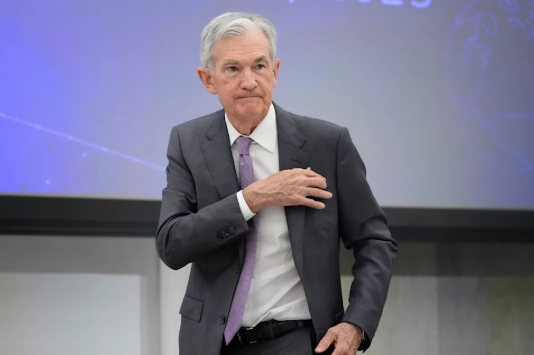

The Federal Reserve is widely expected to hold rates steady at the conclusion of its policy meeting Wednesday, but the big question is whether Chairman Jerome Powell and his colleagues will stay committed to two rate cuts in 2025.

The answer will come in the form of the "dot plot," a chart updated quarterly that shows each Fed official's prediction about the direction of the central bank's benchmark interest rate.

The last dot plot, released in March, revealed a consensus among Fed officials for two cuts this year as some were already factoring the uncertainties of President Trump's economic policies into their projections. They made the same prediction last December.

Many Fed watchers expect central bank officials to stick with what they have already signaled as they weigh numerous unknowns, including the ultimate outcome of trade policies and the ripple effects triggered by a new conflict between Israel and Iran.

"I think they'll end up keeping two cuts, but will stick with narrative that they need more time to see effects of tariffs on inflation," Wilmington Trust senior bond fund manager Wilmer Stith said.

Stith added that recent milder inflation data give the Fed more room to be patient before making rate adjustments.

"Powell may say at his press conference that we're actually seeing lower levels of inflation, but the tariff train hasn't left the station, so to speak, so they still need more time," Stith said.

One figure who will likely pay close attention to what happens today is President Trump. He has called on Powell privately and publicly to cut rates, even saying last week that he "may have to force something."

Trump has noted that he would not fire Powell before his term is up in 2026, a move that would almost certainly be challenged legally.

What has irked Trump is that the Fed has held rates at the current level of 4.25% to 4.5% since December after lowering them by a full percentage point last fall. Trump has been asking for another full percentage point of reductions.

Trump has been citing lower inflation as a reason for the central bank to cut. But Powell and many of his fellow policymakers have made it clear in recent weeks they are still more worried about the risks of higher prices from Trump's tariffs than any rise in unemployment as they weigh both sides of their dual mandate.

The latest measures of inflation have, in fact, shown milder increases in prices even as tariffs were turned on full blast, a trend highlighted last week by Trump and Treasury Secretary Scott Bessent, who told lawmakers last Thursday that "there is no tariff inflation."

On Wednesday, policymakers will also provide updated projections on where they see inflation and unemployment going for the remainder of 2025 and the years beyond.

JPMorgan chief economist Michael Feroli thinks the Fed could raise its forecast for inflation and unemployment and push down its growth outlook. He is calling for only one rate cut this year.

"We think the dots will revise in a modestly hawkish direction," Feroli said in a research note.

Deutsche Bank chief US economist Matthew Luzzetti is also calling for just one rate cut in 2025.

"The June meeting statement will largely serve as a progress report with the main message being that the Committee remains in a holding pattern and policy is well positioned to respond to risks to both sides of the dual mandate," Luzzetti said.