Dear friends, I’m Christian Luis Ahumada, Founder and Chief Quantitative Analyst at Prosper Grove Asset Management. I’m delighted to be with you once again in the group today. In this rapidly changing market environment, we remain committed to using data to gain insights into trends and strategy to guide our direction.

Today, we will analyze the employment market signals and macroeconomic expectations reflected in the initial jobless claims data for the week ending May 3. At the same time, we will continue to track the real-time movements of quality stocks, further optimize asset allocation, and advance the development of our dynamic diversified asset allocation system.

Key Updates for Today:

1.What impact does the initial jobless claims data for the week ending May 3 have on the investment market?

2.How are quality stocks performing in real time, and what are our dynamic adjustment and optimization strategies?

Now, let’s focus on the detailed data for initial jobless claims for the week ending May 3:

Initial jobless claims refer to the number of people filing for unemployment benefits for the first time. It serves as an indicator of the strength of the labor market and the overall level of economic activity.

According to aggregated data from the ProMatrix Quantitative Trading System, for the week ending May 3, seasonally adjusted initial jobless claims fell by 13,000 to 228,000, coming in below the market expectation of 230,000. This indicates that the labor market remains resilient and has eased concerns about a rapid economic slowdown, sending a positive signal to the broader market.

Friends, yesterday the Federal Reserve, as expected by the market, decided to keep interest rates unchanged for the third consecutive meeting. However, what deserves our closer attention are the key signals delivered by Chairman Powell during his post-meeting remarks.

1.Federal Reserve’s Stance: Approach with caution and wait patiently

2. Policy Strategy: Cautious observation with a note of warning, and flexible response to changes

The Federal Reserve does not rule out the possibility of a rate cut if necessary, but it requires sufficient data to support such a move.

3. Market Guidance: Current policy has not shifted toward tightening, and the underlying trend logic remains intact.

Friends, the current market remains in a phase where multiple variables are intertwined, and the uncertainty brought by trade policies continues to evolve. However, at the same time, we must recognize that the overall economic fundamentals remain solid, with no signs of systemic risk.

Just yesterday, according to reputable media sources, the Trump administration announced plans to roll back AI chip regulations imposed during the Biden era. Following the news, semiconductor stocks rose, contributing to a rebound in the broader market.

In addition, President Trump announced a trade agreement with the United Kingdom and revealed plans to hold a trade and economic meeting with top Chinese officials later this week, sending a positive signal to the entire investment market.

Therefore, in the face of the current investment environment, we will not be swayed by emotions and will continue to firmly advance the construction and dynamic optimization of our dynamic diversified asset allocation system.

Now, let’s focus on the real-time movements of quality stocks.

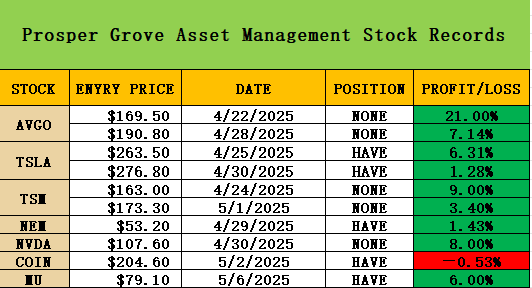

It’s truly fantastic. AVGO’s price has reached a new high once again, delivering a solid 21% profit return. This is a strong validation of our strategy, execution, and systematic understanding.

At this moment, from the perspective of securing steady profits and managing risk, we have decided to take full profits and sell our entire position.

I want to extend special congratulations to those who have consistently followed our Prosper Grove Asset Management group and have firmly executed the strategic layout of the dynamic diversified asset allocation system. Your wealth is now rising to a new level.

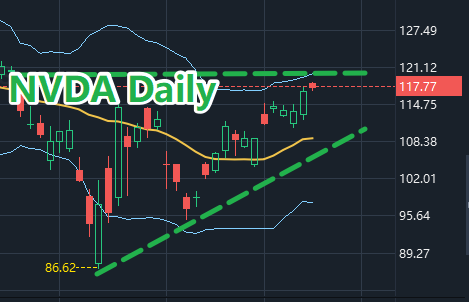

NVDA’s price has been steadily rising recently, following the upward path we had anticipated. It has now delivered an 8% interim gain, adding another impressive result to our dynamic diversified asset allocation system.

Congratulations once again to all the friends who participated in the trade alongside us and consistently executed the system strategy.

