Dear friends, I'm Christian Luis Ahumada, Founder and Chief Quantitative Trading Analyst at Prosper Grove Asset Management. I'm delighted to be with you in this group.

Today, we must not only gain insight into the impact of economic data on the investment market, but also clarify our current strategic priorities. Furthermore, we must further analyze the trends following the release of the non-farm payroll data to provide a strong basis for strategic planning.

Today's Important News:

1. What are our views on the impact of the July ADP employment change and the second quarter real GDP preliminary quarterly rate release on the investment market?

2. What is the impact of the non-farm payroll data release on the cryptocurrency market?

3. What are the detailed plans for the third "Bumblebee Joint Collaborative Trading Plan"?

The ADP Employment Report is an important leading indicator of changes in private-sector employment. Because it is released ahead of the official non-farm payroll report, it holds strong predictive value and significant forward-looking relevance for the market.

Key insight identified through the ProMatrix Quantitative Trading System: In July, private-sector employment increased by 104,000 jobs, exceeding market expectations of 75,000.

This indicates that the labor market remains resilient, with the employment structure still showing some underlying strength. Although the job gain slightly surpassed expectations, the overall slope of employment growth has clearly slowed. From a broader perspective, this may reduce expectations for a Federal Reserve rate cut, making the overall impact slightly bearish.

The preliminary annualized quarter-on-quarter growth rate of real GDP for the second quarter refers to the inflation-adjusted growth of gross domestic product on an annualized basis. It is a key indicator for measuring the overall pace of economic expansion or contraction. By removing the effects of inflation and applying annualization, it directly reflects the true state of economic growth.

Key insight identified through the ProMatrix Quantitative Trading System: The preliminary annualized quarter-on-quarter growth rate of real GDP for the second quarter was reported at 3%, higher than the market expectation of 2.3% but lower than the previous reading of 3.5%.

This indicates that the economy still shows resilience, but its momentum is gradually weakening, suggesting that corporate profits and consumer-driven growth are under pressure.

Based on the above analysis, we conclude that today’s stock market is likely to continue its consolidation pattern, with market divergence expected to persist.

At the same time, investors will remain focused on the upcoming Federal Reserve monetary policy meeting and the release of earnings reports from major tech companies. These two variables will directly influence the market’s short-term direction and trigger a rebalancing of risk appetite.

Therefore, in terms of strategy, caution should remain the priority. We do not recommend blindly chasing high-risk profits. Instead, the focus should be on steady progress amid uncertainty and actively seeking control within a divided market.

Dear friends, potential risks in the current stock market continue to accumulate. The three major indexes are under pressure at high levels, sector rotation is intensifying, and individual stocks are diverging significantly. The overall market profitability has significantly weakened, and the window for operation is rapidly narrowing.

However, I would like to especially congratulate those who have steadfastly followed our strategic plan. You have not only successfully avoided disturbances in the risk zone, but also achieved a sustained leap in wealth during periods of intense market volatility!

We have always believed that profits are never based on luck, but rather on a combination of strategic judgment, system support, and execution.

Through the trend analysis and profitability ratings of the ProMatrix Quantitative intelligent trading system, we immediately discovered that cryptocurrency and cryptocurrency futures trading are the most profitable and fastest-growing asset classes in the market.

Therefore, we decisively adjusted our strategic focus, incorporating BTC, ETH, and PGAM tokens into our core asset allocation, and tailored the "Wealth Dream Factory ProMatrix Quantitative Member Trading Plan" for our members.

Thanks to everyone's collaboration, execution, and collective wisdom, we have achieved today's exciting results:

BTC has achieved a cumulative profit growth of 24.00%; ETH has achieved a cumulative profit growth of 51.53%; and PGAM tokens have achieved a cumulative profit growth of 159.62%!

