Dear friends, I am Christian Luis Ahumada, Founder and Chief Quantitative Trading Analyst at Prosper Grove Asset Management. I am delighted to be with you again in the group at this crucial moment of anticipation and excitement.

Today, we are not only gaining insight into a data-driven market shift, but also a deep dive into strategy, structure, and wealth transformation.

At this moment, we are not bystanders, but rather the strategic executors and wealth creators driving this transformation!

Today's Important News:

1. What is the impact of the July non-farm payroll data on the investment market? What is our assessment?

2. What are the major macroeconomic events in the market, and how are they impacting the market?

3. What is the strategic collaboration implementation framework for the third "Bumblebee Joint Collaborative Trading Strategy Plan"?

Friends, whenever we discuss non-farm payroll data, we're not simply looking at a set of numbers; we're looking for insights into the direction of capital flows and the pace of policy.

As one of the core indicators for measuring the health of the labor market, the signals it conveys not only reflect the health of economic fundamentals but also profoundly influence the Federal Reserve's monetary policy adjustments.

We focus on non-farm payroll data and the unemployment rate.

Non-farm payroll data refers to the change in new employment in the non-agricultural sector, covering manufacturing, construction, retail, services, healthcare, finance, and other sectors.

It's not only a direct barometer of economic vitality, but also directly related to consumer spending, business confidence, and economic resilience. In other words, this data determines whether consumption is sustained, production is expanding, and confidence is stabilizing.

More importantly, it serves as a crucial indicator for the Federal Reserve's interest rate policymaking!

The unemployment rate refers to the proportion of the labor force that is unemployed and is also a measure of the health of the labor market.

So, while the non-farm payroll data may superficially reflect employment, it's actually about policy, and the underlying force is capital!

Based on comprehensive big data analysis from the ProMatrix Quantitative Trading System, a key insight has been identified: In July, non-farm payrolls increased by 73,000, significantly below the market expectation of 104,000. The unemployment rate rose from 4.1% in the previous month to 4.2%. While this aligns with market expectations, it clearly signals that the labor market is cooling and economic momentum is showing signs of slowing down.

To some extent, this supports an increased likelihood of a Federal Reserve rate cut.

At the same time, President Trump has imposed high new tariffs on dozens of countries, including key partners such as Taiwan and India, signaling that a new round of trade tariffs is taking shape.

President Trump signed an executive order to raise the tariff rate on Canada from 25% to 35%, with most other “reciprocal” rates ranging between 15% and 40% (although the baseline rate remains at 10%), set to take effect within seven days.

This means that market investors will need to reassess the reshaped trade landscape, as uncertainty factors are on the rise.

In addition, Amazon’s earnings decline has further raised concerns about the sustainability of growth in the consumer sector.

The final outcome is a combination of three bearish factors:

1.Uncertainty surrounding trade tariffs

2.Weak non-farm payroll data, signaling a slowdown in economic momentum

3.Earnings from tech giants falling short of expectations, triggering a reassessment of valuations

These three factors have converged, directly leading to a pullback in the stock market from its highs. Market risk appetite has cooled rapidly, while risk-averse sentiment is on the rise.

Dear friends, with today’s release of the non-farm payroll data, along with the uncertainty surrounding trade tariffs, it has once again become clear that the true underlying logic of the market has shifted, and risk is quietly building.

