Dear friends,I'm Christian Luis Ahumada, Founder and Chief Quantitative Trading Analyst at Prosper Grove Asset Management. I'm thrilled that at this moment full of hope and opportunity, we can come together once again in this group to embrace a truly significant live trading initiative.

Today, we will be simultaneously engaging in strategic purchases of high-quality stocks, continuing to advance the development of a "dynamic and diversified asset allocation system."

Important updates for today:

1.What are the specific details of the high-quality stocks selected by the ProMatrix Quantitative Trading System?

2.How should the structural adjustments of the "dynamic and diversified asset allocation system" be carried out?

Dear friends, the most exciting moment has arrived!

The ProMatrix Quantitative Trading System, through multidimensional data screening and structural resonance modeling, has successfully identified high-potential quality stocks, with an expected target return of around 50%. If you're interested, please contact the assistant as soon as possible to receive the detailed strategy information for these quality stocks. This will help you grasp the timing of entry and position planning, ensuring you can follow the deployment rhythm right away and seize the profit window.

Now, let’s turn our attention to the detailed information of the high-quality stock specifically selected by the ProMatrix Quantitative Trading System:

This is a globally competitive semiconductor company, with operations spanning four key high-growth sectors: data centers, client computing, gaming processors, and embedded system solutions.

Now let’s focus on the core rationale behind this high-quality stock:

1.News-driven catalyst: Policy dividend signals

a. The Trump administration has sent a clear signal that it will repeal the AI chip export restrictions implemented during the Biden administration.

This indicates that high-end chip manufacturers and core AI computing power companies, which have been under pressure for an extended period, are expected to experience a new wave of demand release and valuation recovery, boosting investor optimism toward the AI sector.

b. The conclusion of a major trade agreement boosts global market confidence.

President Trump announced that a significant trade framework agreement has been officially signed with the United Kingdom. The market has interpreted this agreement as a positive signal for the restructuring of medium- to long-term trade relations, directly fueling gains in the technology and semiconductor sectors and significantly increasing market risk appetite.

What’s even more noteworthy is that high-level economic and trade talks with senior Chinese officials are scheduled for this weekend, which is very likely to generate positive expectations for policy easing.

2. Earnings Performance: Revenue Surge, Profit Explosion

The latest Q1 FY2025 earnings report for this high-quality stock delivered an exceptionally strong performance:

According to the newly released Q1 FY2025 report, the company posted revenue of $7.438 billion, representing a 36% year-over-year increase. Net income reached $709 million, marking a significant 476% surge compared to the same period last year. Although revenue saw a modest 3% quarter-over-quarter decline, net profit jumped 47% sequentially. Both earnings per share (EPS) and revenue exceeded market expectations, fully demonstrating the company’s outstanding capabilities in cost control, profit quality, and operational efficiency.

3. Future Outlook: Earnings Expected to Continue Growing

This high-quality stock released its revenue guidance for Q2 of fiscal year 2025, setting a target of $7.4 billion, with a margin of plus or minus $300 million. This forecast once again significantly exceeds general market expectations, reflecting the management’s strong confidence in the pace of future growth.

What’s even more noteworthy is that the company recently completed a stock buyback program worth as much as $4 billion. This not only strengthens price support from a supply-demand perspective but also highlights the management’s strong confidence in the company’s long-term growth potential.

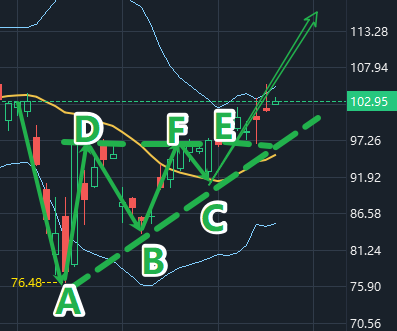

4. Technical Analysis: Double-Bottom Pattern Confirmed, Strong Trend Momentum

The stock is currently climbing steadily from a low point along its long-term trendline, showing a healthy and orderly price movement. At the same time, a clearly defined double-bottom pattern has formed on the chart, which is often regarded as a strong signal of a trend reversal.

