Dear friends, hello everyone, I am Christian Luis Ahumada, Founder and Chief Quantitative Analyst at Prosper Grove Asset Management. I am truly delighted to reconnect with all of you in the group today.

In this space filled with wisdom and opportunity, we will continue to work together, dive deep into the core market logic, clarify our strategic positioning, and jointly build our own wealth growth system.

Today's important updates:

1.How did the stock market perform today, and how can we build a long-term, sustainable wealth growth system?

2.How are the high-quality stocks AVGO and TSLA that we shared performing, and what is our trading strategy?

3. What is today's special benefit sharing, and what are the details?

Today, the latest data released by the Conference Board showed that the Consumer Confidence Index dropped sharply by nearly 8 points to 86, marking the lowest level since May 2020.

This situation has sent out important signals:

1.Ongoing pressure from tariff policies has intensified consumers' concerns about the economic outlook and employment conditions;

2.The pessimistic data performance has further strengthened market expectations for a Federal Reserve interest rate cut, thereby providing a strong wave of optimism for the capital markets on a sentiment level.

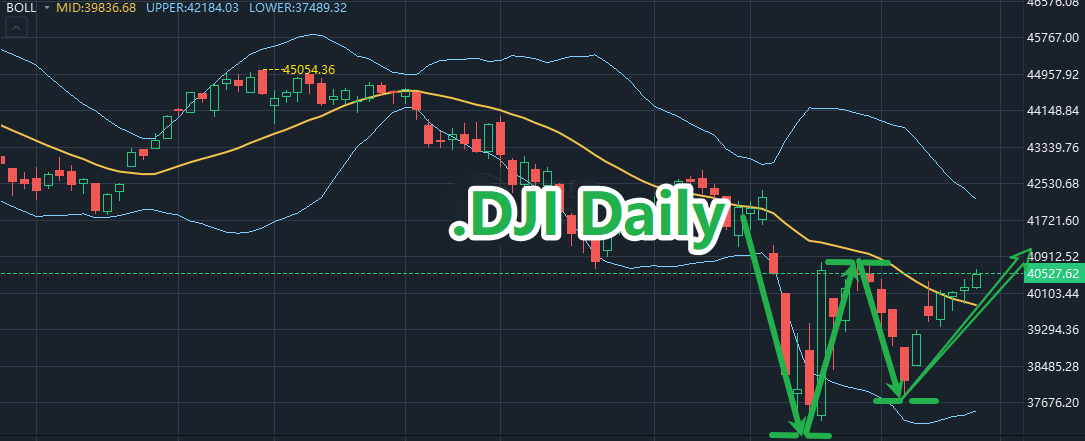

Today, all three major indices rose, and market sentiment improved. The Dow Jones Industrial Average increased by 0.75%, the Nasdaq Index rose by 0.55%, and the S&P 500 Index gained 0.58%.

Through technical chart comparisons, we can clearly observe that the Dow Jones Industrial Average is approaching a key resistance level and is facing a directional choice. Meanwhile, the Nasdaq Index and the S&P 500 Index have shown stronger performance, both breaking through the neckline of a "W" pattern, with overall market momentum looking positive.

Friends, since the overall market trend is clear and the structure is healthy, our core task is to follow the trend, choose the right timing and targets, and participate decisively.

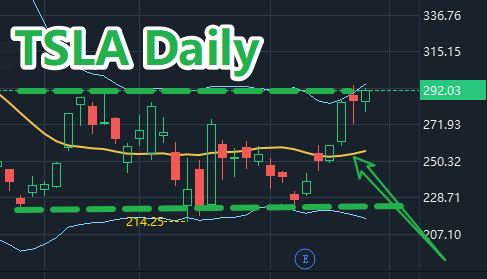

Now, let’s focus on the trend performance of our high-quality stocks: AVGO and TSLA.

From a fundamental analysis perspective, both AVGO and TSLA are demonstrating exceptionally strong earnings expectations and growth momentum.

From a technical analysis perspective, AVGO and TSLA are currently holding steadily above the middle band of the Bollinger Bands (BOLL) channel, showing a classic bullish trend continuation pattern, with the overall trend remaining strong.

Given the strong alignment between the fundamentals and technicals of AVGO and TSLA, we have chosen to continue following the trend by holding our positions and waiting.

If you have not yet made a purchase but are interested in AVGO and TSLA, you are welcome to contact my assistant directly to receive exclusive trading strategy guidance.

Friends, in today’s investment environment filled with both challenges and opportunities, I have received many messages and inquiries from all of you.

The core question is: In a market with heightened volatility and increasing uncertainty, how does Prosper Grove Asset Management continue to achieve steady and sustainable profits?

Now, regarding this question, I would like to discuss our strategic positioning.

First, we adhere to an unchanging fundamental principle: we do not concentrate all of our capital into a single asset.