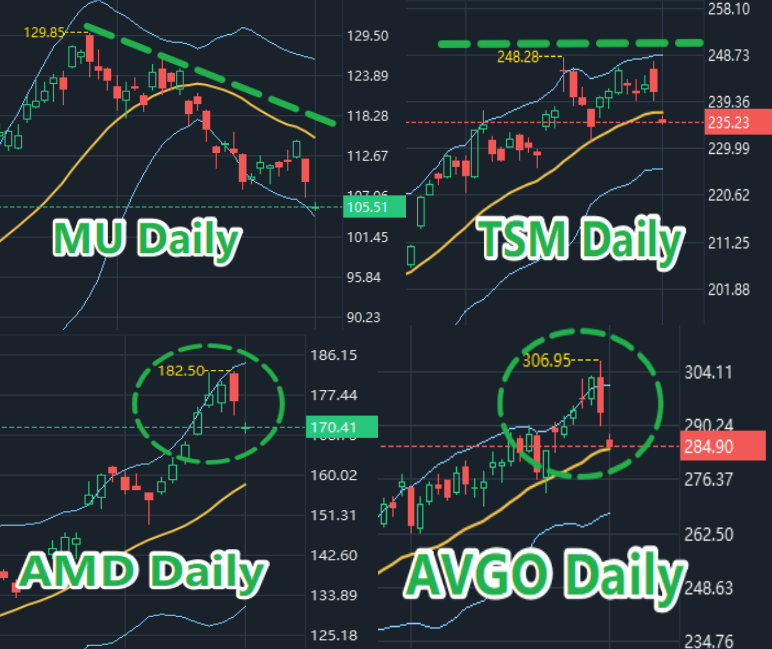

We are seeing the Dow Jones Industrial Average, the Nasdaq, and the S&P 500 all pulling back from high levels, with signs of high-level selling beginning to emerge. Market sentiment is gradually shifting toward caution.

At this moment, it is clear that the tech sector is experiencing a significant pullback, especially among tech stocks that previously accumulated substantial profits. This indicates that potential risks are building. At this critical juncture, we must define a clear strategic plan:

1.Risks in the stock market far outweigh the opportunities, and we do not recommend chasing high-risk profits.

2.Continue to free up profits from stocks, reduce overall position size, and avoid the risk of systemic corrections.

3.Actively reallocate capital to the highly volatile cryptocurrency sector, closely following the established tactical rhythm and collaborative trading strategy.

It is reassuring that those who continue to follow Prosper Grove Asset Management and firmly implement our strategic plans are already firmly on the right track to wealth. They precisely hedged against stock market risks ahead of time, not only successfully locking in the profits earned from previous stocks but also decisively and efficiently allocating the resulting liquidity to the cryptocurrency sector.

This demonstrates strategic foresight and a triumph of execution!

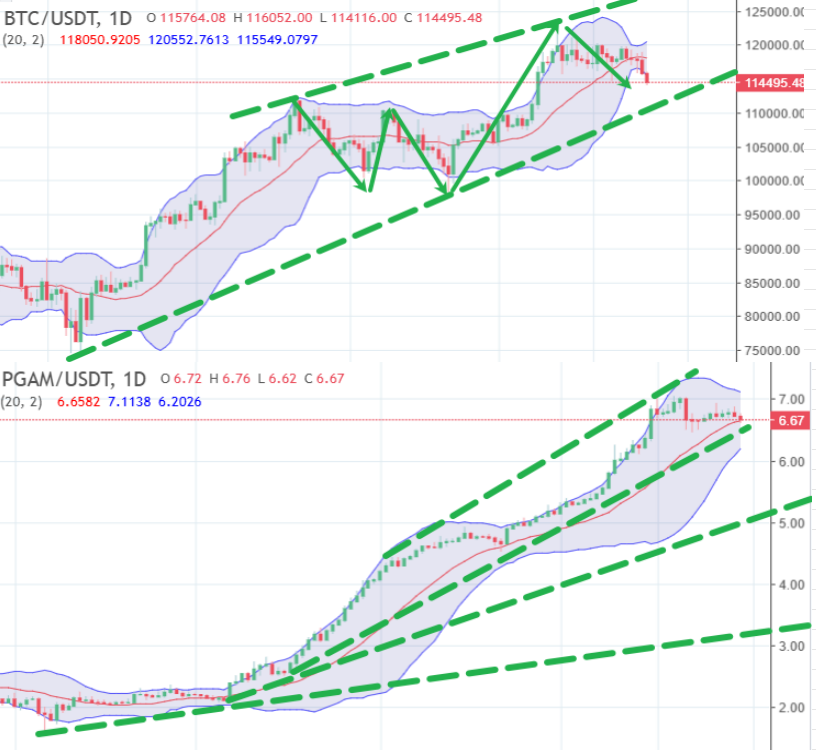

Today, the cryptocurrency market experienced a brief pullback. For those without a sense of direction, this volatility can cause anxiety and confusion, but for us, it's precisely the right time to calmly respond and accurately position ourselves.

First, we must clarify one point:

During this pullback, while the price of the core asset, the PGAM token, has adjusted, the overall decline has been extremely limited, demonstrating its strong resilience.

This demonstrates that the core growth logic of the PGAM token remains unbroken, and its value proposition remains solid. Therefore, there's no need to panic about short-term fluctuations in the PGAM token; continue to hold and wait.

When it comes to cryptocurrency contract trading, we have even less to worry about: the fundamental advantage of cryptocurrency contract trading lies in its two-way trading mechanism for both long and short trades. Regardless of whether the market is rising or falling, as long as we accurately predict the direction, we can generate profits.

In other words, the greater the volatility, the more opportunities there are; the more complex the market, the wider the scope for investment.

