Dear friends and future financial titans,

Hello everyone, I’m Christian Luis Ahumada, Founder and Chief Quantitative Analyst of Prosper Grove Asset Management. I’m thrilled to be here with you in this group as we dive into the detailed data of TSLA’s earnings report and identify the corresponding trading strategies.

Today’s discussion will focus on the following topics:

1.What are the detailed figures in TSLA’s earnings report?

2.What is our outlook on TSLA, and what are our trading strategies?

Friends, let’s begin today’s journey of discovery with a positive mindset.

In the capital markets—this battlefield without gunfire—we must constantly monitor three core coordinates: policy, economic data, and corporate earnings.

Policy is the “helmsman” that determines the direction of the market. It sets the course, influences the flow of capital, and drives shifts in market style as well as the logic behind asset revaluation.

Economic data is the “barometer” that reflects the temperature of the market. It tells us whether the macroeconomy is accelerating or slowing down, providing timely and practical signals to guide our investment decisions.

Corporate earnings reports are the most direct and powerful “health check” of a company’s value. They reveal a company’s profitability, operational efficiency, and growth potential, serving as the key measure of whether a business can weather economic cycles and deliver on its future promises.

These three elements complement each other and form the “golden triangle” for understanding market trends and formulating trading strategies.

To go far and earn steadily in the market, you must read the direction of policy, gauge the temperature of economic data, and grasp the strength within corporate earnings reports.

Now let’s focus on TSLA’s first-quarter earnings report:

Q1 revenue came in at $19.34 billion, significantly below the market expectation of $21.43 billion and lower than the $21.3 billion reported in the same period last year.

Gross margin for the quarter was 16.3%, beating expectations of 16.1%, while automotive gross margin (excluding regulatory credits) stood at 12.5%. From the data TSLA released, we can see that while revenue experienced a sharp decline, profitability remained relatively solid.

TSLA also stated that production of its new affordable vehicle is scheduled to begin in the first half of 2025, and it still expects Robotaxi to enter mass production in 2026.

This has helped bring some stability to market sentiment, so TSLA can be added to our trading radar. More detailed trading strategies will be shared in the group shortly.

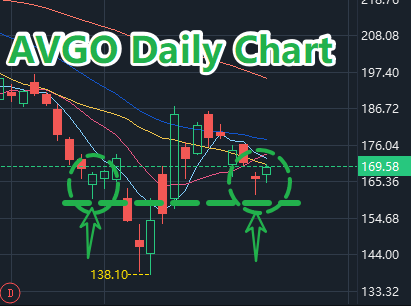

Dear friends, today we focused on AVGO. If you’d like to dive deeper into AVGO’s trading logic, institutional activity, and future potential, feel free to contact my assistant to receive the detailed analysis report.

In addition, to help you better track your trades and manage your timing, you're welcome to send a screenshot of your AVGO entry point to my assistant for registration. We’ll provide you with daily real-time monitoring and personalized follow-up services to ensure you stay updated with AVGO’s latest developments at all times.

This is also the core principle advocated in the 11th ProMatrix Quantitative Trading System Financial Training Program by Prosper Grove Asset Management: “Client interests first.” We are here to support you with professionalism in achieving long-term and steady profit goals.

Our success is never built on theory—it comes from the real profits and lasting trust of each and every client.

At Prosper Grove Asset Management, we are proud to have a team of 32 innovative elites from leading global financial institutions, tech companies, and academia. They bring not only extensive hands-on experience in asset allocation, but also a global strategic perspective and cutting-edge investment philosophies.

At Prosper Grove Asset Management, we design a personalized, efficient, professional, and comprehensive wealth growth path for every member who joins us. Leveraging the cutting-edge ProMatrix Quantitative Trading System, a comprehensive investor education program, highly efficient and targeted asset allocation strategies, and a thoughtful, professional client service system, we create a customized roadmap for each client’s financial growth — delivering real value through effective wealth appreciation and long-term, steady returns.

From reshaping your mindset to putting strategies into practice, from understanding market trends to allocating capital — you are not fighting alone.You are moving forward side by side with a professional and purpose-driven team.

That’s why I hope all of our friends in the Prosper Grove Asset Management group will actively participate—learning with us, growing with us, gaining clarity in market volatility, and winning the future through real-world practice.

This is the starting point of your financial breakthrough;And you are standing on your own golden track.

Friends, that’s all for today’s session. I hope each of you gained something valuable. Tomorrow, I’ll continue sharing live market insights and wealth opportunities. I look forward to seeing even more of you join us. See you tomorrow!