Hello everyone, I’m Christian Luis Ahumada, Founder and Chief Quantitative Analyst at Prosper Grove Asset Management. I’m glad to be here with all of you in the group.

Today, we will be interpreting the latest results of the Federal Reserve’s monetary policy meeting and taking a deep dive into Chairman Powell’s speech to understand the policy guidance signals it conveys.

At the same time, we will continue advancing the development of our dynamic asset allocation system as we move together toward the path of true financial freedom.

Key Updates for Today:

1.What is our strategic positioning in response to the current market environment?

2.What are the real-time developments in quality stocks, and what is our optimization strategy?

3.What is our perspective on the Federal Reserve’s monetary policy meeting?

Friends, against the backdrop of an increasingly complex global landscape, the ongoing uncertainty surrounding President Trump’s tariff policies has brought significant volatility to global investment markets.

The sharp fluctuations in market prices reflect deep investor anxiety over macro policy expectations and the broader economic outlook.

At this moment, global investors are closely watching the upcoming Federal Reserve monetary policy decision and Chairman Powell’s remarks:

1.How the Fed assesses the medium- to long-term risks posed by tariffs

2.Whether there will be clearer signals of easing expectations or a potential shift toward rate cuts

These two key points of focus will help guide our path forward.

In the face of this highly uncertain market environment, we are not choosing to wait passively. Instead, we are actively adjusting and optimizing our asset structure, and continuously advancing the construction and enhancement of our dynamic diversified asset allocation system.

Within our allocation system, we consistently adhere to the principles of dynamic adjustment and structural optimization.

We firmly recognize that technology is the primary driving force behind social transformation and leaps in productivity. In the trajectory of technological advancement, the rise of artificial intelligence is not only a breakthrough in innovation but also a core force in reshaping the future industrial structure.

Artificial intelligence has moved from concept to reality and is now fully integrating into our daily lives and across major industries. From medical diagnostics to autonomous driving, from smart finance to industrial manufacturing, from voice recognition to data algorithm optimization, the power of AI is everywhere. We firmly believe that as time goes on, the profound impact of artificial intelligence will continue to expand and become a key engine driving social progress and economic efficiency.

Therefore, at Prosper Grove Asset Management, when building our dynamic diversified asset allocation system, the artificial intelligence sector has been clearly designated as a core component of our long-term strategic equity allocation. This is not a short-term pursuit of market trends, but a firm belief in long-term value logic and a structural commitment to it.

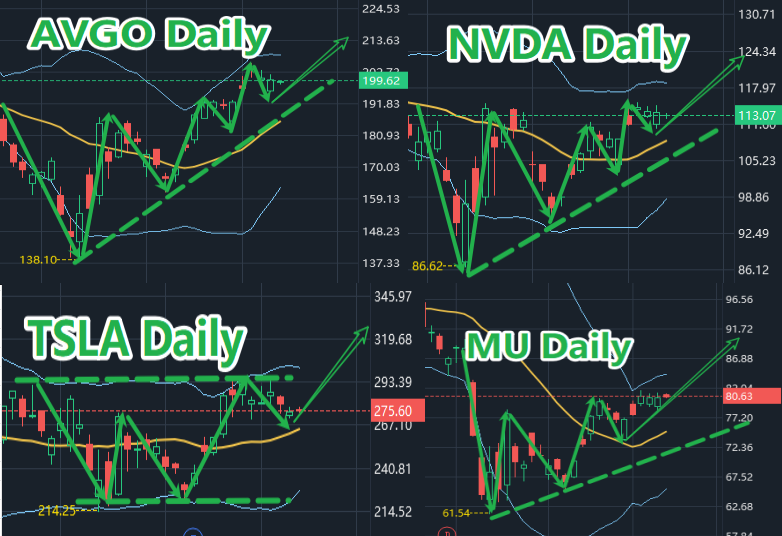

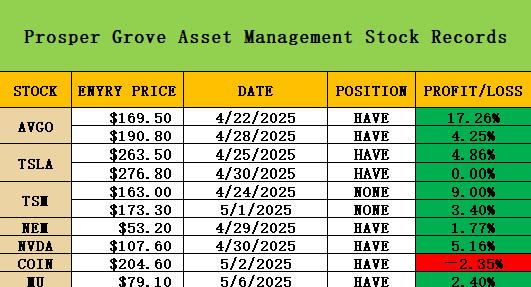

We have strategically allocated our positions in artificial intelligence sector stocks: AVGO, NVDA, TSLA, MU, and TSM.

Among them, TSM has generated a return of approximately 9%, and the profits have already been secured.

Friends, I firmly believe that those who truly understand persistence and execution will ultimately reap the rewards that time and a solid system can provide.

I would like to extend special congratulations to those of you who have consistently followed our Prosper Grove Asset Management group and actively participated in trades based on our strategic guidance. At this moment, you have already achieved a significant phase of success.

This is not a matter of luck or chance. It is the result of your decision to join Prosper Grove Asset Management at a critical moment, to trust in our proprietary investment tool, the ProMatrix Quantitative Trading System, and to follow through with the trading strategies we’ve developed.

