Dear friends, I’m Christian Luis Ahumada, Founder and Chief Quantitative Analyst at Prosper Grove Asset Management. I’m very pleased to be back with all of you in the group today.

In this learning space filled with wisdom and insight, we are not only analyzing the real-time performance of high-quality stocks but also building our own dynamic asset allocation system.

Today's key insights:

1.How are high-quality stocks performing in real time today, and what is our strategy?

2.How can we scientifically build a dynamic diversified asset allocation system?

The market was boosted by strong earnings reports from Microsoft and META, easing investor concerns that economic turbulence would slow spending on artificial intelligence. Tech stocks made a strong comeback, with capital flowing back into core sectors.

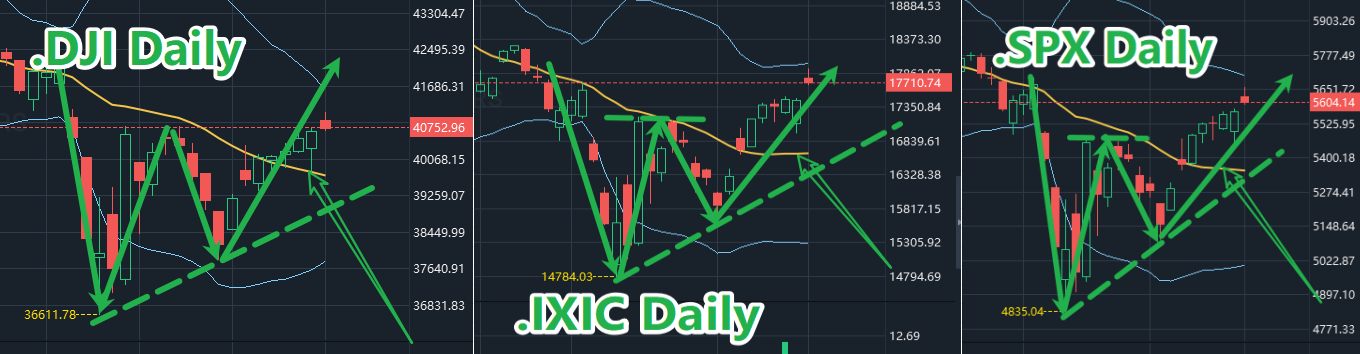

All three major indexes moved higher, reflecting a positive and optimistic market outlook: the Dow Jones Industrial Average rose 0.21%, the Nasdaq gained 1.52%, and the S&P 500 increased 0.63%. This was not just a technical rebound but a sign of the market’s renewed confidence and collective recognition of the long-term growth potential in artificial intelligence and technology.

In this round of structural market recovery, our carefully positioned high-quality stocks have delivered outstanding performance:

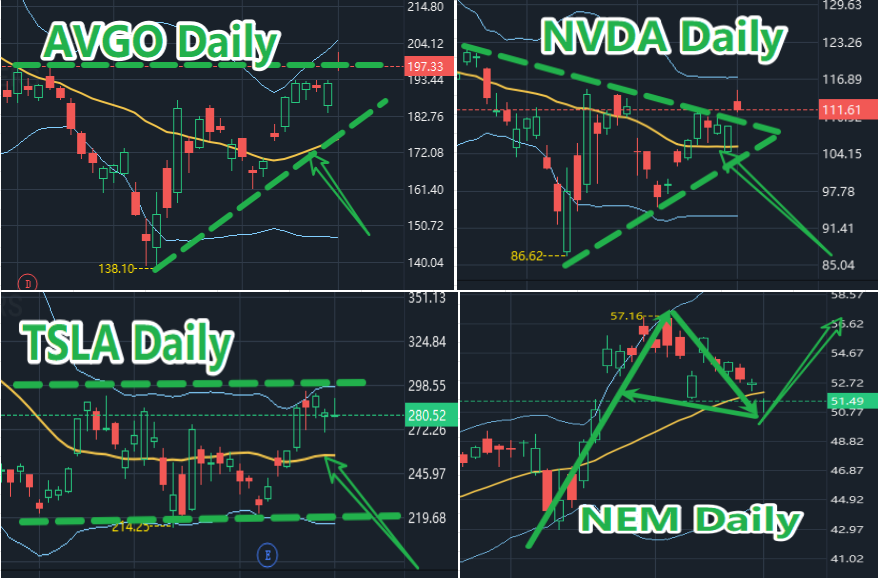

AVGO has continued its upward trend, with a phase profit reaching 16.67%, perfectly capturing the benefits of the trend.

TSLA has shown steady performance, with a current cumulative return of 6.26%.

NVDA has delivered a profit return of 3.52%.

NEM is currently in a consolidation phase. While it has not yet gained momentum, its role as a defensive asset remains solid and will require patience.

In the face of considerable profit returns, we at Prosper Grove Asset Management continue to follow the principles of prudent trading and risk control:

1.At present, we have taken partial profits on our high-quality stock holdings to lock in gains.

2.The remaining positions will be held, while we wait for either a breakout above key resistance levels or a pullback to technical support zones before adding to our positions.

The high-quality stocks mentioned above were selected through our ProMatrix Quantitative Trading System using comprehensive big data analysis. Our actions are not driven by emotion, but rather by strictly following our asset allocation investment framework during every market fluctuation.

