Dear friends, I’m Christian Luis Ahumada, Founder and Chief Quantitative Analyst of Prosper Grove Asset Management. I’m truly delighted that at this opportunity-filled moment, we are once again gathering in the group to embark on a new round of market insights and strategic asset planning together.

In today’s discussion, we will dive deep into the real-time tracking and assessment of high-quality stocks. This aspect is not only a critical component of our daily operations but also a foundational pillar in building our Dynamic Diversified Asset Allocation System.

Key Updates for Today:

1.What is the current investment environment in the market, and what signals is it sending?

2.How are high-quality stocks performing in real time, and how should we adjust our strategic positioning?

3.Practical trading technique: how can we accurately identify entry and exit points using the "converging triangle" pattern?

Friends, today is an important day for us all to celebrate together!

Substantial progress has been made in the talks with Chinese high-level officials. After intensive negotiations, the two sides have reached an agreement to temporarily and significantly reduce tariffs. This decision quickly boosted the confidence of the global market, and the three major stock indexes soared across the board: the Dow Jones Industrial Average rose by 2.81%; the Nasdaq index rebounded strongly by 4.35%; and the S&P 500 index rose by 3.26%.

These figures not only reflect the market's reaction, but also the early fulfilment of expectations.

From the current market operation trajectory, we can clearly identify two extremely critical signals, which are as follows:

1. The current overall environment of the entire investment market is very favourable. It is suitable for us to actively participate in transactions and obtain wealth opportunities.

2. Continuously improving and upgrading the "dynamic diversified asset allocation system" will help us to achieve compound wealth growth in different cycles and style conversions.

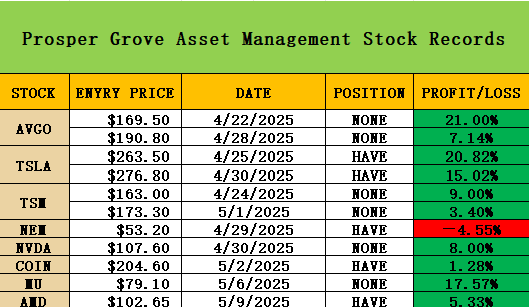

Now let us continue to focus on the real-time dynamics of high-quality stocks, continuously optimize the asset allocation plan in our hands, and lay the foundation for the steady growth of wealth.

In our strategic layout of "dynamic diversified asset allocation system", COIN is worth paying attention to. It belongs to the concept of cryptocurrency stocks. The COIN we currently hold has brought us 1.28% profit returns.

Although its stock price has not risen sharply in the short term, from the overall trend and the strength of the market linkage in the cryptocurrency field, COIN is in the accumulation stage. Its value not only comes from the profitability of the trading platform, but also carries the development potential of the entire crypto-financial ecosystem.

What is more worthy of our emphasis is that our strategic allocation in cryptocurrency assets has recently achieved a very beautiful phased increase. This achievement is a direct reflection of the highly coordinated operation of the two core principles of "diversification" and "dynamic adjustment" in the "dynamic diversified asset allocation system" we advocate.

Since April 8, the price trend of mainstream crypto assets, BTC and ETH, has obviously deviated from the linkage rhythm of the three major stock indexes in the stock market, showing a high degree of independence and resilience. Under the influence of multiple factors such as macro disturbances and liquidity games, they have instead walked out of a strong unilateral upward trend, which has a distinct structural significance in the historical stage.

This also proves once again that crypto assets are no longer just speculative tools, but an important part of asset allocation in the new era.

For those friends who have already included BTC and ETH in our "dynamic diversified asset allocation system", your gains are very considerable.

At this moment, if you are a new member of our Prosper Grove Asset Management group, you can choose to buy BTC and ETH, incorporate them into our "dynamic diversified asset allocation system" strategic layout, and wait for higher profit returns

Dear friends, our Prosper Grove Asset Management group can not only share the opportunity of wealth with you and enjoy the fun of wealth compound growth, but also gain a wealth of financial knowledge and continuously improve practical trading capabilities.

Now let us start today's learning journey with a more positive attitude.

Today, the focus of sharing with you is: How to accurately judge the buying and selling points through the "aggregate triangle" pattern?

Aggregate triangle refers to the continuous decrease of price highs and continuous increase of lows, or the lows are on the same horizontal line, forming a gradually narrowing symmetrical triangle structure, in which the price fluctuates less and less, and eventually faces a breakthrough or fall.

I believe that friends who continue to pay attention to cryptocurrencies BTC and ETH have a very profound feeling.

As shown in the figure, the AVGO daily chart from March 2025 to now

From the chart running track, we can clearly see that the aggregation triangle is a very critical price running pattern. By observing the chart, we can clearly outline this pattern by drawing lines from points A, B, C, D, E,and F.

Among them, points A, B, and C are very strong support positions, while points D, E, and F are very strong pressure positions.

The price trend shows an obvious gradual narrowing.

In the aggregate triangle pattern, we observed that the highs of points D, E and F decreased gradually, while the lows of points A, B and C increased gradually. This phenomenon reflects that the pressure of sellers is gradually weakening and the strength of buyers is gradually increasing.

Among these points, F is a very critical point. Once the position of the upper edge of the aggregate triangle is successfully broken, it indicates that the direction is upward and the multi-party force is dominant, which means that a new round of unilateral rising market has appeared.

Therefore, we chose to buy AVGO at the same time, which allowed us to achieve a 20% staged victory.

Similar graphs clearly show that the 'aggregate triangle pattern' requires us to focus on the positional relationship between the upper and lower edges of the trend and wait before choosing a direction.

An upward breakthrough usually indicates the continuation or start of an upward trend, while a downward breakthrough indicates the continuation or start of a downward trend.

Dear friends, I hope you can master and take notes on what I have shared above. At the same time, apply the knowledge you have learned to actual trading. I believe that it will not take long for your investment and trading ability to be greatly improved, and you will become a master in the investment industry.

Friends, today's sharing has come to a successful end. Thank you for listening and learning carefully.

Tomorrow, we will continue to pay attention to the real-time dynamics of high-quality stocks, dynamically optimise our asset allocation structure with a more keen perspective, and continue to improve and upgrade the "dynamic diversified asset allocation system" to ensure that it can help us cross the cycle and accelerate to our own wealth peak.

See you tomorrow.