Dear friends, I’m Christian Luis Ahumada, Founder and Chief Quantitative Analyst of Prosper Grove Asset Management. I’m truly delighted to walk alongside you in this group as we witness the wealth gains brought by high-quality stocks and experience the growth in financial capability driven by practical trading techniques.

Key Updates for Today:

1.What is the current trajectory of the market, and what is our strategy?

2.The logic and practical application of swing trading strategies.

Today is another exciting day.

The April CPI was released, showing a year-over-year increase of 2.3%, significantly below market expectations and marking the lowest level in nearly four years. The continued decline in inflation has further fueled market expectations of a policy shift toward easing by the Federal Reserve. This has undoubtedly injected strong confidence into the entire capital market.

Meanwhile, high-level economic and trade talks with China have made substantial progress, with significant tariff reductions and a clear easing of trade tensions, removing a major source of uncertainty from global markets. On the international technology cooperation front, NVIDIA has been approved to further expand its AI chip technology to Saudi Arabia and will establish an artificial intelligence factory there. This directly fueled a strong rally in the semiconductor sector, with the Nasdaq index continuing to climb and overall market risk appetite significantly improving.

These favorable developments have not only created positive resonance on the macro level but also provided strong trend momentum and compound wealth-driving force for the strategic layout of our Dynamic Diversified Asset Allocation System, built on the ProMatrix Quantitative Trading System.

Let’s continue to closely monitor the real-time movements of high-quality stocks, not only capturing the rhythm with precision but also truly experiencing the joy of earning profits with ease through real-world trading.

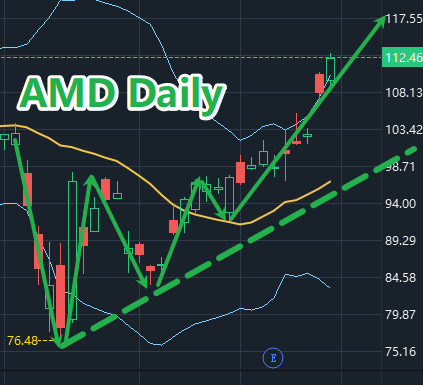

Today, AMD once again demonstrated a strong upward move, delivering an interim profit return of around 9%. This is the result of the synergy between trend recognition, systematic execution, and effective risk management.

At this critical moment, from the perspective of steady profitability and risk management, we have fully exited the position to lock in the gains from this round.

Congratulations once again to those who have consistently followed our Prosper Grove Asset Management group and firmly executed the trading strategy. You have not only secured gains in this round but also achieved a breakthrough in wealth awareness through systematic thinking.

Friends, true victory is never a gift of luck, but rather the crystallisation of strategy and execution. This wave of COIN's rise seems sudden, but it in fact has been ready in the prediction and rhythm layout of our ProMatrix Quantitative trading system.

Today, COIN has risen strongly on the back of the king's return, bringing us an interim profit return of more than 20%. I believe that, at this moment, everyone is still immersed in the joy of easily making money.

I think there should be applause here. This is not only a victory applause for the grasp of COIN's market, but also for those of us who maintained faith in turbulent times and decisively implemented the "dynamic diversified asset allocation system".

At this moment, I lit a cigar and the smoke slowly rose in the air, just like the trend of COIN today: calm, confident, firm and powerful.

While COIN is rising strongly, BTC and ETH in our "dynamic diversified asset allocation system" strategic layout are simultaneously releasing positive signals.

Today, BTC rose by 1.75%, and ETH achieved a strong increase of 7.47%, forming a benign structure of multi-asset synergy. This not only verifies our forward-looking judgment in the systematic layout, but also shows the resilience and tension of diversified configuration in different market cycles.

I would like to especially congratulate the friends who have joined our Prosper Grove Asset Management group:

1. Friends who firmly followed us to layout BTC and ETH in the early stage, your patience and faith are being transformed into stable wealth accumulation;

2. Partners who continue to implement our strategy and actively purchase BTC and ETH in the near future are in the right direction, step by step, and are moving towards the fast lane of compound interest amplification.

At this moment, if you have not yet configured BTC and ETH in your "dynamic diversified asset allocation system" strategic layout, you can continue to buy now, continue to optimize the asset structure, and achieve steady growth of wealth.

Friends, while we enjoy making money easily, we must always keep learning and improving our way of thinking.

