Dear friends, hello everyone. I’m Christian Luis Ahumada, Founder and Chief Quantitative Analyst at Prosper Grove Asset Management. I’m truly delighted to reconnect with all of you in the group today.

Here, we are not merely exchanging market information—we are working together to interpret the deeper logic behind economic data, clarify trend dynamics, and understand capital flows, so that we can identify clear, actionable, and achievable strategic directions in a volatile market.

Today's key updates:

1.What impact have the released data on April ADP Employment Change, Q1 Preliminary Annualized Real GDP, and March PCE Price Index had on the investment markets?

2.How are the high-quality stocks AVGO and TSLA performing, and what is our strategy?

3.How are other potential wealth opportunities performing?

Friends, in the complex and ever-changing capital markets, policy serves as the "weathervane" that determines the direction of market movement, while economic data acts as the "barometer" that gauges the market's temperature.

The introduction and adjustment of policies outline the broader macro landscape of the market, while shifts in key economic data precisely reflect the true pulse of the investment environment.

Now let's focus on today's economic data:

1.April ADP Employment Change

The ADP report is regarded by the market as a “leading indicator” for Non-Farm Payroll (NFP) data. Investors use it to anticipate the state of the economy and employment trends.

Today’s result: Private sector employment increased by 62,000 in April, falling short of the market expectation of 115,000. This indicates that under the current backdrop of economic uncertainty, labor demand is weakening.

Although the ADP data shows a slowdown in hiring activity, unemployment claims remain near pre-pandemic levels, suggesting that layoffs are still relatively low.

2. Preliminary Annualized Real GDP Growth Rate for Q1

Real GDP is the gross domestic product adjusted for changes in price levels (inflation or deflation), providing a true picture of actual economic growth.

The preliminary annualized real GDP growth rate for the first quarter represents the estimated pace of economic growth if the first quarter's performance were sustained for a full year.

It reflects the overall health of the economy.

Today’s release showed that the preliminary annualized real GDP growth rate for the first quarter was -0.3%, below the market expectation of 0.3%, indicating economic contraction in Q1 and highlighting the negative impact of tariff policies.

Taken together, both data points have exerted similar downward pressure on the stock market and have dampened the release of market optimism.

3. March Year-over-Year PCE Price Index

The PCE Price Index measures the changes in prices that consumers actually pay for goods and services in the real economy. It is the Federal Reserve's most favored indicator for measuring inflation.

The market forecast for the year-over-year PCE Price Index in March is 2.2%, lower than the previous value of 2.5%.

If the actual reported value exceeds the forecast, it indicates rising inflation, which may lead investors to expect the Federal Reserve to maintain higher interest rates. This would be a negative factor for the investment markets.

If the actual reported value comes in lower than the market forecast, it suggests easing inflationary pressure, which could trigger investor expectations for a Federal Reserve rate cut. This would have a positive impact on the investment markets.

This key data has not yet been officially released. We will closely monitor it and provide analysis on the potential structural impacts and trading opportunities it may bring to the investment markets once it is announced.

Friends, let’s now focus on the real-time developments of high-quality stocks.

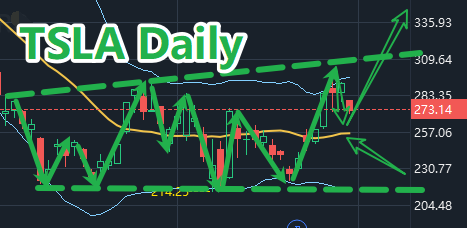

TSLA is a leading giant in the electric vehicle industry. Today, TSLA was affected by market sentiment. Although its price experienced a brief pullback, it remains above the middle band of the Bollinger Bands. From both a trend structure and market logic perspective, this pullback is technical in nature and has not disrupted the original upward trend structure. This means that the bullish momentum is still intact. Additionally, its price has undergone multiple confirmations at the bottom, establishing a solid base of support.

Moreover, with President Trump officially signing the executive order to prevent the cumulative impact of overlapping auto tariffs, the move has effectively eased previous tensions in the supply chain and reduced market uncertainty caused by tariff pressure.

More importantly, from a fundamental perspective, TSLA still possesses exceptionally strong growth potential and future prospects.