At this moment, your wealth is entering a more structured and sustainable growth trajectory.

Friends, within the dynamic diversified asset allocation system we have built, gold and gold-sector stocks have been clearly designated as part of our mid-term core strategic positioning.

As a historically established safe-haven asset, gold possesses natural qualities of risk resistance and value preservation. Whenever unexpected events occur or political or trade risks surge, market risk aversion tends to intensify quickly, leading to a rapid inflow of safe-haven capital into gold and related sectors, creating strong trend-driven momentum.

Since April 2, when President Trump announced the implementation of “reciprocal tariffs,” global market panic has gradually intensified, and the demand for safe-haven assets has risen significantly.

Against this backdrop, international gold prices have rebounded by more than 7%, and gold-sector stocks have also benefited, showing strong overall performance.

Moreover, ongoing geopolitical tensions and the continued uncertainty surrounding trade policies have sustained market fear, further enhancing the opportunities in gold and gold-sector stocks.

At the same time, as a non-yielding asset, gold is highly sensitive to interest rates. Therefore, the outcome of Federal Reserve monetary policy decisions can cause fluctuations in gold prices. In particular, if the Fed enters a rate-cutting cycle, gold prices are often boosted, and stocks within the gold sector also tend to benefit.

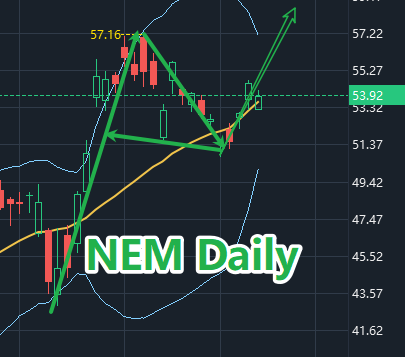

Therefore, we have selected gold and the gold-related stock NEM as mid-term strategic assets within our dynamic diversified asset allocation system.

Dear friends, in addition to the artificial intelligence sector, gold, and the gold-related stock NEM, our dynamic diversified asset allocation system also includes a highly forward-looking, growth-oriented, and globally watched strategic direction: cryptocurrency and the cryptocurrency-related stock COIN.

During last year’s presidential election, we witnessed a significant shift in sentiment: President Trump transitioned from opposing cryptocurrency to publicly expressing support for it, as well as backing the legalization of digital assets.

At the same time, President Trump has introduced a series of strategic-level initiatives in the field of crypto assets:

1.Signing an executive order to establish a “Strategic Bitcoin Reserve” and a “National Digital Asset Reserve Mechanism,” officially incorporating crypto assets into the national reserve system.

2. Appointed Paul Atkins, a strong advocate for crypto assets, as the new SEC Chairman, signaling a shift in regulatory direction.

3. Pledged to gradually withdraw lawsuits and restrictive federal regulatory policies against the crypto industry, clearing the path for its development.

Cryptocurrency is no longer just a technological experiment; it is steadily entering the mainstream of global asset allocation and holds strategic allocation value.

It is precisely based on this deep conviction that, within the dynamic diversified asset allocation system we have built at Prosper Grove Asset Management, cryptocurrency and the crypto-related stock COIN have been firmly included as key components of our strategic allocation.

Friends, if your current asset allocation does not yet include cryptocurrencies or crypto concept stocks, please promptly complete the strategic allocation of this long-term track and continue to promote the improvement and upgrading of your personal "Dynamic Diversified Asset Allocation System".

Dear friends, I believe that at this moment, the eyes of the global financial markets are all focused on the outcome of the Federal Reserve's monetary policy meeting.

Now, allow me to share my judgment and thoughts.

My view is that the Federal Reserve will keep interest rates unchanged in this meeting.

We must recognize that the current macroeconomic environment is filled with contradictions and ongoing tensions. On one hand, the economy continues to show a certain degree of resilience, with some data reflecting relative strength. On the other hand, the external shocks and internal uncertainties brought about by President Trump’s tariff policies have yet to be truly resolved.

Against this backdrop, the Federal Reserve faces an unclear path in its policy decisions. A premature rate cut could be interpreted by the market as a confirmation of economic downturn, while easing too early might heighten inflation expectations and fuel asset bubbles.

In my opinion, the current strategic logic of the Fed is:

1. Continue to wait for more economic data, especially employment, consumption, and inflation data, as the basis for policy adjustments;

2. Observe the actual impact of President Trump's tariff policy on economic fundamentals after it is implemented;

Therefore, in my judgment, the Fed's most likely strategy at this meeting is to leave rates unchanged while sending signals that it is relying on data and making flexible adjustments.

Later, I will provide an in-depth analysis of the final outcome of the Federal Reserve's monetary policy meeting, and, by examining Chairman Powell’s remarks, uncover the key policy signals and guidance for the path ahead.

At the same time, we will also focus on sharing an important trading technique: how to identify and apply the “inverse head and shoulders” pattern. I look forward to seeing more of you actively participate in the upcoming discussion and sharing session. See you later!