Dear friends, I’m Christian Luis Ahumada, Founder and Chief Quantitative Analyst at Prosper Grove Asset Management. I’m pleased to be here with all of you in the group. In this learning environment filled with professionalism and practical insight, we are not only interpreting the market, but also continuously gaining experience, sharpening our skills, and building our own dynamic and diversified asset allocation trading system.

Today's Key Insights:

1.What has been the overall trend of the stock market this week, and what signals has it conveyed?

2.Practical Trading Technique: How can we identify entry and exit points during a downtrend?

This week, global investment markets once again faced a tough test filled with mixed signals and frequent variables.

On one hand, a series of closely watched economic data was released. From the manufacturing PMI to the consumer confidence index, from the preliminary annualized Q1 GDP rate and the PCE price index to the Non-Farm Payroll data, the market has been continuously revising expectations and reshaping its rhythm.

On the other hand, the release of earnings reports from major tech companies, particularly the strong results from Microsoft and Meta, helped boost the release of market optimism.

Fortunately, the market withstood all the challenges this week, with all three major indexes posting strong gains. The Dow Jones Industrial Average rose by 3%, the Nasdaq gained 3.42%, and the S&P 500 increased by 2.92% for the week.

The Dow Jones Industrial Average, Nasdaq, and S&P 500 have all successfully broken through the neckline of a “W-shaped” pattern and held above the middle band of the Bollinger Bands, indicating that a new upward trend has begun.

At this moment, it is not only an increase in the indexes, but also a repricing of future expectations, a reallocation of capital structures, and a renewed confirmation of the market’s primary direction.

Under this trend rhythm, we at Prosper Grove Asset Management utilized the ProMatrix Quantitative Trading System to analyze big data and identify structural signals, allowing us to complete precise entry positioning in high-quality stocks ahead of time and successfully achieve steady wealth growth.

The key stocks we traded this week are as follows:

AVGO: Profit of 20.14%

TSLA: Profit of 8.99%

NVDA: Profit of 5.14%

TSM: Profit of 4.5%

COIN: Trading near the cost price

Congratulations once again to all the friends who have actively followed the insights shared in our Prosper Grove Asset Management group and have consistently executed the dynamic diversified asset allocation strategy. Your wealth is steadily growing, and your understanding is continuously evolving.

Friends, at Prosper Grove Asset Management, we do not predict the market. Instead, we are driven by the ProMatrix Quantitative Trading System, using big data to accurately analyze trends and strategic tools to scientifically manage uncertainty. Every fluctuation becomes a step forward, and every opportunity is transformed into real, tangible profit growth.

More importantly, we turn every learning experience into a building block of capability, and every training session into a bridge that brings us closer to success.

Dear friends, let us begin today’s journey of learning and exploration with a positive and enthusiastic mindset.

Today, we’ll focus on sharing a key trading skill: how to identify entry and exit points during a downtrend.

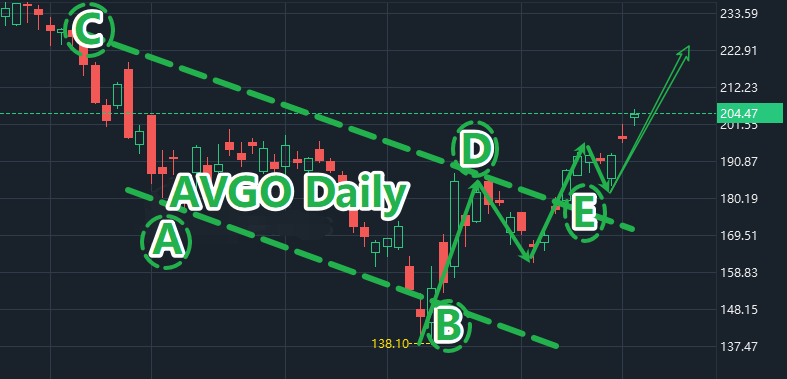

As shown in the chart: AVGO daily candlestick chart (February 2025 to May 2025)

Through the evolution of the chart’s trend, we can clearly see the complete transition of AVGO from a downtrend to a consolidation phase, and finally to an uptrend.

This is a classic pattern of trend reversal and an ideal example for learning how to identify buy and sell signals.

The trend movement from points A, B, C, D, and E forms the downtrend zone.

When analyzing a descending channel, we need to focus on two key elements: the points along the support line and the points along the resistance line.

The line connecting points A and B forms the support line within the downtrend.

The line connecting points C, D, and E forms the resistance line of the downtrend.

Point E is the most critical inflection point in the trend reversal.

These points represent the lows or highs reached during the stock’s price movement, and they are often the best entry or exit positions for us when participating in a trade.

Three Core Trading Strategies:

1.Buy Low, Sell High Strategy: This is one of the most effective short-term strategies for navigating a choppy downtrend. When the stock price approaches the support line (such as at points A and B), we can gradually enter by buying in batches.

When the price rebounds toward the resistance line (such as at points C, D, and E), we take the opportunity to sell at higher levels and lock in swing profits.

3. Active Participation Strategy: When the stock price continues to rebound and breaks through the resistance line of the downtrend, followed by continued upward movement, an active buy-in strategy should be applied. The key is to identify the critical point of trend reversal, such as point E shown in the chart.

This week, we believe all our friends have experienced the remarkable strength of AVGO's steady rise. It not only followed a clear trend path but also achieved a structural breakout at a key technical level. The "Active Participation Strategy" we applied helped members of our Prosper Grove Asset Management group earn a 20.14% profit return.

Dear friends, today’s sharing session has come to a successful close, and the highly anticipated lucky draw is about to begin.

The lucky draw every Friday afternoon is not only a surprise moment full of ceremonial significance but also our most sincere gratitude and feedback from Prosper Grove Asset Management to every friend who continues to learn, actively interact, and grow.

At this moment, we kindly ask all friends who have met the points requirement this week to contact our assistant in advance to confirm your raffle eligibility. We don’t want any dedicated participant to miss out on the luck that rightfully belongs to you.

Here, every learning deserves to be rewarded, every growth deserves to be recorded, and every perseverance deserves to be celebrated. We sincerely wish that all our friends who participate will be able to draw the prizes of their choice and reap a harvest full of joy and inspiration.

Friends, the busy work is about to end and a wonderful weekend is coming. I hope you can all take enough time to be with your family and friends, feel the beauty of life, recharge your hearts, and gather energy for the next week.

Special reminder:

This Sunday, I will take time to interpret next week's political trends in the market, the impact of heavy economic data, and the potential layout of structural wealth opportunities for everyone in advance. Welcome to continue to pay attention and participate in the discussion.

Have a great weekend, everyone!