Dear friends, I’m Christian Luis Ahumada, Founder and Chief Quantitative Analyst at Prosper Grove Asset Management. I’m pleased to be here with all of you in the group as we interpret the results of the Federal Reserve’s monetary policy meeting and analyze Chairman Powell’s remarks to understand the policy signals and guidance for the road ahead.

Key Updates for Today:

1.What important messages were conveyed by the Federal Reserve’s policy decision and Chairman Powell’s remarks?

2.Practical Trading Technique: Identifying and applying the “inverse head and shoulders” pattern.

According to our Prosper Grove Asset Management's exclusive investment tool, ProMatrix Quantitative Trading System, filtering big data shows that the Federal Reserve kept the benchmark interest rate unchanged at 4.25%-4.50%, in line with market expectations, and remained unchanged for the third consecutive meeting.

And we have drawn important policy signals from the speech of Federal Reserve Chairman Powell:

1. Tariffs are the driving force behind the recent rise in inflation expectations

2. The Federal Reserve will not rush to cut interest rates, and the future path of interest rate cuts will depend entirely on changes in data, markets, and the economic environment. If the labor market deteriorates significantly, it would support a rate cut.

3. Although inflation expectations have risen in the short term, overall inflation is still within a controllable range.

4. The independence of the Federal Reserve is not interfered with by external pressure. This is an important statement that conveys institutional confidence and policy credibility to the market and helps stabilize market expectations.

A comprehensive analysis of today’s Federal Reserve policy meeting results and Chairman Powell’s remarks clearly shows that the Fed is conveying a policy stance of “patience, caution, and flexibility” to the market.

Overall, although inflation expectations have slightly risen recently and some economic data have shown volatility, Powell did not signal any clear move toward easing. Instead, he emphasized a stable stance across multiple dimensions, including not rushing to adjust interest rates, closely monitoring incoming data, and maintaining policy independence.

In other words, the underlying logic of the market and the broader environment have not undergone any fundamental changes.

In the face of a macro environment filled with uncertainty, the Federal Reserve’s decision to keep interest rates unchanged further confirms that, at this stage where the turning point of the cycle remains unclear, the most effective strategy is not aggressive trading but a steady, orderly approach focused on dynamic optimization and structural balance.

Therefore, the overall environment remains unchanged, and our strategy continues to focus on building our own dynamic diversified asset allocation system. Please stay tuned for tomorrow’s update for specific optimization plans.

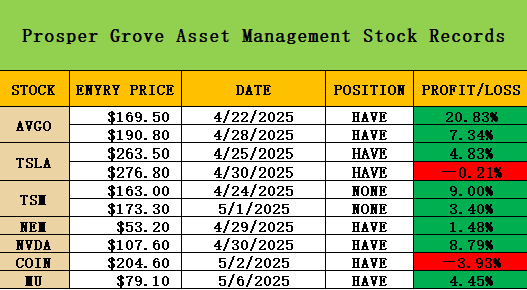

Important Reminder: Recently, many friends who have been paying attention to our Prosper Grove Asset Management Group for a long time have been actively following the operational strategies we have formulated to participate in the market. Under the guidance of the system and disciplined execution, they have successfully generated substantial profit returns.

I would like to take this opportunity to congratulate these friends. Your firm execution is gradually turning into real wealth accumulation.

At this moment, if you are a new friend who has just joined our Prosper Grove Asset Management group, you may not have been able to participate in our early strategic layout in time, so please don’t worry.

At this very moment, I am using the ProMatrix Quantitative Trading System to conduct in-depth screening to identify the next high-quality stock with medium-term volatility potential.

According to the system's expectations, the potential profit target of this quality stock will reach about 50%. If you are interested in this quality stock, you can contact the assistant to register in advance. Once the detailed strategy information of this quality stock is updated, you will receive the real-time dynamic information of the quality stock as soon as possible.

Dear friends, now let us begin today’s learning journey with enthusiasm and focus.

Today, we will focus on a key practical trading technique: how to identify and apply the “inverse head and shoulders” pattern.

The inverse head and shoulders pattern is a classic trend reversal formation that often appears at the end of a prolonged downtrend, serving as a strong bullish signal.

When we spot this pattern in the market, it often indicates a highly promising buying opportunity.

As shown in the chart: AEM’s daily candlestick chart from January to May 2024.

We can clearly see that the “inverse head and shoulders” pattern is primarily composed of three low points and two neckline points, which form the left shoulder, right shoulder, and the head.

Left Shoulder: Segment B to E

Right Shoulder: Segment F to D

Three Low Points: Point A, Point B, Point D

Two Neckline Points: Point E, Point F

Optimal Entry and Exit Strategy:

1.Entry Point: The key buy point in this type of pattern is at the neckline. Once a breakout is confirmed, it becomes the optimal signal to buy.

2. Exit Point: If the price falls below the low point of the right shoulder (Point D), it signals a timely exit to avoid potential risk.

Friends, today’s session on the practical trading technique of identifying and applying the inverse head and shoulders pattern has successfully concluded.

From your focused learning and interactive feedback, I can genuinely feel that each of you is earnestly acquiring knowledge and diligently working to improve your practical trading skills.

Here, I would like to encourage everyone to carefully organize the key points you have learned into notes and actively participate in discussions and exchanges in our Prosper Grove Asset Management group. This will not only help you deepen your understanding and form your own operating logic, but more importantly:

1.Active participation and engagement in the group allow you to accumulate learning points, which qualify you for the Friday afternoon raffle and the chance to win more exclusive rewards.

2. Ongoing communication and sharing can enrich your knowledge base and truly transform theory into actionable trading skills. This is a necessary path for every investor on the journey toward maturity and long-term compounding returns.

This is exactly the educational philosophy that Prosper Grove Asset Management has always adhered to in the 11th ProMatrix Quantitative Trading System Financial Training Course: "The combination of theory and practice is the best way to improve practical skills".

Friends, the practical trading technique we discussed today, the inverse head and shoulders pattern, has already been integrated into the strategy model of the ProMatrix Quantitative Trading System.

Moreover, the assessment and application methods of "Trend Running State Identification" and "Double Bottom Patterns", which we have recently focused on, are all comprehensive interpretations of the core working principles and application methods of the ProMatrix Quantitative trading system.

At this moment, every detail I explain is aimed at helping you build your own trading logic. Moreover, through this period of learning and training, I’ve seen more and more members of our Prosper Grove Asset Management group master the identification and practical application of key patterns, and under the guidance of the system, independently develop trading strategies that lead to steady growth in their account assets.

At this moment, I genuinely feel proud and happy.

Dear friends, that concludes today’s content sharing session. Thank you all for your focus and dedication throughout. Every bit of effort you put in is a foundation for the continued growth of your future returns.

Tomorrow, we will continue to deeply interpret the impact of the initial jobless claims data on the investment market for the week ending May 3rd. At the same time, we will continue to track the latest developments in high-quality stocks and, combined with the macro signals, we will further dynamically adjust and optimize our asset allocation strategy to promote a steady leap in wealth.

Tomorrow, we look forward to more of you actively participating and engaging in the discussion. See you tomorrow.