Dear friends, I’m Christian Luis Ahumada, Founder and Chief Quantitative Analyst at Prosper Grove Asset Management. I’m pleased to once again connect with all of you here in the group. Today, we will continue to focus on the latest released economic data and provide an in-depth analysis of how these macro variables are structurally impacting the current investment market.

At the same time, we will leverage professional asset allocation strategies, combined with the practical tactics of the ProMatrix Quantitative Trading System, to optimize and dynamically adjust our current investment portfolios, ensuring we achieve steady and sustained compound growth.

Today's key updates:

1.What is the market impact of the initial jobless claims for the week ending April 26, and what is our perspective?

2.What are the optimization strategies for the high-quality stocks AVGO, TSLA, and NVDA?

Dear friends, let’s now analyze the impact of the initial jobless claims data for the week ending April 26 on the investment markets.

Initial jobless claims for the week refer to the number of people filing for unemployment benefits for the first time, which reflects changes in the health of the labor market.

According to key information identified by the ProMatrix Quantitative Trading System, initial jobless claims for the week ending April 26 rose by 18,000 to 241,000, marking the highest level since February and exceeding economists' forecast of 223,000.

The data signals a weakening labor market and a marginal decline in economic activity, which has increased investor expectations for more dovish signals from the Federal Reserve. This has sent a positive message to the investment markets.

Now let's shift our focus to the real-time performance and optimization strategy of high-quality stocks:

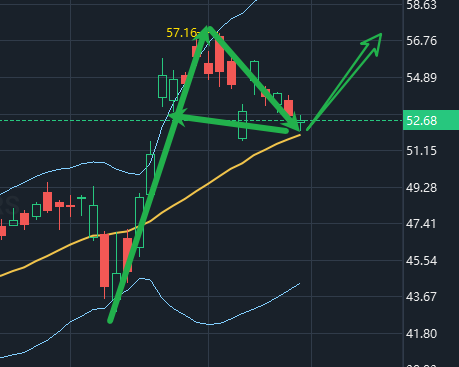

Today, AVGO once again delivered an outstanding performance, demonstrating strong upward momentum and a steady rally, successfully pushing our position profit up to 16.0%. We have now achieved a significant phase victory.

At this point, AVGO’s current price is approaching a major resistance zone from previous highs. From the perspective of steady profit-taking and risk management, we have chosen to take profits by reducing our position by half to lock in partial gains. The remaining position will be held, as we wait for either a breakout above the key resistance level or a pullback that presents a new buying opportunity.

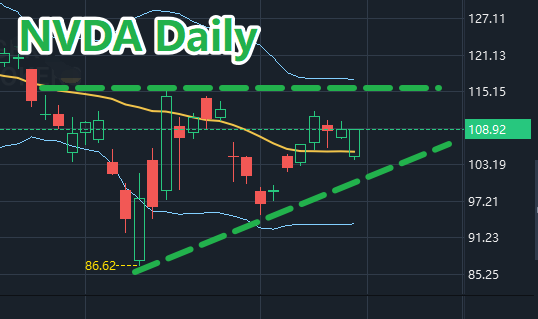

Today, NVDA has already generated a 4.0% profit return for us. However, its price has reached a recent strong resistance level. From a steady profit-taking perspective, we have decided to reduce our position by half to lock in partial gains. The remaining position will be held as we wait for more definitive signals to appear.

I would like to extend special congratulations to those who have consistently followed the updates from the Prosper Grove Asset Management group and firmly executed the strategic plans. It is your trust and discipline that have led to these substantial profit returns.

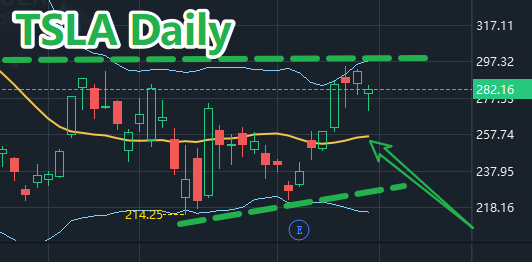

TSLA’s latest trend performance once again validates our precise market analysis and timing control.

After multiple deep pullbacks in the earlier stages, TSLA’s price has built a solid support base at the lower levels. The formation of this bottom structure has not only strengthened market confidence but also laid the foundation for a medium-term upward trend.

