Dear friends and future financial giants,

Hello everyone, I am Christian Luis Ahumada, Founder and Chief Quantitative Analyst at Prosper Grove Asset Management. I am truly delighted to reconnect with all of you in the group today!

In this market full of changes and opportunities, we are not simply following the news; instead, we must look beyond the headlines to see the deeper logic behind the trends. By elevating our understanding, we can discover the wealth opportunities that truly belong to us.

Today's topics for sharing:

1.How are the current key market news events impacting the market?

2.How are the high-quality stocks AVGO and TSLA performing, and where are our new wealth opportunities?

3.Given the current market performance, what is our trading strategy?

Friends, yesterday, the market released a set of important data that drew widespread attention: the Texas Manufacturing Index dropped sharply, hitting its lowest level since May 2020.

Combined with a concentrated sell-off in major tech stocks, short-term market optimism was noticeably impacted. During the trading session, all three major indices — the Dow Jones Industrial Average, the Nasdaq Index, and the S&P 500 Index — experienced significant pullbacks.

Just as market sentiment was weakening, Treasury Secretary Scott Bessent publicly stated that substantial progress is being made in trade negotiations.

Negotiations for customized agreements are currently underway with 18 major trading partners, and the first trade agreement could potentially be finalized as early as this week or next.

This positive statement acted as a stabilizer for the fragile market sentiment, significantly easing investors' concerns about a potential deterioration in trade relations.

Given the current market environment, my view is that although, in the short term, market volatility driven by tariff policy fluctuations has led to significant pullbacks and turbulence in the stock prices of many high-quality companies, as several major tech companies (such as Microsoft, Apple, META, and Amazon) release their earnings reports this week and the benefits of the upcoming trade agreement begin to materialize, the stock market could experience a dual boost from both a recovery in sentiment and a restart of upward trends.

Short-term volatility is part of the process of filtering out true opportunities, and the medium- to long-term logic has never changed because of temporary adjustments.

Technology remains the main engine driving global development;

Innovation remains the core driver of corporate value growth;

And the easing of trade tensions will further promote capital inflows and boost risk appetite.

At this moment, truly mature investors should use unwavering conviction to recognize short-term volatility and adopt strategic positioning to embrace the imminent release of value.

Dear friends, now let’s once again turn our focus to the latest performance of the two high-quality stocks we have carefully positioned: AVGO and TSLA!

Today, AVGO’s price successfully held above the middle band of the Bollinger Bands (BOLL) channel and has successfully broken through the trendline resistance that had been suppressing it for several days.

This marks that AVGO’s bullish momentum is continuing to build, with capital flowing back in at an accelerated pace.

Both the technical and fundamental aspects are resonating upward, and AVGO is steadily and powerfully gathering strength, preparing to surge toward new heights.

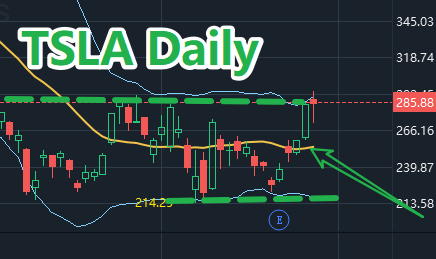

TSLA’s price is hovering near the upper resistance line of its bottom consolidation range, building strength and waiting for a directional breakout. From a fundamental perspective, TSLA’s future is filled with exciting catalysts:

1.In June of this year, a pilot project for autonomous robotaxis will launch in Austin, Texas;

2.By mid-year, the mass production of the affordable electric vehicle is set to begin;

3.The Optimus humanoid robot project is steadily progressing.

These high-growth projects will bring significant new momentum to TSLA, providing it with a broader valuation potential.

Given the clear future growth prospects of AVGO and TSLA, we firmly choose to continue holding our positions, waiting for the trend to accelerate and patiently enjoying the value dividends brought by their growth.

Friends, I believe that by now, you have personally experienced the profit potential brought by the steady rise of AVGO and TSLA!

All of this is thanks to the powerful investment tool we have dedicatedly developed at Prosper Grove Asset Management — the ProMatrix Quantitative Trading System.

Through the ProMatrix Quantitative Trading System, we leverage deep big data mining and intelligent algorithm screening to precisely identify these high-probability, high-quality opportunities.

The four core modules of the ProMatrix Quantitative Trading System:

1.Trading Signal Decision System

It continuously monitors market movements in real time, accurately captures turning points, and generates high-probability trading signals.

2. Advanced Quantitative Trading System

By utilizing automated strategies, it eliminates emotional interference and enables efficient, disciplined trade execution.

3. Investment Strategy Decision System

It integrates multi-factor strategies to dynamically adjust the investment portfolio, optimizing the balance between returns and risks.

4. Expert-Level Investment Decision System

It combines the experience and insights of top investment experts with AI deep learning to achieve accurate forecasting and dynamic optimization.

Dear friends, if you would like to gain a deeper understanding of the complete framework and core working principles of the ProMatrix Quantitative Trading System, you are always welcome to visit our official website at https://pgam.it.com/ for detailed information and exploration!

Later, I will be sharing with you the key trading strategies derived from the comprehensive big data analysis of the ProMatrix Quantitative Trading System.

This is not only a valuable accumulation of knowledge but also a breakthrough in understanding and an important opportunity to elevate your investment journey!

I look forward to having more friends join us as we step into the intelligent world of the ProMatrix Quantitative Trading System,gain insights into the pulse of market trends, and seize the wealth dividends bestowed by this era. See you later!