Dear friends,I'm Christian Luis Ahumada, Founder and Chief Quantitative Analyst at Prosper Grove Asset Management. It's a pleasure to reconnect with you all in the group at the start of this promising new trading week.

This week, we’ll take a deep dive into the key market themes, focusing on policy direction, sector rotation, and shifts in capital structure, as we continue to identify high-quality assets with true growth potential and a solid margin of safety.

At the same time, we will optimize the dynamic adjustment of high-quality stocks and continue to refine and upgrade the strategic framework of our “Dynamic Diversified Asset Allocation System,” ensuring compound growth of assets across different time cycles and market style rotations.

Key Updates for Today:

1.What were the outcomes of the weekend’s economic and trade meetings between the delegation and senior Chinese officials? What important signals were conveyed?

2.How are high-quality stocks performing in real-time, and what are the optimization strategies?

A promising trading week is now underway, and global markets are once again entering an exciting phase. Optimism is spreading, and investor confidence is seeing a notable rebound.

It’s worth highlighting that President Trump and several key officials have released a series of positive signals, suggesting that “substantial progress” has been made in trade negotiations with China. Following a prolonged period of uncertainty surrounding trade policy, this shift has undoubtedly become a key catalyst for sentiment recovery.

Looking back at last week, President Trump signed a significant trade agreement with the United Kingdom, signaling a potential easing of the panic surrounding trade policy. This is a highly positive development.

Now, driven by this series of positive developments, it’s clear that the systemic risks posed by trade policy are gradually being offset by improving sentiment. Market fear is being replaced by growing confidence. This marks not only a trend reversal but also a signal of emerging wealth opportunities.

Therefore, we must enhance our execution capabilities and adopt a more resolute strategic pace to accelerate the refinement and upgrade of the “Dynamic Diversified Asset Allocation System.” This will allow us to achieve true penetration during offensive moves and strong resilience during defensive periods.

Friends, let’s now focus on the real-time dynamics of high-quality stocks and continue advancing the optimization and upgrade of our strategic asset allocation.

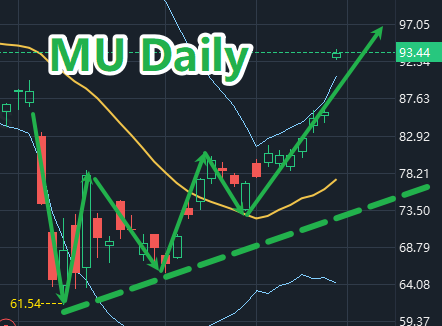

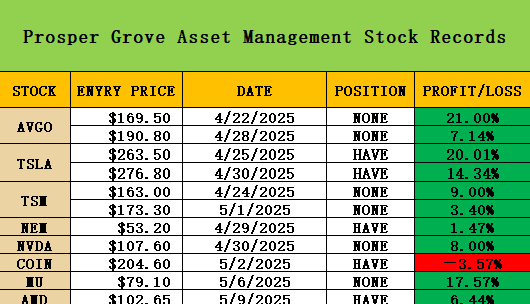

This is excellent news. MU’s price has been steadily climbing, delivering a solid return of around 17.57% for us. All of this is the result of our disciplined execution, rational analysis, and consistent strategy.

MU has now successfully approached a key strong resistance zone. From the perspective of steady profits and risk management, we have decided to fully take profits and sell, successfully locking in gains for this round.

I want to extend special congratulations to all the friends who have consistently followed the strategic rhythm of our Prosper Grove Asset Management group. You have not only witnessed the market’s evolution but also achieved real wealth accumulation through practical execution.

Remember, this is not a coincidence but the genuine reward of systematic trading capabilities.

Friends, we are once again witnessing an exciting moment. TSLA’s price is surging strongly, delivering an 18% interim gain for us. This is a clear reflection of the perfect alignment between strategic execution and market rhythm.

The key catalyst behind this round of gains is TSLA’s official announcement of a new AI-driven strategy. The company plans to launch an AI intelligent agent system designed to optimize customer service processes, enabling clients to interact more efficiently with senior management and significantly enhancing service response times and overall user experience.

This strategy has sent a clear signal of growth, prompting a swift and positive market response that has driven the stock price to continue strengthening.

Nevertheless, at this point, we remain calm and rational. Based on steady profitability and sound risk management, we have chosen to carry out a phased reduction in our position, locking in part of the profits ahead of time.

At this moment, I want to congratulate those who have placed their trust in our Prosper Grove Asset Management group and have actively participated in our ongoing real-time strategies. You have turned conviction into action, seizing wealth opportunities amid volatility and accumulating results through certainty.

This is fantastic. AMD, which we bought together last Friday, has surged again, delivering a solid 6.44% profit return.

At this point, most stocks are experiencing significant gains. From a steady profit perspective, we’ve decided to cut half of our position, while holding the remaining shares to either capture further upside potential or wait for a pullback to add again.

Congratulations once again to all the friends who firmly followed us in the synchronized AMD purchase. It is your trust and execution that led to today’s impressive profit return.

Today, the cryptocurrency-themed stock COIN is also steadily rising, currently delivering a 2.37% interim gain for us. The price is above the middle line of the Bollinger Bands, and the overall trend remains strong. Cryptocurrencies and crypto-related stocks are a key component of our “Dynamic Diversified Asset Allocation System” strategic framework, so we will continue to hold the position, anticipating greater profit returns.

NEM is a gold-related stock. Due to the phased progress in trade negotiations, market risk aversion has temporarily eased, leading to a moderate pullback in gold prices. However, we must always be clear about one thing: gold is never a tool for short-term speculation, but rather a vital component of mid-to-long-term strategic asset allocation.

We believe in the macroeconomic logic and broader trends behind gold, which is why we choose to continue holding gold-related stocks.

At this moment, I believe that friends who continue to follow our Prosper Grove Asset Management group have already deeply felt the powerful potential of our exclusive investment tool: ProMatrix Quantitative trading system.

This is not an ordinary trading system. It embodies the wisdom and hard work of 32 innovative elites from the world's top financial institutions, technology companies, and academia. After countless days and nights of repeated deductions, real-time testing, and dynamic corrections, they finally developed the ProMatrix Quantitative trading system, which can continuously evolve and upgrade.

More importantly, the ProMatrix Quantitative trading system is not static; it learns and grows every day.

Every market fluctuation is the nourishment for its growth; every practical test and inspection is a step in its evolution. We firmly believe that in the near future, it will be officially released to the public and come into everyone's view.

That moment will definitely become an important innovation in the investment world.

This will not only set off a "financial revolution" with the deep integration of quantitative and artificial intelligence, but will also significantly enhance the brand awareness and professional influence of our Prosper Grove Asset Management, laying a solid foundation for the company to accumulate broader customer resources and expand the scale of assets.

We firmly believe that when the ProMatrix Quantitative trading system is fully launched and the strategic results are continuously implemented, the market value of our Prosper Grove Asset Management will gradually rise. We have the confidence and ability to successfully embark on the journey of listing on the Nasdaq within the next three years.

Of course, the realization of all this is inseparable from the joint efforts of every friend. It is your trust, execution and participation that drive this great vision from a grand blueprint to reality.

Friends, this will be a wonderful journey.

Later, I will continue to bring you real-time dynamic tracking of high-quality stocks, and focus on sharing practical trading skills: How to accurately judge the buying and selling points through the "Aggregate Triangle" pattern?

Welcome more friends to actively participate, learn, communicate, and grow together. See you later.