Friends who joined us in the first round of TSLA positioning have now realized approximately an 8.16% profit; those who participated in the second round have accumulated a return of around 1.85%.

Currently, TSLA’s price has firmly held above the middle band of the Bollinger Bands (BOLL), sending a very important signal:

1.TSLA is quietly completing its directional shift.

2. Although TSLA remains in a broad consolidation pattern, consolidation does not mean weakness; rather, it is building up sufficient momentum for a breakout.

Based on the current trend structure and strong future profit potential, we have chosen to continue holding and patiently wait.

Recently, NEM released its first-quarter earnings report, which exceeded market expectations and fully demonstrated its solid profitability. Additionally, NEM is a gold-related stock.

Gold has long been regarded as the "ultimate safe-haven asset" in global financial markets. When market uncertainty rises and systemic risks increase, capital often flows into gold assets as a means of value protection.

Although the impact of tariff policies has eased and panic sentiment has subsided—leading to a pullback in gold prices—the easing of trade tensions combined with weakening economic data has increased expectations for a Federal Reserve rate cut.

Once the Fed officially begins the rate-cutting process, it will directly suppress real interest rates, significantly enhancing the appeal of holding gold. As a result, gold prices will receive strong support, and gold-related stocks will also benefit.

Therefore, in our asset allocation system, gold and gold-related stocks have always been an essential and irreplaceable component.

As for NEM, we have chosen to continue holding and waiting.

Friends, on our journey toward financial freedom, we must always remember one core principle: truly scientific asset allocation is not a rigid, static structure—it is a dynamic strategy system with the ability to adapt and evolve.

I call it a "dynamic diversified asset allocation system." It continuously adjusts strategies in response to changes in the macroeconomic environment, shifts in policy cycles, and transitions in market styles, ensuring that we can achieve steady and sustainable wealth growth.

This is exactly the source of confidence that enables Prosper Grove Asset Management to help everyone rapidly accumulate wealth and accelerate their journey toward financial freedom.

In our Prosper Grove Asset Management group, we provide real-time analysis of news events, macro policies, and economic data every day to help you truly understand the current core market narrative.

At the same time, we also utilize the proprietary ProMatrix Quantitative Trading System developed by Prosper Grove Asset Management to identify the most explosive high-quality stocks and formulate efficient trading strategies to help you rapidly grow your trading account and achieve steady compound returns.

At this moment, through the ProMatrix Quantitative Trading System, we have successfully identified a high-quality stock with a projected profit potential of around 30%. Our team is closely monitoring its price movement, waiting for confirmation of the optimal entry signal.

If you are interested in this high-quality stock, you can contact our assistant in advance to register and ensure you are among the first to participate and profit.

Moreover, in our Prosper Grove Asset Management group, we share a wealth of professional financial knowledge, investment trading techniques, and investment philosophies. We also emphasize applying theoretical knowledge to real-world practice, helping you comprehensively enhance your trading judgment, execution, and system-building abilities. Ultimately, you will be able to create your own wealth system and accelerate your path toward financial freedom.

Dear friends, at every moment along your journey toward financial freedom, we are here to support you wholeheartedly and walk alongside you.

To further cultivate a positive and driven learning environment, and to ignite your passion and initiative for professional investment knowledge,we are committed to ensuring that every participant in the 11th ProMatrix Quantitative Trading System Financial Training Program gains valuable experience, improves practical trading skills, and achieves comprehensive personal and professional growth.

We have specially added an exclusive raffle incentive event every Friday afternoon:

1.You can earn points by checking in daily, actively engaging in discussions, answering questions, and submitting study notes.

2. Once your accumulated learning points reach 100, you’ll qualify for one raffle entry. The more points you earn, the more chances you’ll have to enter the raffle and win your desired prizes.

3. Generous prizes include:

A massage chair valued at $5,999

16 Pro Max

0.001 BTC

0.05 ETH

30 PGAM Tokens, 10 PGAM Tokens

$100 USDT, $30 USDT, $10 USDT

Dear friends, the market continues to evolve today, and our learning and growth never stop.

Later, I will share how to build a "dynamic diversified asset allocation system." I look forward to more of you joining the discussion. See you later!