In the capital markets, no matter how strong a trend may appear, a single bet always carries uncontrollable systemic risks. Diversifying investments and maintaining a balanced allocation are the first steps toward controlling risk and increasing the probability of success.

Therefore, in actual operations, we flexibly apply short-term, medium-term, and long-term strategies, dynamically adjusting based on different assets, different timeframes, and varying market rhythms, in order to achieve steady and sustainable profits.

1.Long-term strategy:

Focus on sectors and leading companies with long-term growth potential, remaining unaffected by short-term fluctuations and benefiting from capital appreciation through economic cycle rotations. Examples include the artificial intelligence sector: AVGO, NVDA, TSLA, and others.

2. Medium-term strategy:

Trade in line with major trends, riding the primary upward waves, while dynamically tracking changes in industry policies and macroeconomic data to adjust portfolio structures in a timely manner. Examples include stocks in the gold sector such as AEM and NEM, and cryptocurrency-related stocks such as MSTR and COIN.

3. Short-term strategy:

Carefully select high-quality assets with breakout potential, combine them with technical breakout signals, and hold for a short cycle to capture profits from rapid market movements.

At this moment, if we elevate our perspective to a higher strategic level, you will see that at Prosper Grove Asset Management, our asset allocation is not limited to the stock market alone.

At Prosper Grove Asset Management, we deeply understand that true long-term wealth growth does not come from fighting alone in a single market, but from the coordinated synergy among diversified assets.

Therefore, our strategic allocation spans multiple major asset classes, including stocks, bonds, options, gold, and cryptocurrencies.

This diversified asset allocation helps us achieve:

1.Navigating through cycles by reducing systemic risk caused by volatility in a single market.

2.Multiple sources of returns, ensuring that there are asset classes achieving counter-trend growth whether in bull or bear markets.

3.Enhanced asset defensiveness, building a truly resilient wealth system capable of withstanding extreme events.

Dear friends, at Prosper Grove Asset Management, we are not only focused on achieving profitable returns in a single sector,

but we are also dedicated to building a resilient wealth matrix for you that can navigate through cycles, withstand uncertainties, and continuously grow in value.

Therefore, as you follow and learn with us in the Prosper Grove Asset Management group, you can build a scientific, diversified, and dynamic multi-asset allocation system to ensure that your investment portfolio continues to achieve steady wealth growth across different market phases and style transitions.

Therefore, in order to further create a positive, ambitious, and growth-oriented learning environment, to inspire everyone's enthusiasm and motivation for investment knowledge, and to ensure that every participant in the "11th ProMatrix Quantitative Trading System Financial Training Program" can gain valuable experiences and achieve comprehensive growth, we are launching a brand-new learning incentive points reward system.

This reward system adopts a points accumulation model. Once you accumulate 100 points, you will qualify to participate in the exclusive raffle event held every Friday afternoon!

The reward is not just a celebration, but also a recognition and encouragement of your dedication to learning and continuous growth!

You can earn points through the following methods: check-in rewards, interaction rewards, knowledge quiz rewards, and note-taking rewards.

1.Check-in Rewards

Check in with the assistant every day to receive daily check-in points and develop a consistent learning habit.

2. Interaction Rewards

During the group learning sessions, actively participating, speaking up, and sharing your viewpoints will earn you interaction reward points.

3. Knowledge Quiz Rewards

After each class, we will release a knowledge quiz based on the day’s lesson. Actively participate and answer correctly to earn the corresponding points.

4. Note-Taking Rewards

Write down key knowledge, strategic logic, and practical techniques shared in the group in your notebook. Submit your notes daily to earn note-taking points.

Special Note: Once you accumulate 100 points, you will earn one raffle entry. The more points you accumulate, the more raffle entries you receive, and the higher your chances of winning.

Friends, the raffle event offers a wide variety of exciting prizes, including a $5,999 massage chair, a 16 Pro Max, 30 PGAM Tokens, 10 PGAM Tokens, $100 USDT, $30 USDT, $10 USDT, 0.001 BTC, and 0.05 ETH.

Dear friends, if you wish to gain a more systematic and comprehensive understanding of Prosper Grove Asset Management and deeply grasp the investment philosophy and practical strategies we advocate, then be sure to visit our official website: https://pgam.it.com/.

The official website includes sections such as company introduction and corporate culture, team profiles, wealth opportunity sharing, financial news updates, a wealth archive zone, investment and trading skills training, and interactive raffle events.

We believe these resources will not only help you quickly enhance your practical trading abilities but also assist you in achieving substantial profit returns.

Join us as we walk side by side on the journey toward financial freedom.

That’s all for today’s sharing. Tomorrow, I will join you in exploring the impact of key data—including the April ADP Employment Change, the preliminary annualized GDP growth rate for Q1, and the March year-over-year PCE Price Index—on the investment market, as well as the potential wealth opportunities they present.

I look forward to more of you joining the discussion. See you tomorrow!