Dear friends, I’m Christian Luis Ahumada, the founder and Chief Quantitative Analyst of Prosper Grove Asset Management. I’m truly pleased to reconnect with all of you in this group filled with wisdom and shared resonance. This is not only a convergence of information, but also an elevation in understanding and the beginning of a new journey toward transformational wealth.

Today, we will not only interpret key economic data and the important signals conveyed by Federal Reserve Chairman Jerome Powell's remarks, but also continue to advance the strategic development of our dynamic and diversified asset allocation system to accelerate wealth elevation to new heights.

Today’s Key Insights:

1.What is our perspective on the impact of the initial jobless claims for the week ending May 10 and the April year-over-year PPI data on the investment market?

2.Within the strategic layout of the dynamic and diversified asset allocation system, what are the current developments of high-quality assets, and what is our optimization strategy?

3.What is the operating principle behind the ProMatrix Quantitative Trading System?

Friends, let us now interpret this important economic data with a positive mindset:

1.Weekly initial jobless claims refer to the number of individuals filing for unemployment benefits for the first time. It serves as an indicator of the labor market’s health and the overall state of economic development.

According to the data filtered and analyzed by the ProMatrix Quantitative Trading System:

For the week ending May 10, initial jobless claims came in at 229,000, in line with market expectations, indicating that the labor market remains stable and the impact on the broader market is limited.

2. PPI, or Producer Price Index, reflects the prices businesses pay for raw materials, goods, or services during the production process. It serves as a leading indicator for measuring inflation.

According to the data filtered by the ProMatrix Quantitative Trading System, the Producer Price Index (PPI) declined by 0.5% from March but increased by 2.4% compared to April 2024. Excluding the more volatile food and energy prices, the so-called core wholesale prices dropped by 0.4% from March and rose by 3.1% year over year.

The data indicates that inflationary pressures are easing at the margin, which helps create more room for monetary policy adjustments. This, in turn, strengthens market expectations that a rate cut window is approaching, thereby boosting overall risk appetite.

Dear friends, after several consecutive weeks of strong rebound, the current market sentiment is showing signs of cooling. Investor enthusiasm for risk assets has eased somewhat, and the stock market has entered a brief yet healthy phase of technical correction.

However, we must be clear on a core understanding: this type of short-term pullback does not mark the end of the trend, but rather represents a natural phase of the market releasing pressure and gathering momentum for the next move upward. It should not be a reason for emotional fluctuations. Truly seasoned investors know how to stay calm during volatility and actively optimize during corrections.

What should we do in the face of a market correction?

At this stage, our response should not be panic, but action. We recommend the following two strategic optimization approaches:

1.For high-quality individual stocks that have already achieved significant gains, we suggest reducing positions at an appropriate time to lock in short-term profits.

2.Continue building and optimizing the dynamic and diversified asset allocation system.

Friends, the market is never just a celebration of upward rallies; it also includes brief periods of correction and consolidation.

But as long as we understand the trend, stay in sync with the rhythm, and optimize our allocation, we can achieve steady asset growth and long-term value accumulation even during market adjustments.

In this broader environment, our focus should not be limited to observing trends, but should be on actively responding to them. Let us now turn our attention to the real-time performance of high-quality assets within the strategic framework of the dynamic and diversified asset allocation system, and further optimize our asset allocation.

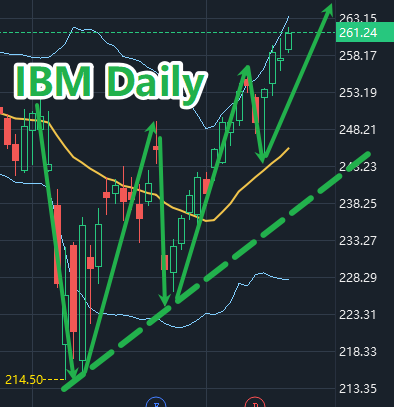

It’s truly fantastic that IBM’s price continues to rise steadily, and our wealth is growing steadily along with it.

Although the overall stock market experienced a brief technical correction today, with most stocks pulling back to varying degrees amid volatility and market sentiment showing some caution, the encouraging news is that IBM, one of the high-quality stocks selected by our ProMatrix Quantitative Trading System, has remained resilient and continues to move upward against the trend.

This is precisely the unique advantage and core strength of our ProMatrix Quantitative Trading System.

During market uptrends, it can identify and position early in structurally strong stocks, helping us outperform the broader market and seize early opportunities.

During market corrections, it also demonstrates exceptional risk identification and defensive capabilities, helping us maintain our positions and preserve gains.

Friends, let’s now focus on the real-time performance of TSLA.

At present, TSLA, one of the high-quality stocks selected by our ProMatrix Quantitative Trading System, has delivered a 28.42% short-term profit return. That’s truly an exciting number.

At this moment, although TSLA is experiencing a brief pullback in its price movement, it does not affect our outlook on its future profit potential.

We have always emphasized that trading is not about predicting the market, but about responding to trends and managing positions.

Therefore, based on the current market rhythm and our position risk control logic, our operational strategy is:

1.If your current position in TSLA is relatively large, you may consider moderately reducing your holdings to lock in some profits, improve liquidity, and reserve capital for future potential opportunities.

2.If your position is relatively light or part of a balanced allocation, you may choose to continue holding, maintain position stability, and wait for higher profit returns.

Once again, congratulations to those who have been consistently following our Prosper Grove Asset Management group and strictly implementing the strategic deployment of the dynamic and diversified asset allocation system. Your wealth is experiencing steady appreciation.

