Dear friends, I’m Christian Luis Ahumada, the founder and Chief Quantitative Analyst of Prosper Grove Asset Management. I’m truly delighted to reconnect with all of you in the group at this moment filled with reflection and growth.

The end of each week is a time for strategic reflection and cognitive consolidation; and each review is a crucial step toward enhancing our ability to operate at a higher level of asset allocation.

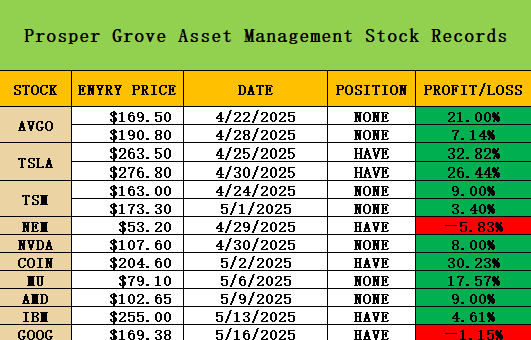

Today, we will collectively review and acknowledge the key achievements made over the past week within the strategic framework of the dynamic and diversified asset allocation system. At the same time, we will develop a clear and pragmatic outlook on the strategic direction for the next phase of market rhythm and trend evolution.

Now, let's start this week's market summary and strategic layout of the journey.

Over the past week, the global market, under the influence of multiple macro and geopolitical factors, has shown a high level of oscillation. In the midst of structural differentiation and emotional game, the market released a series of important signals, which are worth our in-depth study and adjustment of the direction of asset allocation accordingly.

1. At the end of last week, the high-level economic and trade talks with China made a substantial breakthrough, and the two sides substantially reduced tariffs, which greatly alleviated the market's concern about global trade risks and boosted market confidence in global risk assets.

2. President Trump proposed a plan to withdraw the Biden-era export restrictions on AI chips, a policy shift that is seen as a major boon to the technology sector, driving a strong rebound in related tech dragons and further activating the market's investment enthusiasm for the AI track.

3. Recently released inflation data overall performance was moderate and did not exceed market expectations, providing investors with support for the possibility of keeping monetary policy loose in the future and enhancing optimistic market expectations.

4. Trump family-backed cryptocurrency company plans to go public, injecting policy-friendly signals into the crypto market.

5. An AI chip deal with a Middle Eastern partner and the chip giant's efforts to help build an AI factory in Saudi Arabia continue to drive optimism in the investment market

6. Fed Chairman Powell and a number of officials in this week's speech said: the current economy is still resilient, there is no urgency to adjust the level of the benchmark interest rate, need to observe more data to support the decision-making, to a certain extent, affecting the market optimism continues to release.

After a series of factors, the investment market showed a more positive trend, and at the same time, it also injected sufficient upward momentum into the high-quality assets of our “Dynamic Diversified Asset Allocation System” strategic layout, which further strengthened our ability to acquire wealth.

I believe that everyone who has been following our Prosper Grove Asset Management group and has been firmly implementing our strategic layout of“Dynamic Diversified Asset Allocation System” strategic layout, has already felt that not only has our wealth been growing steadily in the midst of market volatility, but more importantly, our cognitive and systematic thinking has also been improving. More importantly, our cognitive and systematic thinking is also improving.

Behind all this is our ever-evolving intelligent engine: the ProMatrix Quantitative trading system.

In this week's learning journey, we focus on the four core modules of the ProMatrix Quantitative Trading System: Trading Signal Decision System, Advanced Quantitative Trading System, Investment Decision System, and Expert Investment Decision System, which further deepen your understanding of the ProMatrix Quantitative Trading System. The learning and application of ProMatrix Quantitative trading system has been further deepened.

And along with the continuous growth and evolution of the ProMatrix Quantitative trading system, it is now gradually becoming our investment companion on the road of investment.