At this moment of celebration, it's even more important to remain calm and risk-aware. NVDA’s stock price is once again approaching a key resistance zone, and we’ve decided to take full profits and lock in gains. Congratulations once again to those who actively participated in our position

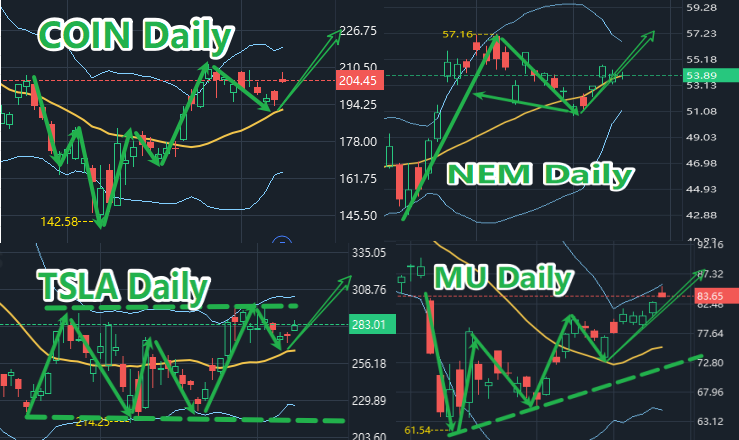

COIN is a cryptocurrency-related stock. Although it has experienced a brief price pullback recently, the inverse head and shoulders pattern has clearly formed in its technical structure, which is a classic trend reversal signal.

From a trend perspective, COIN’s overall performance remains strong, so we have decided to continue holding the position.

NEM is a gold-related stock, and its price is currently hovering near the middle line of the Bollinger Bands, entering a decision zone.

From a medium-term allocation perspective, gold assets remain an essential part of our defensive holdings, so we have decided to continue holding and wait.

TSLA is part of the electric vehicle sector and has currently achieved a profit of around 5%.

Its price is above the middle line of the Bollinger Bands, and the overall trend remains strong. With substantial future growth potential and profit opportunities, it is well worth continuing to hold in anticipation of higher returns.

MU is a stock within the artificial intelligence sector and has currently delivered a profit of around 6%.

Recently, MU has shown strong performance, with its price successfully breaking through long-term trendline resistance and holding above the middle line of the Bollinger Bands, confirming the formation of an upward trend structure. Therefore, we have decided to continue holding, anticipating greater profit returns.

Important Reminder: I am currently conducting a new round of in-depth screening for quality stocks using the ProMatrix Quantitative Trading System. This is a high-potential stock with strong breakout potential, and the expected profit margin could reach approximately 50%.

Once the ProMatrix Quantitative Trading System identifies the optimal entry point and confirms the alignment of technical patterns and capital structure, I will immediately share the official entry strategy with everyone in the group.

If you’re interested in this quality stock, please contact the assistant now to complete your early registration. This will ensure that once the detailed strategy update is finalized, you will be the first to receive its real-time developments and the complete trading strategy.

Dear friends, I believe that at this moment, those of you who have been closely following our Prosper Grove Asset Management group and have firmly executed the strategic layout of the dynamic diversified asset allocation system are feeling the impact most profoundly.

Throughout this period of market activity, whether facing macro policy uncertainty or repeated fluctuations in market sentiment, you’ve remained calm and exercised rational judgment, responding dynamically with the support of the system. This, in itself, is the most genuine and powerful validation of our investment philosophy.

The "Dynamic Diversified Asset Allocation System" built by Prosper Grove Asset Management is neither a static configuration nor a simple diversified investment, but a systematic asset management model that can truly adapt to market cycle changes and cross-macro fluctuations.

It has both offensive growth potential and the ability to seize the rising opportunities of emerging industries and strong sectors; it also has defensive pressure resistance, which stabilizes asset value during market corrections and policy disruptions, and resists systemic risks.

Friends, we always believe that establishing a "dynamic diversified asset allocation system" is a core path that can truly guide us to achieve long-term, stable, and compound wealth growth.

We welcome more friends with dreams to join our Prosper Grove Asset Management Group to learn together, make progress together, and build their own wealth growth path together, truly realize compound wealth growth, and accelerate the entry into the ranks of financial freedom.

This is also the original intention and mission of our Prosper Grove Asset Management: through systematic education and practical training, to provide each student with a successful investment thinking framework and an executable practical path, to comprehensively improve the students' practical trading capabilities, and to create a group of "strategic investors" who can truly gain a foothold in the market.

Here, students will not only be able to master professional financial knowledge but will also be able to build their own complete trading system through the deep integration of theory and practical trading.

Moreover, when you achieve success in trading, it is not only a leap in your personal ability, but also an investment of valuable trust and word-of-mouth power into the development of our Prosper Grove Asset Management.

Your achievements will become our best endorsement. Your progress will also help us further expand our brand influence, accumulate more high-quality customer resources, and promote the continuous growth of our asset volume and the steady increase of the company's market value.

This will be a win-win situation, and as our company's market value steadily increases, we firmly believe that in the next three years, our Prosper Grove Asset Management will successfully embark on the road to listing on the Nasdaq and occupy our place in the global capital market..

Dear friends, this is the end of this morning's exchange, but I believe we will never stop pursuing cognitive growth and the freedom of wealth.

Later, I will continue to track the real-time dynamic performance of high-quality stocks with you, and focus on sharing practical trading skills with you:

The Judgment and Application Method of the "Cup Handle Pattern".

I look forward to more friends joining the discussion. See you later.