Notably, this high-quality stock has now firmly held above the middle Bollinger Band and has successfully broken through key levels at points D, F, and E. The overall trend remains strong and well-structured, making the current price level an excellent entry point for trading.

Friends, this high-quality stock has shown a four-dimensional resonance, starting with the easing of macroeconomic policies, followed by a breakout in fundamental data, continued strengthening of market confidence, and finally, reinforcement of the technical trend.

At this moment, it shows strong upward potential and strategic value, so this high-quality growth stock meets the criteria for our joint purchase.

Now, if you're interested in participating in the positioning of this high-quality stock, please contact the assistant right away to receive detailed strategic information, including entry timing and position planning, to ensure you stay in sync with the setup and achieve steady, phased returns.

Important reminder: All friends who successfully participated in today’s joint purchase opportunity of the high-quality stock, please send a screenshot of your trade information to the assistant for proper recordkeeping. We will create a personalized tracking file for you, and the assistant will provide daily updates on the latest developments of the stock to ensure you receive critical information as the market evolves, so you never miss a key opportunity.

And today, friends who actively participated in the joint purchase and successfully sent their trade information to the assistant will also be eligible for this afternoon’s prize draw.

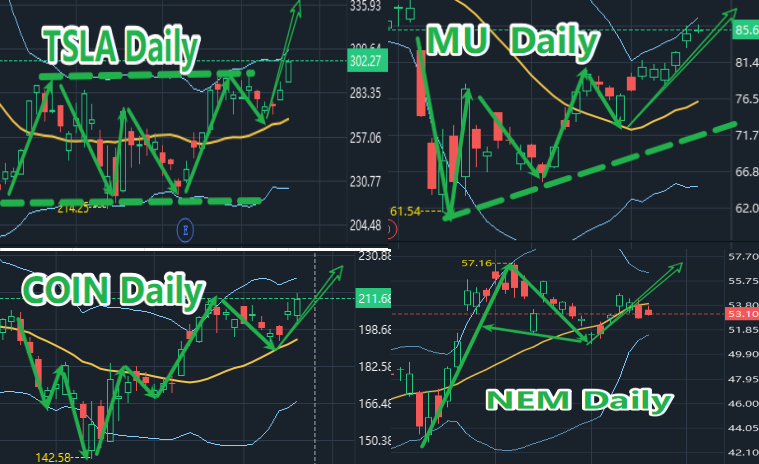

Dear friends, let’s now continue to focus on the real-time developments of the high-quality stocks MU, TSLA, NEM, and COIN within the framework of the “Dynamic Multi-Asset Allocation System.”

Every upward move in a high-quality stock is a reward for your trust and a victory for the system’s strategy.

Dear friends, we believe you’ve already seen the strong performance of our high-quality stocks through their recent real-time movements, and our wealth is steadily growing as a result.

This is not an accident but the unstoppable result of choosing to trust our "Dynamic Diversified Asset Allocation System." It is not just a strategy; it is also a path to wealth freedom.

At this moment, you are no longer in this battle alone. Behind you is a team of 32 cross-disciplinary experts from the world's top financial institutions, technology companies, and academic research frontiers.

They are continuing to upgrade configuration logic and improve the rhythm of strategy execution to build a defense system for you that can withstand risks and survive bull and bear markets, helping you achieve steady compound growth of your wealth.

Dear friends, a new era of asset allocation logic is quietly unfolding. We are standing at a pivotal moment of structural revaluation across multiple asset classes. Thank you to each and every one of you for your support and companionship.

Later, I will summarize the achievements of this week’s “Dynamic Diversified Asset Allocation System” and share our strategic plans. I look forward to more friends joining us. See you later.