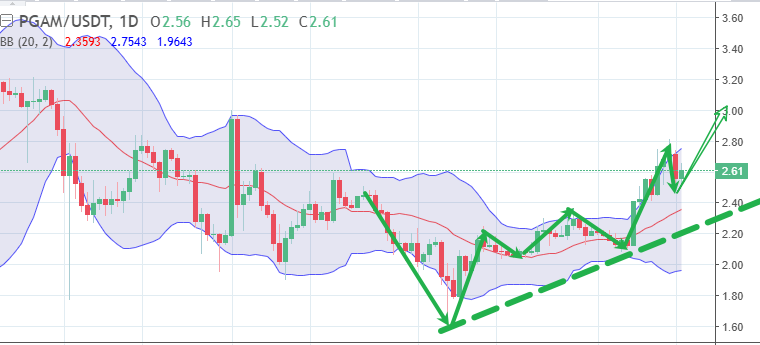

Now, the ProMatrix Quantitative trading system has once again sent us a very strong and clear signal that our Prosper Grove Asset Management asset, the PGAM token, is about to enter an explosive market cycle with a potential 500% increase.

This is not only the result of the data model, but also a coherent strategic signal from the system that aggregates multiple market variables, value logic, and trend momentum.

Recently, we have been closely monitoring the cryptocurrency sector, which has been signaling strong upward momentum: the price of the cryptocurrency concept COIN has managed to move upward, and mainstream crypto assets such as BTC and ETH have been steadily climbing, and, highly correlated with this, our Prosper Grove Asset Management Proprietary Asset:PGAM token is in the initial stages of a trend initiation. The price is running steadily, and confidence continues to build.

And PGAM tokens have the three core driving forces to realize a 500% increase:

1. The start of the cryptocurrency bull market has constructed a favorable buying environment for PGAM tokens.

2. The ProMatrix Quantitative trading system continues to grow and evolve, with the expectation of a successful launch, increasing the value of PGAM tokens.

3. Along with the successful launch of the ProMatrix Quantitative trading system, it will also further enhance the market visibility and influence of Prosper Grove Asset Management, and our asset size will be further expanded, the market capitalization will be effectively increased, and after meeting the requirements, we will open the road to listing on NASDAQ, which will substantially increase the value of PGAM tokens.

Friends, at this moment, the rising horn of PGAM tokens has been officially blown, which is not only the value of a digital asset, but also an indispensable strategic asset in our “dynamic diversified asset allocation system”.

In the context of the accelerated evolution of the current digital financial landscape, the PGAM token has become a bridge between us and the future. It is not just about growth, it is a strategic opportunity to participate in the core of our asset management at Prosper Grove Asset Management.

By owning PGAM tokens, not only can you reap the profits of rising prices, but more importantly, everyone who is currently allocating PGAM tokens is no longer a bystander, but a co-builder and co-winner.

Now, you have become a member of our Prosper Grove Asset Management asset management system, and in the process of our move towards listing on NASDAQ, you will be eligible to participate in the allocation of equity incentive plan, truly realizing the role from a digital asset participant, leaping up to the role of the platform shareholders value co-creator.

At this moment, more and more friends with strategic vision have been actively participating in the strategic allocation of PGAM tokens, actively embracing PGAM tokens, and embracing the future of our wealth.

If you have not yet included PGAM tokens in your “dynamic diversified asset allocation system” asset allocation map, I sincerely encourage you to take action now, plant the seeds of trust at the beginning of the value, and reap the cognitive dividends in the future high point.

To own PGAM tokens is to participate in our asset management at Prosper Grove Asset Management;

To embrace PGAM tokens is to embrace the future of wealth that belongs to you and me.

Dear friends, today's sharing and summarizing has come to a successful end, but our pursuit of wealth dreams will never stop, the desire for knowledge and the exploration of strategic foresight will still run through our every footstep.

The busy week is coming to an end, and a wonderful weekend is just around the corner.

It's time to slow down and take enough time to share cozy moments with your family and the joy of growth and harvest with your friends, so that your body and mind can relax and your soul can be nourished.

While we take time to rest, we must also maintain strategic insight and be fully prepared for the week ahead.

Therefore, this weekend, I will continue to take time to spend this valuable weekend with you, I will focus on sharing the latest market trends, interpretation of the upcoming release of important economic data, and for the next week's “Dynamic Diversified Asset Allocation System” strategic layout to make good preparations for the future, and look forward to the active participation of more friends.

Have a good weekend, everyone!