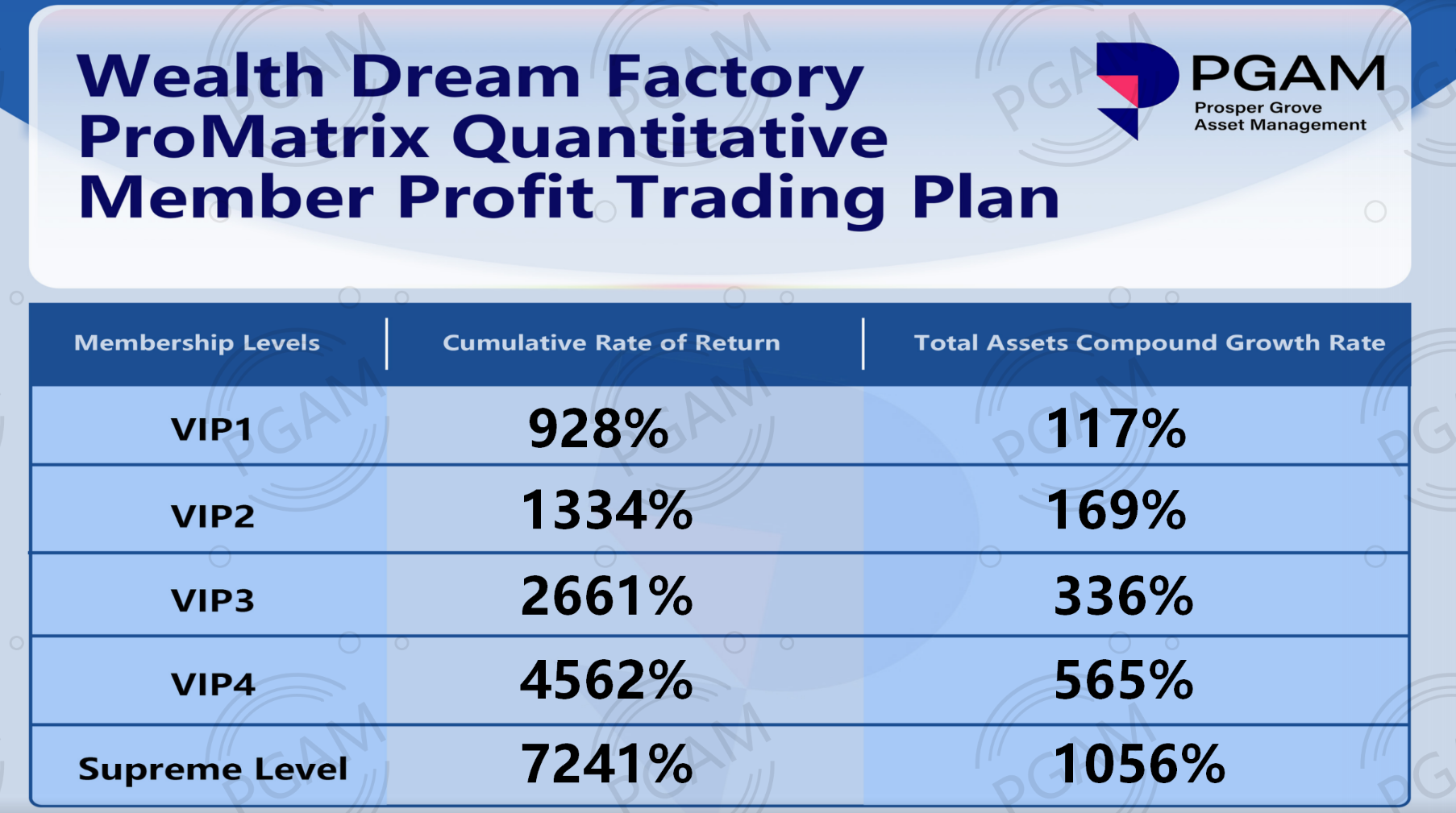

Meanwhile, the strategic results of our ProMatrix Quantitative membership trading program, DreamWorks Wealth, are even more impressive:

VIP1 Member Group: Return Increase of 928%, Total Asset Growth of 117%;

VIP2 Member Group: Return Increase of 1334%, Total Asset Growth of 169%;

SVIP3 Member Group: Return Increase of 2661%, Total Asset Growth of 336%;

SVIP4 Member Group: Return Increase of 4562%, Total Asset Growth of 565%;

Supreme Member Group: Return Increase of 7241%, Total Asset Growth of 1056%!

Of particular note: the profit growth rate of our Supreme Membership Group has surpassed 1000%. This is not just a numerical breakthrough, but also a milestone achievement on our path to "compounding, replicable, and sustainable" wealth growth.

This remarkable achievement is inseparable from the in-depth implementation of our two-round "Bumblebee Collaborative Trading Strategy Plan." These two rounds of collaborative strategic opportunities not only consolidated the massive power of institutional capital but also integrated the intelligent execution of retail investors, truly achieving the organic integration of "capital synergy, system-driven, and unified strategy."

It is precisely this deep collaboration and integration of strengths that has led us to a profound understanding: when market trends resonate with institutional capital, and when systematic strategies are precisely linked with group collaboration, a truly compounding, replicable, and sustainable path to wealth is now open for us.

What we are experiencing now is no longer a simple transaction; it is a deep collaboration between systems and execution, a wealth-building practice involving upgraded cognition and reconstructed perspectives.

In this process, we have come to a profound understanding: profit returns are no longer a distant dream; they are the natural flow of wealth when you are on top of the trend, within the system, and through collaboration.

However, this Friday's third "Bumblebee Joint Collaborative Trading Strategy Plan" is the result of a strategic plan we have already negotiated with several well-known institutions. It will also be our final joint collaborative strategic plan deployment. Therefore, this time, we will launch this strategic plan with higher strategic standards, a larger capital base, stricter execution discipline, and a more confidential operational mechanism.

Therefore, we estimate that all participants in the third "Bumblebee Joint Collaborative Trading Strategy Plan" will have the opportunity to achieve returns far exceeding those of the previous two rounds.

Moreover, in order to ensure that every friend who truly participates can accurately match their own echelon, and each step of the transaction can be completed efficiently and executed without interference, every transaction can maximize its own profit space!

The transaction pace and details of this strategic plan will not be disclosed in public groups. All operational information will be shared exclusively with those who have successfully registered and completed fund-raising to ensure consistent execution and confidentiality.

