Wall Street's hopes that 2025 would be a banner year were abruptly cut short after the deals market froze up in April. But as the first half of the year winds down, the mergers and acquisitions market looks not as bad as investors feared.

Bankers can thank AI for that.

Corporations and private equity firms aren't letting up on their push to capture the artificial intelligence wave, and it's not expected to slow down.

"Anything that's sheltered from tariffs in a shifting and evolving sector is where you're going to see the activity right now, and AI is somewhere with that, where there is an absolute race," Lucinda Guthrie, head of data provider Mergermarket, told Yahoo Finance.

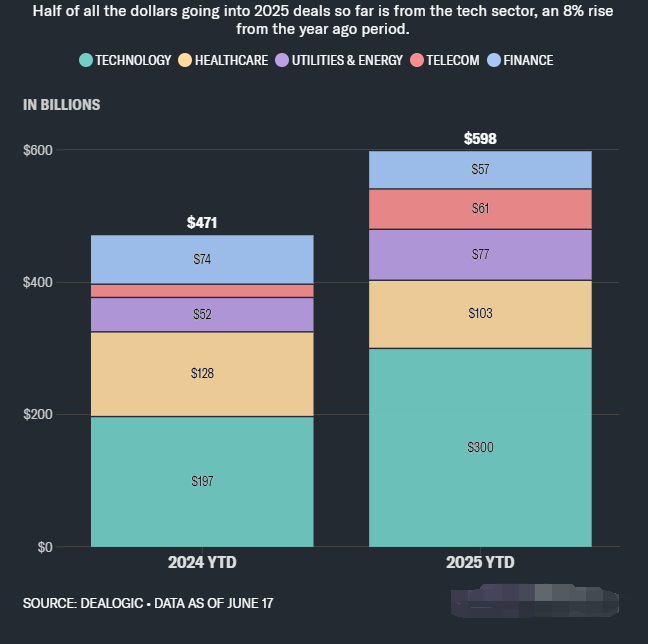

Between the beginning of January and June 17, the number of US-targeted mergers and acquisitions is down by roughly 18%, according to Dealogic. But the total value of all of this year's deals is up 10% compared to the same period in 2024.

Much of that added volume is coming from AI-related deals where "the traditional tech giants all now need to do something," Guthrie said, adding that "although not necessarily clear-cut," these same firms have been anticipating a smoother approval process from antitrust regulators.

From Meta's (META) $14 billion acquisition of Scale AI last week to the $8 billion purchase agreement Salesforce (CRM) struck with AI-powered data platform Informatica (INFA) in late May, some of the biggest recent deals have been AI-focused. But that was the case even before the Trump administration rolled out sweeping "reciprocal" tariffs on April 2.

In fact, seven of the 15 largest US M&A deals so far this year have been about positioning for AI, according to Dealogic data.

The two biggest came in March with Google's (GOOG, GOOGL) all-cash acquisition of New York-based cloud security platform Wiz for $32 billion and Japanese firm SoftBank's (9984.T) agreement to lead a $40 billion fundraiser of ChatGPT maker OpenAI.

It hasn’t just been software companies either, according to a first-half deals report from PwC. Companies in industrials, utilities, and even private equity are doing AI deals.

"Whether it's the advent of AI and the whole ecosystem behind AI, not just the technology and the language models, but the data centers, the energy, getting the energy to the data centers, all the [telecommunications] that goes around that, there's a tremendous amount of change," PwC US deals platform leader Kevin Desai said in a Friday press briefing.

Following Constellation Energy's (CEG) $16 billion merger agreement with Calpine Corporation in January, Houston-based NRG Energy (NRG) made moves last month to double its energy capacity with a $12 billion announcement to buy 18 Texas and East Coast natural gas power plants. Both power suppliers pointed to forecasts for rapidly growing demand for energy of all kinds as companies build out their AI tools and services.

Constellation framed its deal as "creating the right company at the right time." NRG CEO Larry Coben said in a May press release that the US is "in the early stages of a power demand supercycle."

It's far from rosy in other corners of the M&A market. Smaller companies can't as easily forecast or absorb the potential costs of President Trump's tariffs, making it far trickier to justify a deal. About 30% of companies said they paused or revisited pending deals due to tariffs, according to a PwC executive survey from late May.

Some of Wall Street's biggest investment banks weighed in earlier this month about their expectations for second quarter investment banking results at a Morgan Stanley conference in New York. Their feedback was mixed.

The second quarter did start "slow, really pausing in a big way," Morgan Stanley CEO Ted Pick told investors, adding, "I do think investment banking, specifically, is a tale of two quarters."

"Look, there is a lot of anxiety," Citigroup head of banking Viswas Raghavan said. Citigroup expects its second quarter investment banking fees to be up in the "mid-single digits" compared to the same period last year.

But big AI deals, at least, aren't showing signs of slowing. And that may be the saving grace for dealmakers.