We have already used the ProMatrix Quantitative trading system to proactively analyze trends. Combined with the tactical rhythm of the Wealth Dream Factory ProMatrix Quantitative member trading plan,we will be able to truly follow the trend, execute accurately, and achieve stable profits.

So, please deeply understand this truth: Investing isn't just about making money; it's about elevating your life. With wisdom and action, you're paving a path for long-term, steady, and sustainable compound growth for your life, your family's future, and the realization of your dreams.

For Yourself: This is the beginning of redefining the heights of your life. No longer hustling for a living, no longer constrained by reality. Through resolute strategic execution, you will calmly control the rhythm of your life, possess the ability to freely choose, and become the true master of your own destiny.

For Your Family: What you pursue isn't just personal success; it's also about ensuring your family has a stable, prosperous, and worry-free life; ensuring your parents enjoy a comfortable retirement, your children receive a quality education, and your partner lives a respectable and dignified life.

Behind every investment decision you make lies the hope and future of your family.

Dreams: Everyone harbors a distant destination in their heart: a journey you've longed for but always put on hold; a career you've loved for years but been sidelined by reality; a lifestyle you've always dreamed of.

Now is the time to fulfill those unrealized goals you've written about for years. It's time to empower yourself with wealth and turn your dreams into a reality within reach.

Friends, remember: The investment path you choose today determines the quality of life and the direction of your destiny tomorrow.

Choosing the right investment direction is not only your deepest respect for time, but also a solemn commitment to fulfill your responsibility to yourself, your family, and your future destiny!

So, what strategy deserves the most attention at this moment?

The answer is clear: the optimal investment path right now is the unilateral trend opportunities brought about by the non-farm payroll data and the upcoming launch of the third "Bumblebee Joint Collaborative Trading Strategy Plan."

The third "Bumblebee Joint Collaborative Trading Strategy Plan" is not only a technical practice of collaborative trading, but also a deep strategic action to reshape and elevate the destiny of wealth.

This time, we will establish in-depth collaborations with more powerful institutions, achieving higher-level strategic resonance, unleashing unprecedented capital flows and execution power, jointly guiding the trend, and forming a system-wide trend and profit resonance!

However, I must remind everyone again: this will be our final strategic assembly for collaborative operations with institutions. Therefore, all friends who aspire to change their fortunes, please immediately enter a state of comprehensive strategic preparation.

Of particular note: The strategic collaboration execution framework for the third "Bumblebee Joint Collaborative Trading Strategy Plan" has been comprehensively upgraded, with every detail thoroughly optimized to ensure every participant is part of a collaborative system with a higher win rate, more precise cadence, and more predictable results.

1. Institutional Collaboration

This program has successfully attracted the participation of more reputable institutions, bringing in even greater financial support. This will significantly amplify trend momentum, create clearer signals, and create a more favorable trading rhythm.

This means the trend will be even more powerful, and there will be more profit opportunities.

2. Tiered Collaboration Mechanism

All successfully registered participants will be assigned to tiers based on their capital size and execution capabilities.

Rest assured: we will ensure that every participant can accurately enter and exit trades at the right time and with the right trading rhythm, achieving profitable strategies.

3. Closed Execution Management

This round of collaborative trading strategy plan utilizes a highly confidential and closed tactical execution system:

a. All trading rhythms, tactical signals, and entry and exit strategies will not be publicly released in the group;

b. All instructions will be communicated only to members who have successfully registered to participate;

c. One-on-one tactical rhythm coordination will be implemented throughout the process to ensure highly consistent execution.

Dear friends, the clarion call for the third "Hornet Joint Collaborative Trading Strategy Plan" has now sounded, and a new wealth revolution is upon us.

Now, please put aside your hesitation. For yourself, for your family, for your dignity, for everything you want to protect, and for the goals you want to achieve, now is the critical moment for you to shoulder your responsibility and wealth mission!

Please act now and contact our assistant, Sophia Morgan, to complete your registration and be matched with the strategic team that best matches your funding and execution capabilities. Follow the unified strategic rhythm and embark on a path of guaranteed profit growth!

Friends, remember: every decisive action reshapes your destiny; every strategic move is the starting point for your journey to the pinnacle of wealth.

Your actions are the most powerful catalyst for changing the trajectory of your life. Therefore, I look forward to working alongside you in the upcoming launch of the third "Bumblebee Collaborative Trading Strategy Plan," collaborating on advancements and precise execution, so that together we can become true wealth creators and write our own wealth legends. See you later!