More notably, IBM and TSLA are not isolated cases. Recently, a number of high-quality stocks screened by our ProMatrix Quantitative trading system through multi-dimensional data mining, technical pattern analysis, and macro-logic have realized significant gains. All of this is a true reflection of the strategic value of our ProMatrix Quantitative trading system, as shown in the chart:

Dear friends, I believe that you have once again experienced the powerful charm and unlimited potential of our proprietary investment tool, the ProMatrix Quantitative trading system.

Now, let's go into the world of ProMatrix Quantitative trading system and explore the underlying structure and operation logic of this trading system.

The ProMatrix Quantitative Trading System is the brainchild of 32 innovative elites from the world's top financial institutions, technology companies and academia, who, after countless days and nights of repeated rehearsals, real-time testing and dynamic modifications, finally developed the ProMatrix Quantitative Trading System, which is capable of constant evolution and continuous upgrading. ProMatrix Quantitative Trading System

The ProMatrix Quantitative Trading System consists of four core components: Trading Signal Decision System, Advanced Quantitative Trading System, Investment Decision System, and Expert Investment Decision System.

1. Trading signal decision-making system: accurately identifies the pulse of the market

This is the “sensory nerve” of the entire system. Through massive data processing, machine learning algorithms, and real-time market monitoring mechanisms, it is able to quickly capture price fluctuations, structural changes and short-term opportunities, and output high-quality trading signals. The system will continue to iterate the signal optimization model to significantly improve the accuracy and timeliness, ensuring that investors enter the market at the optimal time to achieve efficient asset allocation.

2.Advanced quantitative trading system: the central engine of automated strategy execution

This module is the embodiment of the system's execution power. Relying on the deep calculation of historical data and real-time market, the advanced quantitative trading system realizes fully automated, low-latency, high-frequency strategy execution. In the future, it also has the ability to automatically optimize the logic of the strategy based on market feedback, truly “autonomous evolution”, so that every trade has a scientific basis and algorithmic support, maximizing operational efficiency and profitability.

1. Investment Strategy Decision-making System: Strategic Hub for Strategy Design and Dynamic Optimization

As the “brain” of the system, this module integrates modern financial theories, economic cycle models, and multi-factor strategy architecture to assess macro trends, industry trends, and market structure in real time. It automatically matches the optimal strategy portfolio and continuously iterates and upgrades it according to market conditions, ensuring that each asset allocation is forward-looking, adaptable and sustainable, allowing the portfolio to move forward steadily amidst fluctuations.

4.Expert Investment Decision System: Intelligent Forecasting Models with a Global Perspective

This is the “forward-looking eye” of the ProMatrix Quantitative trading system. It integrates a global data network and deep learning algorithms, dynamically integrates macroeconomic data, policy dynamics, industry trends, and market sentiment, and builds a highly intelligent market forecasting system. This module will provide investors with multi-dimensional, three-dimensional, and structured forward-looking recommendations, helping them to grasp the certainty of opportunity in a complex environment and stay ahead of the trend.

These four core boards are not run in isolation, but driven by each other, data interoperability, and logical consistency, to build a complete quantitative trading closed-loop system:

1. From trend identification to strategy generation, to execution, and finally to intelligent feedback.

2. Realize the trading rhythm, position control, risk management, asset rotation, and other core aspects of the comprehensive coverage

This whole set of structure ensures that the system has high adaptability, high efficiency and strong growth in the complex and changing market, and truly empowers investors to enter a new era of “systematic, intelligent and globalized” asset allocation.

At this point, I believe you have a better understanding of how our ProMatrix Quantitative trading system works.

More importantly, the ProMatrix Quantitative trading system is not a static operation, it is a continuous learning, continuous optimization, active growth of the intelligent life form.

Every market fluctuation is the nutrient for its growth; every real-world test is a step in its evolution. We firmly believe that in the near future, it will be formally released to the public and come into full view.

Of course, in the process of our ProMatrix Quantitative trading system formally coming into everyone's view, it is indispensable for everyone's trust, participation and joint promotion.

We sincerely look forward to more friends with dreams to join us at Prosper Grove Asset Management, and to continue to promote the construction of a “dynamic and diversified asset allocation system” to accelerate the accumulation and growth of personal wealth more systematically and intelligently. We will continue to promote the construction of “Dynamic Diversified Asset Allocation System” with us.

Your success is our strongest testimony and best case.

Your every real investment return, every rational strategy implementation, and every firm choice are the most touching story and the most convincing promotional power of Prosper Grove Asset Management.

Your participation not only accelerates the pace of personal asset accumulation, but also helps us to: expand market awareness and brand influence; expand the scale of asset management to realize the effect of scale; and continuously raise the valuation of the enterprise.

All of this is to lay a solid foundation for Prosper Grove Asset Management to successfully embark on the path of listing on NASDAQ within three years.

Dear friends, investment is never a person's battle, it is not only about the allocation of funds, but also a comprehensive training on the depth of cognition, endurance of endurance and implementation of the firm.

Only with the same idea, the same direction, we can support each other in the complex and volatile market fluctuations, steady forward, and ultimately realize the leap leap of wealth.

Friends, the morning's sharing has come to a successful conclusion. thank you for every friend's listening and participation.

Later, I will share with you the practical trading skills: the judgment and strategic application of the flag pattern. It is also an important part of our in-depth understanding of the application of the core working principles of the ProMatrix Quantitative trading system, and I look forward to the participation and discussion of more friends, see you later.