Dear friends and future financial giants,

Hello everyone, I am Christian Luis Ahumada, Founder and Chief Quantitative Analyst at Prosper Grove Asset Management. I am truly delighted to reconnect with all of you in the group at this special moment.

As the stock market experiences a brief pullback and price fluctuations, we are not swayed by emotions. Instead, we face the market’s ups and downs with a broader perspective, a longer-term vision, and a more positive mindset.

Today's topics for sharing:

1.What signals are being conveyed by the current brief pullback in the stock market?

2.How are AVGO and TSLA performing, and what are the current trading strategies?

Friends, this week the capital markets are set to experience an extremely critical and highly volatile period.

First, the four major tech giants, Microsoft, Apple, META, and Amazon.

They will be releasing their first-quarter earnings reports throughout the week, which will provide deep insights into the real impact of policy uncertainty on the business environment and corporate profitability.

At the same time, this week will also see the intensive release of Non-Farm Payroll data and GDP figures. These major macroeconomic indicators will further explore the health of the labor market and the state of economic growth, guide market expectations, and influence asset price movements.

It is foreseeable that the entire investment market, driven by key earnings reports and critical economic data, will enter a period of heightened volatility and a sensitive window.

Today, influenced by the early digestion of market sentiment and concerns over uncertainty, the Dow Jones Industrial Average rose by 0.28%, the Nasdaq Index fell by 0.1%, and the S&P 500 Index edged up by 0.06%.

Notably, the technology sector led the decline with a clear pullback. Some of the optimism accumulated last week has been diminished, but overall, this pullback remains within a controllable range and has not yet disrupted the medium- to long-term trend structure.

My strategic view: The power of technology is the cornerstone driving social progress and industrial transformation.

No matter how the market fluctuates in the short term, social advancement will not stop, technological innovation will not pause, and technology — especially the core assets in the field of artificial intelligence — will continue to be the main force leading future growth.

As Mr. Buffett once said, "Be greedy when others are fearful, and fearful when others are greedy."

Today's pullback in the stock indices is not a moment for panic, but rather a perfect opportunity window for us to patiently seek better entry points and build up momentum for future profits!

Friends, now let's once again turn our attention to the trend performance of two key high-quality stocks we have been focusing on: AVGO and TSLA.

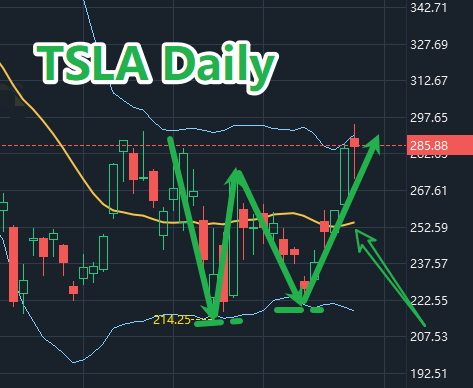

Currently, both AVGO and TSLA are maintaining strong fundamentals, stable performance, and clear prospects. Their prices are steadily running above the middle band of the Bollinger Bands (BOLL) channel, with the upper and lower bands widening, indicating strong trend momentum. This suggests that bullish forces continue to dominate the market rhythm, and the overall trend structure remains healthy and positive.

However, from the perspective of securing steady profits and controlling risk, we have proactively implemented a phased strategy by taking profits and reducing our positions by half.

The remaining holdings will be maintained, either waiting for a breakout above key resistance levels or for an opportunity to add positions after a pullback.

At this moment, our position in AVGO is up by 14.23%, and TSLA is up by 8.16%.

Although there has been a brief pullback in the prices of these high-quality stocks, always remember: a pullback is never a signal for fear, but rather the fertile ground for new opportunities; volatility is never the beginning of failure, but the prologue to positioning for the future.

Moreover, through the comprehensive big data analysis conducted by our ProMatrix Quantitative trading and investment system, we have reached an important conclusion: Artificial intelligence is the most penetrating core technological driving force of our time. It represents the trend of global technological evolution and serves as the fundamental driver of future society.

With demand remaining strong and immense growth potential ahead, the long-term trend and logic for artificial intelligence remain unchanged.

Dear friends, if you are uncertain about the future trend of the stocks you are currently holding, you can contact my assistant. Send her your portfolio, and she will provide you with the most objective analysis and the most professional investment strategies using our patented investment system at Prosper Grove Asset Management — the ProMatrix Quantitative Trading System — to help you achieve steady profits.

Please remember: no matter how intense market fluctuations may be, we will stand by your side; no matter how distant your goals may seem, we will use our expertise to help you achieve stable returns.

Friends, the ProMatrix Quantitative Trading System is the result of tremendous dedication and intelligence from our team at Prosper Grove Asset Management.

It embodies the collective efforts of 32 innovative elites from the world's leading financial institutions, technology companies, and top academic circles.

In order to help everyone gain a deeper understanding and mastery of the core logic and application methods of this powerful system, starting tomorrow, our daily sharing sessions in the Prosper Grove Asset Management group will officially include special topics on explaining the core working principles and practical application techniques of the ProMatrix Quantitative Trading System.

I hope all friends in the Prosper Grove Asset Management group will actively participate in every session of learning and exchanging system knowledge starting tomorrow.

This is not only an elevation of your understanding but also a valuable opportunity to unlock the door to future wealth!

Believe that this effort and dedication will, one day in the future, bring you rewards far beyond your expectations!

If you would like to learn more about Prosper Grove Asset Management, you can visit our official website at https://pgam.it.com for further information.

Tomorrow, I will continue to share more news events, policy interpretations, wealth opportunities, and the core working principles of the ProMatrix Quantitative Trading System.

I look forward to more friends participating in the discussion. See you tomorrow!