Therefore, TSLA’s pullback is building stronger momentum for the next upward move.

Now, if you do not currently hold a position in TSLA but are optimistic about its future trend, feel free to contact my assistant to receive the latest trading strategy for TSLA.

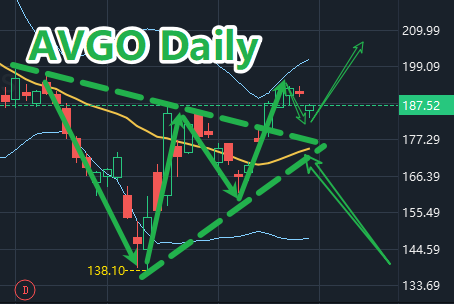

AVGO was affected by negative market sentiment, leading to a brief price pullback. However, from a trend perspective, we can see that its price still remains above the middle band of the Bollinger Bands. At the same time, the price has successfully broken through the upper boundary of the triangle consolidation pattern, indicating that the direction of the trend has shifted. An upward trend structure has now been established.

More importantly, AVGO operates within the core technology sector of artificial intelligence, which remains one of the market’s primary driving themes. The long-term growth narrative has not changed.

At this moment, our position in AVGO has generated a profit of approximately 10.8%. Strategically, we are choosing to continue holding firmly, following the trend, and patiently waiting for profits to expand further.

If you do not currently hold AVGO but remain optimistic about its trend performance and future potential, the current level still offers value for positioning. For specific trading advice, feel free to contact my assistant directly.

Dear friends, with the release of several major economic data points and corporate earnings reports this week, the investment market is filled with countless opportunities and challenges. At this critical moment, please remember that you are not alone. We at Prosper Grove Asset Management stand with you every step of the way, serving as your strongest and most reliable support.

At Prosper Grove Asset Management, we have a team of 32 innovative elites from top global financial institutions, technology companies, and academic circles. They not only bring extensive international perspective but also possess deep expertise in asset allocation and cutting-edge investment strategies.

They focus on the deep integration and innovative application of artificial intelligence and quantitative trading in asset management. By leveraging quantitative trading strategies and intelligent investment tools such as the ProMatrix Quantitative Trading System, they help you dynamically adjust and optimize your portfolio across multiple asset classes including stocks, bonds, options, gold, and cryptocurrencies, ensuring that you can move quickly toward financial freedom.

Moreover, to further enhance the brand influence and market recognition of Prosper Grove Asset Management, and to expand our client service resources and asset management scale, we launched the 11th session of the ProMatrix Quantitative Trading System Financial Training Program.

This is not just a learning journey, but a structured empowerment initiative aimed at elevating your understanding and advancing your practical trading capabilities.

This training program will bring you four core values:

1.We will provide in-depth analysis of global real-time news, macro policy developments, and key economic data, offering you the most timely and accurate strategic wealth opportunity positioning to help you move swiftly toward financial freedom.

2.A comprehensive and systematic sharing of financial investment knowledge, including technical indicator analysis, candlestick logic, trend identification, capital management, investment philosophy development, position sizing, and sector rotation, all designed to help you build the wealth system that best suits you.

3. We combine theoretical instruction with practical trading strategies, using real-world application to validate what you’ve learned. Through systematic training and hands-on trading, you can rapidly enhance your practical trading skills and accelerate your journey toward becoming an investment master.

4. During the training program, participants can actively earn points by checking in, engaging in discussions, answering knowledge quizzes, and taking notes. These points can be used to enter the weekly Friday raffle, with prizes including a $5,999 massage chair, a 16 Pro Max, 30 PGAM Tokens, 10 PGAM Tokens, 0.001 BTC, 0.05 ETH, $100 USDT, $30 USDT, and $10 USDT.

Dear friends, if you would like to gain a deeper understanding of the philosophy, mission, and professional framework of Prosper Grove Asset Management, we invite you to visit our official website at https://pgam.it.com/.

We look forward to welcoming more like-minded individuals to join us, walk alongside us, and move forward together on the path to financial freedom.

Later, I will be sharing the working principles and usage methods of the ProMatrix Quantitative Trading System. I look forward to the active participation and discussion from more friends. See you later.