Dear friends, I’m Christian Luis Ahumada, Founder and Quantitative Trading Analyst at Prosper Grove Asset Management. I’m pleased to be here with all of you in this group, where we are not only seekers of wealth opportunities but also companions in long-term value and fellow travelers on the path of knowledge and growth.

Each time we come together is a perfect opportunity for us to dive deep into economic data, identify the main trends in the market, develop asset allocation strategies, and continuously advance the construction of our Dynamic Diversified Asset Allocation System.

Key Updates for Today:

1.How has the release of the unadjusted year-over-year CPI data for April impacted the investment market, and what is our perspective?

2.How have the high-quality stocks within our Dynamic Diversified Asset Allocation System performed, and what important signals are they sending?

Policy guides the directional trend of the market, while economic data serves as a barometer of investor sentiment.

Economic data not only helps us assess the health of the labor market but also provides insight into the state of economic growth.

In a complex and ever-changing market environment, only by deeply analyzing policies and economic data can we truly grasp the core logic driving the trend.

CPI, or Consumer Price Index, reflects the price changes of goods and services purchased by typical households and is a key indicator for measuring inflation levels.

The unadjusted year-over-year CPI for April refers to the percentage increase in CPI in April of this year compared to April of last year, without excluding seasonal factors.

According to data screened by the ProMatrix Quantitative Trading System:

The unadjusted year-over-year CPI for April came in at 2.3%, the lowest since February 2021, compared to market expectations of 2.4%. The seasonally adjusted month-over-month CPI for April was 0.2%, higher than last month’s -0.1%, but below the expected 0.3%.

The unadjusted year-over-year core CPI for April stood at 2.8%, matching market expectations and remaining at its lowest level since March 2021. The seasonally adjusted month-over-month core CPI for April was 0.2%, below the forecasted 0.3%.

From the above data, we can see that the decline in CPI indicates easing inflation, which will have a positive impact on the investment market. The market is expected to continue showing a rebound today.

Dear friends, in the context of an improving overall market environment, our core strategy remains focused on continuously identifying high-quality assets with long-term value and further refining and upgrading the strategic framework of our Dynamic Diversified Asset Allocation System.

Now, let’s turn our attention to the real-time performance of high-quality stocks and enjoy the continued growth of our wealth.

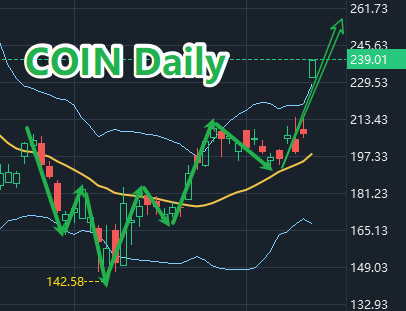

Excellent! COIN’s price has once again seen a significant surge, delivering an interim profit return of around 10%. This outcome is not only a triumph of strategy execution but also a true reflection of everyone’s conviction and execution.

I believe that right now, your hearts are filled with the same joy and sense of accomplishment as mine.

Pour yourself a smooth glass of fine whiskey and take a moment to truly savor the fruits of victory. This drink is not just to celebrate the growth in our account balances, but more importantly, to honor our unwavering belief in staying systematic, executing with discipline, and continually striving to improve ourselves.

As we celebrate this victory, we must also remain mindful of the underlying logic behind it. Through market data mining by the ProMatrix Quantitative Trading System, we’ve uncovered a key piece of market intelligence: COIN will officially replace Discover Financial Services (NYSE: DFS) in the S&P 500 Index prior to the market open on Monday, May 19.

This is a significant signal of recognition for COIN’s fundamentals and market capitalization. It also means that a large amount of passive index capital will begin to allocate into COIN, providing substantial sentiment and liquidity support for its stock price.

When presented with the opportunity to realize profits, we remain firmly committed to the principle of "risk control first." At this key point following the price surge, we have chosen to partially reduce our position by half to lock in some profits, while holding the remaining shares in anticipation of greater returns or a chance to re-enter after a pullback.

