Dear friends, I’m Christian Luis Ahumada, the founder and Chief Quantitative Analyst of Prosper Grove Asset Management. I’m truly pleased to reconnect with all of you at this energetic moment in our learning and growth group. Today, we will focus on the real-time dynamics of high-quality stocks, further refine and upgrade our dynamic and diversified asset allocation system, and at the same time, strengthen our practical trading skills and enhance individual execution capabilities.

Today’s Key Insights:

1.What is the real-time performance of high-quality stocks, and what is our strategy?

2. Our exclusive token PGAM has reached the ideal buying opportunity. How should we proceed?

3.Practical trading techniques: identifying flag patterns and applying strategic approaches.

Friends, today we turn our attention to one of the most closely watched voices in the global market: Federal Reserve Chairman Jerome Powell's latest speech. In his remarks, he clearly stated that policymakers are considering adjustments to the monetary policy framework in order to more effectively address post-pandemic inflation developments and interest rate outlooks. This statement sends an important signal: the Fed’s policy mindset is shifting from short-term stimulus to structural adjustment.

At the same time, other Federal Reserve officials also expressed a wait-and-see attitude toward the impact of the new round of tariff policies led by the Trump administration. They generally stated that they would maintain “strategic patience” and wait for more data and market reactions, thereby further tempering the market’s previous overly aggressive expectations for a rapid rate cut.

Against this macro backdrop, we observe that after several consecutive weeks of strong rebound, market enthusiasm has begun to cool at the margin. Some short-term profit-taking capital has exited, and rising risk aversion has led the stock market into a phase of short-term volatility and correction. Overall market risk appetite is gradually being recalibrated and rebalanced.

However, while most people hesitate and remain on the sidelines, the power of a systematic approach is revealing its unique and rare value.

During this market correction phase, we can clearly see that the core high-quality assets within the strategic layout of our dynamic and diversified asset allocation system, built through the ProMatrix Quantitative Trading System, are still generating steady and consistent wealth returns for us.

Now let's focus on the real-time development of high-quality assets in the strategic layout of the “Dynamic Diversified Asset Allocation System”.

What a wonderful moment.

In our “Dynamic Diversified Asset Allocation System” strategy, the ProMatrix Quantitative trading system continues to provide us with a strong selection of high-quality assets that are building a clear and solid path to wealth growth.

IBM has now realized a 4.58% milestone gain, outperforming the broader market.

TSLA has realized a cumulative gain of 30.10% to date. Despite the recent brief technical pullback in the stock price, from a trend perspective, the core long structure has not been undermined, and we remain confident in its medium-term performance.

Of particular concern: cryptocurrency concept stock COIN saw a short pullback today. Perhaps, some of my friends will have a slight fluctuation in their hearts, but I want to say: real investors, look not at the “price of the surface fluctuations”, but “the deep logic of the trend”.

As Mr. Buffett said, “We have to learn to be greedy when others are fearful.”

We need to use reason to block out the noise and see good buying opportunities in pullbacks, rather than getting caught up in short-term mood swings.

Therefore, COIN's current price correction is instead a good opportunity for us to refocus and build a position in tranches.

Not only that, but the market was impacted by sentiment today as the prices of the mainstream tokens in the cryptocurrency space, BTC and ETH, briefly retreated, but this retracement is not a shift in the trend; rather, they are in the midst of brewing the next round of upward momentum. For a medium- to long-term allocation perspective, this is the perfect phase to suck in at lower levels.

Meanwhile, our Prosper Grove Asset Management token, PGAM, which is linked to BTC and ETH, has also seen a pullback in price, but the price has stabilized at the BOLL mid-rail, and the overall trend is in good shape.

We have always emphasized that “the market is led by sentiment in the short term and driven by logic in the long term.” Therefore, now that the price of PGAM tokens is pulling back, it is the perfect opportunity for us to allocate it.

Moreover,along with the continuous evolution and growth of the ProMatrix Quantitative trading system, and even its successful launch into the public eye, these will become a strong catalyst for the value of our PGAM tokens to jump.

At this moment, through the powerful trend analysis and forecasting function of our ProMatrix Quantitative Trading System, we have already foreseen that the value of PGAM tokens will increase up to 500%.

Friends, let's experience this exciting scenario together:

The current price of PGAM token is 2.61USDT, if it increases by 500% according to the forecast, it means that the price of PGAM token will increase by 500%. It means that the price of PGAM token will reach an exciting 13.05USDT.

What does this mean?

If you own $100,000 worth of PGAM tokens right now, and they go up 500%, you're looking at an exciting $500,000 in profits;

If you own $1,000,000 worth of PGAM tokens now, with a 500% increase, your future profits will reach a crazy $5,000,000.

What a wonderful number, what an exciting scenario!

Please think seriously, when the intrinsic value of PGAM tokens is gradually amplified by the system's application scenarios, the user base is expanding, and the market confidence is fully boosted, the price increase is no longer a matter of probability, but a matter of time and rhythm.

