Let’s now focus on the detailed information of the high-quality stock selected by the ProMatrix Quantitative Trading System:

This company is a leading player deeply rooted in the artificial intelligence sector. Its overall financial performance and industry position present us with an investment landscape full of strong potential and stability.

Through systematic data comparison, we conducted a comprehensive analysis of this company’s fundamentals against 70 peer companies in the interactive media and services industry. It stood out across multiple dimensions.

1.Both financial health and profitability received an “Excellent” rating.

2. It possesses strong cash flow and debt repayment capacity, with no liquidity or solvency risks.

This means the company is not only at the forefront of the artificial intelligence trend but also has a strong foundation for long-term sustainable operations and expansion.

Strong Financial Performance:

1.Maintained a profitable track record for five consecutive years, demonstrating solid management and strong resilience to economic cycles.

2.Return on Equity (ROE) stands at 26.71%, outperforming 95.71% of peer companies in the industry.

3. The profit margin stands at 30.86%, higher than 92.86% of industry peers, showcasing an exceptional profitability model.

4.With a debt-to-equity ratio of just 0.04, this structure indicates that the company possesses strong risk resistance in the current environment of global interest rate uncertainty, and does not rely on high external leverage to sustain its expansion.

Future Outlook:

According to projections, the company’s earnings per share (EPS) is expected to grow at an average annual compound rate of 15.11% over the coming years;

Strong growth potential.

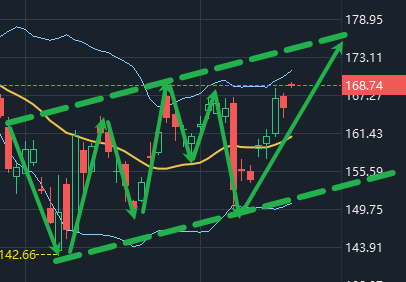

Technical Perspective:

From a technical standpoint, the stock has been steadily climbing along the trendline, rising consistently from its lows and currently moving within a clear and well-defined upward channel. Moreover, the price has successfully stabilized above the middle band of the Bollinger Bands indicator, forming a very favorable trend structure.

At this moment, the price pullback presents an excellent buying opportunity.

Friends, from a healthy financial structure to efficient profitability, from stable growth prospects to a promising valuation, and from a strong technical trend to powerful upward momentum, this company is undoubtedly a top-tier target that should not be overlooked within the dynamic and diversified asset allocation system.