Special congratulations to those who firmly followed our strategic plan and joined us in buying COIN on May 2. Your wealth continues to grow steadily.

Participating in the COIN trade has truly been a remarkable journey filled with insight and rewards.

Friends, with COIN already on the rise, can the price surge of major cryptocurrencies like BTC and ETH be far behind?

Since April 8, through comprehensive big data analysis using the ProMatrix Quantitative Trading System, we have accurately identified the quietly strengthening trend resilience of BTC and ETH.

It was at that moment that we guided our forward-thinking friends to decisively invest in BTC and ETH, integrating them into the strategic framework of our Dynamic Diversified Asset Allocation System. Now, these friends are already enjoying substantial returns—and the future holds even greater promise.

Moreover, through our ProMatrix Quantitative Trading System and comprehensive big data analysis, we’ve identified another key piece of information: the Bitcoin mining company backed by President Trump’s sons, Eric Trump and Donald Trump Jr., is set to go public on the Nasdaq through an all-stock merger with Gryphon Digital Mining.

This event is far from an ordinary capital maneuver. It represents mainstream political and financial forces rapidly aligning themselves with the Bitcoin and blockchain industry, undoubtedly bringing a powerful and positive impact to the entire crypto asset market.

In response to a series of positive signals, our ProMatrix Quantitative Trading System, through comprehensive structural big data analysis, predicts:

BTC is projected to reach $180,000, and ETH is expected to hit $5,000.

This is not just about numbers moving; it is the realization of trends, the progression of logic, and most importantly, a reflection of our strong confidence in the powerful forecasting and analytical capabilities of the ProMatrix Quantitative Trading System.

At this moment, for the new members who have just joined our Prosper Grove Asset Management group, this is a golden window of opportunity to take action. We recommend continuing to purchase BTC and ETH and incorporating them into our Dynamic Diversified Asset Allocation System as part of the strategic framework, while waiting for greater profit potential to be realized.

Friends, in a complex and ever-changing market, we are not speculators chasing price swings but committed navigators of trends and discoverers of value. We look forward to everyone continuing to refine and upgrade the Dynamic Diversified Asset Allocation System and accelerating the path toward financial freedom.

Let’s now continue to monitor the real-time performance of other high-quality stocks.

This is fantastic! AMD’s price has once again demonstrated strong momentum, rising steadily and bringing us a profit increase of approximately 7.51%.

After a long period of low-level fluctuations and sideways consolidation, TSLA finally completed a key interval breakthrough and brought us a staged victory of about 18%. This is not only a turning point in the market, but also a testimony of strategic patience.

While many people were hesitant and wavering in the noise, we had firm beliefs and waited for the opportunity. The moment the price pierces the upper border of the fluctuation, the victory signal is sounded. This rise in price is not only the realization of profits, but also the victory of system trading logic and commitment, and execution.

The story of TSLA is far from over. As a representative of the new energy and artificial intelligence revolution, it carries not only the rise in stock prices, but also the trend of future global industrial changes. What we see is not only technical graphics but also deep industrial logic and the long-term value behind them.

Imagine if we were together; the hall would have been filled with thunderous applause. Because we know that this 18% gain is the result of countless days and nights of observation, waiting, and execution, all of which have been invested in to ensure success.

At this moment, TSLA's current price trend is still running well, the technical structure is healthy, and the profit potential and growth expectations are still strong. Driven by these dual factors, we have chosen to continue holding and wait for the next stage of more lucrative profits to materialise.

Friends, at this moment, I believe you have once again deeply experienced the extraordinary power released by the ProMatrix Quantitative trading system. It is not only accurately screens batches of high-quality assets with long-term value for us, but also helps us continuously improve and upgrade the "Dynamic Diversified Asset Allocation System" to achieve compound growth of wealth.

Dear friends, this morning’s session has come to an end, but our pursuit of wealth and our desire for systematic growth will never stop.

Later on, I will continue to be with you as we monitor the real-time updates of high-quality assets and dive deeper into practical trading techniques, focusing on the logic and application of swing trading strategies. See you later.