Dear friends, I’m Christian Luis Ahumada, Founder and Chief Quantitative Analyst at Prosper Grove Asset Management. I’m delighted to reconnect with all of you in the group during this opportunity-filled moment. Today, we will continue to stay in tune with the pulse of the market, focus on high-quality stocks with true long-term growth potential, and keep refining our asset allocation structure.

We are currently in a critical macroeconomic window: the Federal Reserve’s monetary policy meeting. This not only affects short-term market sentiment but will also influence global capital flows and risk appetite in the medium to long term. Therefore, we must always be prepared with both offensive and defensive allocations.

Key Updates for Today:

1.What are the key areas of focus in the current market environment?

2.What are the recent developments in quality stocks, and what strategies can be used to optimize asset allocation?

Dear friends, here are the key topics we need to pay attention to today:

1.OPEC has significantly increased production once again, putting downward pressure on oil prices.

Over the past weekend, OPEC unexpectedly announced another significant increase in crude oil production. This decision comes against the backdrop of a global economy impacted by trade tensions and weakening oil demand expectations, clearly intensifying market concerns about an oversupply of crude oil.

This decision sends a very clear signal: oil prices will face sustained pressure in the short term, and this situation is unlikely to ease quickly.

In this macroeconomic environment, we are maintaining a cautious outlook on the oil sector. I recommend temporarily avoiding trading opportunities in oil-related stocks, and for those already holding positions, it's crucial to prioritize risk management.

Remember, we are not in the business of predicting the market; we create strategies to respond to it. As a mature investor, you should allocate more capital to assets that have potential, a solid rationale, and strong momentum.

2. Big Tech Earnings Beat Expectations, AI Sector Pullback Presents a Buying Opportunity

Last week, several leading tech giants in the field of artificial intelligence released their latest earnings reports, with overall results far exceeding market expectations. This not only reignited investor confidence but also reaffirmed a key fact: artificial intelligence has already profoundly transformed our present way of life and the logic of modern industries.

An important point I’ve shared with you before is this: the power of artificial intelligence will not disappear. While it may experience periodic pullbacks, its impact will only grow deeper and wider over time.

From healthcare and industrial manufacturing to autonomous driving and data security, the applications of artificial intelligence have become deeply integrated into our lives. Moreover, over the past two years, it has been the AI boom that has provided the core momentum behind the bull market in the stock market.

Therefore, what I want to say to everyone is this: when facing a pullback in the artificial intelligence sector, it is not a time for panic, but a time for calm reflection and decisive strategic positioning.

This is not just a tactical move; it is also a crucial part of building our dynamic and diversified asset allocation system.

At this moment, we are holding stocks in the artificial intelligence sector: AVGO, TSLA, and NVDA.

From a trend perspective, the prices of these three quality stocks remain steadily above the middle line of the Bollinger Bands, indicating that the core trend has not fundamentally changed.

Moreover, all three of these quality stocks have strong growth prospects and solid profit potential.

Therefore, short-term price fluctuations are often merely a reflection of market sentiment, not a signal of fundamental changes.

As such, our view remains clear and firm: short-term corrections do not shake our long-term expectations for these quality assets.

On the contrary, if market sentiment brings about more reasonable price ranges, that presents an ideal opportunity for us to further optimize our allocation and buy during the pullback.

3. Media and Entertainment Sector: Policy Disruptions Intensify, High Caution Needed in the Short Term

Recently, President Trump publicly stated that he has authorized relevant government agencies to impose tariffs of up to 100% on foreign-produced films. This sudden policy announcement triggered a sharp reaction in the market, leading to a broad decline across the media and entertainment sector, with capital exiting rapidly.

This policy essentially poses a major disruption to cross-border collaboration and content distribution within the global film and television industry. It also implies that, in the near future, the profit expectations and valuation models of related companies will need to be reassessed.

In the face of such high policy uncertainty, we continue to follow the principle of “avoiding risk first, then looking for opportunities.” Therefore, when it comes to media and entertainment-related stocks, we will adopt a defensive strategy of non-participation for the time being.

4. Gold Prices Continue to Stabilize and Rebound, Strategic Value Becoming Increasingly Apparent

Recently, after a short-term pullback, international gold prices have shown a consistent stabilization and a moderate rebound. There are several underlying drivers behind this trend that should not be overlooked.

A. The high level of uncertainty surrounding global trade policies and geopolitical tensions has triggered widespread risk-off sentiment in the market. As a traditional safe-haven asset, gold has naturally attracted capital under these conditions.

B. Central banks around the world continue to increase their gold reserves. This steady buying not only enhances gold’s resilience against price declines but also provides strong support for its long-term value.

Therefore, we are including gold and high-quality stocks in the gold sector as core assets in the mid-term strategy of our dynamic diversified asset allocation system.

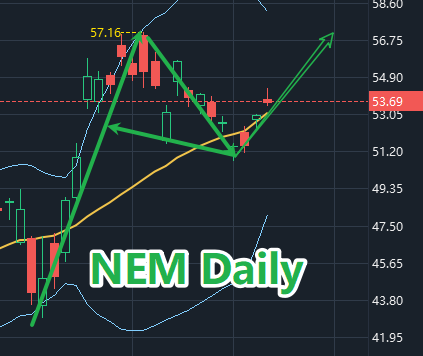

Currently, we are holding the gold-related stock: NEM.

Recently, after experiencing a period of short-term pullback, NEM has successfully moved back above the middle line of the Bollinger Bands. Its technical pattern is gradually strengthening, and the trend remains positive, indicating that the market is once again recognizing its fundamentals and the broader gold thesis.

It is important to note that the market’s short-term focus is now centered on the upcoming Federal Reserve monetary policy meeting and Chairman Powell’s remarks. This will be a critical moment that could influence short-term capital flows and shape the trajectory of interest rate expectations.

As we all know, gold prices are highly correlated with interest rates. Therefore, the release of these policy signals is likely to bring some volatility to both gold and gold-related stocks.

During this period of heightened macro uncertainty, our strategy is very clear: remain patient and continue to hold.

5. President Trump has stated that he will make a major announcement on drug costs next week, and the pharmaceutical sector needs to remain on high alert.

According to the latest news, President Trump has publicly stated that he will make a major announcement on "drug costs" next week. The announcement of this policy expectation has attracted widespread attention in the market, especially from large pharmaceutical and biotechnology companies. It has been a clear potential negative.

At the moment, we are cautious about the pharmaceutical sector, especially those companies with large valuation bubbles and closely related to the medical insurance payment system, and we should pay more attention to risk management control.

Dear friends, in the face of the current complex and changing market environment, especially in the context of continued uncertainty in trade policy, we need to deeply understand that investing has never been a game of chance, but rather a competition of systematic thinking.

Therefore, in our strategic system, we do not put all our chips in the same stock, sector, or even field. We never put "all our eggs in one basket," which is not only the basic principle of risk management but also the core path to long-term stable returns.

We must learn to break out of the "single investment" thinking mode and build our own "dynamic diversified asset allocation system", so that our strategic layout can not only steadily defend in different market cycles, but also seize the opportunity to attack in the wave of style change, and truly realize the dual driving factors of "risk resistance" and "income increase".

Friends, this is exactly the mission that Prosper Grove Asset Management has always upheld: to build on a foundation of systematic investment principles, helping more people develop asset allocation strategies tailored to their needs, navigate market cycles, and achieve long-term compound growth of their wealth.

Later, I will continue sharing real-time updates on quality stocks and practical trading techniques, focusing on how to identify and apply the “double bottom” pattern. I welcome more of you to join the discussion. See you later.