Moreover, in yesterday's share, we have deeply analyzed the three core drivers of PGAM token value growth:

1. Macro-cycle driven: the arrival of the cryptocurrency bull market

2. Driven by technology empowerment: The successful launch of ProMatrix Quantitative trading system is expected.

3. Capital Confidence Driver: Our Prosper Grove Asset Management's vision of going public on NASDAQ.

All of these will be strong catalysts for the continued growth in the value of the PGAM token, which is why it is up 500%.

This is no longer an unattainable dream, but a realistic path based on logic-driven, trend-supported growth.

Friends, owning PGAM tokens is not only asset allocation, but also embracing the future.

Therefore, I encourage all friends to allocate PGAM tokens to our “dynamic diversified asset allocation system” strategic layout, to accelerate the accumulation of wealth.

The current pullback in the PGAM token presents us with the best opportunity to own it.

At this moment, you can get PGAM tokens by participating in the lucky draw every Friday afternoon, or by purchasing PGAM tokens with your own funds. No matter which way you choose, you will be a witness to the brilliant growth of PGAM tokens.

Friends, in the process of we continue to broaden the boundaries of wealth, the refinement of trading skills is also indispensable. Real investors not only rely on the system empowered, but also to have the ability to independently identify market signals, accurately grasp the rhythm of trading.

Now, let's start today's learning journey with a proactive mindset.

Today's focus is on sharing practical trading skills: flag pattern judgment and strategy application.

Flag pattern is a very practical value of technical analysis of the classic trend structure, often appearing in a round of rapid rise after the adjustment phase, with a significant accumulation of power characteristics.

Its existence often signals that the current trend is not over, but in a healthy technical repair, for the next round of upward momentum.

The components of the flag pattern: the flagpole and the flag.

Flagpole: indicates a rapid one-sided upward movement.

Flag: After the flagpole, a short retracement of the trend.

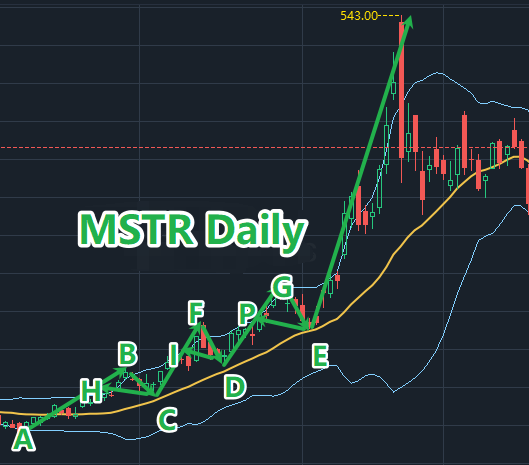

The daily chart of MSTR for the period September 2024 to November 2024 is shown.

Flagpole: A-B, C-F , D-G

Flag: B-C-H ;F-D-I ;G-P-E

Through the analysis, we can see that stock prices will have a period of price correction after experiencing a rally. This adjustment is not a trend reversal signal, but a brief sell-off caused by some investors taking profits. At this time, the unfaltering chips are washed out, while institutional investors may buy again at a lower cost position, which is a common strategy for institutional operations.

Therefore, when price retraces to key support points, such as points C, D, and E, and stabilizes at these locations, a strong trend continuation is usually in order. This creates an opportunity to re-enter the market, and subsequently, the market tends to show a very good unilateral trend that delivers substantial profits.

Therefore, in our investment process, it is essential to focus on whether a strong unidirectional trend, after a continued pullback, can establish effective support. Once a support level is confirmed, that becomes our signal to re-enter the market.

Now, I believe that all of you have a deeper understanding of the judgment and application of the Flag Finishing Pattern, and I believe that it can help us to better grasp the market opportunities, which will bring us more profit returns.

More importantly, the technical patterns and strategic thinking that I share with you every day have been embedded in our ProMatrix Quantitative trading system.

So, if you continue to study the content shared in our Prosper Grove Asset Management group every day, you will understand the core working principles of the ProMatrix Quantitative trading system, and I believe it won't take long for you to master its essence and use it well.

Dear friends, today's sharing has come to a successful conclusion, thank you for your attentive listening and active participation.

In the Prosper Grove Asset Management group, we not only want to gain professional knowledge, but also to gain considerable profit returns, especially the potential 500% upside of PGAM tokens, which is showing us a golden track to the peak of wealth.

We hope that every one of you can grasp the trend, seize the moment, and become a participant and witness of this historic opportunity.

Friends, tomorrow is Friday, and it’s also a perfect opportunity for everyone to acquire the PGAM token.

Whether you’re participating in our Prosper Grove Asset Management raffle or allocating your own funds directly into PGAM tokens, each decision represents an investment in future growth.

At the same time, tomorrow we will also have the opportunity to make synchronized purchases of high-quality stocks, and we hope more of you will take part.

See you tomorrow.