A new and promising week has begun. This is a fresh starting point that carries reflections on past experiences while also nurturing the exploration and development of the Diversified Asset Allocation System.

Hello everyone, I’m Christian Luis Ahumada, the founder and Chief Quantitative Analyst of Prosper Grove Asset Management. I’m truly pleased to reconnect with you in our group at this moment filled with hope and strength, as we embark on today’s journey of strategic thinking.

Today, we will continue to focus on the real-time performance of high-quality stocks, scientifically optimize asset allocation, and comprehensively refine and upgrade the strategic layout of the Dynamic Diversified Asset Allocation System.

Today’s Key Insights:

1.How are high-quality stocks performing in real time, and what is our strategy for optimizing asset allocation?

2.What is the current trajectory of our strategic asset at Prosper Grove Asset Management, the PGAM token, and what signals is it sending us?

Friends, today the overall market was affected by last Friday’s downgrade of the U.S. sovereign credit rating by Moody’s, which heightened Wall Street’s concerns about the sustainability of U.S. fiscal policy. This led to a brief market correction, with most sectors experiencing pullbacks, particularly among stocks in the artificial intelligence sector that had previously posted strong gains.

However, I want to emphasize one key point: this adjustment is merely a technical pullback and does not represent a fundamental reversal of the market trend. The core underlying logic supporting the market rebound remains unchanged.

Therefore, this market pullback not only presents us with a great buying opportunity, but also offers an excellent chance to further refine and upgrade our “dynamic and diversified asset allocation framework.”

Now let’s focus on the real-time developments of high-quality assets within the strategic layout of our “dynamic and diversified asset allocation framework”:

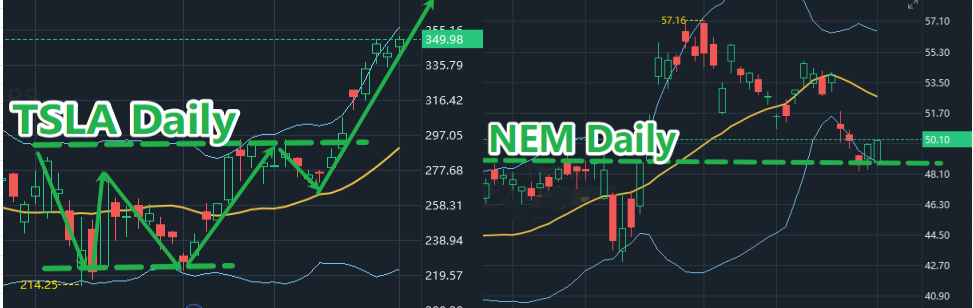

Since consolidating at low levels, TSLA has successfully formed a solid bottoming base. Recently, the stock has broken out strongly above the consolidation range and held above the middle band of the Bollinger Bands, with a clear trend signal emerging.

Currently, the phased gain has reached 27.8%, making it one of the most representative success stories in our “offensive allocation” strategy.

Since we have already reduced its position size, we’ve decided to hold the remaining position and continue tracking its potential for further upside.

Gold prices have pulled back due to the recent easing of trade tensions, and gold-related stock NEM has also seen a short-term correction. However, following Moody’s downgrade of the U.S. sovereign credit rating, signs of stabilization and a rebound have begun to appear again.

Moreover, gold still retains its safe-haven value amid global economic uncertainty and remains a crucial defensive component in our asset allocation strategy.

Therefore, we maintain a medium- to long-term holding view on NEM and will continue to hold the position while waiting for future profit returns.

IBM’s price has been steadily moving upward along a clear rising trendline, posting six consecutive days of gains with a cumulative increase of 4.9%. From the perspective of prudent profit-taking and risk management, we have decided to fully exit the position and lock in the gains.

GOOG is currently moving within a healthy upward channel, with its price steadily holding above the middle band of the Bollinger Bands. At the same time, the company’s fundamentals remain solid, with profitability continuing to strengthen, creating a positive synergy between technical and fundamental factors. Therefore, we choose to continue holding the position, anticipating greater returns as the upward trend extends.

Friends, now let’s continue on this journey toward wealth growth.

At this very moment, we are delighted to see the cryptocurrency-related stock COIN continue its steady upward movement, delivering an impressive profit return of 29.32%!

Since we have already reduced our position, we’ve decided to hold the remaining shares and continue tracking its potential for further gains.