We firmly believe that those with true foresight, vision, and a desire for greater wealth will understand and support our highly confidential and highly executed strategic plan.

Those interested in the third "Bumblebee Collaborative Trading Strategy Plan" and eager to seize the initiative in wealth management can now contact assistant Sophia Morgan directly to pre-register and complete the fund preparation and tier matching as soon as possible to secure their participation.

At the same time, while we actively raise funds, we must also pay attention to the wealth opportunities presented by the upcoming non-farm payroll data.

The non-farm payroll data is not only a core indicator of the health of the labor market, but also a crucial factor influencing the direction of the Federal Reserve's monetary policy. Therefore, each release of the non-farm payroll data is associated with significant price fluctuations in the investment market. These dramatic price fluctuations often create extraordinary wealth opportunities in the highly volatile cryptocurrency market.

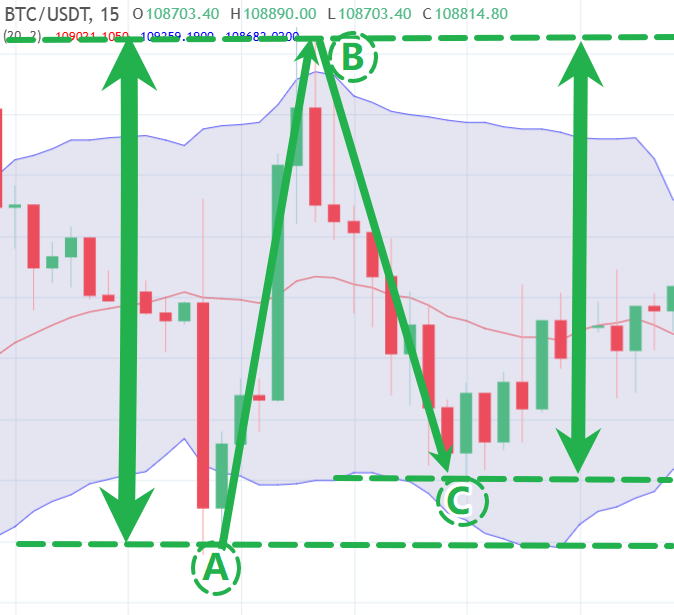

Now let's focus on the cryptocurrency market's performance after each non-farm payroll data release:

In June, after the non-farm payroll data release, the cryptocurrency market experienced two unilateral trending periods: Segments A-B and B-C.

Segment A-B: Unilateral Uptrend

After the release of the non-farm payroll data, the price of BTC rose from $103,500 to $105,200, a 1.64% increase.

Based on a 100x trading volume for cryptocurrency futures, the release of the non-farm payroll data resulted in a 164% profit increase.

B-C Segment: Unilateral, volatile decline

Subsequently, the price of the cryptocurrency BTC fell from $105,200 to $104,040, a drop of 1.10%.

Based on a 100X cryptocurrency futures contract, this unilateral, volatile decline resulted in a 110% profit increase.

In July, after the release of the non-farm payroll data, the cryptocurrency market experienced a short-term correction followed by two volatile periods: Segments A-B and B-C.

A-B Segment: Unilateral, volatile rise

After the release of the non-farm payroll data, the price of the cryptocurrency BTC rose from $108,760 to $110,450, a 1.55% increase. Based on a 100X calculation based on cryptocurrency futures trading, the non-farm payroll report brought us a 155% profit increase.

B-C Segment: Unilateral, volatile decline

Subsequently, the price of BTC fell from $110,450 to $109,000, a drop of 1.31%.

Based on a 100X calculation based on cryptocurrency futures trading, this unilateral, volatile decline brought us a 131% profit increase.

Friends, through our statistical analysis and precise judgment of the cryptocurrency market's performance after the release of non-farm payroll data, we can clearly see that each release of non-farm payroll data will bring about a unilateral trend in the investment market.

Therefore, August 1st (this Friday) will be a strategic moment for all of us who firmly adhere to the principles of execution to achieve an accelerated leap in wealth: This Friday, we will not only usher in the unilateral trend brought about by the non-farm payroll data, but will also launch the highly anticipated third "Bumblebee Joint Collaborative Trading Strategy Plan."

This will be a deep integration of trend data, capital synergy, and systematic trading. It will also be a comprehensive upgrade from a tactical perspective to a strategic one. It will truly be a feast for the wealth of all of us who firmly adhere to the principles of execution.

Therefore, I once again encourage those friends who want to truly change their wealth destiny and reshape their asset map to take action immediately, complete fund preparation, and contact assistant Sophia Morgan to match you with the echelon that best suits you, strive to enter the core echelon, and participate in this strategic wealth action.

Dear friends, the clarion call for a leap forward in wealth has sounded once again! Now, let us ignite the engine of wealth creation with conviction, leverage capital with strategy, and pool our energy for growth through collaboration, embarking on a new journey of strategic wealth advancement!

I will continue to closely track current investment market trends and clarify our strategic direction. We will also continue to plan the strategic execution points for the third iteration of the "Bumblebee Joint Collaborative Strategic Trading Plan." I look forward to meeting you on your journey of wealth exploration. See you soon!