Dear friends, I’m Christian Luis Ahumada, Founder and Chief Quantitative Trading Analyst at Prosper Grove Asset Management. On this hopeful morning, I’m delighted to connect with you once again in the group.

Today, we will focus together on the latest wealth insights, formulate forward-looking strategic plans, and continue to build and optimize each of our personalized Dynamic Diversified Asset Allocation Systems.

Today's Market Update:

1.How did last week's high-quality stocks perform in real time, and what were our trading strategies?

2.What are the advantages of a Dynamic Diversified Asset Allocation System?

Friends, this week, the global investment market is heading into a critical "Federal Reserve moment."

Investors will be closely watching the upcoming May monetary policy meeting. Whether it's the final interest rate decision or the tone of Jerome Powell's remarks, both will have a profound impact on market sentiment, asset pricing, and capital flows. At the same time, the latest developments in tariff policy will also serve as another key driver of market volatility.

This week, within the Prosper Grove Asset Management group, we will continue to track the evolution of macro developments and the logic behind the data, while aligning our strategic positioning with real-time market dynamics to continuously refine our dynamic and diversified asset allocation framework.

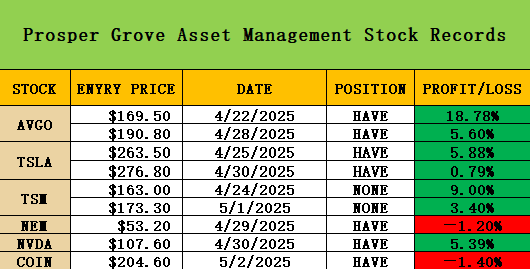

Friends, let’s now focus on the real-time performance of our high-quality stocks:

AVGO has once again released a positive signal. The current price has successfully held above the middle line of the BOLL channel and has effectively broken through a key trendline resistance level, signaling the start of a new upward trend.

From a fundamental perspective, AVGO is a global leader in semiconductor device development and supply, and serves as a key supporting force in the AI industry chain.

Currently, AVGO holds a Zacks Rank #2 (Buy) rating, with a VGM Score and Growth Style Score both rated as B, and its profit is projected to grow by 35.5% year-over-year in 2025.

This not only reflects the market’s strong recognition of its future profitability, but also confirms its strategic position in the wave of artificial intelligence.

As Mr. Buffett mentioned at the shareholder meeting: “As long as a company’s underlying fundamentals and profit potential remain intact, there’s no need to panic over short-term volatility.” Volatility is a friend to long-term investors, not an enemy.

Therefore, given AVGO’s current trend structure and fundamental support, we choose to continue holding the position and patiently wait for greater upside potential to unfold.

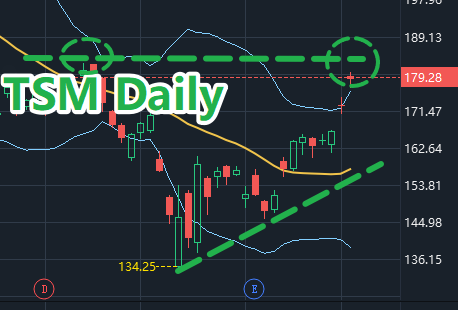

TSM has been moving steadily and has now approached a major resistance level, delivering approximately a 9% profit return for us. As the price is now near a short-term resistance area, in line with our principle of securing steady profits and managing risk, we have decided to fully take profits and lock in our gains.

Congratulations once again to all of our friends who have consistently followed the Prosper Grove Asset Management group and actively executed the strategic plans. It is your determination and execution that have led to steady growth in your profit returns.

TSLA is currently consolidating strength, waiting for the next upward opportunity.

After multiple rounds of consolidation from its lows, TSLA has built a strong support level and is now firmly holding above the middle band of the Bollinger Bands. The overall trend direction remains solid.

Therefore, despite the brief pullback in TSLA’s price at the moment, it does not affect our outlook for its future performance.

We are focusing on two key catalysts:

1.During the Q1 earnings call, Elon Musk revealed that TSLA will launch a pilot program for autonomous taxis in Austin, Texas this June.

2.Musk has committed to significantly reducing his time spent on the "Department of Government Efficiency (DOGE)" and devoting more of his time and energy to TSLA’s operations and growth.

The level of Elon Musk's commitment to TSLA and the realization of the company’s future strategic adjustments will be key factors in evaluating TSLA’s investment value.

Therefore, we will closely monitor the pace at which these two critical events unfold. Once they are realized, we believe TSLA has the potential to reach new highs. As a result, we choose to continue holding TSLA and wait.

COIN is a cryptocurrency-related stock, and its current price has successfully held above the middle band of the Bollinger Bands. Although there has been a brief pullback, it does not affect its long-term trend.

What’s even more noteworthy is the policy direction at the macro level:

President Trump has signed an executive order to establish a strategic Bitcoin reserve and a national digital asset reserve. He has appointed cryptocurrency advocate Paul Atkins as the new SEC Chairman and pledged to gradually roll back federal lawsuits and restrictive regulatory measures.

These actions undoubtedly send a clear signal to the market: "The cryptocurrency environment is about to improve," which could bring potential gains.

As a result, not only COIN but the entire cryptocurrency sector is likely to become a focal point in the capital markets. This also represents a critical component of our “Dynamic and Diversified Asset Allocation System.”

Friends, the above stock records reflect the real-time performance of the high-quality stocks that our Prosper Grove Asset Management group is closely tracking.

For those who have already invested, please remain patient, stay in sync with the rhythm, and keep an eye on the optimization strategies shared by the group to ensure you can make steady progress amid market fluctuations and achieve real asset growth.

Friends, the core of the “Dynamic and Diversified Asset Allocation System” lies in continuously optimizing our portfolio structure and investment rhythm based on real-time news, policy trends, and shifts in economic data.

Moreover, it is not a fixed or static combination, but rather a strategic framework that is adaptive and evolutionary in nature. It possesses five key advantages that enable it to navigate through cycles and withstand uncertainty.

1. Risk Diversification, Steady Safeguard

Low correlation among different assets effectively diversifies systemic risk and helps avoid the potential risks associated with any single asset.

2. Flexibility and Dynamic Adjustment

Able to optimize allocation structures in real time based on policy direction, economic data, and market sentiment, seizing wealth opportunities driven by emerging trends.

3. Capture Rotation, Lock in Trends

The market is constantly shifting in style, and only dynamic strategies can consistently capture strategic opportunities in sector rotations and align with prevailing themes.

4. Cross-Cycle Allocation, Reduce Volatility

By diversifying across equities, gold, bonds, and crypto assets, an investment portfolio can be built that combines both offensive and defensive strategies.

5. Long-Term Compounding, Weathering Bull and Bear Markets

It is not about short-term tactical speculation, but a strategic approach designed to help you steadily accumulate wealth across different market cycles and achieve sustained compound growth over time.

Friends, the market is always full of uncertainty, and our “Dynamic and Diversified Asset Allocation System” is our secret weapon for navigating the storms of the financial world.

It allows for flexible asset allocation and precise strategic positioning across different timeframes, market cycles, and style rotations, providing the confidence for steady growth and a pathway to long-term compounding.

Remember: trends rotate, markets shift, and only by responding dynamically can we stay in control, ride out volatility, and achieve sustained wealth elevation.

Later, I will continue to share the latest updates on high-quality stocks along with investment and trading techniques, including how to identify buy and sell opportunities during consolidation breakouts.

I look forward to more of you joining the upcoming session and discussion. See you later.