Dear friends, in this ever-changing era, only an investment system with the ability to evolve can truly guide us through market volatility and achieve sustained wealth growth.

Today, let’s take a deep dive into how to scientifically build a dynamic diversified asset allocation system.

At Prosper Grove Asset Management, we have always upheld and continuously refined our core investment philosophy: truly scientific asset allocation is never a rigid, static structure, but rather a dynamic strategy system with the ability to adapt and evolve.

In the face of a complex and diverse global market environment, the investment landscape we operate in is no longer limited to a single asset class but instead spans the full spectrum of global investment markets.

First, let's start by discussing the allocation logic within the stock market.

In stock market investing, we never place all our hopes on a single sector or one specific stock, because we understand well:

You should never put all your eggs in one basket, and certainly not pin all your hopes on a single hot trend. Capital allocation must be broadly diversified to spread risk and enhance the resilience of the investment portfolio.

So, how do we at Prosper Grove Asset Management structure our approach?

The answer is: by building a multi-timeframe, multi-tiered stock market strategy portfolio.

1.Long-term strategy: Focused on the core theme of technological growth.

We are firmly invested in core stocks within the artificial intelligence sector,

such as AVGO, NVDA, and TSLA. These high-quality stocks have already delivered significant compound returns for us.

2. Medium-term strategy: Focused on value stability and risk resilience.

We have chosen gold sector stocks as a core allocation, with current focus on NEM, which has strong fundamentals.

3. Short-term strategy: Seize trending momentum and high-volatility opportunities.

Based on current market news and hot themes, combined with real-time scanning by the ProMatrix Quantitative Trading System, we identify high-quality stocks with explosive potential. For example, cryptocurrency-related stocks like MSTR and COIN.

At this point, if we elevate our portfolio construction to a multi-dimensional investment landscape, our strategy at Prosper Grove Asset Management is no longer limited to the stock market alone.

Let's consider a possible scenario: On April 2, President Trump announced the implementation of the "reciprocal tariff" policy, causing widespread panic in global marketings. Investors' concerns about an economic recession spread rapidly, causing the Dow Jones Industrial Average, Nasdaq Index, and S&P 500 Index to fall by more than 9%, and the stock market suffered a collective decline.

If you bet all your money on the stock market, you will be unable to avoid market shocks. You will also see your account funds "passively shrink" again and again during the retracement. You will be powerless to do anything about it.

While the Nasdaq Index and the S&P 500 Index have gradually returned to their operating range before the policy shock, the road back has been tortuous, repetitive, and anxiety-inducing.

During this period, in the face of drastic market fluctuations, our strategic layout at Prosper Grove Asset Management chose to take active action instead of waiting quietly.

During this trade war shock, we at Prosper Grove Asset Management successfully implemented the following three core strategies, not only effectively controlling risk but also achieving an evolutionary upgrade of our portfolio structure.

1.Introduced options strategies: Building a hedging firewall against stock declines

During periods of extreme market volatility, we promptly implemented options strategies by purchasing put options on stocks to hedge risk, effectively protecting against drawdowns caused by market downturns.

2. Allocated gold assets: Preserving asset value stability

We increased the allocation weight of gold and gold sector stocks, such as NEM and AEM. As risk-off sentiment intensified, these assets rose against the trend and became standout performers within our investment portfolio.

3. Continuously optimize the investment portfolio and adjust dynamically

After market panic subsided and trade war expectations eased, we quickly optimized the portfolio structure and resumed our allocation strategy:

a. We maintained a strong focus on the stock market, primarily targeting the artificial intelligence sector and gold-related stocks.

b. Using the ProMatrix Quantitative Trading System, we expanded the portfolio to include cryptocurrencies and cryptocurrency-related stocks.

Dear friends, what you are seeing now as a "dynamic diversified asset allocation system" is not just a simple investment portfolio. It is a dynamic, cross-market, and sustainably evolving wealth engine carefully designed for you by Prosper Grove Asset Management.

Please remember: markets may change, policies may shift, and styles may rotate, but our structural logic of proactive allocation, flexible adjustment, and forward-looking positioning will never change.

As long as you consistently follow the insights shared in our Prosper Grove Asset Management group and firmly execute the strategic plan, I believe that no matter which market cycle or style rotation phase you are in, you will be able to achieve steady wealth growth and truly accelerate your journey toward your own financial freedom.

Friends, tomorrow will be a critically important day for the investment markets.

Global investors will be closely watching the release of a major economic indicator: the Non-Farm Payroll (NFP) report. This is a key metric for assessing economic vitality, employment conditions, and policy direction. It will not only trigger significant market volatility but may also directly influence expectations surrounding the Federal Reserve's monetary policy.

At the same time, through the ProMatrix Quantitative Trading System and comprehensive big data analysis, we have identified a high-potential stock with an expected profit margin of around 30%. The optimal entry signal is anticipated to appear following tomorrow’s Non-Farm Payroll report. If you are interested in this high-quality stock, you can contact our assistant now to reserve your spot in advance and ensure that you’re among the first to participate in the trade and capture the profit opportunity.

We look forward to more of you joining us tomorrow. See you tomorrow!