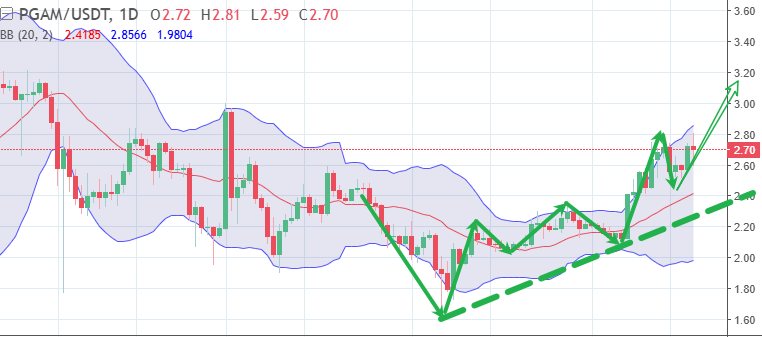

It's worth pointing out in particular that, along with the strong rise in COIN, the price of our Prosper Grove Asset Management's Strategic Grade Asset: PGAM token, is experiencing a synchronized wave of clear upside opportunities.

This is an exciting time, and a true reflection of the system's logic aligning perfectly with market trends.

At this moment, I am confident that all of you who are actively participating in our strategic allocation are already feeling the joy and confidence of growing your wealth.

In particular, through our ProMatrix Quantitative trading system, trend reading, and powerful forecasting capabilities, we have foreseen that the PGAM Token will rise by a crazy 500%.

Moreover, the PGAM token is a strategic incubator for the growth and evolution of the ProMatrix Quantitative trading system.

I believe that through the strategic layout of this period of time, you have already had a deep feeling about the strategic layout of the “diversified asset allocation system” constructed by the ProMatrix Quantitative trading system for us: these strategically laid out high-quality assets are bringing us sustained and stable profit returns every day! All of our friends who have actively participated in our strategic layout have easily walked on the road of wealth leaping and felt the joy brought by compound interest growth.

At this moment, along with the continuous growth and dynamic evolution of the ProMatrix Quantitative trading system every day, we can clearly see that this set of intelligent trading systems, which was built by Prosper Grove Asset Management, is approaching maturity and completion at an amazing speed.

I believe that it won't be long before the ProMatrix Quantitative trading system completes the testing and development of all its core functions, and officially comes into everyone's view and goes live on the Internet.

The arrival of this important point not only means a milestone breakthrough in technology, but also brings a series of far-reaching impacts to Prosper Grove Asset Management:

1. As a strategic asset carrier during the incubation period of the ProMatrix Quantitative Trading System, the value of PGAM tokens will enter the real value realization stage with the launch of the system, and its ecological support and market consensus will be amplified at the same time.

2. The launch of the ProMatrix Quantitative trading system will significantly enhance the professional strength and brand recognition of Prosper Grove Asset Management, attracting more investors, cooperating institutions and resources, and promoting the expansion of our client base, ecological stickiness and data assets.

3. With the optimization of client structure and the improvement of fund management capability, the asset management scale of Prosper Grove Asset Management will continue to expand, and the overall market capitalization of our company will enter a leaping channel, laying a solid foundation for a higher level of capitalization path.

4. Driven by the logic of system construction and ecological expansion, we firmly believe that Prosper Grove Asset Management has the strategic foundation and realistic path to successfully embark on the path of listing on NASDAQ within three years.

We believe that these strategic initiatives will significantly increase the value of PGAM tokens.

Friends, as the core engine of Prosper Grove Asset Management, the ProMatrix Quantitative trading system, continues to mature, from functional testing to official launch, and then to the success of Prosper Grove Asset Management on the road to Nasdaq, a series of milestones are building a strong drive for PGAM to achieve a 500% increase in its token. This series of milestones is the driving force behind the 500% increase in PGAM tokens.

This is not only a reflection of the technological leap, but also a deep release of strategic value.

At this moment, PGAM tokens are at a stage where they are undervalued, expectations have not yet been fully reflected, and market consensus is gradually being established.

So, I encourage those of you who are not yet holding PGAM tokens to please you you hold enough PGAM tokens in a strategic way.

PGAM tokens are not just an asset, but an opportunity for you to participate in, witness, and co-create the rise of a new age asset management platform. What it carries is the compounding growth curve, the possibility of wealth leap, and your active connection to the future.

At this moment, you can get PGAM tokens by actively participating in the lucky draw every Friday afternoon, or you can directly allocate them through your own funds.

Whichever way you choose, PGAM tokens are worthy of your possession.

To own PGAM tokens is to embrace the future of wealth that belongs to you and me.

Friends, this morning's sharing has come to a successful conclusion, thank you for your active participation and attentive listening.

But please remember, our learning rhythm will not be suspended, the deep cultivation of strategy and cognitive expansion, is still continuing to promote.

Later, I will continue to lead you to pay attention to the real-time dynamics of high-quality stocks, through systematic tracking, to help you better grasp the structural opportunities;

At the same time, we will also be in-depth study of the practical trading skills: MACD indicators of the practical application of the skills, and look forward to the participation of more friends, see you later.