The market is always developing in fluctuations, and opportunities arise in rhythm. Only through continuous learning every day will we improve our practical trading ability.

Every learning and communication is a leap in self-cognition and a practice leading to a higher level of trading.

We believe that real wealth is not only the growth of account numbers, but also the continuous advancement of cognitive structure and practical ability.

Now let us start today's learning journey with a positive attitude.

Today, I will focus on sharing investment and trading skills with you: the judgment logic and application skills of swing trading.

Swing trading is neither about holding on to investments for a long time nor about making high-frequency intraday entries and exits. It emphasizes buying low and selling high within a clear fluctuation cycle, in order to obtain the main profit range during trend operations.

The operation cycle is usually between a few days and a few weeks.

The core concept of swing trading: Enter the market in time at the beginning of the market, and exit in time before the trend weakens.

We rely on technical analysis combined with trend judgment, structural analysis, and identification of key positions to effectively determine the entry and exit points of the market and achieve stable returns.

In trend analysis, focus on: Whether it is in an upward trend and whether the key support line position is maintained, usually with the help of moving average and BOLL judgment.

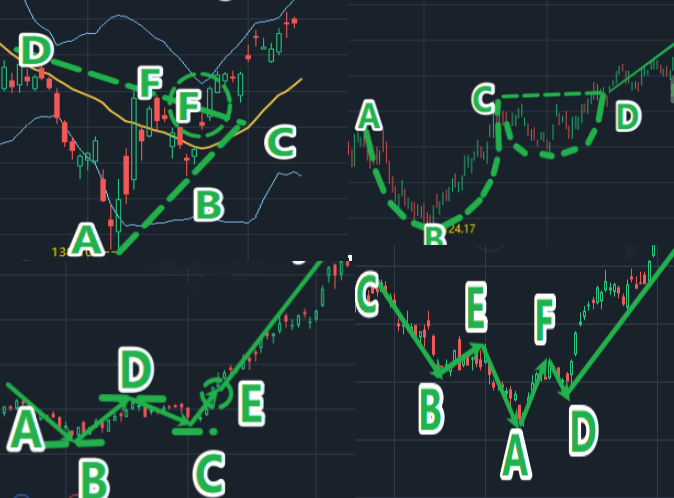

Commonly used technical graphics identification: Aggregate Triangle Pattern, cup handle pattern, double bottom pattern, inverted head and shoulders pattern, flag pattern, etc., as shown in the figure:

Friends, we have already shared and explained the classic technical patterns we explained earlier, such as the aggregate triangle, cup handle pattern, double bottom pattern, inverted head and shoulder pattern, etc., in the group. I believe that those of you who have been following us for a while have gradually developed the ability to recognise and work with these patterns in real situations.

If you are new to our Prosper Grove Asset Management group, welcome! To help you establish a systematic cognitive foundation more quickly, we recommend contacting our exclusive assistant as soon as possible to receive detailed learning materials and graphic analysis diagrams for this section. This will enable you to study systematically and lay a solid foundation for the underlying logic of technical analysis.

The process of swing trading:

1. Determine the trend, that is, whether it is an upward trend.

2. Analyze the pattern structure, find the support position and pressure position.

3. Set the entry point, stop loss point, and target position.

4. Buy in batches and track dynamically.

5. When the profit reaches the target, sell in batches or trigger the stop loss point, and exit decisively.

As shown in the figure: TSLA's trend trajectory, we can clearly see that a "double bottom pattern" was formed at a low level, and the price successfully broke through the BOLL middle track line, and the trend changed from a shock trend to a bullish trend.

Therefore, friends who continue to pay attention to our Prosper Grove Asset Management group have started to participate in TSLA transactions on April 25. The trend is running well and has now brought us a profit return of about 26%.

Through today's study, I believe that everyone has gradually mastered the key technical pattern recognition methods and understood the core concept and practical logic of swing trading.

Once you truly understand and flexibly apply the idea of swing trading, you will have the essential foundation to accelerate wealth accumulation.

Dear friends, today’s session has successfully come to a close. Thank you all for your full participation and attentive listening.

Tomorrow, we will continue tracking the real-time performance of high-quality assets, deeply analyze market structure changes, dynamically adjust our position rhythm, and steadily advance the strategic development of our Dynamic Diversified Asset Allocation System. See you tomorrow!