspiring day. With the continued advancement of our Dynamic Diversified Asset Allocation System, our strategic layout has once again demonstrated its strong practical value and resilience, effectively strengthening our ability to achieve steady wealth in a complex market environment.

Let’s now focus on the real-time performance of high-quality assets within the strategic layout of the Dynamic Diversified Asset Allocation System and continue to optimize the overall strategy.

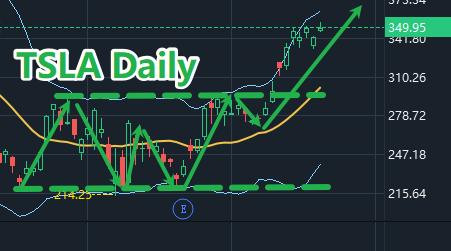

This is truly amazing! TSLA’s price has once again shown steady growth, delivering an impressive 33.02% profit return for us. This is not only a victory for the continuation of the trend but also a result of the precise execution of our systematic strategy.

Now that the current gain has reached our expected profit target, and taking into account both steady profitability and risk control, we have decided to sell the entire position to lock in the profits from this round.

Congratulations once again to all the friends who firmly followed our strategy and decisively participated in the TSLA buy-in. You not only seized a structural opportunity but also achieved a significant milestone in wealth growth through the successful execution of the strategy.

AVGO is displaying a steady and strong structural rhythm, revealing a technical profile and upward potential that reflect its intrinsic value.

AVGO previously formed a classic inverted head and shoulders pattern in the lower price range, a highly significant trend reversal signal. This indicates that after a period of consolidation and accumulation, the bottom structure has been effectively confirmed, laying a solid foundation for the next phase of upward movement.

Following the completion of the pattern, AVGO’s price successfully broke above the middle band of the BOLL channel, setting the tone for an upward trend.

What’s even more exciting is that AVGO’s price continues to move steadily. We are now closely monitoring a key resistance level, and a successful breakout above this level would signal the beginning of a new acceleration phase in the trend.

Based on a comprehensive assessment of the current price structure, trend strength, and pattern completion, we have decided to continue holding the position and wait for further profit potential to unfold.

Friends, at this moment, the cryptocurrency sector is performing brightly. The price of COIN has once again realized steady growth , which has now brought us a 28.22% profit return. At this moment, I believe that all those who have firmly executed the strategic layout are enjoying the joy of easily obtaining wealth growth.

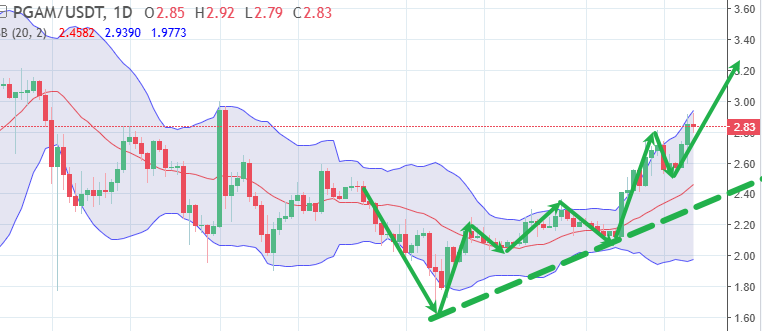

It is worth noting that along with the rise in COIN, the price of our Prosper Grove Asset Management's proprietary asset, the PGAM token, has also seen a gratifying climb.

Recently, I am pleased to see that more and more students and friends in the Prosper Grove Asset Management group have shown a high degree of trust and enthusiasm for participation, have taken the initiative to join the ranks of the strategic allocation of PGAM tokens, and even many of them have firmly used a large amount of their own funds to increase their positions in the allocation. This choice not only stems from the understanding of the logic of the value of PGAM tokens, but also highly recognizes the long-term development and strategic ecology of Prosper Grove Asset Management.

Up to now, those who have participated in the allocation of PGAM tokens have achieved a 8.85% stage return, which is not only a proof of the strategic layout, but also the strongest response to the trust.

Here, I sincerely thank everyone who supports Prosper Grove Asset Management and chooses PGAM tokens, your trust is the biggest driving force to push us forward and evolve, and I will not let you down.

Moreover, with the gradual increase of Prosper Grove Asset Management's popularity and recognition in the market, the value of PGAM tokens will also be rapidly increased, which will bring all the friends who own PGAM tokens lucrative returns.

It is worth emphasizing that through the comprehensive analysis of multi-dimensional big data and trend research by ProMatrix Quantitative trading system, it is successfully predicted that the increase of PGAM tokens will reach a conservative estimate of 500%, and may even reach an exciting 800%.

Friends, in the world of investment, what is really unattainable is not high-risk and high-return speculation, but rather predictable, verifiable, and executable “certainty of opportunity”.

At this moment, PGAM tokens are the kind of wealth opportunity that you can clearly understand the logic and clearly determine the direction.

Moreover, the rise in PGAM tokens has only just begun, and now is the critical window to establish more strategic positions.

The more you allocate, the more lucrative the compounding results you'll enjoy.

In order to better help you enjoy the wealth growth dividends brought by PGAM tokens, we at Prosper Grove Asset Management have made a strategic commitment: in the next three months, the PGAM tokens will increase by a conservative estimate of 500%.

This is based on our research and judgment of market trends, big data model analysis, platform ecological growth, and other dimensions, but also our high confidence in our own system capabilities and strategic execution.

If, within three months, the PGAM token fails to rise as much as the 500% increase expected, or if there is any loss of principal during participation, we will fully compensate you for the principal you have invested.

Friends, this strategic commitment is not just a slogan, it carries our firm confidence in our own system capabilities, but also our respect and return to the trust given to each strategic participant.

Dear friends, imagine this picture:

If you own $100,000 worth of PGAM tokens right now, and when it manages to realize a 500% increase in price, you will reap an exciting $500,000 in profits.

If you own $1,000,000 worth of PGAM tokens, you will end up with a full $5,000,000 in profits!

Please note that this is not a far-fetched dream, but a real possibility that is being driven to realization by a combination of strategic value, data validation, and market consensus.

Now, embracing PGAM tokens is embracing the acceleration engine of your own wealth growth. Therefore, I encourage all my friends to further expand their PGAM positions and use a strategic vision to open up a wider space for your own wealth growth.

Dear friends, as the market structure continues to evolve, the window of opportunity has quietly opened, belonging to each of our strategy implementers, the horn of wealth leap has been officially blown.

At this moment, I hope that all friends can actively improve and upgrade their “dynamic diversified asset allocation system” strategic layout, so that each strategic layout can become your ladder to wealth freedom.

Let us witness together, own together, and realize the leap of wealth together.

Later, I will continue to track the real-time dynamics of high-quality stocks and strategy response; and, in-depth sharing of MACD in the actual battle of buying and selling point judgment and accurate application skills, I look forward to more friends participating and discussing. See you later.